EMU Start page

|

Euron efter Greklands "räddning" den 21 februari 2012

“We on the part of the IMF have made a major concession - we had argued that these debt-relief measures should be approved up front

and we have agreed that they will be approved at the end of the program,” said IMF Director of European Department Poul Thomsen,

Bloomberg 25 May 2016

The IMF and calling Berlin’s bluff over Greece

Wolfgang Münchau, FT 22 May 2016

IMF insists on debt relief, but Germany resists.

Germany are trapped in the lie that Greece is solvent, which is what their own backbenchers were told.

Without that lie, Greece would no longer be a eurozone member.

But the lie cannot be sustained.

IMF insistence on debt relief is what could expose this lie.

If Europe wants to continue to ‘extend and pretend’ so be it. But it should be with their own money

Christine Lagarde letter to Eurozone finance ministers demands:

drop all the talk about new austerity measures and quickly agree a plan for debt relief

so that a deal can be met before a possible Greek default in July.

Peter Spiegel, FT Alphaville 6 May 2016

Greece faces more than 10 billion euros of debt repayments in June and July

which may strain its finances

Bloomberg 4 April 2016

BBC, August 14, 2015

but its fundamental macroeconomic illiteracy.

Wolfgang Münchau, July 21, 2013

Martin Wolf:

There are no /Greek/ government deficits to finance consumption (or almost none).

So money would be used to pay interest and amounts due

Rolf Englund blog 9 July 2015

Initially, private lenders were happy to lend to the Greek government on much the same terms as to the German government.

Then, in 2010, it became clear the money would not be repaid.

Rather than agree to the write-off that was needed, governments (and the International Monetary Fund)

decided to bail out the private creditors by refinancing Greece.

Martin Wolf, FT 21 April 2015

BBC 5 June 2015

Euro adoption provides protection from international financial turmoil."

18/01/2008, Trichet

portobellobooks.com/the-13th-labour-of-hercules

Keep Talking Greece - Greek News in English, Blog

Click

IMF demands debt relief as price for involvement in Greek bail-out

Telegraph 14 January 2016

IMF remained cool over the prospect of providing more financial aid to Greece,

insisting its support was still conditional on the EU granting Greece substantial debt relief.

"In addition to a comprehensive policy package, Greece also requires debt relief from European partners," said IMF spokesman Gerry Rice.

Spain

Greece's creditor powers have delayed talks over reducing the country's debt mountain

for fear of emboldening anti-austerity forces in the southern Mediterranean, its finance minister has claimed.

Telegraph 10 November 2015

Euclid Tsakalotos said EU lenders would not discuss the question of Greece's debt burden, which stands at 200pc of GDP, until after the Spanish elections are held in the new year.

IMF could now see its involvement when its Greek programme ends in March 2016.

In debt sustainability analysis carried out by body, it has suggested Greece may need a full moratorium on payments for 30 years to finally end its reliance on international rescues.

Telegraph 1 October 2015

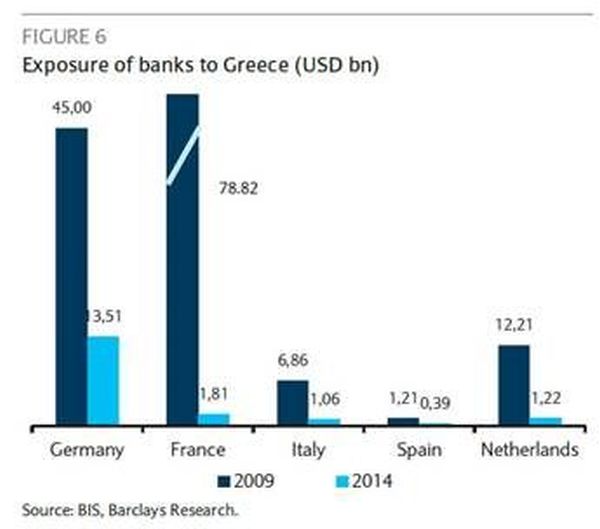

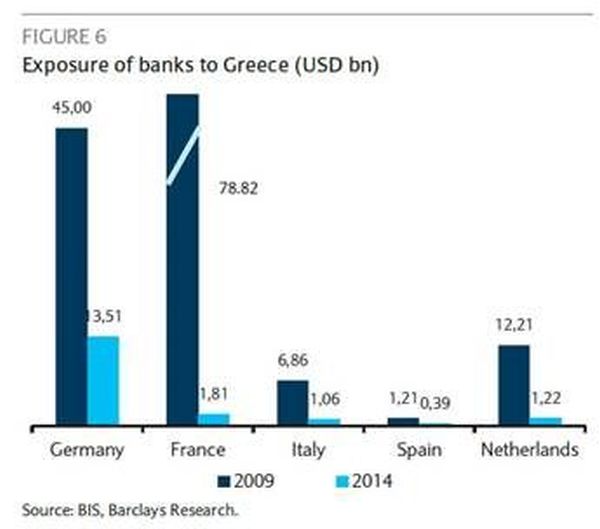

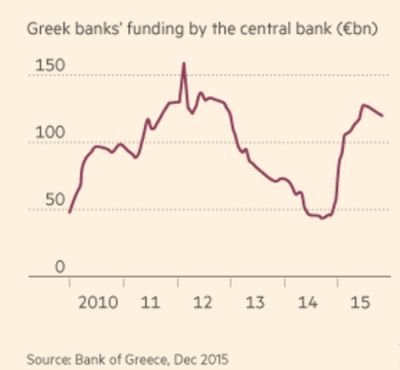

Grekiska banker skyldiga 1.000 miljarder

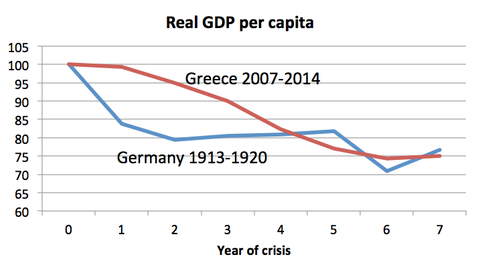

Detta diagram fann jag i en artikel av Marin Wolf i Financial Times.

Rolf Englund blog 2015-12-23

Bank resolution will become more complicated after January 1, when new eurozone rules will force depositors to face the costs of rescue programmes.

Under the EU’s Bank Recovery and Resolution Directive (BRRD),

shareholders and depositors will have to take a hit worth 8pc of their total liabilities before lenders receive official sector aid.

Telegraph 19 Sep 2015

Greece could struggle to win German support for its third bailout programme after

IMF confirmed last night that it was not yet prepared to put any cash into the deal.

The Times, August 12 2015

Varoufakis:

"The International Monetary Fund... is throwing up its hands collectively despairing at a programme that is simply founded on unsustainable debt...

and yet this is a programme that everybody is working towards implementing."

He added: "Ask anyone who knows anything about Greece's finances and they will tell you this deal is not going to work,"

BBC 12 August 2015

Bernanke Isn’t Serious

His latest on Greece and the euro suggests that the deeper problems lie not in Greek fecklessness

but in the refusal of the core — basically Germany — to allow either monetary or fiscal policies that would offset the downdraft from austerity in the periphery.

He even questions the sacred status of “structural reform”

Paul Krugman 17 July 2015

When the French finance minister Mr Sapin arrived in Brussels at midday, he received a shock:

Wolfgang Schäuble, the German finance minister, was armed with a one-page paper advocating

a Greek “timeout from the eurozone” for “at least the next five years”

if Athens did not accept the bloc’s exacting conditions for a new bailout.

FT 17 July 2015

“The eurozone is going through a war of religion with a northern Europe that’s Calvinist and that doesn’t want to forgive the sinners,

and a Catholic Europe in the south that wants to turn the page,” said Emmanuel Macron, the French economy minister and former Rothschild banker.

Om man ger ett treårigt lån till Grekland på t ex 100 miljarder euro,

skall man då bli förvånad om Grekland efter tre år kommer tillbaka och vill låna 100 miljarder igen

så att de kan lösa det förfallande lånet?

Rolf Englund blog 9 juli 2015

So why don't we have a major crisis in Turkey and why is Turkey not on the brink of default when neighboring Greece is?

The answer is simple - It's the exchange rate exchange rate regime stupid!

The Market monetarist, 7 July 2015

Euron förvärrar den grekiska krisen

SvD-ledare signerad Ivar Arpi, 6 juli 2015

At the end of the day, the central issue behind the Greek crisis hasn’t changed: it is still, ultimately, a question of who, picks up the bill.

If everyone avoids their share, the result is unfortunate.

If, as with Germany in 1990, everyone accepts their share, the result is tranquillity.

Germans, however, wanted to be reunited. It is still far from obvious that the nations of Europe feel the same way about each other.

