EMU Start

|

Spanien - Spain

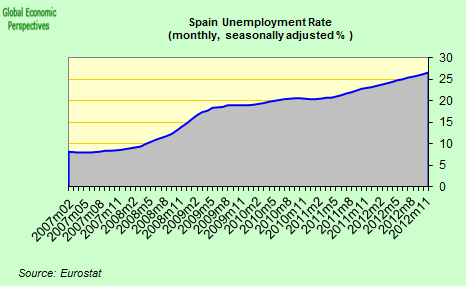

The people will not tolerate 25% unemployment forever - with no hope in sight.

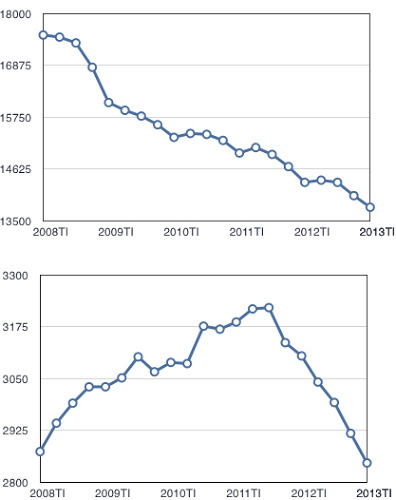

CalculatedRisk, 25 January 2015

Spain will be stuck with an unemployment rate above 25 per cent for at least five more years,

according to a forecast by the International Monetary Fund

Financial Times, August 2, 2013

Kommentar av Rolf Englund

Detta är - eller borde i alla fall vara - fullständigt oacceptabelt.

Att Spaniens och EMUs ledare låter detta fortgå kan bara förklaras av ett fanatiskt fasthållande vid EMU-projektet

och/eller en ovilja att erkänna sina misstag. Hellre får folket lida.

Det kan inte vara bra för freden.

Stigande huspriser och skulder är Sveriges största bekymmer just nu

lösningen stavas hårdare tyglar för bankerna.

Det signalerar finansminister Anders Borg, DI 21 november 2012

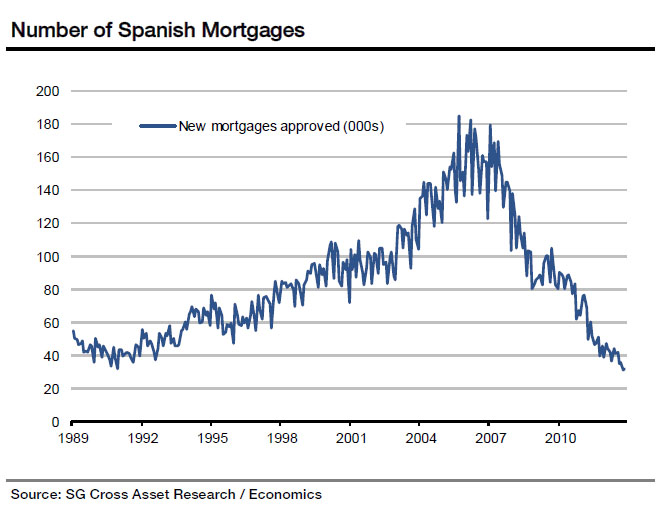

The Spanish Housing Market Is About To Bottom

Tyler Durden, zerohedge, 28 January 2013

The tightrope PM Rajoy is trying to walk between austerity and human costs is the fault line dividing the whole of Europe.

Louise Armitstead, Telegraph 29 March 2012

Like Greece's Syriza party, they make empty protests, catering to ignorance,

unwilling to accept that the euro itself has now become their real enemy.

As yet, I can see no clear proposal on the table in any EMU country

– from any major movement, party, or political leader – that offers a way out of the current impasse.

Somebody will fill the vacuum.

Ambrose, October 19th, 2012

"To talk about a bail-out for Spain at the moment makes no sense," he told reporters.

"Spain is not going to be rescued; it's not possible to rescue Spain, there's no intention to, it's not necessary

and therefore it's not going to be rescued."

Louise Armitstead, Telegraph 12 Apr 2012

Q&A: What went wrong in Spain?

Spain's story illustrates the fact that the eurozone's problems run far deeper than the issue of excessive borrowing by ill-disciplined governments.

BBC 28 September 2012

I’ve always viewed Spain, not Greece, as the quintessential euro crisis country

Paul Krugman, 7 March 2012

Tyskarna gick in i EMU med en övervärderad kurs

Efter återföreningsbubblan som lämnade dem med en svag ekonomi i ett halvt decennium.

