|

Rolf Englund IntCom internetional

|

How the euro was saved

In the French seaside resort of Cannes

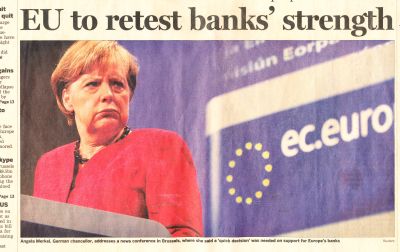

To the astonishment of almost everyone in the room, Angela Merkel began to cry.

the man sitting next to her, French President Nicolas Sarkozy, and the other across the table, US President Barack Obama

Peter Spiegel, Financial Times 11 May 2014

Europe’s Plan Z - The Grexit gamble

Part two of Peter Spiegel’s series from behind the scenes on how the euro was saved

"no single Plan Z document was ever compiled and no emails were exchanged between participants"

Financial Times 14 May 2014

‘If the euro falls, Europe falls’ - How the euro was saved - the third part

Angela Merkel was handed the piece of paper Barack Obama had just passed around.

“What is this?” the German chancellor asked. “I haven’t seen this before.”

A full-scale endorsement of a plan for the European Central Bank to protect eurozone countries when they came under attack from financial markets by automatically buying their bonds.

In retrospect, it marked the beginning of the final turning point in the crisis.

Peter Spiegel, Financial Times, 15 May 2014

Om man har en sedelpress går man inte i konkurs.

Det var varit det till synes självklara budskapet på denna blog ett antal gånger, första gången i november 2011.

Rolf Englund blog

The /German Constitutional/ court concludes that OMT violates the German constitution.

It accuses the ECB of making a power grab by extending its own mandate.

It says the scheme endangers the underpinnings of the eurozone rescue programmes.

Worse, it says OMT undermined deep principles of democracy.

Wolfgang Münchau, FT 9 February 2014

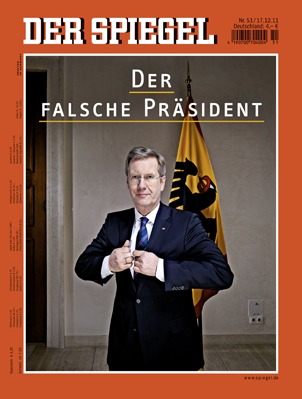

Tim Geithner recounts in his book Stress Test: Reflections on Financial Crises just how far the EU elites are willing to go to save the euro, even if it means toppling elected leaders and eviscerating Europe’s sovereign parliaments.

The former US Treasury Secretary says that EU officials approached him in the white heat of the EMU crisis in November 2011 with a plan to overthrow Silvio Berlusconi, Italy’s elected leader.

"They wanted us to refuse to back IMF loans to Italy as long as he refused to go," he writes.

Ambrose Evans-Pritchard, May 15th, 2014

Geithner told them this was unthinkable.

The US could not misuse the machinery of the IMF to settle political disputes in this way. "We can't have his blood on our hands".The revelations about EMU skulduggery are coming thick and fast. Tim Geithner recounts in his book Stress Test: Reflections on Financial Crises just how far the EU elites are willing to go to save the euro, even if it means toppling elected leaders and eviscerating Europe’s sovereign parliaments.

The former US Treasury Secretary says that EU officials approached him in the white heat of the EMU crisis in November 2011 with a plan to overthrow Silvio Berlusconi, Italy’s elected leader.

"They wanted us to refuse to back IMF loans to Italy as long as he refused to go," he writes.

Geithner told them this was unthinkable.

The US could not misuse the machinery of the IMF to settle political disputes in this way.

"We can't have his blood on our hands".

internetional.se/lehman911.htm#geitner

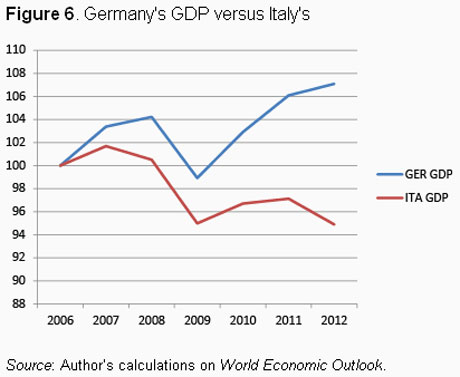

Don't blame Germany for the eurozone's travails, blame the euro itself

Germany didn’t set out to design an economic model that impoverishes much of the rest of Europe

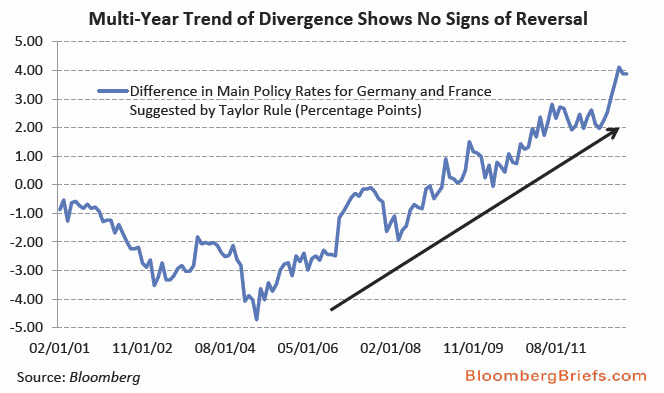

Any attempt to set a single interest rate for 17 politically and fiscally sovereign nations is almost by definition doomed to failure.

Perpetual crisis is more or less guaranteed.

Jeremy Warner, Telegraph, 11 Nov 2013

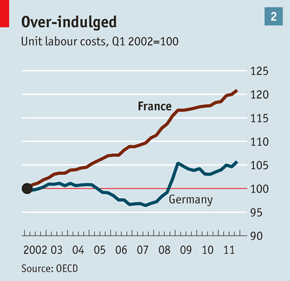

Germany’s path to competitiveness: cutting the cost of labour.

Make no mistake; that has been the basis of the nation’s export success in the past dozen years;

and exports have been its sole consistent source of growth in that period.

But low wages are not the basis on which a rich nation should compete.

Adam Posen, president of the Peterson Institute for International Economics, FT 3 September 2013

Angela Merkel

After all, the German chancellor had grown up and reached adulthood in communist East Germany and

then risen to be not only the elected leader of a united Germany but Europe’s most respected politician.

She more than others understands that the price for unification in 1990 was

Germany’s acceptance of a common currency, a project unpopular with Germans

and agreed to only after assurances that the euro would be as strong as the revered dee mark.

MarketWatch July 11, 2014

SPIEGEL: How long can Brussels continue to impose austerity on countries like Spain and Greece,

a policy that the majority in those countries does not support?

Merkel: Bla, bla, bla

SPIEGEL: Once again, what makes you so confident that the countries in Southern Europe will subject themselves to your austerity mandate in the long run?

Merkel: Bla, bla, bla

SPIEGEL: Youth unemployment in Southern Europe is above 50 percent in some cases.

The austerity policies you have imposed are having disastrous consequences.

Der Spiegel 3 June 2013

It is economic logic for the eurozone to break up. But since when has economic logic played a part in the EU? The political will has shown itself to be stronger than even I imagined.

Perhaps this attitude can best be summarised by a conversation I had with Angela Merkel, the German chancellor. I asked her if it would not be liberating for Greece to default and devalue its currency to get its economy back on track, as Iceland did?

Her reply was chilling.

“No,” Merkel said. “If Greece left the eurozone then other countries would want to leave

and that would be the end of our European dream.”

Nigel Farage, leader of the UK Independence Party, MEP, Financial Times 16 November 2012

What she meant was, whatever the suffering, the euro must survive at all costs.

Full text---

"You know, it's not over until the fat lady sings, as the saying goes," Ms Lagarde told reporters

when asked if she expected a deal to be forged at the meeting next week in Brussels.

Telegraph 16 November 2012

A crucial meeting of eurozone finance ministers next week will be key to getting Greece "back on its feet", IMF chief Christine Lagarde said, as she cut short her visit to Asia to attend the talks.

The president of the Bundesbank was once the mightiest central banker in Europe. No more.

In the council of the European Central Bank, Jens Weidmann is just one of 23.

He has only one vote – the same as Greece.

Josef Joffe, editor of Die Zeit and a fellow of the Hoover Institution at Stanford University, Financial Times 4 September 2012

This is the story of a historical bet gone badly wrong. After the fall of the Berlin Wall, chancellor Helmut Kohl offered the D-Mark to President François Mitterrand in exchange for French acceptance of German reunification.

The Economist, The Merkel Memorandum och Plan B

Rolf Englund blog 10 augusti 2012

Germany's chancellor, Angela Merkel, who is among those forcefully pushing Greece to meet its ambitious savings targets,

said that her "heart bleeds" for the Greeks facing hardship as a consequence of swingeing cuts.(But)

Guardian, 17 September 2012

"I won't take part in pushing Greece out of the euro. That would have unforeseeable consequences," Merkel told students

during a discussion in Berlin's Neues Museum after she held a speech on the future of Europe - exactly 20 years after the day European Union leaders signed the Maastricht Treaty

Click here

Tyskarna gick in i EMU med en övervärderad kurs

Efter återföreningsbubblan som lämnade dem med en svag ekonomi i ett halvt decennium.