Stephen King, HSBC’s Chief Global Economist and author of When the Money Runs Out, FT 6 July 2015

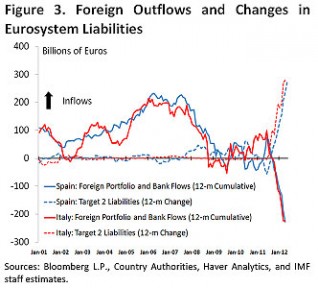

Om greker flyttar sina pengar från grekiska till tyska banker, stiger då Greklands skulder?

Rolf Englund blog 2015-07-06

Därför avgår Varoufakis

Rolf Englund blog 2015-07-06

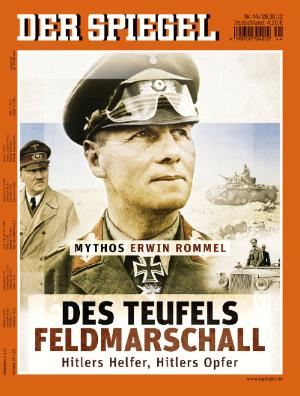

How Merkel Failed Greece and Europe

Der Spiegel 3 July 2015

IMF admits: we failed to realise the damage austerity would do to Greece

Guardian, 5 June 2015

Greece needs €60bn in new aid, says IMF

Financaial Times 2 Juky 2015

Dear Mr Tsipras,

You should not be reluctant to leave the euro.

Even if you somehow manage to cobble together a deal with the creditors, this would not solve your country’s crisis.

Roger Bootle 21 June 2015

You may recall that your country’s situation was closely examined in a report, lead-authored by me, which won the 2012 Wolfson Prize.

My advice builds on that report. I have ten key points:

I realise that your government is strapped for cash and you will not be wanting to fork out for expensive consultancy.

(Did you not employ Goldman Sachs to ease your passage into the euro? That must have cost a pretty penny.)

But you can download

our report for free from the Capital Economics website.

They are obsessed with the financial problem, i.e. with getting their money back.

But your fellow Greeks’ plight derives from your economy’s catastrophic loss of output.

Even if Greece is granted a significant amount of debt forgiveness, this would do next to nothing to bring an economic recovery.

The spectacle is astonishing.

The European Central Bank, the EMU bail-out fund, and the International Monetary Fund, among others,

are lashing out in fury against an elected government that refuses to do what it is told.

They entirely duck their own responsibility for five years of policy blunders that have led to this impasse.

Ambrose Evans-Pritchard 19 June 2015

Greece has nothing to lose by saying no to creditors

If it were to default on its official-sector debt, France and Germany stand to forfeit €160bn

Wolfgang Münchau, FT June 14, 2015

Most people also understand that the Greek debate is not just about Greece but also about whether or not several other countries

— Spain, Portugal and Italy among them, and perhaps even France — will also have to restructure their debts with partial debt forgiveness.

What few people realize, however, is these countries have effectively already done so once.

Michael Pettis February 25, 2015

It is Europe, as much as Greece, which is opposing a settlement

IMF in an awkward position, because its doubts on the sustainability of Greece's debts cut two ways.

Either Greece, burdened with massive unemployment, would have to raise taxes and cut public spending further;

or some of its debt would have to be written down.

Bloomberg editorial, 12 June 2015

IMF is also frustrated that the European side has been unwilling to address the issue of Greece’s debt pile seriously.

According to the IMF’s calculations, putting the Greek economy on a sustainable path now requires

— at the very least — an extension of the maturities on Greece’s outstanding debts.

But European officials, wary of public opinion, have been reluctant to discuss even that.

FT June 11, 2015

IMF åker hem därför att de är missnöjda med EU?

Rolf Englund blog 11 June 2015

I vastly overestimated the risk of /Euro/ breakup, because I got the political economy wrong

— I did not realize just how willing euro elites would be to impose vast suffering in the name of staying in.

Relatedly, I didn’t realize how easy it would be to spin a modest upturn after years of horror as success.

Paul Krugman, NYT 10 June 2015

Bildt, Mona, Ingvar Carlsson och krisen i Grekland

Rolf Englund blog 7 juni 2015

Saying no would be to plunge a whole financial system into chaos

The ECB reportedly provided extra liquidity to the Greek economy on Wednesday

upped its emergency liquidity assistance (ELA) from €80.7bn to €83bn,

a move that could keep the domestic economy afloat as Greeks continue to pull their cash from the country.

Telegraph 10 June 2015

Greek Banks On Verge Of Total Collapse:

Bank Run Surges "Massively" As Depositors Yank €700 Million Today Alone

Tyler Durden, zerohedge, 5 June 2015

Att på den gemensamma marknadens grund bygga en fullt fungerande ekonomisk och monetär union

har visat sig svårare än vad många insett

Carl Bildt, DN Debatt 23 juli 2012

Själv röstade jag ”ja” till att Sverige skulle gå med i valutaunionen vid folkomröstningen 2003

Jag har svårt att tro på idén om en långtgående centralisering av finanspolitiken

Alternativet är en partiell eller total upplösning av valutaunionen

jag tvivlar på att befolkningen i länder med statsfinansiella problem kommer att acceptera förmynderi och bestraffning beslutade av politiker i andra länder

Assar Lindbeck, DN Debatt 17 juli 2012

Germany and Greece’s other creditors continue to demand that Greece sign on to a program

that has proven to be a failure, and that few economists ever thought could, would, or should be implemented.

Joseph Stiglitz, Project Syndicate 5 June 2015

Greek PM Alexis Tsipras: "We do not need an agreement. We need a solution"

BBC 5 June 2015

IMF has betrayed its mission in Greece, captive to EMU creditors

The IMF’s Original Sin in Greece was to let Dominique Strauss-Kahn hijack the institution

to save Europe's banks and the euro when the crisis erupted, dooming Greece to disaster.

Ambrose Evans-Pritchard, 5 June 2015

The IMF remains sceptical about Greece’s ability to meet the ambitious budget surplus targets

and continues to seek assurances that eurozone governments would agree to restructure Greek debt

— mostly now held by EU creditors — if a credible reform programme is not implemented.

FT 2 June 2015

Will the ECB play its trump card over Greece's future?

So if the ECB's governing council took the view that the Greek banks were not solvent

it would have to tell the Bank of Greece to pull the plug.

Would they?

BBC 2 June 2015

It’s time for Greece to put itself out of its misery.

It must stop hoping for a miracle, default on its debts and exit the euro.

Allister Heath, Telegraph 1 June 2015

Ideally, the Greek government would choose to press the Grexit button itself. But if it decides instead to cling on indefinitely, the rest of the eurozone should find a way of forcing it out of the single currency as soon as possible.

That would go against the EU’s imperialistic mindset, for sure, and would violate the infamous acquis communautaire rule:

the view that EU integration should never be allowed to be reversed in any area and in any country.

But it’s the only way to end the current nonsense, and the only hope for a country that has been suffering horrendously for years.

Sleepwalking into the Abyss

consistently warning against the fall-out from a Greek exit.

"Anyone who doesn’t see there is a humanitarian crisis in Greece is deaf and blind to what is happening there,"

Mr Juncker told a German newspaper on Monday.

Bloomberg

The top-level huddle lasted past midnight Tuesday morning at Germany’s government headquarters with Chancellor Angela Merkel, IMF chief Christine Lagarde, European Central Bank President Mario Draghi, French President Francois Hollande and European Commission President Jean-Claude Juncker in attendance.

The goal was to hammer out an offer that Greece could consider in coming days, according to two people familiar with the plan.

After Merkel left, her office put out a statement saying the five leaders “agreed that work must now be continued with greater intensity”

and that “they have been in closest contact in recent days and want to remain so in the coming days, both among themselves and naturally also with the Greek government.”

...

GREEK GOVERNMENT ENCOURAGING CAPITAL FLIGHT:

That's the theory of Hans Werner Sinn, one of the German government's economic advisers.

"The Greek government is driving up the costs of Plan B for the other side, by allowing capital flight by its citizens.

If it so chose, the government could contain this trend with a more conciliatory approach, or stop it outright with the introduction of capital controls.

But doing so would weaken its negotiating position, and that is not an option ... private capital is being turned into public capital.

Basically, Greek citizens take out loans from local banks, funded largely by the Greek central bank, which acquires funds through the European Central Bank’s emergency liquidity assistance (ELA) scheme. They then transfer the money to other countries to purchase foreign assets (or redeem their debts), draining liquidity from their country’s banks."

http://bit.ly/1AKlvue

Deposit outflows from Greek banks accelerated this week,

with about €800m withdrawn on Wednesday and Thursday alone

FT 29 May 2015

A First-Hand Account Of The Greek Bank Run

by Tom Winnifrith of Share Prophets, via zerohedge

“The Greek government would do well to act quickly because it is five to midnight for the Greek banks,”

Andreas Dombret, an ECB Supervisory Board member, said in an interview with Bild Zeitung published Monday.

http://www.bloomberg.com/news/articles/2015-05-31/greece-s-endgame-nears-as-tsipras-warns-bell-may-toll-for-europe

Tsipras might seek the intervention of German Chancellor Angela Merkel and French President Francois Hollande.