De arbetade långsamt tillbaka konkurrenskraften den hårda vägen, genom att pressa löner och driver upp produktiviteten.

Det är helt förståeligt att de nu tror att Club Med kan och bör göra samma sak.

De är helt fel, naturligtvis, eftersom Tyskland kunde sänka relativlöner under

a) en global boom, b) mot andra EMU-stater som inflaterade C) och med räntor som var låga även under de svåra åren.

Ingen av dessa faktorer gäller Italien eller Spanien nu.

Ambrose Evans-Pritchard, 2 December 2011

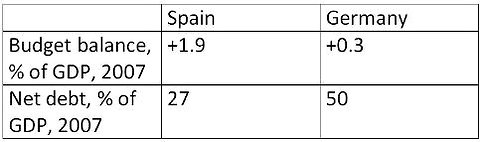

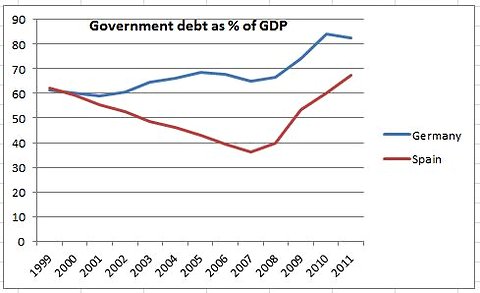

The Germans entered EMU at an overvalued rate

after the Reunification bubble, leaving them in semi-slump for half a decade.

They slowly clawed back competitiveness the hard way, by squeezing wages and driving up productivity.

It is entirely understandable that they now think Club Med can and should do the same.

They are profoundly wrong, of course, because Germany was able to lower relative wages during

a) a global boom, b) against other EMU states that were inflating c) and with benchmark borrowing cost that stayed low even during the dog days.

None of these factors apply to Italy or Spain now.

Ambrose Evans-Pritchard, December 2nd, 2011

Expression from Aubie Balton

Wolfgang Münchau, April 10, 2011

Paul Krugman, New York Times, 22 May 2011

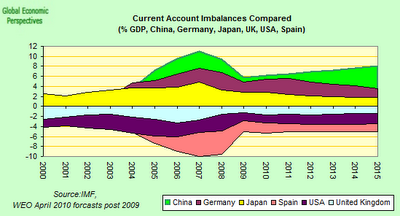

a comparison of the recent history of the Spanish and German economies can prove illuminating

As Wolfgang Munchau pointed out in the FT yesterday, Germany entered the eurozone at an uncompetitive exchange rate and embarked on a long period of (quite painful) wage moderation and deep structural reform.

A Fistful Of Euros, 31 August 2010 with many nice charts

Unfortunately, the number of new houses was not just more than

France, Germany and Italy combined built last year.

It was also more than anybody wanted to buy.

FT editorial 28/4 2007

DN huvudledare 7/5 2010

Population: 45.8 million, Budget deficit in 2009: 11.1%,

Unemployment in Sept: 20.8%

Like the Irish Republic, a collapse in the housing market has also been a key factor in Spain's economic woes. Yet the country's economic problems run a lot deeper, as Spain's 20.8% unemployment rate reveals.

The country is now continuing to liberalise its labour laws to make it easier for firms to make people redundant.

This may sound as if it will worsen the problem, but Madrid hopes the increased flexibility will persuade more companies to take on extra staff.

BBC 17/11 2010

Spain’s Bankia, the country’s fourth-largest bank

It’s been a headache for Spanish leaders since it required a rescue in 2012 to avert a collapse

that could have brought down the nation’s entire financial system.

Bloomberg 6 July 2018

...

Bankia had a 4.47bn-euro loan by the Spanish bailout fund converted into shares.

BBC 11 May 2012

Political uprising in Spain shatters illusion of eurozone recovery

"Our message to Europe is clear. Spain will never again be the periphery of Germany.

We will restore the meaning of sovereignty," said Podemos

Ambrose Evans-Pritchard, 21 Decenber 2015

There has been an export miracle of sorts, led by a surge in car output as multinational companies switch plant from France to Spain to take advantage of wage cuts, reaching 27pc for new workers at plants in Valladolid.

But what has really eliminated the current account deficit is a 12pc collapse in internal demand. Imports have been choked. The country can barely balance its external books with unemployment at 22pc.