De arbetade långsamt tillbaka konkurrenskraften den hårda vägen, genom att pressa löner och driver upp produktiviteten.

Det är helt förståeligt att de nu tror att Club Med kan och bör göra samma sak.

De är helt fel, naturligtvis, eftersom Tyskland kunde sänka relativlöner under

a) en global boom, b) mot andra EMU-stater som inflaterade C) och med räntor som var låga även under de svåra åren.

Ingen av dessa faktorer gäller Italien eller Spanien nu.

Ambrose Evans-Pritchard, 2 December 2011

The Germans entered EMU at an overvalued rate

after the Reunification bubble, leaving them in semi-slump for half a decade.

They slowly clawed back competitiveness the hard way, by squeezing wages and driving up productivity.

It is entirely understandable that they now think Club Med can and should do the same.

They are profoundly wrong, of course, because Germany was able to lower relative wages during

a) a global boom, b) against other EMU states that were inflating c) and with benchmark borrowing cost that stayed low even during the dog days.

None of these factors apply to Italy or Spain now.

Ambrose Evans-Pritchard, December 2nd, 2011

Few have realised the most dangerous feature of Emu: it has locked Germany into a seriously uncompetitive real exchange rate

Martin Wolf, Financial Times, March 31, 1999

Wolodarski och Tysklands framgång med Ådalsmetoden

Merkel ändrar grundlagen för att lättare flytta makt till Bryssel

Rolf Englund blog 2011-11-14

Ms. Merkel,Madame Nein until she has persuaded her colleagues to amend the euro-zone treaty

to permit Brussels (spelled B-e-r-l-i-n) to control the tax, spending and fiscal policy of euro-zone members.

Work on that final piece of the still incomplete architecture of a united Europe will begin at the next euro-zone leaders' meeting on Dec. 9.

At that meeting, the shark that is the euro zone will resume its forward motion.

Unless, of course, many of the member nations prefer leaving the euro zone to becoming part of what they have taken to calling the Fourth Reich.

Irwin Stelzer, director of economic policy studies at the Hudson institute, Wall Street Journal 28/11 2011

The problem, as European leaders understand it, is that the European Council (composed of member-states) routinely blinked when it came to penalizing violators, including Germany and France.

Last week's deal supposedly makes the sanctions "automatic" by shifting enforcement authority to, of all places, the European Court of Justice.

The notion that justices in Luxembourg would levy and enforce financial sanctions on an already-bankrupt member-state is obviously absurd.

The actual enforcement mechanism remains what it is-the Germans' willingness to pay.

Put bluntly, credible enforcement means German puppet regimes in Rome, Athens, Madrid, and perhaps Paris.

Michael S. Greve, Timbros storastyster American Enterprise Institute, December 13, 2011

While there aren't going to be German tanks in Athens or anywhere else, the Brussels deal does illustrate the deeper, constitutional problem with heaping yet more authority on a government-over-governments.

We’re not occupiers, says Greek task force

Horst Reichenbach, who was appointed leader of the task force in September, acknowledged in an interview he had

underestimated how much his German nationality would inflame local sensitivities and complicate his mission.

Financial Times November 25, 2011

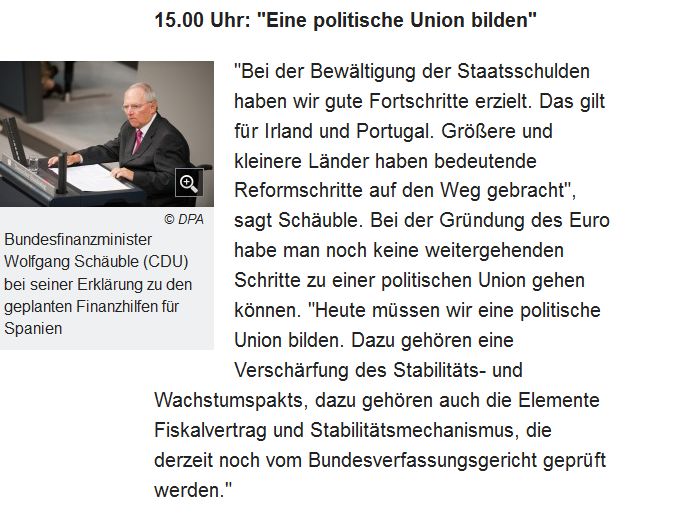

"The challenge of our generation is to finish what we started in Europe, and that is to bring about, step by step, a political union,"

Merkel told the party congress in the east German city of Leipzig, CNBC 14 Nov 2011

Making the European Monetary Union, by Harold James, Harvard University Press

It was an aspiration first formulated in 1970 in the so-called Werner plan

Review by Tony Barber, Financial Times December 16, 2012

It is sometimes said that the euro’s creation was the price demanded by Germany’s European allies for supporting German reunification during the collapse of eastern European and Soviet communism. Reunification supposedly filled Europe’s Lilliputian nations with such fright that they scrambled for a means to tie down the new German Gulliver. The single currency fitted the bill.

In his careful reconstruction of the political, financial and bureaucratic processes that led to the euro’s launch in 1999, Harold James demonstrates that the trail towards European monetary union was, in truth, blazed long before anyone dared even imagine the anti-communist revolutions of 1989-91.

It was an aspiration first formulated in 1970 in the so-called Werner plan, named after Pierre Werner, a prime minister of Luxembourg.

Om Maastrichts föregångare, den s k Werner-planen ur boken

"Vår framtid i Europa" (MUF, 1971) av Jan Brännström, Rolf Englund och Claes-Henric Siven

"The challenge of our generation is to finish what we started in Europe,

and that is to bring about, step by step, a political union,"

Merkel told the party congress in the east German city of Leipzig, CNBC 14 Nov 2011

Vi har glömt det nu – och då det begav sig försvann alltsammans i allmän segeryra och Europaretorik.

Men Mitterrand fick Helmut Kohl att ge upp den tyska D-marken i utbyte mot den europeiska euron.

Richard Swartz, Kolumn DN, 24 november 2012

Svårt var det inte: Kohl tillhör den kanske sista generation av tyska politiker som utan reservationer sätter likhetstecken mellan tyska och europeiska intressen.

Euron – “tekniskt” illa genomtänkt i vad som kallas ett icke optimalt valutaområde – skulle bli Europas nya instrument att hålla Tyskland i schack.

While Germans celebrated the collapse of the Berlin Wall, Helmut Kohl and Francois Mitterand were at war over the consequences of a united Germany.

Secret government documents obtained by Der Spiegel appear to show that Bonn was forced to sacrifice the Deutschmark for reunification.

Presseurope, 1 October 2010

With link to Der Spiegel

The Price of Unity Was the Deutsche Mark Sacrificed for Reunification?

09/30/2010

Newly revealed German government documents reveal that many in Helmut Kohl's Chancellery had deep doubts about a European common currency when it was introduced in 1998.

First and foremost, experts pointed to Italy as being the euro's weak link. The early shortcomings have yet to be corrected.

Der Spiegel, 8 May 2012

It was shortly before his departure to Brussels when the chancellor was overpowered by the sheer magnitude of the moment. Helmut Kohl said that the "weight of history" would become palpable on that weekend; the resolution to establish the monetary union, he said, was a reason for "joyful celebration."

Soon afterwards, on May 2, 1998, Kohl and his counterparts reached a momentous decision.

Eleven countries were to become part of the new European currency, including Germany, France, the Benelux countries -- and Italy.

The euro was not a German project. Quite the reverse.

German voters wanted to hold on to their currency.

It was pressed by those, led by France, who wanted to break the D-Mark zone.

The euro was the price Helmut Kohl paid to Mitterrand to win his blessing for reunification.

Philip Stephens, Financial Times 18 April 2013

"The 50 Days That Changed Europe" explains how the EU grew

from a six-nation trade alliance to a 27-country behemoth with its own currency.

in Strasbourg on Dec. 9, 1989, after the Berlin Wall fell,

Germany agreed to monetary union in order to get President Mitterand to agree to German reunification

WSJ 23 Sept 2011

Mrs. Siebelink tells of one summit in Strasbourg on Dec. 9, 1989, after the Berlin Wall fell, which turned out to be the day that Germany agreed to monetary union in order to get French President François Mitterand to agree to German reunification.

But the difficulty of understanding the EU is that so many of its important days are not about history.

They're just about the EU and meetings and the normal tick-tock of an institutional bureaucracy at work

The European election results showed euroscepticism rising across most of Europe.

But the really shocking factor for the euro elites should have been the strength of the vote for the Front National in France.

For the EU’s history – and its future – turns on France.

President Mitterrand exacted agreement to the euro as the price of France’s support for German reunification.

This only made sense if it was believed that the euro was in French interests and against Germany’s.

This is not quite how things have worked out

Roger Bootle, 1 June 2014

Ville Kohl ha euron, som Rolf Gustavsson påstår, eller blev han tvingad?

Rolf Englund blog 7 oktober 2012

Twenty years after the Maastricht Treaty, which was designed not just to integrate Europe

but to contain the might of a united Germany,

Berlin had effectively united Europe under its control, with Britain all but shut out.