The three leaders are scheduled to hold a call on Sunday evening

http://www.bloomberg.com/news/articles/2015-05-31/greece-pins-hopes-on-merkel-as-rescue-talks-yield-scant-progress

Defiant Tsipras threatens to detonate European crisis rather than yield to creditor "monstrosity"

Ambrose Evans-Pritchard 31 May 2015

Writing for Le Monde in a tone of furious defiance after the latest set of talks reached an impasse, Mr Tsipras said the eurozone's dominant players were by degrees bringing about the "complete abolition of democracy in Europe" and were ushering in a technocratic monstrosity with powers to subjugate states that refuse to accept the "doctrines of extreme neoliberalism".

"For those countries that refuse to bow to the new authority, the solution will be simple: Harsh punishment. Judging from the present circumstances, it appears that this new European power is being constructed, with Greece being the first victim," he said.

Ingen fara, fattas bara

The European Central Bank Wednesday left the level of emergency cash available to Greek banks unchanged from a week ago at 80.2 billion euros /743 miljarder SEK

Greek lenders still have a liquidity buffer of about 3 billion euros

Bloomberg onsdag 27 maj 2015

Mohamed A. El-Erian:

A significant amount of potentially unpayable Greek debt has been transferred from private creditors

to public balance sheets underpinned by European taxpayers.

via Rolf Englund blog 25 maj 2015

The admission that the euro was a mistake should not be confused with a desire to dissolve it. That would be even more catastrophic.

It is merely a recognition that we are trapped in a dysfunctional monetary system.

Enlargement and the euro are two big mistakes that ruined Europe

Wolfgang Münchau FT 1 November 2015

I was among those who supported monetary union at the time of its introduction.

Advocates of the euro at the time came from two different groups, who struck a Faustian Pact.

Members of the first group believed the euro as constructed would fail, and hoped it would somehow be fixed.

The others thought the system would stay rigid, and bend the economies of its members into a new shape.

My quarrel is with the speed of accession, and the criteria that aspiring members have to meet.

Just as countries have maximum absorption capacities for migrants, the EU has a maximum absorption capacity for new members.

I have no idea what that number is in any given time period, but it surely is not 13 members in a single decade.

The eurozone countries must accept some economic truths

— all expressed accurately, albeit not diplomatically — by Yanis Varoufakis, Greek finance minister.

Wolfgang Münchau, FT 17 May 2015

They should begin by recognising that austerity was an unqualified disaster.

They should also think differently about debt sustainability.

When they drew up the latest Greek loan programme in 2012, together with the International Monetary Fund, they first calculated the outstanding debt,

then made some wildly optimistic assumptions about growth, and then calculated the fiscal surpluses needed for the country to pay down that debt.

AND THE WEAK SUFFER WHAT THEY MUST?

Europe's Crisis and America's Economic Future

YANIS VAROUFAKIS

"The strong do as they can and the weak suffer what they must." —Thucydides

Europe’s leaders decided to create a monetary union of 18 nations without control of their own money, without democratic accountability, and without a government to support the Central Bank. This bizarre economic super-power was equipped with none of the shock absorbers necessary to contain a financial crisis, while its design ensured that, when it came, the crisis would be massive. When disaster hit in 2009, Europe turned against itself,

humiliating millions of innocent citizens, driving populations to despair, and buttressing a form of bigotry unseen since the Second World War.

Greece's onerous obligations to the IMF, the European Central Bank and European governments can be traced back to April 2010,

when they made a fateful mistake. Instead of allowing Greece to default on its insurmountable debts to private creditors,

they chose to lend it the money to pay in full.

Ashoka Mody, Bruegel 21st April 2015

At the time, many called for immediately “restructuring” of privately-held debt, thus imposing losses on the banks and investors who had lent money to Greece.

Among them were several members of the IMF’s Board and Karl Otto Pohl, a former president of the Bundesbank and a key architect of the euro.

The IMF and European authorities responded that restructuring would cause global financial mayhem.

As Pohl candidly noted, that was merely a cover for bailing out German and French banks, which had been among the largest enablers of Greek profligacy.

The IMF's big Greek mistake

Ashoka Mody, Bruegel 21st April 2015

- Den stora risken var att Grekland skulle utlösa en kris i italienska, franska och tyska banker.

Nu finns i praktiken en EU-garanti för de utestående grekiska statsobligationerna.

Anders Borg, TT februari 2012

Nobody was forced to lend to Greece.

Initially, private lenders were happy to lend to the Greek government on much the same terms as to the German government.

Then, in 2010, it became clear the money would not be repaid.

Rather than agree to the write-off that was needed, governments (and the International Monetary Fund)

decided to bail out the private creditors by refinancing Greece.

Martin Wolf, FT 21 April 2015

Greece

Juncker: ‘There will be no default’

Politico 20 april 2015

He declined to elaborate on the nightmare scenarios he sees potentially unfolding but warned that the failure to keep Greece afloat would “lead us to consequences that people don’t know the amplitude about.”

“We are prepared for all kinds of events but I am excluding at 100 percent this Grexit, or Greek exit,” Juncker said. “There will be no default.”

"Default necessary but Grexit is not"

- "A Greek default must go the whole way and leave the euro"

Wolfgang Münchau and Roger Bootle 19 April 2015

Why Europe Needs to Save Greece

Anders Borg, Project Syndicate 12april 2015

Barry Eichengreen: French and German banks have been able to sell their holdings of Greek government bonds, largely to the ECB,

which has acted as bond purchaser of last resort.

via Rolf Englund blog med länk till Anders Borg om detta

Accidental exit from the eurozone is quite likely — not because Greece or its partners want it

Exit would transform the eurozone from an irrevocable currency union into a regime of hard exchange-rate pegs.

That would be the worst of both worlds: neither as credible as a union nor as flexible as floating rates.

Martin Wolf, FT 31 March 2015

Greek and German leaders meet amid cash shortage fears

BBC 23 mars 2015

Mr Tsipras has reportedly already warned Mrs Merkel Greece will not meet imminent debt payments without new aid.

It is a sign of low expectations in the handling of the Greek debt crisis

when a deal to keep the country from chaos for four months at the most and only 72 hours at the least

is hailed as a great breakthrough.

FT View 22 February 2015

I have been pro-EU all my adult life and a proponent of monetary union,

but it is increasingly hard to argue the case for a union that behaves in this manner.

I always felt that euroscepticism was an irrational gut instinct.

But today there exist perfectly rational reasons to oppose membership both of the eurozone and the EU itself.

Wolfgang Münchau, Financial Times, March 1, 2015

The economic equivalent of a ceasefire agreement is a debt rollover of an insolvent state. In Europe, we have had both in the past three weeks.

Europe’s political and economic diplomacy is focused solely on averting imminent catastrophe with no strategic purpose.

I boken Vår framtid i Europa, uttalade jag mig, i maj 1971, för EEC och mot eurons föregångare Werner-planen.

On Friday, Greek depositors transferred more than €1bn of bank deposits abroad.

The bank system would have collapsed within days without an extension.

And Athens had no plan for a euro exit.

It had no choice but to cut a deal in which the Germans prevailed on all the substantive issues.

Wolfgang Münchau, FT Sunday 22 February 2015

SPIEGEL: Mr. Varoufakis, you have referred to the European Union's bailout policy for Greece as "fiscal waterboarding." What exactly do you mean by that?

Varoufakis: For the past five years, Greece has been subjected to austerity measures that it cannot, under any circumstances, meet.

Our country is literally being pushed under water. Just before we suffer an actual cardiac arrest, we are granted a momentary respite.

Then we're pushed back under water, and the whole thing starts again.

My aim is to end this permanent terror of asphyxiation.

Der Spiegel 16 February 2015

SPIEGEL: Going back to your metaphor, who is the torturer that keeps pushing Greece under water?

Varoufakis: The troika of technocrats sent periodically to Greece to enforce an unenforceable program, technocrats representing the European Commission, the European Central Bank and the International Monetary Fund. I have nothing against these three institutions as such. However, they sent a cabal of technocrats to Greece to implement and monitor an entirely destructive program.

SPIEGEL: You are talking about officials who were sent there to do their job.

Varoufakis: And fine people they were. But they were sent to implement a program that caused great damage. We know there were also some pretty good guys in the CIA who took part in the waterboarding interrogations against their will and ended up in awful moral dilemmas.

Top of pageWeimar and Greece

Paul Krugman, 15 February 2015

Weimar, it’s never about the deflationary effects of the gold standard and austerity in 1930-32,

which is, you know, what brought you-know-who to power.

Eurozone must not allow Greece to become another Lehman Brothers

Greece and Germany have been playing a dangerous game of bluff over the future of the eurozone.

The Guardian 15 February 2015

It’s mid-September 2008. The seventh anniversary of the 9/11 terrorist attacks has just been marked.