A full recovery would quickly expose Spain's chronic lack of competitiveness within the euro structure.

Spain

Greece's creditor powers have delayed talks over reducing the country's debt mountain

for fear of emboldening anti-austerity forces in the southern Mediterranean, its finance minister has claimed.

Telegraph 10 November 2015

Euclid Tsakalotos said EU lenders would not discuss the question of Greece's debt burden, which stands at 200pc of GDP, until after the Spanish elections are held in the new year.

GreeceSpain’s recovery has been helped hugely by external factors outside Mr Rajoy’s control.

A weaker euro has helped to boost the growth in Spanish exports.

The decline in oil prices has been particularly beneficial for a country which imports all its energy needs from abroad.

The European Central Bank’s adoption of quantitative easing has been a further boost.

Financial Times editorial, 25 August 2015

Jobless numbers are falling but the unemployment rate — at 22 per cent — remains the highest in the EU after Greece.

Many without work have been out of the labour market for more than two years.

Spaniens ekonomi skördar nu frukterna av ekonomiska reformer men det kvarstår ihållande strukturella problem, som "mycket hög" arbetslöshet, låg produktivitet och höga skuldnivåer.

Det skriver IMF i en Spanienrapport

SvD Näringsliv 14 augusti 2015

IMF Executive Board Concludes 2015 Article IV Consultation with Spain

Press Release August 14, 2015

"However, deep structural problems limit Spain’s growth potential going forward and vulnerabilities remain.

The high structural unemployment and pervasive labor market duality, and the lack of economies of scale of Spain’s many small firms hold back medium-term growth. Public and private debt levels are still high and are likely to keep weighing on consumption and investment.

Spain has a large negative net international investment position, which adds to its external vulnerabilities.

Despite doing (basically) everything right, Spain’s membership in the euro has left it at the mercy of

forces far stronger than anything even the most competent and responsible national institutions can handle.

Matthew C Klein. FT Alphaville June 11, 2015

The normal response would be to let the currency float while defaulting on some foreign debt and maybe imposing some capital controls. Let’s call that the Iceland model, which seems to have worked out pretty well, all things considered.

And yet output is still about 6 per cent below peak while 23 per cent of the labour force remains unemployed. Even if GDP and job growth maintain their current rapid rates, neither output nor employment will return to pre-crisis levels until sometime in 2019

— and again, this is the result of following the designs of elite Euro area policymakers as well as any other country in Europe.

Is The Crisis Now History In Spain?

Unemployment falling back, to 23.2%

Edward Hugh, 14 april 2015

The real debate is about the following decade, whether or not that one will be lost too,

as deflation and secular stagnation steadily take hold in the context of an ageing and declining population

A similar picture emerges when it comes to unemployment which is now steadily falling back, with the seasonally adjusted rate falling to 23.2% in February.

Top of pageDenna genomklappning av Spaniens två stora partier har givetvis med landets långa och svåra ekonomiska kris att göra,

men det är korruptionen som är den riktiga boven i dramat.

Mauricio Rojas, SvD 21 mars 2015

Skandalerna har varit så många och så pinsamma att det krävs stor partilojalitet för att fortsätta stödja det gamla partietablissemanget. Men korruptionens tentakler når mycket längre än till politiken: kungahuset, stora företag och fotbollsklubbar, fackföreningarna – ja, praktiskt taget varje viktig samhällsinstitution har drabbats av förödande skandaler. Men samhället i övrigt är givetvis inte immunt mot denna farsot, tvärtom.

Top of page

The Economist 16 February 215

Top of pageAusterity – the policy of saving your way out of a demand shortfall – simply does not work.

The question now is not whether the German government will accept it, but when.

Will it take a similar debacle for Spain’s conservatives in that country’s coming election

to force Merkel to come to terms with reality?