New York Times, 9 December 2011

Valutaunionens rötter, kommunismens fall för 20 år sedan kom att bli eurons definitiva startskott

Den franske presidenten Mitterrand ställde då ett ultimatum:

för att acceptera ett tyskt enande var landet tvunget att ge upp sin D-mark och gå med på ett stärkt EU-samarbete.

Tyskland ville egentligen inte ha en gemensam valuta, men accepterade samarbetet på villkor att det inte fick drag av en traditionell valutaunion.

Peter Wolodarski, Signerat DN 21 augusti 2011

Förbundskansler Helmut Kohl gick med på förslaget – landsmännens skepsis till trots – och ett fördrag undertecknades senare i den holländska staden Maastricht.

när medlemmarna vid upprepade tillfällen tillåter sig att bryta mot reglerna, och två av syndarna är Tyskland och Frankrike, då förlorar valutasamarbetet ram och stadga. Och i en finanskris blir centralbankens passivitet och bristen på ekonomisk politik snabbt fatal.

Den europeiska krisen handlar inte längre om att ge stöd till mindre länder som Grekland, Portugal och Irland.

Den har övergått till vad som händer med stora ekonomier som Spanien, Italien och Frankrike om marknaderna inte lugnas.

Eurokrisen är på väg att omfatta en tredjedel av hela valutaunionen eller 130 procent av Tysklands ekonomi.

Inte konstigt att börsen har fallit kraftigt på sistone.

Om Italien får problem, då innebär det också att franska och tyska banker som har skulder i Italien får problem

Charles Wyplosz, en av Europas ledande makroekonomer, pekar i likhet med allt fler på Europeiska centralbanken.

Det som akut krävs för att lugna marknaden är att ECB – som har obegränsad tillgång till euro – garanterar att inget euroland ställer in betalningarna

Angela Merkel, som har sin bakgrund i DDR, blev tysk förbundskansler som en konsekvens av den tyska återföreningen. Det vore en ödets ironi och en historisk galenskap om hon lät euron krascha.

Angela Merkel föddes i Hamburg i dåvarande Västtyskland i en prästfamilj.

Hon kom med sin familj som barn till staden Templin i dåvarande Östtyskland, där hon växte upp.

Läs mer här

Charles Wyplosz, professor of economics at the Graduate Institute in Geneva, warned that he saw parallels with 1980s-era Japan,

where so-called zombie banks weighed down with bad investments tried to improve their financial standing by simply withholding new loans.

HOWARD SCHNEIDER The Washington Post 20 August 2011

Mr. Trichet may be remembered “as a charming and talented leader who failed to grasp the gravity of the crisis,”

said Charles Wyplosz, a professor of economics at the Graduate Institute in Geneva.

http://www.nytimes.com/2011/08/06/business/global/jean-claude-trichet-builder-of-the-euro-ends-his-career-on-a-bitter-note.html

Helmut Schlesinger, was president of the Bundesbank when sterling was forced out of the European Exchange Rate Mechanism in 1992.:

- And I would say that either we get the United States of Europe, that is an actual political union, and then that political union gets its own currency.

But then it is no monetary union any longer, but the currency of that new state.

Robert Peston, BBC Business editor, 17 May 2012

Förbundskansler Helmut Kohl gick med på förslaget – landsmännens skepsis till trots – och ett fördrag undertecknades senare i den holländska staden Maastricht.

Thatcher lade oförblommerat fram sin uppfattning för den man som hade makt att hindra den tyska återföreningen.

Gorbatjov svarade att Sovjetunionen var väl insatt i problemet, och hon kunde vara lugn.

Hans land ville lika lite som Storbritannien se ett enat Tyskland.

Det var värdefullt att de båda kände till varandras syn på denna ömtåliga fråga.

Till råga på allt lät François Mitterrand och fransmännen ledningen i Moskva förstå att de var inne på samma linje.

Timothy Garton Ash, DN

Mitterrand forderte Euro als Gegenleistung für die Einheit

Aus bisher geheim gehaltenen Protokollen geht nach SPIEGEL-Informationen hervor: Erst die Bereitschaft der Kohl-Bundesregierung, ihren Widerstand gegen die Einführung des Euro aufzugeben, ebnete den Weg zur Einheit.

Der Spiegel 25/9 2010

Der frühere Bundesbank-Präsident Karl-Otto Pöhl wurde noch deutlicher:

"Möglicherweise wäre die Europäische Währungsunion gar nicht zustande gekommen ohne deutsche Einheit."

Den tyske förbundskanslern Helmut Kohl tog denna oro på allvar och accepterade tanken på valutaunionen, som ett sätt att förankra det nya starka Tyskland i Europasamarbetet.

Resultatet blev Maastrichtfördraget.

Inför hotet om ett sönderfall kan man enas om åtgärder som vanligtvis ökar EU:s överstatliga karaktär.

Mats Hallgren, e24 21/12 2010

More Very important articles about EMU and the Financial Crisis

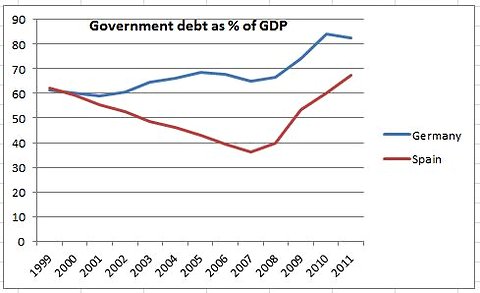

For those willing and able to examine our present situation with a reasonably open mind,

a comparison of the recent history of the Spanish and German economies can prove illuminating

As Wolfgang Munchau pointed out in the FT yesterday, Germany entered the eurozone at an uncompetitive exchange rate and embarked on a long period of (quite painful) wage moderation and deep structural reform.

A Fistful Of Euros, 31 August 2010 with many nice charts

Merkel’s Christian Democrats shellshocked after Bremen elections

A disaster for Angela Merkel’s CDU. Coming in third behind the Greens is traumatic for the Christian Democrats

Eurointelligence 24 May 2011

Frankfurter Allgemeine Zeitung and Süddeutsche Zeitung report on the soul searching within the CDU which comes to the depressing conclusion that it is no longer able to win majorities in an urban population.

Right now Europe may be embarking on a path that could tilt the union away from economic liberalism,

risking a split and, ultimately, even a British exit.

Mrs Merkel seems to be sleepwalking into this danger.

The Economist print 10/3 2011

Merkel följer folkets vilja

Kärnkraften har ingen framtid

Aftonbladet ledare, signerad Katrine Kielos, 2011-05-31

”Kärnkraften har ingen framtid... den är inte heller lämplig som en övergångsteknologi, tvärtom står den i vägen för nya och innovativa lösningar samt en framtidsorienterad omstrukturering av energiutbudet.” Citatet kommer varken från en trädkramande Greenpeace-aktivist, eller en miljöpartist med idéer om att framtidens välstånd ska växa på postindustriella träd.

Det är IG Metall, de tyska metallarbetarnas mäktiga fackförbund, som uttalar sig.

Natten till i går enades förbundskansler Angela Merkels regeringskoalition om att alla tyska kärnkraftverk ska stängas 2022. För Merkel var det ännu en politisk U-sväng

(”vår kansler är inte gjord av stål, hon är gjord av pudding”, som Der Spiegel nyligen skrev).

Förra veckan beslutade den schweiziska regeringen att fasa ut kärnkraften till 2034. Samtidigt har planerna för att bygga kärnkraftverk i Italien stoppats. Likaså i Thailand.

I Sverige sitter däremot en centerpartistisk miljöminister och beklagar den tyska avvecklingen.

Pakten löser inte eurons problem

Fredrik Reinfeldt vill inte uttala sig, och precis som statsministern påpekade: vad är det han ska uttala sig om?

Det finns inget papper och inga detaljer nerskrivna än. Men faktum kvarstår: Tysklands Angela Merkel och Frankrikes Nicolas Sarkozy föreslår en ”fransk-tysk konkurrenspakt” för eurozonen.

Allt ska vara bestämt om drygt en månad och nej, det finns inget papper.

Aftonbladet ledare, signerad Katrine Kielos, 12/2 2011

Någon verklig plan för hur man ska utjämna obalanserna inom EMU finns inte. Den underliggande politiska analysen handlar om att eftersom finanssektorn har orsakat krisen, så ska vanliga löntagare betala och förslaget går långt in och petar i nationella angelägenheter som kollektivavtal.

Skulle det genomföras är det naturligtvis ännu svårare att se ett euro-medlemskap för svensk del.

Katrine Kielos hos Aftonbladet

zc

Keep an eye on Austria, with an increasingly unstable banking system,

and the Netherlands, with slow growth and a massively over-indebted household sector.

Don’t assume that Germany can sail through this crash unscathed either. Its economy has been driven by exports to China, worth $100bn a year.

If China slows down dramatically, we may well find that the German economy is a lot weaker than we thought.

Matthew Lynn, Telegraph 24 Aug 2015

Unless Gordon Brown turned out to be right after all, and 'boom and bust' actually has been abolished, it was always going to come to a stop sometime. That’s how the market works

The eurozone was in a bad enough state already. But in a bear market, fresh cracks will emerge, just as they did in 2009 and 2010 in the wake of the last collapse.

When the French finance minister Mr Sapin arrived in Brussels at midday, he received a shock:

Wolfgang Schäuble, the German finance minister, was armed with a one-page paper advocating

a Greek “timeout from the eurozone” for “at least the next five years”

if Athens did not accept the bloc’s exacting conditions for a new bailout.