And an American investment bank called Lehman Brothers is in trouble.

Lehman is not a particularly big bank. It is not thought to be systemically important for the rest of the global financial system.

So when the US authorities are unable to find a private-sector buyer for the stricken bank, they allow it go to the wall.

Everyone knows what happened next. Confidence that there would be no contagion from Lehman proved spectacularly misplaced.

Within days, the entire global financial system was brought to the brink of collapse. Banks were bailed out, credit dried up and the global economy entered a deep recession from which it has yet to fully recover.

Lehman is a cautionary tale for eurozone finance ministers when they sit down in Brussels on Monday to decide what to do about Greece. Like Lehman, Greece is considered small fry. It is not seen as systemically important. There is confidence that the single currency could cope with a Greek exit.

Well, perhaps it could.

Can Merkel et al really be sure that there will be no contagion effects from Greece, no sell-off in Italy, Spain and Portugal as the markets speculate on which country might be next?

Today’s calm can easily become tomorrow’s panic. The reason the financial markets could turn nasty is that the departure of Greece from the eurozone would mark the first time in more than half a century that the drive towards greater integration had been reversed.

Politically, this would be a big and dangerous moment.

Är det tyskarna som är The Good Guys inom Euroland?

Rolf Englund 15 Februari 2015

The banks in Greece will not open on Monday, I guess

Rolf Englund, 14 February 2015

Greece: What are the options for its future?

Jamie Robertson BBC World News 12 February 2015

The Obama administration, Caroline Atkinson, the US deputy-national security adviser, has leapt to the defence of Greece,

warning Germany and Europe’s creditor powers that they must meet Athens half-way

to avert a potentially dangerous rupture and a euro break-up.

Ambrose Evans-Pritchard, 13 February 2015

Caroline Atkinson, the US deputy-national security adviser, said the eurozone authorities had imposed the main burden of adjustment on the weaker deficit states and should do more to accept their share of responsibility for the euro crisis. “They have asymmetric rules. They need to make it socially fairer,” she said.

“It is important for creditors to take into account that Greece has had a very sharp drop in incomes, real wages, and output as well as a big rise in unemployment,” she told a gathering at Chatham House in London.

Chatham House

Caroline Atkinson, Deputy Assistant to President Obama and Deputy National Security Advisor for International Economics

Chair: Sebastian Mallaby, Paul A. Volcker Senior Fellow in International Economics

Doing the same thing and expecting different results, Einstein is supposed to have said, is the definition of insanity.

In the euro zone it is the ordinary line of business. The fundamental contours of the dispute have not changed.

The new Greek government, priced out of private markets, needs financial help from its euro-zone partners but insists it will leave behind the bail-outs and "fiscal waterboarding" to which its predecessor succumbed.

The euro zone, led but in this case not dominated by Germany, demands that the price of such help is an extension of the current Greek bail-out

The Economist, Friday 13th February 2015

All eyes now turn to a second Eurogroup meeting, on Monday. This probably represents the last chance for Greece to secure a bail-out extension, given that such a change would have to be approved by several euro-zone parliaments.

Greek banks probably lost about 21 billion euros ($24 billion) of deposits in the past two months.

Bloomberg, 5 February 2015

Greek Finance Minister met ECB president.

Analysts said the ECB statement was a sign the meeting had not been a success.

ECB has effectively just given a green light for Greek bank runs

Rolf Englund 5 februari 2015

What is needed is not structural reform within Greece and Spain so much as structural reform of the eurozone’s design

and a fundamental rethinking of the policy frameworks that have resulted in the monetary union’s spectacularly bad performance.

Joseph E. Stiglitz, Project Syndicate 3 February 2015

Hittills har EU-ledarna varit beredda till nästan vad som helst för att förhindra att Grekland lämnar eurosamarbetet.

Man har varit rädd för att överträda ”ett kritstreck” som skulle kunna skapa ohanterliga förväntningar om att fler länder ska göra det.

Lars Calmfors DN 2 februari 2015

Strategin innebar dels att kravet på åtstramningar blev större än om en statsbankrutt tillåtits, dels att åtstramningarna kom att ses som något utifrån påtvingat.

Därmed lyckades övriga euroländer med bedriften att ge hjälp som i stället kom att uppfattas som en orsak till problemen. Det kunde bara resultera i valframgångar för populistiska protestpartier på det sätt som skett.

Ett grekiskt utträde skulle förmodligen resultera i en kaosartad situation i landet med bankrusningar, en ny valuta som faller kraftigt i värde och hög inflation.

Kanske behövs en sådan demonstration för att vaccinera väljarna i andra euroländer med stora problem mot populistiska vänstersprång i den ekonomiska politiken.

Some eurozone policy makers seem to be confident that a Greek exit from the euro, hard or soft,

will no longer pose a threat to the other periphery countries.

They might be right; then again, back in 2008, US policy makers thought that the collapse of one investment house, Bear Stearns,

had prepared markets for the bankruptcy of another, Lehman Brothers.

We know how that turned out.

Kenneth Rogoff, Project Syndicate, 2 February 2015

First and foremost, the eurozone countries’ decision to admit Greece to the single currency in 2002 was woefully irresponsible, with French advocacy deserving much of the blame.

Back then, Greece conspicuously failed to meet a plethora of basic convergence criteria, owing to its massive debt and its relative economic and political backwardness.

Second, much of the financing for Greece’s debts came from German and French banks that earned huge profits by intermediating loans from their own countries and from Asia.

They poured this money into a fragile state whose fiscal credibility ultimately rested on being bailed out by other euro members.

– Vi vet alla nu, och vi visste alla då, att Grekland fuskade med sin statistik

berättar Pascal Lamy, WTO-chefen som på nittiotalet var EU-kommissionens ordförande Jacques Delors högra hand

Teresa Küchler, SvD 29 februari 2012

The biggest threat is that the European Central Bank ceases to fund Greece's banks.

ECB may well feel obliged to turn off the tap, since right now it is only financing those banks

because the country is officially complying with the terms of its IMF and eurozone bailout.

The moment that Greece was deemed not to be in compliance, it is difficult to see

how the ECB could continue to provide emergency liquidity assistance to Greek banks.

Robert Peston, BBC economics editor, 2 February 2015

The game is up. It’s time for Greece to leave the eurozone and move on

The stand-off between Greece and the rest of the eurozone will escalate,

neither side will blink and the country will default

Allister Heath, Telegraph 29 Jan 2015

There is now a clear threat of Grexit.

In 2011-12 Mrs Merkel did not want Germany to be blamed for another European disaster,

and both northern creditors and southern debtors were nervous about the consequences

of a chaotic Greek exit for Europe’s banks and their economies.

The Economist, editorial, Jan 31st 2015

Greek Credit Risk Spikes, Default Probability Tops 70%

New Greek Finance Minister Yanis Varoufakis reality-exposing comments yesterday,

"the problem with the bailout is that it wasn’t really a bailout... it was an extend and pretend,

'it was a vicious cycle, a debt-deflationary trap, which destroyed our social economy."

zerohedge 28 January 2015

The idea that the Greeks will run large fiscal surpluses for a generation,

to pay back money creditor governments used to rescue private lenders from their folly

is a delusion.

Just 11 per cent of the loans directly financed government activities.

Martin Wolf, FT January 27, 2015

The loans supplied by the eurozone and IMF amount to the huge sum of €226.7bn

But this went overwhelmingly not to benefiting Greeks but to avoiding the writedown of bad loans to the Greek government and Greek banks.

Just 11 per cent of the loans directly financed government activities.

Creditors have a moral responsibility to lend wisely. If they fail to do due diligence on their borrowers, they deserve what is going to happen.

In the case of Greece, the scale of the external deficits, in particular, were obvious. So, too, was the way the Greek state was run.

Det är Greklands konstnadsläge/växelkurs, Stupid

Det är inte Greklands skulder som är huvudproblemet.

Det är kostnadsläget.

Rolf Englund 2015-01-27

Why aren't markets panicking about Greece?

Robert Peston, BBC economics editor, 26 January 2015

Greece's debt problem is worse today than it was when it was rescued.

To state the obvious, it is the collapse in the economy which has done the damage.

So just maybe, after Greeks have made a colossal and some would say pointless economic sacrifice,

Germany will allow a rescue that permits the country a fighting chance of crawling out from beneath its colossal debts.

We discussed this several years ago - in a democracy, austerity will eventually fail at the ballot box.

The people will not tolerate 25% unemployment forever - with no hope in sight.

CalculatedRisk, 25 January 2015

Att den grekiska statsskulden måste skrivas ned, som Syriza kräver,

borde inte vara kontroversiellt. Den går ändå inte att betala.

DN-ledare 2015-01-24

Eurons livslögn: Grekland kommer att återbetala lånen på 2.088 miljarder kronor

Rolf Englund 2013-08-26

Governments that commit themselves to painful reforms, but receive no help from demand-side policies, will be discredited and then rejected.