Joschka Fischer, Project Syndicate JAN 30, 2015

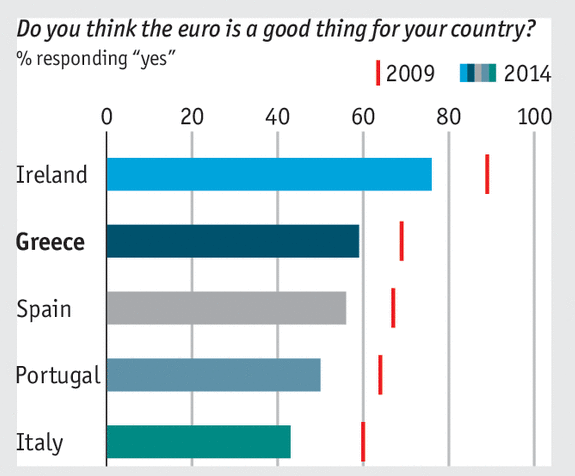

In the next act of the eurozone’s economic drama, keep a close eye on Spain

2015 could be when we find out, one way or another, whether the current strategy for fixing the eurozone is workable

— not just economically but politically

Stephanie Flanders, FT December 21, 2014

At the start of 2014, the radical leftwing party, Podemos, did not exist.

Today it is the most popular political movement in Spain.

Policy makers want to believe this muddle-through combination will be enough.

Even in an environment of near zero inflation, they hope the eurozone and its battered governments are on a path

that is both financially and politically sustainable. There will be no better test than the next 12 months in Spain.

The writer is chief market strategist for UK and Europe at JPMorgan Asset Management

There is the argument in government ministries and the smoke-free conference rooms of Brussels,

as politicians and bureaucrats attempt to define new continent-wide rules to ensure Europe does not slip back into a new and debilitating debt crisis.

But the future of the European economy and its single currency is more likely to be decided on the streets.

Gideon Rachman, FT October 18 2010

Radical left is right about Europe’s debt

The tragedy of today’s eurozone is the sense of resignation with which the establishment parties of the centre-left and the centre-right

are allowing Europe to drift into the economic equivalent of a nuclear winter.

You may not consider yourself a supporter of the radical left.

But if you lived in the eurozone and supported those policies, that would be your only choice.

Wolfgang Münchau, FT November 23, 2014

Both Ms Le Pen and Mr Grillo want their countries to leave the eurozone.

In Greece, Alexis Tsipras and his Syriza party lead the polls.

So does Podemos in Spain, with its formidable young leader Pablo Iglesias

The euro is in greater peril today than at the height of the crisis

Insurrectional electorates more likely to vote for a new generation of leaders

Wolfgang Münchau, FT November 9, 2014

Spain

“On the macroeconomic level you see that things are going better. But our people see no change,”

“There are more and more people whose unemployment benefits have run out, and who have used up all their financial reserves.”

FT 30 October 2014

Top of page

Top of page

America’s experience in the 1960s should have warned the eurozone’s creators that tying national monetary authorities’ hands might not be such a good idea.

Europe’s leaders must recognize that the eurozone, as it is currently constituted, is larger than Europe’s optimal currency area.

Some of its member countries – certainly Greece, and probably Italy and Spain – need an independent monetary policy.

Koichi Hamada, Special Economic Adviser to Japanese Prime Minister Shinzo Abe and Professor of Economics at Yale University, Projet Syndicate 28 October 2014

Independence referendum in November

Mr Pujol, who was Catalan president for 23 years until 2003,

stunned supporters last month by revealing he had kept undisclosed bank accounts outside Spain for the past 34 years.

FT 12 August 2014

Spain

IFRS imposed a strict “incurred-loss” method, in which debt was valued at par until a borrower actually stopped paying.

One of the biggest changes between the new rules and many of the national guidelines that preceded them was

a ban on banks writing down the value of their loans in anticipation of future losses,

a practice some had abused to disguise volatility in their earnings.

The Economist print 26 July 2014

Investor appetite for yield has reached such voracious levels that valuations have started to look "strange", bond investors have said,

with 10-year Apple bonds and 10-year Spanish government bonds now trading at similar levels

CNBC 14 May

Violence has broken out at the end of an anti-austerity protest

attended by tens of thousands of people in the Spanish capital Madrid.

Dozens of youths threw projectiles at police, who responded by charging at them.

Demonstrators were protesting over issues including unemployment, poverty and official corruption.

BBC 23 March 2014

Nice video and pics

Telegraph 14 March 2014

Flera katalanska partier är nu överens om hur folket i regionen nästa år ska tillfrågas om självständighet.

En författningsvidrig folkomröstning som ska stoppas, hälsar regeringen i Madrid.

DI, 12 december 2013

Catalan leaders set date for vote on independence

“This consultation will not take place because it is not allowed by the constitution,” said the minister for justice.

FT, December 12, 2013

“This consultation will not take place because it is not allowed by the constitution,” said Alberto Ruiz-Gallardón, the minister for justice.