FT 17 July 2015

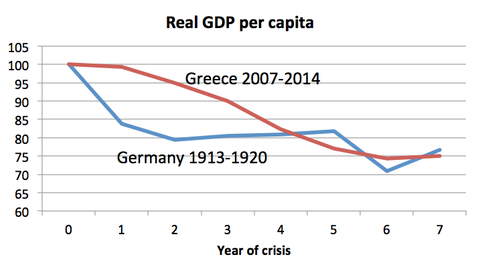

Weimar and Greece

Paul Krugman, 15 February 2015

Weimar, it’s never about the deflationary effects of the gold standard and austerity in 1930-32,

which is, you know, what brought you-know-who to power.

Är det tyskarna som är The Good Guys inom Euroland?

Rolf Englund 15 Februari 2015

Athanasios Orphanides, a former member of the ECB’s governing council, said it potentially broke EU rules.

“It is as if it’s accepted that the euro area’s modus operandi is to clear things with Germany,

and for the ECB to constrain its actions to what is best for Germany,” he told the Financial Times.

“This is inconsistent with and violates the [EU] treaty.”

FT 20 January 2015

The destruction of the Reichsmark’s value is an important historical lesson.

But missing from that narrative is the painful deflation that followed hyperinflation.

In 1923, at the height of the hyperinflation, 751,000 Germans were without work.

By 1932, as deflation began to bite, unemployment hit 5.6m.

Financial Times 18 January 2015

The European Court of Justice has declared

legal supremacy over the sovereign state of Germany, and therefore of Britain, France, Denmark and Poland as well.

If the Karlsruhe accepts this, the implication is that Germany will no longer be a fully self-governing sovereign state.

"This Union" - meaning the Union to which EU integrationists aspire

- is currently blocked by the German court, the last safeguard of our nation states against encroachment.

Ambrose Evans-Pritchard, 14 Jan 2015

What must change is the way in which nations are treated like wayward children.

People not just in the periphery, but in Italy and France, the euro’s second and third countries,

and the EU’s co-founders, are fed up with being dictated to.

It does not help when the orders themselves are wrong-headed,

as in the case of universally applied demand-destroying economic policies.

Financial Times editorial December 29, 2014

2015 must be the year when the eurozone’s most influential leaders lift their eyes from technocratic fixes to the wider horizons of politics.

That does not mean fiscal or political union.

If all the euro’s member states and, more importantly, their peoples,

were freely willing to take such a step, this newspaper would welcome it.

But the tolerance for further integration is at rock bottom.

This is due in part to the antagonising politics and contractionary policies with which the eurozone chose to confront the crisis.

It is also because of the overdone claim that “there is no alternative”.

The current path instead converges on a German model, not just in fiscal matters but more critically in the nature of structural reforms. Germany’s are credited with growth and employment, but they brought under-investment, precarious jobs and wage stagnation.

Top of pagePolicy makers remain wilfully blind to the reality that the debt problem is unresolved,

and that the eurozone’s outstanding public sector borrowings will never be repaid in full.

The West German economic miracle was launched from a clean balance sheet while the Allies remained heavily indebted.

John Plender, FT December 29, 2014

Some are born great, some achieve greatness, and some have greatness thrust upon ’em.

Germany did not seek the euro. On the contrary, it was a price others foolishly asked Germans to pay for unification.

German policy makers understood the political and economic implications of a currency union.

Those of almost all other would-be members did not.

Martin Wolf, FT December 9, 2014

The economic doctrines central to German conventional wisdom are those of a small open economy.

Debt restructuring must now be on the table, starting with Greece. Ireland, similarly, should be freed of the onerous burden of bailing out the foolish foreign creditors of its banks.

"The 50 Days That Changed Europe"

In Strasbourg on Dec. 9, 1989, after the Berlin Wall fell,

Germany agreed to monetary union in order to get President Mitterand to agree to German reunification

Wall Street Journal, 23 Sept 2011

“Be not afraid of greatness. Some are born great, some achieve greatness, and others have greatness thrust upon them.”

William Shakespeare, Twelfth Night

Germany’s policymakers deny the eurozone’s crisis-ridden countries a more active fiscal policy;

refuse to support a European investment agenda to generate demand and growth;

have declared a fiscal surplus, rather than faster potential growth, as their primary domestic goal;

and have begun turning against the European Central Bank (ECB) in the struggle against deflation and a credit crunch.

On all four counts, Germany is wrong.

Marcel Fratzscher, Project Syndicate 21 November 2014

Marcel Fratzscher, a former head of International Policy Analysis at the European Central Bank, is President of DIW Berlin, a research institute and think tank, and a professor of macroeconomics and finance at Humboldt University.

To be sure, Germany is justified in rejecting narrow-minded calls by France and Italy for unconditional fiscal expansion.

After all, fiscal stimulus can work only if it supports private investment and is accompanied by much more ambitious structural reforms – the kind of reforms that France and Italy are currently resisting.

The key to ending the European crisis is a stimulus plan that addresses deficiencies on both the supply and demand sides.

That is why Germany’s refusal to help find a way to finance the proposed European investment agenda – which, for a limited time, would fund productive private investment – is a mistake.

Equally problematic is Germany’s focus on maintaining a fiscal surplus.

The Germans have a name for their unique economic framework: ordoliberalism.

Wolfgang Münchau FT 16 November 2014

Mario Draghi's efforts to save EMU have hit the Berlin Wall

If the ECB tries to press ahead with QE, Germany's central bank chief will resign.

If it does not do so, the eurozone will remain stuck in a lowflation trap and Mario Draghi will resign

Ambrose Evans-Pritchard, 5 November 2014

Deep Divisions Emerge over ECB Quantitative Easing Plans

Some view /ECB/ bond purchases as unavoidable, as the euro zone could otherwise slide into dangerous deflation

Others warn against a violation of the ECB principle, which prohibits funding government debt by printing money.

Der Spiegel, 3 November 2014

Otmar Issing, ECB’s former chief economist, one of my Gurus,

apparantly does not understand that Germany no longer is an idependent state, regarding monetary policy.

Rolf Englund blog 24 October 2014

ECB should abolish its OMT program – which, according to Germany’s Constitutional Court, does not comply with EU treaty law anyway.

Furthermore, the ECB should reintroduce the requirement that TARGET2 debts be repaid with gold, as occurred in the US before 1975

The fiscal compact – formally the Treaty on Stability, Coordination, and Governance in the Economic and Monetary Union

French Prime Minister Manuel Valls and his Italian counterpart, Matteo Renzi, have declared – or at least insinuated –

that they will not comply with the fiscal compact to which all of the eurozone’s member countries agreed in 2012

Their stance highlights a fundamental flaw in the structure of the European Monetary Union

– one that Europe’s leaders must recognize and address before it is too late.

Hans-Werner Sinn, Project Syndicate 22 October 2014

German model is ruinous for Germany, and deadly for Europe

The Hartz IV reforms – so widely praised as the foundation of German competitiveness,

and now being foisted on southern Europe – did not raise productivity

Ambrose Evans-Pritchard 8 Oct 2014

The Hartz IV reforms – so widely praised as the foundation of German competitiveness, and now being foisted on southern Europe – did not raise productivity, the proper measure of labour reform.

Prof Fratzscher says the chief effect was to let companies compress wages through labour arbitrage. Real pay has fallen back to the levels of the late 1990s.

The legacy of Hartz IV is a lumpen-proletariat of 7.4m people on “mini-jobs”, part-time work that is tax-free up to €450. This flatters the jobless rate, but Germany has become a split society, more unequal than at any time in its modern history. A fifth of German children are raised in poverty.

Germany’s path to competitiveness: cutting the cost of labour.

Make no mistake; that has been the basis of the nation’s export success in the past dozen years;

and exports have been its sole consistent source of growth in that period.

But low wages are not the basis on which a rich nation should compete.

Adam Posen, president of the Peterson Institute for International Economics, FT 3 September 2013

Germany's Ukip threatens to paralyse eurozone rescue efforts

Alternative für Deutschland winning 12.6pc of the vote in Brandenburg and 10.6pc in Thuringia

Ambrose Evans-Pritchard (11,7k Twitterföljare), 23 September 2014

The new movement calls for an “orderly break-up” of monetary union, either by dividing the euro into smaller blocs or by returning to national currencies.

“Germany doesn’t need the euro, and the euro is hurting other countries. A return to the D-mark should not be a taboo,” it says.

Club Med states should recover viability through debt restructuring, rather than rely on taxpayer bail-outs that draw out the agony.

Unlike Ukip, the movement wants Germany to stay in a “strong EU”.

S&P said a forthcoming judgment by the European Court on the ECB’s backstop plan for Italy and Spain (OMT) might further constrain the EU rescue machinery. Germany’s top court has already ruled that the OMT “manifestly violates” EU treaties and is probably ultra vires, meaning that Bundesbank may not legally take part.

The political climate in the eurozone’s two core states is now extraordinary.

A D-Mark party is running at 10pc in the latest polls in Germany,

while the Front National’s Marine Le Pen is in the lead in France on 26 pc with calls for a return to the franc.

One more shock would test EMU cohesion to its limits.