The eurozone might soon find itself coping with populist governments of the left or right utterly opposed to the policies imposed upon them.

Martin Wolf, FT 22 January 2015

Two Greek banks have applied for emergency funding from the European Central Bank as a “precautionary measure”

against a possible run on deposits ahead of a critical general election on Jan 25, a senior Athens banker said on Friday.

FT 16 January 2015

Here’s one road map for a Greek eurozone exit

One possible path was detailed by economist Roger Bootle, the plan won the 2012 Wolfson Economics Prize,

which was a contest for proposals on how to dismantle the eurozone.

MarketWatch Jan 7, 2015

Greece exit

“In the short run, it would be Lehman Brothers squared,” Eichengreen warned.

Kenneth Rogoff, a former chief economist at the International Monetary Fund and a Harvard professor, said the euro “is a historic disaster.”

“I think there may be no way to end to euro crisis,” Feldstein said.

MarketWach 5 January 2015

A Greek exit would likely spark runs on Greek banks and the country’s stock market and end with the imposition of severe capital controls, said Barry Eichengreen

The exit would also spill into other countries as investors speculate about which might be next to leave the currency union, he said.

He predicted that European politicians would “swallow hard once again” and make the compromises necessary to keep Greece in the currency union.

Kenneth Rogoff, a former chief economist at the International Monetary Fund and a Harvard professor, said the euro “is a historic disaster.”

“It doesn’t mean it is easy to break up,” he said.

Martin Feldstein, a longtime critic of the euro project, said all the attempts to return Europe to healthy growth have failed.

“I think there may be no way to end to euro crisis,” Feldstein said.

Om Grekland lämnar valutasamarbetet

Förutsättningarna för att hantera denna påfrestning är betydligt bättre än för några år sedan

menar tongivande ekonomer som SvD Näringsliv talat med 5 januari 2015

This is going to be the year in which the eurozone will have its moment of truth.

Three scheduled elections — in Greece this month; in Portugal and in Spain in the second half of the year —

will tell us whether the EU’s approach to crisis resolution works politically or not.

Wolfgang Münchau FT January 4, 2015

Greece economic depression depth is similar in scale to the US depression in the 1930s, but without the subsequent recovery.

My preferred indicator for the continuing eurozone depression is not the rate of unemployment, but the rate of employment. The former does not capture the large number of disheartened people who have simply dropped out of the labour market altogether.

The Spanish employment rate fell from 66 per cent of the employment-age population to 56 per cent between 2007 and 2014.

In Greece that number is below 50 per cent.

With existing policies, Spain and Greece have no chance of reverting to normal levels of economic activity within a generation.

Eurozone’s weakest link is the voters

The euro crisis is back.

The rise of anti-system parties threatens a currency that depends on consensus

Gideon Rachman, FT December 29, 2014

Investors seem to be betting that the people of Italy, Spain and France will peek at the chaos in Athens,

shudder—and stick to the austerity that Germany’s Angela Merkel has prescribed for them. But that seems too sanguine to this newspaper.

It is hard to believe that a Greek crisis will not unleash fresh ructions elsewhere in the euro zone

not least because some of Mrs Merkel’s medicine is patently doing more harm than good.

The Economist editorial 3 January 2015

There was a worrying echo this week of the Lehman crisis of September 2008.

Then the widespread assumption was that the global financial system was robust enough to cope with the failure of a single investment bank.

So desperate has their position become that Greeks may be about to vote for economic and political suicide

rather than tolerate any more of the medicine prescribed to them by Berlin and Brussels.

Jeremy Warner, Telegraph 29 Dec 2014

Policy makers remain wilfully blind to the reality that the debt problem is unresolved,

and that the eurozone’s outstanding public sector borrowings will never be repaid in full.

The West German economic miracle was launched from a clean balance sheet while the Allies remained heavily indebted.

John Plender, FT December 29, 2014

As a percentage of gross domestic product, government debt rose across the eurozone from 66 per cent in 2007 to 95 per cent in 2013 — with Greece, Italy, Portugal and Ireland all well above 100 per cent.

Central bank bond-buying is no panacea: the main effect is simply to raise asset prices, which benefits the rich. An uneven distribution of income and wealth thus makes it harder to galvanise the real economy.

Economists at the Bank for International Settlements, the central bankers’ bank, add that policy has exacerbated the problem because it has failed to lean against booms,

and has eased aggressively during busts, inducing a downward bias in interest rates and an upward bias in debt levels.

That, in turn, makes it harder to raise interest rates without damaging the economy, thereby creating a debt trap.

The logical way forward is debt forgiveness. Yet a moralistic perception of creditors as inherently virtuous and debtors as profligate sinners stands in the way

(no matter that such “profligates” as Spain and Ireland entered the crisis with government debt way below the German level). So, too, does a selective German historical memory.

The paradox of the German view on debt is that Germany has been the biggest developed world beneficiary of debt forgiveness in recent memory. In the postwar London Debt Agreement, German external debt was substantially written off or deferred. The West German economic miracle was thus launched from a clean balance sheet while the Allies remained heavily indebted.

Eurons livslögn: Grekland kommer att återbetala lånen på 2.088 miljarder kronor

Rolf Englund blog 2013-08-26

The spectre of Greece's exit from the single currency - or "Grexit" - once again.

Eurozone policymakers have consistently ruled out that possibility because they are wary of opening Pandora's box.

Linda Yueh, BBC Chief business correspondent, 29 December 2014

It may be unsurprising, since Greece has only just emerged from six years of recession; when it has been that long, it is really more of a depression.

The economy is more than 25% smaller now than in 2008, unemployment is around 25%, and roughly a quarter of households live in poverty.

Some 100,000 businesses have closed, and there are many who wonder what could get the economy going,

as borrowing costs (yields on 10 year government bonds) have climbed back to 8%, a level considered to be unaffordable.

Greece faced those levels when it first sought a rescue.

Eurozone policymakers have consistently ruled out that possibility /exit/ because they are wary of opening Pandora's box.

Their concern is if one weak country leaves the eurozone, then markets will pick off the next weakest one and so on.

Borrowing costs for those economies will rise, making it impossible for governments to finance themselves, and it becomes a self-fulfilling prophecy of sorts.

Snap elections in Greece open the way for an anti-austerity government

and a cathartic showdown over the terms of euro membership.

Yields on 3-year Greek debt surged 185 basis points to 11.9pc

Ambrose Evans-Pritchard, 29 Dec 2014

German finance minister Wolfgang Schauble warned Greeks not to play with fire by pressing impossible demands. “Fresh elections won’t change Greece’s debt. Each new government must fulfil the contractual obligations of its predecessors. If Greece chooses another way, it’s going to be tough,” he said.

Sources close to Mr Tsipras say he is braced for a showdown with the ECB at any time and knows that loss of bank support would force Greece’s ejection from EMU in short order. Yet they say he intends to call the bluff of EU leaders, calculating that they have invested too much political capital in Greek bailouts to let the crisis spin out of control.

Contagion has been limited so far. Michael Hüther, head of the German Institute for Economics (IW), said spill-over effects no longer pose the same danger now that backstop machinery is in place. “Monetary union can handle a Greek exit,” he said.

Yields on Italian and Spanish debt spiked on Monday but remain blow levels earlier this month before the latest spasm of the Greek crisis began. “Athens is no longer the tail that can wag the Spanish and Italian dogs,” said sovereign bond strategist Nicholas Spiro.

“Everything hinges on the ECB. There will be no contagion long as the markets believe that the ECB will come out with all guns blazing and launch quantitative easing on a meaningful scale,

but they are deluding themselves because this is not going to happen and that is when the trouble will start,” he said.

Nine charts showing why Greece has to leave the euro

Eurozone’s weakest link is the voters

The euro crisis is back.

The rise of anti-system parties threatens a currency that depends on consensus

Gideon Rachman, FT December 29, 2014

There is no chance whatsoever of Greece, or for that matter several other periphery Eurozone economies, repaying their debts.

Jeremy Warner, Telegraph 16 December 2014

For Greece, this would be the same with or without Mr Tsipras’s unhinged political agenda.

Only the creditor nations of the north refuse to acknowledge this reality.

The current set-up is completely unsustainable.

New research by the credit rating agency Standard & Poor’s lends strong support to this contention.

It beggars belief that Athens will ever repay all its debts.

Tony Barber, FT December 12, 2014

The euro is still vulnerable, and Greece is not the only problem

Even if the immediate threat of break-up has receded,

the longer-term threat to the single currency has, if anything, increased.

The Economist, Dec 13th 2014 print

The euro zone seems to be trapped in a cycle of slow growth, high unemployment and dangerously low inflation.

Mr Draghi would like to respond to this with full-blown quantitative easing,

but he is running into fierce opposition from German and other like-minded ECB council members (see article).