He went on to describe the Catalan move as an “attempt to violate the constitution and the fundamental rights of all Spaniards”.

Spanien får beröm för att ha lyckats sina kostnader och för att ha vänt ett underskott i bytesbalansen på 10 procent till ett litet överskott.

Men en arbetslöshet på över 25 procent imponerar inte.

Betyget blir ”godkänt”.

Dagens Industris Henrik Mitelman, 2013-08-27

Man häpnar.

Hur kan man undvika att inse att 25 procents arbetslöshet är en katastrof för land och folk?

Att det är fullständigt oacceptabelt.

Det är till och med ett orimligt pris även om man inbillar sig tillhöra dem som håller på att skapa ett nytt Romerskt rike.

Rolf Englund blog 2013-08-27

Rome, Habsburg and the European Union

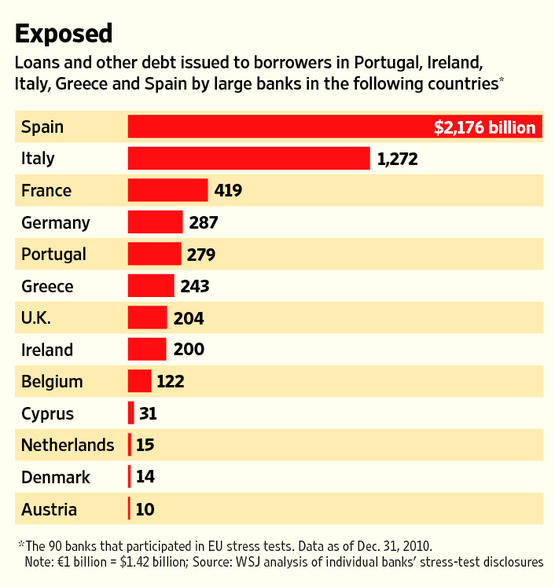

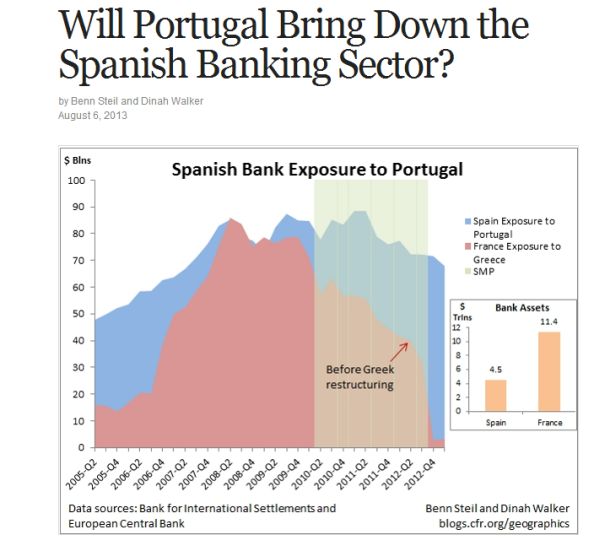

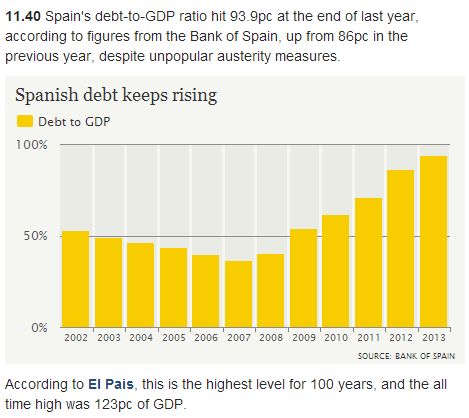

Will Portugal Bring Down the Spanish Banking Sector?

Spanish bank exposure to Portugal today is higher than French bank exposure to Greece in early 2010.

France’s exposure to Greece totaled $86 billion.

Geo-Graphics, Council on Foreign Relations, 6 August 2013

Spanish bank stress tests in 2012 suggested that the capital hole was more manageable than widely feared,

but those tests looked only at the domestic lending books; foreign assets were excluded.

In its recent evaluation of the Greek bailout program, the IMF revealed that the euro area leadership sought to delay a Greek sovereign debt restructuring back in 2010

because of contagion fears; that is, Greece’s creditors might get sucked into the bailout vortex.