Top of page with link also to German Constitutional Court

Europe’s banking union is set to face a challenge in Germany’s constitutional court,

a development that threatens to generate renewed uncertainty over one of the main responses to the eurozone’s financial crisis.

EU’s banking union is illegal under German law because it was created without the necessary treaty changes.

FT July 27, 2014

EU behöver inte en till tysk seger

Matteo Renzi, Italiens populäre socialdemokratiske premiärminister, har tagit över ordförandeklubban i EU

och utmanar Tyskland gällande åtstramningspolitiken.

Lycka till, säger kommentariatet, britterna förlorade nyss med 7-1.

Eller 26-2 för att använda de faktiska röstsiffrorna i rådet.

Men man ska nog inte räkna ut Matteo Renzi.

Katrine Kielos, Aftobladet 13 juli 2014

The argument between Italy and Germany asks a question at the heart of the currency’s future

Can an arrangement that will always fall well short of a textbook monetary union

be at once economically robust and politically sustainable?

Philip Stephens, FT 10 July 2014

David Cameron insisted on a show of hands, that leaders take responsibility for their decision.

The prime minister told them they would regret their decision and that they were taking

"an irreversible step, handing power to the European Parliament and away from the heads of government".

It was a sad day, he said.

But Angela Merkel defended the candidate she had been so lukewarm about just a few weeks ago.

She described him as a man who understood Europe and could balance the wishes of both the national governments and the European Parliament.

Later the German chancellor appeared to reach out to Britain.

She said that ever-closer union did not mean a one-speed Europe.

Gavin Hewitt, BBC 27 June 2014

David Cameron will hold crisis talks in Sweden on Monday with Angela Merkel in a further high-risk bid to persuade the German chancellor to drop support for the federalist Jean-Claude Juncker

Downing Street said that the prime minister, who will also be joined by the anti-Juncker prime ministers of Sweden and the Netherlands

to discuss the impasse, would be open to new names coming forward, and the idea of a woman taking the job

http://www.theguardian.com/world/2014/jun/07/david-cameron-new-bid-stop-jean-claude-juncker

Cameron, Reinfeldt, Merkel

Toppmöte på Harpsund om Juncker

Rolf Englund blog 8 juni 2014

The German economy Clouds ahead

Recent vigour hides underlying weaknesses in Europe’s leading economy

The Economist print edition June 7th 2014

I notice that the European Parliament’s president Martin Schulz (a socialist from the opposing bloc) is

calling for everybody to “accept the inevitable” and close ranks behind the Juncker juggernaut.

But he could hardly have chosen language more exasperating language,

since it is the presumption of inevitability that is most repugnant.

Ambrose Evans-Pritchard, June 6th, 2014

Schäuble explained that, as far as decisions over OMT bond purchases are concerned, the ECB ”cannot make these decisions because it has bound them to conditions that are beyond its control.”

Schäuble said that these conditions are decided by the European Stability Mechanism, the European governments’ bail-out program.

“ESM decisions are subject to a unanimous vote and we will not approve of such a program as announced by the ECB,” Schäuble explained

— buttressing a belief that, after a two-year interregnum, euro-area jitters may be about to restart.

David Marsh, MarketWatch, June 4, 2014

German wages fell 0.2pc in 2013. Germany too is in wage deflation.

Which raises the question: how on earth are France, Italy, Spain, Portugal, and Greece supposed to claw back lost labour competitiveness against Germany

by means of "internal devaluations" if German wages are falling?

Ambrose Evans-Pritchard, February 20th, 2014

Outright Monetary Infractions

The Court has now declared that it fully endorses the plaintiffs' arguments, and that the OMT program does indeed violate EU primary law.

Since its launch in 2012, the OMT program has allowed the ECB to buy, if necessary, unlimited amounts of troubled euro zone countries' government bonds,

provided the affected countries subscribe to the rules of Europe's rescue fund, the European Stability Mechanism.

Hans-Werner Sinn/Project Syndicate/CNBC, 10 Feb 2014

The /German Constitutional/ court concludes that OMT violates the German constitution.

It accuses the ECB of making a power grab by extending its own mandate.

It says the scheme endangers the underpinnings of the eurozone rescue programmes.

Worse, it says OMT undermined deep principles of democracy.

Wolfgang Münchau, FT 9 February 2014

In a speech setting out her priorities for the next parliamentary term, the German chancellor

Ms Merkel called for a “real economic union” in Europe through treaty change

saying that the current level of economic co-ordination in the eurozone is unsatisfactory.

The eurozone is currently in a state of “deceptive calm” in which the crisis is “under control, at best,” she said

Financial Times, 14 January 2014

“We want to emerge stronger from the crisis than we were at its outbreak,” Ms Merkel said.

Ms Merkel does not say “no” to eurozone bonds.

She says: “Not without treaty change.”

FT 2012

Martin Hellwig betonar att många problem återfinns i det tyska banksystemet.

"This is the most important book to have come out of the financial crisis", Martin Wolf

Martin Hellwig har skrivit boken ”The Bankers' New Clothes: What's Wrong with Banking and What to Do About It”.

Han anser att en äkta bankunion är en absolut nödvändighet om eurosamarbetet ska överleva.

SvD Näringsliv 26 december 2013

Quick: I say "German banks," and what's the first thing that comes to your mind?

Deutsche Bank? Big, German – must be stable and low-risk.

The fact that southern Europeans are opening accounts left and right in DB must mean that DB is lower-risk than the local wild guys.

Except that they have the largest derivatives portfolio, at $70 trillion

(but don't worry because it all nets out, sort of, and of course there is no counter-party risk!),

and they are the most highly leveraged bank in Europe (at 60:1 in the last tests – not a misprint)

John Mauldin, 16 december 2013

Without a truly integrated union and strong institutions to coordinate and enforce policy decisions,

the cries of “Berlin must do something” ring hollow.

Karl-Theodor zu Guttenberg, New York Times, 27 November 2013

A concern is that the monetary policy of the ECB is unsuitable for Germany and might even cause asset price bubbles.

This is surely true, just as the monetary policy pursued before 2007 was unsuitable for Ireland and Spain and did indeed drive asset price bubbles.

A central bank called upon to deliver a target rate of inflation in a union of diverse economies will destabilise nearly all the members at some time.

But that is what joining a currency union entails for all members, including even the largest.

Martin Wolf, FT, November 12, 2013

Why the eurozone will come apart sooner or later

The single currency has failed to become the harmonising force that it was supposed to be

Samuel Brittan, Financial Times, August 8, 2013

Don't blame Germany for the eurozone's travails, blame the euro itself

Germany didn’t set out to design an economic model that impoverishes much of the rest of Europe

Any attempt to set a single interest rate for 17 politically and fiscally sovereign nations is almost by definition doomed to failure.

Perpetual crisis is more or less guaranteed.

Jeremy Warner, Telegraph, 11 Nov 2013

I’ve found it impossible to ascertain who was originally responsible for the expression “one size fits all monetary policy”; Eddie George, former governor of the Bank of England, used it in the context of the single currency as far back as the late 1990s, though it possibly has a much longer pedigree.

In the early years of the euro, monetary policy was set loose to support a struggling Germany. From a German perspective, it should very probably have been looser still, but even as it stood, it was far too accommodative for much of the periphery, where it helped inflate unsustainable construction, banking and spending bubbles.

Germany didn’t set out to design an economic model that impoverishes much of the rest of Europe. Unfortunately, it did acquiesce in the euro, which prevents the natural market remedy of free-floating exchange rates and the application by nations of self-interested monetary policy.

The fault lies not with hard working Germans, but the folly of Europe’s policy elite.

The German finance ministry responded that its current account surplus was “no cause for concern, neither for Germany, nor for the eurozone, or the global economy”.

This reaction is as predictable as it is wrong.

The surplus, forecast by the IMF at $215bn this year (virtually the same as China’s) is indeed a big issue, above all for the future of the eurozone.

Martin Wolf, Financial Times, 5 Novermber 2013

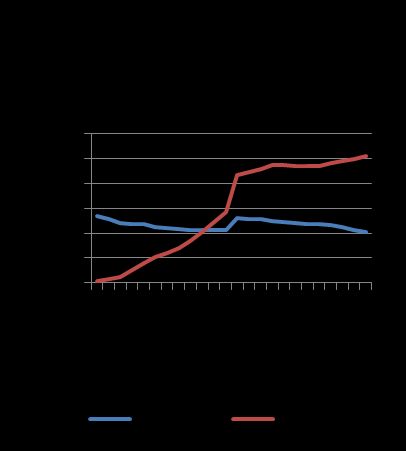

I förhållande till ekonomins storlek så utklassar svensk bytesbalans faktiskt både Kinas och Tysklands,

vilket framgår av följande diagram eller nedanstående tabell.

Andreas Cervenka, SvD Näringsliv 16 november 2013

China, Germany Criticized by U.S. for Account Imbalances

Germany’s nominal current-account surplus was larger than that of China

Bloomberg, Oct 31, 2013

The Treasury targeted “countries with large and persistent surpluses” in the euro area, which “need to take action to boost domestic demand growth and shrink their surpluses.”