Fiscal expansion is similarly blocked by Germany’s unyielding insistence on strict budgetary discipline.

And forcing structural reforms through the two sickliest core euro countries, Italy and France, remains an agonisingly slow business.

The euro is in greater peril today than at the height of the crisis

Insurrectional electorates more likely to vote for a new generation of leaders

Wolfgang Münchau, FT November 9, 2014

The yield on Greece’s 10-year bonds – the benchmark rate at which Athens can borrow money from financial markets –

had moved from 7 per cent to almost 9 per cent.

Financial Times 16 October 2014

Remember Europe?

You know — the place with the common currency that almost fell apart two years ago because of trouble in Greece,

prolonged recession and fighting among political leaders over the best way out of the mess.

Until a few days ago, international investors seemed to have forgotten that there was ever anything wrong on the Continent,

as they lined up to buy bonds from Spain, Italy and even Greece

New York Times 16 October 2014

Why eurozone should monitor US Supreme Court decision on Argentina

Can bondholders demand full repayment of what they lent to a country even when others have settled for a haircut?

Linda Yueh, BBC Chief business correspondent, June 2014

Argentina's 2002 default of around $100bn was the largest at the time, until Greece's around 200bn euros debt restructuring.

Most of Greece's bonds didn't have those clauses. In other words, some creditors like the European Central Bank can be accorded special treatment, which arguably helped politically - since the central bank likely didn't take losses like private creditors.

But, there was a minority of Greek bondholders that did, since such clauses tend to exist for bonds governed by English or Swiss law.

There are other complications as to whether a debt restructuring can really be "voluntary" if the alternative is no payment at all.

Whether it's voluntary or not matters since it could trigger payout on credit default swaps (CDS), which act as a form of insurance against government default.

It would constitute a technical default and have the impact as if debt was not paid, which tends to make a country a pariah on international bond markets for years. It's essentially what every country seeks to avoid.

Clinging to my naive faith in the integrity of contracts, I assume that ISDA will soon trigger the credit default swaps on Greek debt.

This will happen once Athens activates its retroactive law to coerce bondholders (the Collective Action Clauses).

Here is a chart from Paulo Batori at Morgan Stanley on winners and losers. It does include the hedge funds.

Ambrose Evans-Pritchard, 7 march 2012

Involuntary

Greek default looms as voluntary debt deal looks set to fail

Louise Armitstead, Telegraph, 3 Mar 2012

This month marks the fourth anniversary of the May 2010 financial rescue of Greece.

Clearly, the supposed experts who predicted the imminent disintegration of the eurozone have been proved wrong.

But it is equally likely that those now declaring that the crisis is over will be proved wrong as well.

Barry Eichengreen, Project Syndicate, 12 May 2014

Europe’s Plan Z - The Grexit gamble

Part two of Peter Spiegel’s series from behind the scenes on how the euro was saved

"no single Plan Z document was ever compiled and no emails were exchanged between participants"

Financial Times 14 May 2014

Greece has reached a deal with international lenders that will allow it to unlock a much-needed €10bn tranche of bailout aid.

The €10bn payment will cover a similar amount of sovereign bond repayments coming due in May

FT 18 March 2014

- Den stora risken var att Grekland skulle utlösa en kris i italienska, franska och tyska banker.

Nu finns i praktiken en EU-garanti för de utestående grekiska statsobligationerna.

Anders Borg, TT, SvD papper 22 februari 2012

EU lånar ut ytterligare 10 miljarder euro (89 miljarder kronor) till Grekland.

Grekland löser in statsobligationer för samma belopp

Då blir dom banker glada som har varit dumma nog att köpa grekiska statspapper.

Rolf Englund blog 21 mars 2014

Yanis Varoufakis:

What You Should Know About Greece’s Present State of Affairs

Greece has been, and remains, a failed social economy - a failed nation-state

naked capitalism, March 2, 2014

– Vi vet alla nu, och vi visste alla då, att Grekland fuskade med sin statistik

berättar Pascal Lamy, WTO-chefen som på nittiotalet var EU-kommissionens ordförande Jacques Delors högra hand

Teresa Küchler, SvD 29 februari 2012

Members of a European Parliament committee investigating the role of the troika

call to replace this “interim” institution by a “more democratically accountable and transparent” inspection process

“We need more transparency, more democratic legitimacy,” Othmar Karas, the conservative Austrian MEP leading the inquiry.

“All instruments of the EU must be based on community law,” he added.

His colleague, the French Socialist MEP Liem Hoang Ngoc, was more categorical, declaring that there was “no legal basis for the actions of the troika.”

Eurointelligence 31 January 2014

Hoang Ngoc emphasised the need for debt relief if Greece is to emerge from a spiral of austerity.

“Without a debt restructuring, Greece won’t have the room to manoeuvre for less austerity,” he said,

noting that a restructuring could take the form of extended maturities or lower interest rates on loans.

Greece may need a third aid package as soon as next year,

Klaus Regling, the head of the European Stability Mechanism (ESM) permanent bailout fund is quoted as saying

Greece might not be in a condition to raise money by selling sovereign debt on the open market in 2014.

Der Spiegel, October 04, 2013

So far, Greece has received two large bailouts.

The first aid package included €110 billion, the second bailout package, which was agreed to in 2012 and came to a total value of €164 billion.

Matters continue to worsen in Greece. In the second quarter of 2013, the already ailing Greek economy contracted by 4.6 percent,

and unemployment now stands at a record 27.6 percent.

'Greece Can Never Pay Back Its Debt'

George Soros, Der Spiegel, 7 October 2013

Eurons livslögn: Grekland kommer att återbetala lånen på 2.088 miljarder kronor

Rolf Englund blog 2013-08-26

Roubini about Greece

RGE vs. consensus: We remain more cautious than consensus on Greece’s prospects for three reasons: First, we have a more negative view on eurozone (EZ) growth; second, we argue that political risk and fiscal policy uncertainty are higher than consensus believes today; finally,

private demand will remain depressed for a long period,

as households have already run down their assets and have few resources left in reserve.

Roubini Monitor Spotlight, 1 October 2013

Angela Merkel: Greece should never have been allowed in the euro

Ms Merkel’s finance minister, Wolfgang Schaeuble, admitted last month that Greece will need another bailout, raising fears among Germans that they will have to foot the bill.

On Sunday, the Chancellor refused to rule out another aid package but dismissed debt haircuts, which would hurt Germany as the country with the largest exposure to Greece.

“I am expressly warning against a haircut,” she said. “It could create a domino effect of uncertainty ... in the eurozone.”

www.telegraph.co.uk/Angela-Merkel-Greece-should-never-have-been-allowed-in-the-euro.html

Greece moved to the center of the German election campaign four weeks before election day,

as the SPD escalates its attacks over Merkel’s crisis response

With the European debt crisis in its fourth year, Merkel’s party allies have begun to address openly the prospect of a fresh Greek aid package.

Bloomberg, August 25, 2013

Merkel's Conservatives Split on Greek Aid

Schäuble, a senior member of the CDU, said that Athens would need more financial assistance

beyond the €230 billion it has already been promised to keep it solvent through the end of 2014.

Der Spiegel, 22 August 2013

Fotnot: 230 miljarder euro, i lån, är cirka 2,000 miljarder svenska kronor, för att Grekland skall klara sig till slutet av 2014.

Sedan skall pengarna återbetalas, någon gång, eller skrivas av.

Greece Needs a 21st Century Marshall Plan

It is clear by now that the European Union’s policies in Greece have failed.

Dimitri B. Papadimitriou, Bloomberg, Aug 12, 2013

At their White House meeting last week, U.S. President Barack Obama assured Greek Prime Minister Antonis Samaras of his support as Greece prepares for talks with creditors on additional debt relief amid record-high unemployment.

The U.S. should also endorse a new blueprint for recovery based on one of the most successful economic assistance programs of the modern era: the Marshall Plan.

Beträffande tilltron till den svenska växelkurspolitiken vill jag erinra om att den privata räntebärande nettoskulden till utlandet den 30 juni 1990 var 473 miljarder, en ökning med mer än 200 miljarder på ett år.

Är då 473 miljarder i privat utlandsskuld mycket eller litet?

Jag håller just på med en bok om det svenska biståndet till u-länderna - Bistånd med slagsida - och råkade därvid på några uppgifter om Marshall-hjälpen.

Omräknat till dagens priser och växelkurser uppgick Marshall-hjälpen till 382 miljarder svenska kronor.

Den privata lånestocken är således cirka 100 miljarder större än Marshall-hjälpen.

Rolf Englund, Nationalekonomiska föreningen, 16 januari 1991

Marshall-hjälpen och nästa svenska devalvering

Mycket förtroligt Eyes Only

Sänt till Carl Bildt 90-11-02

Utlagt på Internet 96-10-29

Rolf Englund

The IMF’s latest report on Greece lays bares the country’s grotesque situation, and exposes the charade of EMU policy. It states that public debt will reach 176pc of GDP this year.