Among eurozone national banking systems, France had the largest exposure. At its peak in the second quarter of 2008, France’s exposure to Greece totaled $86 billion.

That exposure has since plummeted, partly because French banks took advantage of the ECB’s Securities Market Programme (SMP) during 2010-11 to fob off Greek bonds, effectively forcing a eurozone mutualization of the debt.

SMP was terminated in September 2012.

Thanks to Eurointelligence for the link.

- Den stora risken var att Grekland skulle utlösa en kris i italienska, franska och tyska banker.

Nu finns i praktiken en EU-garanti för de utestående grekiska statsobligationerna.

Anders Borg, TT, 22 februari 2012

Considering issuing at least €6bn in hybrid equity capital such as convertible bonds

Deutsche Bank set to shrink to achieve leverage target

Deutsche Bank has one of the lowest leverage ratios of large banks globally

Financial Times, July 21, 2013

Spain will be stuck with an unemployment rate above 25 per cent for at least five more years,

according to a forecast by the International Monetary Fund

Financial Times, August 2, 2013

Kommentar av Rolf Englund

Detta är - eller borde i alla fall vara - fullständigt oacceptabelt.

Att Spaniens och EMUs ledare låter detta fortgå kan bara förklaras av ett fanatiskt fasthållande vid EMU-projektet

och/eller en ovilja att erkänna sina misstag. Hellre får folket lida.

Det kan inte vara bra för freden.

IMF Spain:

2013 Article IV Consultation, August 02, 2013

Spain's slow-motion implosion into an insolvent singularity has been one of the most amusing sideshows for over a year.

The chief reason for this is the sheer schizophrenic and absurdist polarity between the sad reality, visible to everyone, and the unprecedented propaganda by the government desperate to paint a rosy picture.

Zerohedge, July 22, 2013

Tack till Professor Pelotard som påminde om Frank Hellers funderingar om Minorca:

- Vid sextonhundratalets utgång var storhertigdömet så nära ruinen en stat gärna kan bli (och ogärna bör vara): och i sin nöd finner vi dess härskare tillgripa de mest olika metoder för att lätta en förtvivlad ställning - metoder som onekligen stöter oss något.

Spanish Prime Minister Mariano Rajoy

El Mundo newspaper reported on Tuesday that it had presented the Spanish High Court with documents that

showed payments were made from an illicit "slush fund" to leading members of the ruling People's Party,

including Rajoy.

CNBC, July 9, 2013

Rajoy on slush fund:

“It is all untrue, except for some things”

EL PAÍS, Madrid 4 FEB 2013

France, Spain and Slovenia are set to be criticised in a major commission report on Wednesday

as countries that have failed to cut public debt and to implement structural reforms

European Union studies on “macroeconomic imbalances” have been given new teeth this year

under eurozone “governance” legislation

Telegraph, 25 May 2013

Braulio Rodriguez, the Archbishop of Toledo:

"We have to change direction, otherwise this is going to bring down whole political systems,"

"The Vatican has always been an enthusiast for Europe, but a Europe of solidarity where we help each other,

not a Europe of coal and steel. Whether this is possible depends on Germany and Chancellor Angela Merkel,"

Ambrose 12 May 2013

The decline in yields on Spanish debt, shown so clearly in the chart, dates almost precisely to 26th July 2012, the date on which Mario Draghi, president of the ECB, told an audience in London that “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

This statement, in turn, led to the announcement by the ECB on August 2nd 2012 of “outright monetary transactions” which would be aimed “at safeguarding an appropriate monetary policy transmission and the singleness of the monetary policy”.

Rightly or wrongly, markets concluded that the risk of an outright default on Spanish bonds had largely disappeared.

Martin Wolf, Financial Times, 10 May 2013

5.136 miljarder SEK

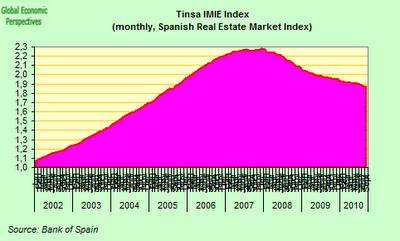

The pre-crash bubble saw Spaniards borrow merrily, owing almost twice as much in mortgages as Italians by 2010.

The total debt is falling gradually, but is still around €600 billion ($780 billion).

Some 8% of mortgage-holders are now jobless.

Last year 80 families a day had mortgages foreclosed, with their properties usually valued far below the purchase price.