Germany has “maintained a large current-account surplus throughout the euro-area financial crisis, and in 2012, Germany’s nominal current-account surplus was larger than that of China,”

IMF Backs U.S. Treasury in Criticizing German Exports

"neglect of domestic demand has delayed ending the misery"

Bloomberg, Nov 1, 2013

The International Monetary Fund joined the U.S. Treasury Department in rebuking Germany’s trade surpluses, rebuffing the claim of Chancellor Angela Merkel’s government that booming exports are a sign of economic health.

As Germany bristled over a Treasury report critical of its current-account surpluses, the fund’s First Deputy Managing Director David Lipton urged Merkel’s government to reduce its export surplus to an “appropriate rate” to help its euro-area partners cut deficits.

The Treasury report berated Germany’s export focus during Europe’s debt crisis, saying its neglect of domestic demand has delayed ending the misery.

"The election had to take place before new policy initiatives could be rolled out."

This was always naïve. Mrs. Merkel is not about to pull a rabbit out of her hat.

Barry Eichengreen, 15 October 2013

Rather, she was always going to stay the course. Her temperament is perfectly attuned to that of her public.

She is content with the status quo, just as the German public is content.

It is not her way to accept, much less offer, radical changes in policy strategy.

The IMF has just told her that the growth of German GDP should accelerate further to 1.4% in 2014.

Southern Europe may be suffering, but who is to say that a little suffering is bad for the soul?

A little suffering may not be bad for the soul, but it is bad for stability.

There is still the possibility that high unemployment and continuing recession may result in a sudden vote of no confidence in the Greek or Italian government.

Portugal and Ireland may fail in their efforts to regain bond market access. A big bank failure in Italy or Spain might alarm investors.

Complacent Germans evidently believe that the status quo is tenable. In fact, any number of untoward events could upset the applecart. At that point, the crisis will be back with a vengeance.

And the biggest problem is yet to come

Italy that is unable to grow, incapable of reforming, and burdened with what increasingly looks like an unsustainable debt.

The parallels drawn by Mr Schäuble between Germany’s reforms in the 2000s

and the position of today’s vulnerable countries are absurd.

Martin Wolf, Financial Times, September 24, 2013

Wolfgang Schäuble, Germany’s finance minister, laid out the view on which Berlin’s current policy is based, with sobering clarity, in the Financial Times last week. The doomsayers, he argued were wrong. Instead, “the world should rejoice at the positive economic signals the eurozone is sending almost continuously these days”.

The latest unemployment rate is 12 per cent in Italy; 13.8 per cent in Ireland; 16.5 per cent in Portugal; 26.3 per cent in Spain; and 27.9 per cent in Greece.

Mr Schäuble accuses his critics of living in a “parallel universe”. I am happy to do so rather than live in his.

Ambrose Evans-Pritchard of The Telegraph has provided a colourful rejoinder. Kevin O’Rourke of Oxford and Alan Taylor of the University of California, Davis, offered a sober assessment, concluding that a break-up is not unthinkable.

One needs to understand why the parallels drawn by Mr Schäuble between Germany’s reforms in the 2000s and the position of today’s vulnerable countries are absurd.

Germany experienced a mild recession in 2003; today’s vulnerable countries are suffering depressions. Germany’s largest current account deficit was 1.7 per cent of GDP in 2000; those of today’s crisis-hit countries were far larger, with those of Greece, Portugal and Spain more than 10 per cent of GDP.

In the terrifying summer of 2012, the European Central Bank promised to do “whatever it takes” to save the euro. The ECB then announced its Outright Monetary Transaction programme of support for bonds of beleaguered sovereigns. This assuaged the markets’ alarm without any need (so far) to fire a shot in anger. This has given the eurozone time. But it has not solved the underlying problems.The new macroeconomic imbalances procedure avoids recognising the role of Germany’s shortage of domestic demand is most revealing.

The benchmark for concern over a current account surplus is 6 per cent of GDP, regardless of the size of the country.

Germany’s average turns out to be exactly 5.9 per cent.

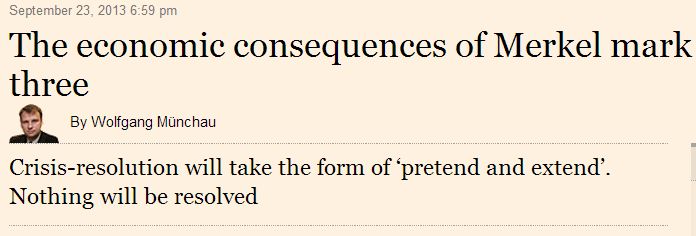

“pretend and extend”

You extend the maturity of the loans, reduce the interest rates and pretend your credit is still whole.

Wolfgang Münchau, Financial Times, September 24, 2013

It lacks transparency and it is undemocratic.

In the eurozone crisis, the logical limit would be to extend the maturity of the loans to infinite and reduce interest rates to zero. They will probably stay clear of this limit but the net present value of the loans will have to fall.

Crisis resolution through any form of debt forgiveness has no legal basis in the EU and is a political minefield.

So there will be a third Greek programme, a second Portuguese programme, and then fourth and third programmes respectively.

Everything will be revolved. Nothing will be resolved.

For me, the biggest achievement was the total and utter destruction of the FDP, her junior coalition partner. Or rather it was a case of assisted suicide.

While I disagree with almost all her economic policies, I cannot hide my admiration for her political ruthlessness.

Wolfgang Münchau, Financial Times, September 24, 2013

Germany’s path to competitiveness: cutting the cost of labour.

Make no mistake; that has been the basis of the nation’s export success in the past dozen years;

and exports have been its sole consistent source of growth in that period.

But low wages are not the basis on which a rich nation should compete.

Adam Posen, president of the Peterson Institute for International Economics, FT 3 September 2013

Since 2003 a falling unemployment rate has been the consequence of the creation of a large number of low-wage and part-time or flexitime jobs, without the benefits and protections afforded earlier postwar generations.

Germany now has the highest proportion of low-wage workers relative to the national median income in western Europe. Average wages increased by more than inflation and productivity growth in the past year for the first time after more than a decade of stagnation.

An American economist on the Bank of England’s monetary policy committee,

Mr. Posen is no academic scribbler or lonely blogger

New York Times 17 Sept 2011

Only?

Reverting to the D-mark is only backed by one-third of voters (32%)

46% said the euro shouldn’t be saved “at any cost”, while 42% said it should.

Open Europe and Open Europe Berlin, the first in a three-part series about Germans’ views on Europe,

ahead of the country’s federal elections on 22 September.

Open Europe, September 3, 2013

42% said they agree the euro is now threatening the European project – only marginally lower than those who say it does not (45%)

There was considerable support for the German Constitutional Court to rule the ECB’s bond-buying programme (OMT) illegal in its on-going court case.

By a margin of almost two to one (46% to 25%), Germans said the Court should rule against the OMT if the stability of the euro could be ensured in other ways.

Over a third (35%) said that the Court should rule against the OMT, even if that threatens the stability of the euro.

In a strong indication of how seriously Germans take the rule of law, almost half (48%) of those asked said upholding the law is more important than saving the euro (30% disagreed).

Germans love Merkel. Why? Because she asks little of them.

And because Merkel is practising a new style of power politics in Europe, which I have called Merkiavellism:

a combination of Machiavelli and Merkel.

Ulrich Beck, The Guardian, 2 September 2013

"Is it better to be loved or feared?" Machiavelli inquired in The Prince.

His answer was that "one ought to be both feared and loved, but as it is difficult for the two to go together, it is much safer to be feared than loved, if one of the two has to be wanting".

Merkiavelli is applying this principle in a new way. She is to be feared abroad, and loved at home – perhaps because she has taught other countries to fear. Brutal neoliberalism to the outside world, consensus with a social democratic tinge at home – that's the successful formula that has enabled Merkiavelli constantly to expand her own position of power and that of Germany as well.

There's a striking discrepancy concerning the positions of executive elites and political parties too. In most European countries there are strong Eurosceptic movements and parties giving the increasingly restless citizenry a voice.

PRINCE-programmet (program för att informera de europeiska medborgarna) ”kompletterar och förstärker kommissionens permanenta informationverksamhet för särskilda politikområden”.

- Detta är ett viktigt steg i utvecklingen av informationspolitiken för Europeiska unionens medborgare, skriver Kommissionens befullmäktigade i Sverige.

De motsträviga EU-medborgarna skall således med hjälp av sina egna skattepengar fås att förstå att EU och EMU är bra. Inte ens den berömde Machiavelli hade kunnat räkna ut det bättre.

Jag friskar upp mitt minne i Nationalencyklopedin och läser: Machiavelli, Niccolò, 1469-1527, italiensk statsman, historiker och filosof. Framför allt genom de kontroversiella läror M. förde fram i "Il principe" kan han sägas ha grundlagt den s.k. realpolitiska traditionen i västerländskt politiskt tänkande och samtidigt ha givit upphov till den dåliga klang som fortfarande vidlåder hans namn ("machiavellism", "machiavellisk").

M. framhöll bl.a. att en furste för att uppnå och hålla sig kvar vid makten ofta tvingas göra sig skyldig till handlingar som i det privata livet skulle betraktas som förkastliga - lögn, mord, svek, skoningslöshet.

Det viktigaste politiska målet var för M. skapandet av en italiensk enhetsstat under en stark furste.