“The commitment of Greece’s European partners to provide debt relief as needed to keep debt on the programmed path remains, therefore, a critical part of the program,” said the Fund.

All EMU “solidarity” so far has been in the form of loans, adding further debt. There have been no grants or transfers. The moment that this starts to cost real money, we will enter a new phase of the EMU saga.

This cannot be countenanced before the German elections in September, and for the sake of appearances it cannot be carried out immediately afterwards either. That would be too cynical.

Ambrose Evans-Pritchard, August 1st, 2013

Elva latinamerikanska länder, med Brasilien i täten, sågar IMF:s fortsatta stöd till det konkursmässiga eurolandet Grekland.

Lånevillkoren uppfylls inte, anser ländernas regeringar, som avstod från att rösta när den senaste utbetalningen av grekiska nödlån godkändes.

Dagens Industri, 31 juli 2013

During the current calendar year, Greece's mountain of debt will grow by around €330 billion

The only thing left that can help Greece pull itself out of the crisis is a debt haircut by public creditors.

Whether one wants to call that step a haircut, debt forgiveness or a state bankruptcy is of secondary importance

Der Spiegel, July 18, 2013

The interest payments the Greek state has to send abroad are making the recession even worse, which in turn is causing debt levels to rise. How is Greece ever going to get itself out of this vicious circle?

2012 private creditors forgave a part of Greece's debt. But it was already clear at the time that it wouldn't go far enough.

In order to truly and sustainably help the country out, public creditors (e.g. the governments of countries like Germany) would also have to write off part of the money they lent to Greece.

Currently, two-thirds of Greece's bonds are held by public creditors abroad.

Whether one wants to call that step a haircut, debt forgiveness or a state bankruptcy is of secondary importance

The worst cannot be prevented -- it can only be delayed by repeatedly providing Greece with new loans and leading the people to believe that the sums given will someday be paid back. If need be, they can also just extend the period on the loans to future generations of politicians.

That's precisely the approach being taken by Schäuble and Chancellor Angela Merkel.

Federal elections in Germany take place on Monday, Sept. 22

Indeed, German Finance Minister Wolfgang Schäuble ruled out such a possibility just last week.

Greece is expecting a second debt haircut from its European creditors following the German election,

the country's economy minister said on Tuesday. First, though, Athens must prove that it has done enough

to receive the next tranche of badly needed bailout money.

Der Spiegel, June 2, 2013

With German elections just three months away, Berlin is eager to avoid any talk about yet another debt haircut for ailing Greece.

Indeed, German Finance Minister Wolfgang Schäuble ruled out such a possibility just last week.

It is clear, he said, "that we aren't going to undertake such a debt reduction."

Eurokrisen handlar om bankerna

Rolf Englund 26 april 2013

French and German banks reduced their exposures to these markets by some 30-40 percent

between mid-2011 and the third quarter of last year

David Lipton, First Deputy Managing Director IMF, April 25, 2013

Voluntary

Eurozone finance ministers reached a long-delayed 130 bn euro second bail-out for Greece early on Tuesday

after strong-arming private holders of Greek bonds to take even deeper losses than they had accepted last month.

Financial Times 21 February 2012

- Den stora risken var att Grekland skulle utlösa en kris i italienska, franska och tyska banker.

Nu finns i praktiken en EU-garanti för de utestående grekiska statsobligationerna.

Anders Borg, TT, 22 februari 2012

Grekpaketet handlar om bankstöd och imperiebyggande

Rolf Englund blog 10 maj 2010

If Greek (and Portuguese and Irish, etc.) debt returned a modest premium (2-3%) over German or French debt, then the spread was worth it to the bank managers and shareholders. After all, the regulators had said there was no risk; it was easy money.

Even economists can figure out how to make money at a "modest spread" on 40 times leverage with no risk.

Just ask those clever guys at Long Term Capital.

If Greece were allowed to default, then what would that imply about other peripheral-country debt?

The word contagion slipped into the economic lexicon as Merkel and Sarkozy (and many other European leaders) openly worried that

if Greece were allowed (or forced) to exit the euro, the entire euro experiment might be called into question.

John Mauldin 25 January 2013

As I have written about at length, the European banking system is a systemic disaster. The regulators ENCOURAGED (there is no graphic strong enough to express the outrageousness of such a design) their banks to buy government debt and allowed them to leverage that debt by up to 40 times.

This was on the theory that no sovereign (European) government could actually default, so therefore there was no need to actually reserve capital against the possibility of a default.

And if Greek (and Portuguese and Irish, etc.) debt returned a modest premium (2-3%) over German or French debt, then the spread was worth it to the bank managers and shareholders.

After all, the regulators had said there was no risk; it was easy money.

Even economists can figure out how to make money at a "modest spread" on 40 times leverage with no risk. Just ask those clever guys at Long Term Capital.

And if the spread was 2%? Then back up the truck and give me some more. 100% on your capital per year with no risk? Where do I sign up?

And thus the EU found itself in a credit crisis when Greek debt started to rise in risk, having already been decimated by the subprime crisis. Someone finally noticed that Greece could not hope to pay off its debt.

However, German and French banks had so much Greek (and other peripheral-country) debt that if Greece defaulted they would be bankrupt.

That would of course force the respective governments to capitalize their banks to keep their countries afloat. But then that would call into question their own credit worthiness as we are talking a great deal of money.

And if Greece were allowed to default, then what would that imply about other peripheral-country debt? The word contagion slipped into the economic lexicon as Merkel and Sarkozy (and many other European leaders) openly worried that if Greece were allowed (or forced) to exit the euro, the entire euro experiment might be called into question.

It all went wrong in 2010. The crisis in Greece was taken, wrongly, as a sign that all governments had better slash spending and deficits right away.

Austerity became the order of the day, and supposed experts who should have known better cheered the process on, while the warnings of some (but not enough) economists that austerity would derail recovery were ignored.

Paul Krugman, New York Times 6 January 2013

Interndevalvering (Ådals-metoden)

Acropolis Adieu med Mireille Mathieu och Angela Merkel

Rolf Englund blog 6 december 2012

Bloomberg News sued the ECB

The papers may illuminate the role the central bank played as Greece covered up its deficit for almost a decade

Han som då var chef för Greklands motsvarighet till Riksgälden, var den som talade hos SNS och förklarade att allt var på rätt väg, och som jag då skrattade åt helt ostentativt

Rolf Englund blog 28 november 2012

Europe’s Plan C for Greece Is No Better Than Plans A or B

Bloomberg, Editors, Nov 28, 2012

Europe’s leaders have reached Plan C in their efforts to rescue Greece. Unfortunately, it lacks a crucial element also absent in Plans A and B: adequate debt relief.

The agreement between euro-area finance ministers and the International Monetary Fund is welcome and overdue. It provides much-needed support for a Greek government that has taken enormous political risks to meet the conditions for aid. It also puts an end to weeks of bickering between Europe and the IMF over how to cover Greece’s funding shortfall -- a delay that had threatened to undermine faith in the bailout program, even among Greeks who believe in making the changes and sacrifices demanded.

The deal, however, doesn’t do enough to address the biggest issue: a Greek government debt burden that, at about 170 percent of gross domestic product, remains unbearable under any reasonable scenario. The agreement assumes that Greece will largely grow its way out of the problem, reducing its debt to less than 110 percent of GDP by 2022 even as it endures the crushing austerity required to sustain a budget surplus of 4 percent of GDP. In other words, this is just the latest in a long line of stopgap measures to fend off the kind of disorderly default and euro exit that could trigger contagion in the much larger economies of Spain and Italy.

In a characteristically outraged comment, Holger Steltzner writes in Frankfurter Allgemeine Zeitung that Wolfgang Schauble can no longer claim the rescue of Greece did not cost any money.

An interest moratorium constitutes a debt restructuring in all but name.

It makes no difference to the taxpayer whether he get less in terms of interest rates, in terms of repayment, or in terms of both.

Eurointelligence 28 november 2012

The illusionists keep on pretending that Greece could ever repay its debt. He also makes the point that the bond repurchasing programme is unlikely to succeed, as the market price is likely to be too low. The joker in all of this is the ECB, which will ultimately foot the entire bill through monetary financing – another taboo term like debt restructuring. He says it will be interesting to see whether Angela Merkel can really keep the lid on all of this until the elections.

Euro-zone finance ministers meeting in Brussels this week have been unable to reach an agreement with IMF

on how to ensure that Greece's debt load comes down to manageable levels.

Germany and other European countries continue to reject a new debt haircut.

The standoff could become dangerous.

Der Spiegel, 21 November 2012

Orsaken till Greklands depressionsliknande nedgång verkar att huvudsakligen bero på åtstramningspolitiken

Danne Nordling 20 november 2012

Det pågår en omorientering av de ekonomiska analyserna av Europas problem. Den förda åtstramningspolitiken börjar alltmer ifrågasättas. Ett exempel på detta är IMF med Christine Lagarde i spetsen.