Many owe money on homes they no longer own or live in

The Economist print Apr 27th 2013

The total number of unemployed people in Spain has now passed the six million figure,

A big demonstration in Madrid is being planned against the austerity measures.

BBC etc, 25 April 2013

I am surprised that a great historic nation should put up with 27pc unemployment, or accept vassal status to an incompetent and dysfunctional EMU regime.

Does anybody in Madrid think that EU officials in Brussels actually know what they are doing?

Ambrose

More than 6 million without jobs in Mariano Rajoy's Spain while figure in François Hollande's France is 3.2 million, Guardian

Family's struggles as Spain unemployment hits new high, BBC

money.cnn.com/video/news/2013/04/25

money.cnn.com/2013/04/25/news/economy/spain-greece-unemployment

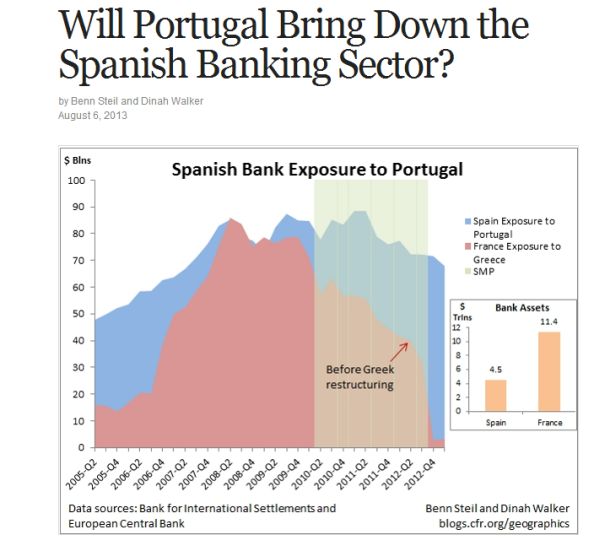

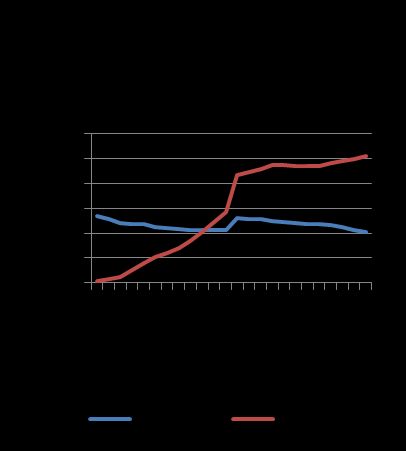

Det övre diagrammet visar antalet anställda (i tusental) i den privata sektorn och det undre diagrammet visar antalet anställda i den offentliga sektorn.

Man noterar att antalet anställda i den offentliga sektorn inte har sjunkit alls sedan krisen började även om antalet har minskat sedan Zapatero-regeringens kollaps.

Det innebär att Spanien inte har "dragit åt svångremmen" på samma sätt som Portugal, Grekland eller Italien.

Det återstår fortfarande - med en arbetslöshet på över 27% (eller över 32% om man skulle använt sig av det gamla sättet att räkna).

Fortsätter man på den här vägen går Spanien rakt in i ett socialt sammanbrott.

Via tips från Professor Pelotard 26 april 2013

Euron kollapsar i Spanien Rolf Englund 28 maj 2012 - Rolf Englund blog Maj 31, 2010

The turmoil produced by the Italian elections has directed attention back to where it should have been all along – to the politics of the eurozone crisis.

It is possible that southern Europe will give the Germans until the autumn to come around to a new approach.

But toleration for austerity is unlikely to last much beyond then.

Europe may be approaching a stark choice: giving up the euro; or keeping it and seeing the political crisis spin out of control.

Mark Mazower, professor of history at Columbia university, Financial Times 28 February 2013

Socialism eller barbari, brukade vi säga

Europa befinner sig i sönderfall på grund av den ändlösa eurokrisen, en kris som ingen kan se något slut på.

Denna abstrakta, flytande gemensamma valuta, är den inte bara ett fantasifoster

med sin brist på förankring i en gemensam ekonomi, resurser och ekonomisk politik?

Europa är inte i kris. Europa är döende. Inte i geografisk bemärkelse, naturligtvis, men Europa som idé. Europa som dröm, som projekt.

"Elva europeiska intellektuella" i ett flertal europeiska tidningar,

bland annat Le Monde, Frankfurter Allgemeine och El País i januari 2013.