År 1513 tillkom hans mest berömda verk, Il principe ("Fursten") eller - som den heter på engelska - The Prince.

Rolf Englund, Nya Wermlands-Tidningen 2001-04-04

I ett europeiskt perspektiv heter mardrömmen ”Alternativ för Tyskland” (AfD).

Om detta lilla parti skulle lyckas ta sig in i förbundsdagen så rubbas i grunden förutsättningarna för Tyskland som en betryggande pålitlig partner i Europa.

När nu ett tredje stödpaket till Grekland diskuteras offentligt får AfD understöd för sin agitation.

Fortfarande säger opinionsmätningarna att knappt 40 procent av väljarna är osäkra.

Rolf Gustavsson, SvD 1 september 2013.

Sannolikt är det för tidigt att räkna ut det nybildade eurokritiska partiet Alternativ för Tyskland.

DN besökte på måndagskvällen ett möte som borde vara en varningssignal för de etablerade partierna.

AfD präglas helt av talesmannen och nationalekonomen Bernd Lucke, professor vid universitetet i Hamburg och en debattör med pojkaktig utstrålning.

Han håller ett långt tal i på hotellet och gisslar det han konsekvent kallar gammelpartierna.

De cirka 400 åhörarna är helt i hans händer.

DN 27 augusti 2013

De etablerade partierna har än så länge försökt tiga ihjäl AfD i vetskap om att angrepp ger uppmärksamhet och eventuellt också nya anhängare.

Förbundskanslern Angela Merkel (CDU) har sagt att ”misslyckas euron så misslyckas Europa”. Bernd Lucke skakar på huvudet, han förstår inte vad Merkel menar, säger att det är ett av hennes många ogrundade påståenden.

– Hon har väldigt dåliga rådgivare i eurofrågan. Det som är vettigt består oavsett hur det går för euron, om det så är Schengen, frihandeln eller den fria arbetsmarknaden, tror han.

Angela Merkel: Greece should never have been allowed in the euro

Ms Merkel’s finance minister, Wolfgang Schaeuble, admitted last month that Greece will need another bailout, raising fears among Germans that they will have to foot the bill.

On Sunday, the Chancellor refused to rule out another aid package but dismissed debt haircuts, which would hurt Germany as the country with the largest exposure to Greece.

“I am expressly warning against a haircut,” she said. “It could create a domino effect of uncertainty ... in the eurozone.”

Greece moved to the center of the German election campaign four weeks before election day,

as the SPD escalates its attacks over Merkel’s crisis response

With the European debt crisis in its fourth year, Merkel’s party allies have begun to address openly the prospect of a fresh Greek aid package.

Bloomberg, August 25, 2013

“Germany will have to pay for the stability of Europe and the euro zone,” Steinbrueck told ARD television in an interview yesterday in Berlin.

“I have the impression that this Greek package is connected with an assessment that crisis strategy up until now hasn’t lit a spark, but has rather failed.”

Merkel's Conservatives Split on Greek Aid

Schäuble, a senior member of the CDU, said that Athens would need more financial assistance

beyond the €230 billion it has already been promised to keep it solvent through the end of 2014.

Der Spiegel, 22 August 2013

Fotnot: 230 miljarder euro, i lån, är cirka 2,000 miljarder svenska kronor, för att Grekland skall klara sig till slutet av 2014.

Sedan skall pengarna återbetalas, någon gång, eller skrivas av.

Merkel's European Failure: Germany Dozes on a Volcano

Angela Merkel's government is forcing Southern Europe to undertake profound reforms

while at the same time denying its own responsibility for the consequences of its crisis policies.

Germany is risking a historic failure with its shortsighted wrangling.

Jürgen Habermas, Der Spiegel, August 09, 2013

Under the imploring headline "We Germans Don't Want a German Europe," German Finance Minister Wolfgang Schäuble recently denied in a newspaper essay published simultaneously in Great Britain, France, Poland, Italy and Spain that Germany seeks a political leadership role in the European Union.

Full textTyskland är eurokrisens största vinnare.

Den tyska statskassan har sparat över 350 miljarder kronor på att landets räntekostnader rasat under krisen.

SvD Näringsliv, 21 augusti 2013

Germans are exposed to € 86 bn in European Financial Stability Facility loans

German Finance Ministry via tips Open Europe, August 2013

While the language of the IMF report is polite,

it masks a bitter dispute between the Fund and Germany over the nature of the EMU malaise,

and whether austerity and reform really have cleared the way for a viable recovery.

Ambrose, 6 Aug 2013

The IMF said Germany is barely above recession level, with growth of just 0.3pc this year followed by a Japan-style stagnation for the rest of decade with a peak growth rate of 1.3pc

The two have clashed at each stage of the crisis, with the Bundesbank deriding the IMF as the “Inflation Maximising Fund” under the control of Keynesians who have overstepped their “institutional and legal” authority.

The rebukes have infuriated the IMF Board members, especially those from Asia, Latin America, which think the Fund has been doing Germany’s work for it. They grumble that the IMF has been dragged into ill-designed rescue packages, and that the lion’s share of IMF resources have been used to prop up the currency experiment of rich countries well able to clean up their own messs.

Its envoy to the IMF refuted suggestions that Germany has misread the crisis, writing “I would like to emphasize that substantial progress has already been made”. He insisted that Germany must pursue “prudent policies” and act as an “anchor of regional stability” rather than try to kick-start growth with Keynesian stimulus.

He swatted aside demands by the Fund for a near halving of Germany’s current account surplus -- 7pc GDP last year -- saying the chronic imbalance is a result of complex market forces and the “high competitiveness of German enterprises”.

The IMF said Germany’s currency is undervalued by up to 10pc, roughly the same as China, but monetary union is jamming the correction mechanism with EMU.

The IMF’s latest report on Greece lays bares the country’s grotesque situation, and exposes the charade of EMU policy. It states that public debt will reach 176pc of GDP this year.

“The commitment of Greece’s European partners to provide debt relief as needed to keep debt on the programmed path remains, therefore, a critical part of the program,” said the Fund.

All EMU “solidarity” so far has been in the form of loans, adding further debt. There have been no grants or transfers. The moment that this starts to cost real money, we will enter a new phase of the EMU saga.

This cannot be countenanced before the German elections in September, and for the sake of appearances it cannot be carried out immediately afterwards either. That would be too cynical.

Ambrose Evans-Pritchard, August 1st, 2013

Considering issuing at least €6bn in hybrid equity capital such as convertible bonds

Deutsche Bank set to shrink to achieve leverage target

Deutsche Bank has one of the lowest leverage ratios of large banks globally

Financial Times, July 21, 2013

Elefanten i rummet är Frankrike – EU:s näst största ekonomi

Det tyska förbundsdagsvalet den 22 september lägger en död hand över europeisk krishantering under sommaren.

Thomas Gür, Kolumn SvD 20 juni 2013

De senaste 30 åren har Frankrike haft budgetunderskott nästan varje år.

I fjol var det 4,6 procent; högre än Italiens och i klass med Portugals.

Landets offentliga skuldsättning har gått från 56 procent av BNP år 2000 till vad som uppskattas bli nästan 95 procent i år.

Det tyska förbundsdagsvalet den 22 september lägger en död hand över europeisk krishantering under sommaren.

Tysklands Angela Merkel kan finna sig i rollen som den enda räddaren i nöden för Frankrike.

Kommer i så fall Tyskland och de tyska väljarna mäkta med att också ta sig an Grekland, Portugal, Spanien och Italien?

Thomas Gür är nejsägaren som ändrat

uppfattning och kommer att rösta för euron i

folkomröstningen.

MUF:s Blått, nr 1 2003

Fram till folkomröstningen om euron i september kommer Thomas Gür att arbeta som rådgivare till partiet i samband med kampanjarbetet för ett moderat ja.

- Jag tycker att euron är felaktigt uppbyggd,

och att en valutaunion skapar man

när den övriga integrationen

är färdig. EMU som system kan man vara kritisk till

"Elephant in the room" is an English metaphorical idiom for an obvious truth that is either being ignored or going unaddressed.

The idiomatic expression also applies to an obvious problem or risk no one wants to discuss.

It is based on the idea that an elephant in a room would be impossible to overlook;

thus, people in the room who pretend the elephant is not there have chosen to avoid dealing with the looming big issue.

http://en.wikipedia.org/wiki/Elephant_in_the_room

Tomas Lundin

Klart står också att det tyska förbundsdagsvalet den 22 september lägger en död hand över hela krispolitiken.

Alla vet att Portugal sannolikt kommer att behöva ett nytt stödpaket, precis som Grekland. Men det får man inte ens viska om så länge Angela Merkel är på valturné och möter väljare som ser rött bara ordet Sydeuropa nämns.

Allt detta är naturligtvis makulatur när valet i Tyskland är över, oavsett vem som vinner.

Då finns det ingen anledning längre att blunda för det oundvikliga.

http://www.svd.se/naringsliv/nyheter/varlden/eurokrisen-tar-fart-igen_8350976.svd

Germany is preparing for a national election in which – much like in last year’s French presidential election – the European crisis is to play no part, or at least only a minor one.

Both government and opposition believe that it would be better to tell the people the truth concerning

the most vital question of the day only after the election (and in measured doses).