A visibly angered Mrs Lagarde, the managing director of the IMF, shook her head and rolled her eyes

at the announcement /by Jean-Claude Juncker, president of the Eurogroup/ that breaches the Washington-based fund’s condition that Greek debt must become sustainable by 2020.

Daily Telegraph och Financial Times 13 November 2012

Very nice pic

Euroländer och ECB oense om skuldlättnader

Grekland ska den 16 november återbetala ett förfallande lån på 5 miljarder euro

och har inga pengar till detta om landet inte får ytterligare stöd.

WSJ och SvD Näringsliv 6 november 2012

Enligt källor till WSJ ska ECB vara berett att sälja sina grekiska statsobligationer för samma pris som de köptes för. Detta skulle ge Grekland lättnader på 8 miljarder euro, men det täcker bara till en liten del av Greklands finansieringsbehov. Enligt ECB-företrädare måste merparten av arbetet göras av Europas regeringar.

Detta upplägg skulle vidare kräva att euroländerna lånar mer pengar till Grekland för att landet ska kunna köpa tillbaka sina obligationer, vilket euroländerna tidigare har vägrat att göra.

Plats för skratt om Grekland

New debt forecasts dash Greece hopes

The German bloc will have to take its bitter medicine in Greece

Financial Times och Ambrose, October 31st, 2012

Rolf Englund blog 31 oktober 2012

Francois Hollande will travel to Berlin with leaders for crisis talks on Tuesday

after Germany said a Greek sovereign debt restructuring was “out of the question”

Louise Armitstead, Daily Telegraph Chief Business Correspondent, 6:59PM GMT 29 Oct 2012

On Monday, the French president met with Jim Yong Kim, head of the World Bank, and IMF chief Christine Lagarde, as well as leaders of the World Trade Organisation and the OECD, to discuss solutions for Greece, including a debt buy-back. The group will talk about the ideas with Ms Merkel on Tuesday.

Greece's international creditors have proposed that the country receive another debt writedown,

this time from EU governments (OSI)

Fresh aid for Athens, they argue, has been inevitable for months,

but leaders have shied away from telling the truth.

Der Spiegel, 29 October 2012

SPIEGEL has learned that the troika of inspectors from the European Commission, European Central Bank and International Monetary Fund is proposing a further debt cut for Greece, in a move that would for the first time cost taxpayers money because public creditors, meaning EU governments, would be called on to write off a portion of their claims.

With two weeks to go before the EU has to decide on how to fund Greece

Spiegel reports Merkel rejects OSI, but ready for a third Greek programme

though no OSI ahead of the 2013 elections

Eurointelligence 29 October 2012

Spiegel Online reports the chancellor cannot sell OSI to the Bundestag in an election year, while bankers fear a return of market chaos, as such a process would invariably coincide with a messy political process.

(Delaying OSI for another year, while possible, would significantly increase the risk of a major political backlash, as the Greek debt will have increased, and GDP decreased, by then. We continue to see that Greece will end up defaulting on all its debt – except that of the IMF, the ECB, and domestic residents. The political delay of OSI ensures that the eurozone crisis will continue for much longer than necessary. The purpose of a debt buyback programme is merely to signal action when there is none. Debt buybacks don’t work, as market prices adjust quickly.)

Germany was now ready to accept a two-year extension of the Greek programme,

but there would be no new money, leaving Greece itself to fund the gap –

something that is simply not going to happen.

Wolfgang Münchau, Financial Times, October 28, 2012

En av få vedertagna sanningar inom statsvetenskapen att demokratier inte går i krig med varandra, oavsett om de går samman i politiska unioner eller inte.

Den ”demokratiernas fred” som förutspåddes av Immanuel Kant har idag solitt stöd i forskningen.

Däremot hade Angela Merkel inte mötts av upplopp i Aten om det inte hade varit för euron.

Paulina Neuding, jurist och chefredaktör för det borgerliga samhällsmagasinet Neo, Kolumn SvD 20 oktober 2012

Anders Borg tror att Grekland kan komma att tvingas lämna eurozonen

– Skulle man lämna eurosamarbetet är det troligt att man får tillbaka sin konkurrenskraft

och då kanske Grekland kan komma på fötter vart efter.

– Det är en smärtsam och komplicerad väg

men det är svårt att se en alternativ väg som skulle kunna fungera.

Ekot 12 oktober 2012

Snipers, Commandos to Welcome Merkel in Greece

CNBC, 8 October 2012

Armageddon i Grekland den 18-19 Oktober:

How much more pain can the people take?

BBC via Rolf Englund blog

Grekland, Tyskland och IMF vid avgrundens rand

Rolf Engund blog 30 september 2012

The debate over whether the U.S.’s largest banks are too big is heating up.

Since the 2008 financial crisis, the perception has taken hold among some analysts and economists that certain U.S. institutions are too big to fail, meaning they would have to be bailed out to protect the financial system in the event of another calamity.

The continued downward spiral in Europe raises a similar question: Are some banks too big to save, meaning their collapse could dramatically worsen the euro crisis

(as happened in Ireland in the fall of 2008 and is happening now in Spain and Greece)?

Simon Johnson, who served as chief economist at the IMF in 2007 and 2008, Bloomberg 3 September 2012

Men hade det inte varit bra om Grekland i stället för att misskötas från Aten hade styrts från Bryssel?

Ett ett sådant system, med en gemensam finansminister för alla euroländer, skapar lika många problem som den löser.

Jag tänker inte enbart på det demokratiskt tvivelaktiga med ett sådant arrangemang, eller ens på svårigheten att

skapa legitimitet för nedskärningar av pensioner, skolor och sjukvård i Grekland beslutade av anonyma makthavare i Bryssel.

Mats Persson,professor vid institutet för internationell ekonomi, Stockholms universitet, DN Debatt 19 juni 2012

De som fortfarande tror att eurokrisen handlar om lata greker som inte vill göra rätt för sig

bör titta närmare på det spanska exemplet. Eller det irländska.

Europa har slagit in på en kamikazekurs som ser ut att leda mot att euron bryts sönder.

/Spanien/ riskerar att dras ned i en negativ spiral som kan knäcka banksystemet, orsaka en statsbankrutt

och leda till att Spanien lämnar den europeiska valutaunionen.

Peter Wolodarski, Dagens Nyheter 3 juni 2012

If the Greek people get their euros out of the system, then there is very little pain of exit.

With the banks and government insolvent, repudiating the debt and reintroducing the drachma is a winning strategy!

The fact that this is even possible is amazing. The Greeks have nothing to lose if they can keep their deposits in euros and exit!

David Zervos, managing director and chief market strategist of Jefferies and Company, via John Mauldin, 26 May 2012

Rumours – detailed by the bank of Tokyo Mitsubishi-UFJ – that a Greek exit is now imminent.

The bank said there was speculation that a “planned departure” would take place over the weekend of June 2 and 3

Telegraph 25 May 2012

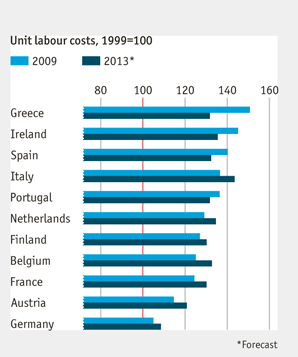

Levelling out competitiveness in the euro area will be costly

Greece must lower its real exchange rate, by cutting prices and wages.

This is proving a painful process.

Nice chart EMU Unit Labour Cost 1999-2013

The Economist online May 22nd 2012

Grekland besparades både kommunismen och uppgörelsen med den;

landet hamnade efter 1945 på “rätt” sida.

Richard Swartz, kolumn DN 26 maj 2012

Glömt är också att Grekland efter kriget gick igenom ett inbördeskrig mellan den politiska högern och vänstern som intill denna dag kluvit samhället, en spricka som med hjälp av bland annat massiva euro-krediter kunnat spacklas över, men som kan spricka upp igen.

Europa säger till Grekland: om ni inte sparar och reformerar kastar vi ut er. Grekland svarar: varsågod! Gör det då! Men ni vågar inte.

Vi är inte ens ense om vad Europa egentligen är. Hur stort är det? Var ligger dess gränser?

The charismatic /han kör en BMW-MC till parlamentet/ Greek leftist who could determine the fate of the euro

begins a tour of European capitals on Monday

"We are not at all an anti-European force"

CNBC 21 May 2012

"We are not at all an anti-European force. We are fighting to save social cohesion in Europe.

We are maybe the most pro-European force in Europe, because its dominant powers will lead the union into instability

and the euro zone to collapse if they insist on austerity," he said.

*

His party Syriza, or Radical Left Coalition, came a shock second place in the May 6 election

An eloquoent, skilled performer who shuns neck ties and likes to get around on his motorcycle, Tsipras can be a fiery orator in parliament, railing against austerity.