Such an outcome would make a mockery of democracy.

Joschka Fischer, Project Syndicate, April 30, 2013

During the current calendar year, Greece's mountain of debt will grow by around €330 billion

The only thing left that can help Greece pull itself out of the crisis is a debt haircut by public creditors.

Whether one wants to call that step a haircut, debt forgiveness or a state bankruptcy is of secondary importance

Der Spiegel, July 18, 2013

Is Germany Repeating American Errors at Bretton Woods?

Today, Germany is trying to resuscitate /återuppväcka/ the periphery of the crisis-stricken euro area

in much the same way, and it is worth looking back at the formation of Bretton Woods for clues as to how this will play out.

Germany will soon have to choose: a Marshall Plan for the south, or an economic and political breakdown of the euro zone.

Bloomberg, July 16, 2013

Why Austerity Still Isn't Working in Greece

Representatives of Greek business are now convinced that the country cannot survive without yet another debt haircut.

The subject is politically sensitive, especially in Germany, because this time a debt haircut would also affect public creditors,

which already hold 80 percent of Greek sovereign debt.

In other words, a large share of German assistance loans would be irretrievably lost.

Der Spiegel, July 9, 2013

Indeed, German Finance Minister Wolfgang Schäuble ruled out such a possibility just last week.

Greece is expecting a second debt haircut from its European creditors following the German election,

the country's economy minister said on Tuesday. First, though, Athens must prove that it has done enough

to receive the next tranche of badly needed bailout money.

Der Spiegel, June 2, 2013

Many Germans believe it is time to abandon the euro.

They're part of a growing movement spurred by influential populists from the worlds of business and academia.

Their arguments stoke fear but offer no clear alternatives.

Der Spiegel, June 19, 2013

SPIEGEL: How long can Brussels continue to impose austerity on countries like Spain and Greece,

a policy that the majority in those countries does not support?

Merkel: Democratically elected governments are our partners in all of these countries. My Greek, Spanish and Portuguese counterparts are all democratically authorized to pursue their courageous and arduous course of reforms. In politics, we are repeatedly forced to make decisions that are not popular at first. Take, for example, the retirement age of 67, which we've already addressed. It still has little support in the polls, even if it remains unavoidable.

SPIEGEL: Once again, what makes you so confident that the countries in Southern Europe will subject themselves to your austerity mandate in the long run?

Merkel: Many people in these countries know that years of undesirable developments led to these problems, and that this is why something has to change. At the same time, I know all too well that the necessary reforms demand a great deal of them. Many often justifiably raise the question of fairness, and whether too much is being asked of ordinary working people while the more affluent seem to be getting off lightly. In many countries, for example, labor laws for young people have been made very flexible, which means that when a company runs into difficulties, they are the first ones to lose their jobs. There is also a fierce debate over fairness when it comes to older workers, although in their case we cannot forget the reasons for the difficulties.

SPIEGEL: Youth unemployment in Southern Europe is above 50 percent in some cases. The austerity policies you have imposed are having disastrous consequences.

Full text at Der Spiegel 3 June 2013

The EU's bailout of Cyprus has elicited unusually frank and vehement criticism from the finance experts grouped in the IMF's Executive Board.

Although no names were mentioned, the criticism was directed at all European politicians involved in the bailout,

from Merkel and Schäuble to Hollande, Barroso and Olli Rehn.

The criticism applies in particular to the Eurogroup president, Dutch politician Jeroen Dijsselbloem, who has even recommended the Cyprus bailout as a model for future bailout programs.

Der Spiegel, 3 June 2013

Germany’s largest banks were €14bn short of the capital needed to meet incoming Basel III banking rules

The banks, which include the two largest by assets – Deutsche Bank and Commerzbank – managed to cut

their collective capital shortfall from €32bn in the second half of 2012,

as lenders responded to pressure from investors to improve their balance sheets ahead of the introduction of the Basel III rule book by 2019.

Financial Times 28 May 2013

A new way of thinking has recently taken hold in the German capital

Wolfgang Schäuble sounded almost like a new convert extolling the wonders of heaven as he raved about his latest conclusions on the subject of saving the euro.

"We need more investment, and we need more programs," the German finance minister announced

The man who had persistently maintained his image as an austerity commissioner is suddenly a champion of growth.

Der Spiegel, 27 May 2013

Does George Soros know something we don’t about the S&P 500?

Soros Fund Management increased a bear-call bet on the S&P 500 in a huge way.

The fund lifted a put position — a bet the market will go lower — to its biggest size yet,

making a 605% leap over the previous quarter.

MarketWatch 15 August 2014

For the past 25 years or so the financial authorities and institutions they regulate have been guided by market fundamentalism:

All the innovations – risk management, trading techniques, the alphabet soup of derivatives and synthetic financial instruments – were based on that belief.

The innovations remained unregulated because authorities believe markets are self-correcting.

George Soros FT 2/4 2008

Soros om att dom inte förstod att det var ett stort steg att avskaffa den egna sedelpressen Rolf Englund blog 2012-09-10

Soros versus Sinn:

The German Question

Project Syndicate May 6, 2013

George Soros:

The causes of the crisis cannot be properly understood without recognizing the euro’s fatal flaw:

By creating an independent central bank, member countries have become indebted in a currency that they do not control.

At first, both the authorities and market participants treated all government bonds as if they were riskless, creating a perverse incentive for banks to load up on the weaker bonds.

When the Greek crisis raised the specter of default, financial markets reacted with a vengeance, relegating all heavily indebted eurozone members to the status of a Third World country over-extended in a foreign currency.

Subsequently, the heavily indebted member countries were treated as if they were solely responsible for their misfortunes, and the structural defect of the euro remained uncorrected.

Once this is understood, the solution practically suggests itself.

It can be summed up in one word: Eurobonds.

Hans-Werner Sinn:

Soros is playing with fire. Crunch time is fast approaching.

Cyprus is almost out of the euro,

Moreover, the Greeks and Spaniards are unlikely to be able to bear the strain of economic austerity much longer, with youth unemployment inching toward 60%. France, too, has competitiveness problems, and is unable to meet its commitments under the European Union’s Fiscal Compact. Portugal needs a new rescue program, and Slovenia could soon be asking for a rescue as well.

Many investors echo Soros. They want to cut and run – to unload their toxic paper onto intergovernmental rescuers

If Soros were right, and Germany had to choose between Eurobonds and the euro, many Germans would surely prefer to leave the euro. The new German political party would attract much more support, and sentiment might shift. The euro itself would be finished;

after all, its primary task was to break the Bundesbank’s dominance in monetary policy.

But Soros is wrong. For starters, there is no legal basis for his demand. Article 125 of the Treaty on the Functioning of the European Union expressly forbids the mutualization of debt.

Worst of all, Soros does not recognize the real nature of the eurozone’s problems. The ongoing financial crisis is merely a symptom of the monetary union’s underlying malady: its southern members’ loss of competitiveness.

Soros argumenterar för att Tyskland antingen måste acceptera euroobligationer – eller lämna valutaunionen.

Soros tankar om euron får stor uppmärksamhet i hela Europa.

Det säger något om hur desperat jakten på lösningar är och hur få svar på krisen de politiska ledarna verkar ha.

Åtstramningarna har blivit en ond cirkel av sjunkande tillväxt och stigande arbetslöshet

och den bankunion som sades vara räddningen är halvfärdig och skjuts på framtiden.

Annika Ström Melin, signerat, DN 23 april 2013

Grundfelet med euron enligt Soros var att

medlemsländerna skuldsattes i en valuta som de inte kunde kontrollera.

Det gjorde nationella konkurser möjliga.

Danne Nordling om George Soros artikel i DN:s kulturdel 21/4 (ej onl)

Wolfgang Schäuble warns

EU bank rescue agency needs treaty changes

"EU democratic legitimacy could be improved upon"

"EU powers defined by its treaties. To take them lightly ...is to tamper with the rule of law"

Financial Times May 12, 2013

“The EU does not have coercive means to enforce decisions. Its historical roots are young. Its democratic legitimacy could be improved upon,” Mr Schäuble writes.

“What it has are responsibilities and powers defined by its treaties. To take them lightly, as is sometimes suggested, is to tamper with the rule of law.”

In the past decade, public and private debt levels have rocketed. This debt will have to come down.

And for our banks to fulfil their role as financiers of the economy, they will have to deleverage.

The European Commission will soon put forward a proposal for a resolution mechanism. We will assess it with an open mind.

Yet while today’s EU treaties provide adequate foundation for the new supervisor and for a single resolution mechanism,

they do not suffice to anchor beyond doubt a new and strong central resolution authority.

We should not make promises we cannot keep. The overly optimistic predictions about a single supervisor starting work as early as January 2013 cost the EU credibility.

This would be a timber-framed, not a steel-framed, banking union. But it would serve its purpose and

buy time for the creation of a legal base for our long-term goal:

a truly European and supranational banking union, with strong, central authorities, and potentially covering the entire single market.

The writer is German finance minister

Ms Merkel does not say “no” to eurozone bonds.

She says: “Not without treaty change.”

The German constitutional court in Karlsruhe would never allow Germany’s sovereign guarantee

to be given to its eurozone partners without them submitting to effective and centrally budgeted discipline.

Financial Times 31 May 2012