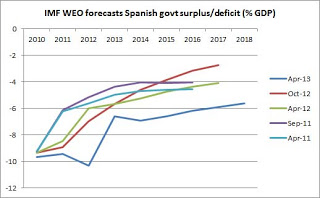

The IMF seems to have turned significantly more pessimistic on the prospect of a Spanish recovery.

The charts below provide a comparison with the previous WEO forecasts (highlighting how these forecasts tend to be overly optimistic)

- which very much confirms what we have noted before about the real risks in Spain

Open Europe 18 April 2013

"In two Member States, Spain and Slovenia, imbalances can be considered excessive.

In Spain, the very high domestic and external debt levels continue to pose

serious risks for growth and financial stability.

The adequacy of their policy responses will be assessed in time for the conclusion of this year’s European Semester of economic policy coordination,

in the context of which country-specific recommendations will be adopted on 29 May."

EU-Kommissionen, 10 april 2013

Spaniens statliga pensionsfond nu har 97 procent av sina tillgångar i spanska statspapper.

Moody’s rapport om de spanska bankerna. Andelen dåliga lån är uppe i 10,8 procent eller motsvarande 160 miljarder euro.

Många av bankerna är beroende av nödlån från ECB för att klara sig.

En annan stor risk enligt Moody’s: bankernas stora exponering mot spanska statspapper.

Bankerna har, vid sidan om pensionsfonder, nämligen stödköpt det egna landets skuldebrev i enorm omfattning.

Andreas Cervenka, SvD 5 april 2013

Cyprus, Spain, Greece, Italy

At what point does it become economically rational for a country to leave the eurozone

Wolfgang Münchau, Financial Times, March 31, 2013

There are two things to consider.

The first is whether the country’s banking system is viable in the presence of an imperfect banking union – one that will not share any risks in the foreseeable future.

The second is whether public and private sector debts are sustainable, given the country’s present and expected future growth rates.

If the Federal Deposit Insurance Corporation raids a bank in San Francisco, and bails in uninsured depositors,

there is no bank run on neighbouring banks as California is not liable for the banking system.

Instead the US has a federal resolution authority and deposit insurance system.

But as each eurozone country remains responsible for their banking systems, Cyprus had no choice but to impose capital controls after the bail-in.

The authorities have in effect launched a new parallel currency convertible to the standard euro at an exchange rate of one to one, but only up to €5,000, the monthly transfer limit.

Jeroen Dijsselbloem, Dutch finance minister and president of the eurogroup of eurozone finance ministers – in an interview with the Financial Times – shocked the world by telling the truth.

It is now the stated policy of the creditor countries to solve the problem of a debt overhang in the banking sector in the peripheral countries through the bail-in of bondholders and depositors.

The logical consequence of Mr Dijsselbloem’s dictum and the reality of austerity and a deficient banking union is a future bail-in of Spanish bank bondholders and depositors.

The problem is that even insured deposits will then not be protected.

Look at what happens in Cyprus, where capital controls affect small and large deposits alike.

I would expect that to happen in Spain as well.

Given the stated policy, it is logically irrational for any Spanish saver to keep even small amounts of savings in the Spanish banking system.

There is no way that the Spanish state can guarantee the system without defaulting itself.

Cypriot Financial Sector Faces Collapse

Data from the BIS in Basel shows that, at the end of September 2012, the Cypriot banks had a total of

$441 million in debt with foreign banks - a dimension that could be coped with easily.

Spain, by comparison, has a whopping €132 billion in liabilities to foreign banks.

Der Spiegel, 21 March 2013

Spanish economist advocates controlled demolition of Eurozone

Juan Francisco Martin-Seco wonders whether the high cost of austerity wouldn't justify

"admitting that the Monetary Union has been a failure and should not have been done"

Eurointelligence 11 March 2013

Martin-Seco, who is promoting his new book "Against the Euro: the story of a mousetrap" argues that:

the successive failures of the European Monetary System to sustain fixed exchange rates foretold the failure of the Euro.

the alternative to "rolling back" the Euro is to "press forward" which requires "a true fiscal union" including a common Public Finance and sizable resource transfers from richer to poorer countries, but "this scenario is virtually impossible because Germany will never accept it".

if the Eurozone consisted only of France and Germany, France would eventually end up like Greece because of the structural differences between the countries.

Eurozone membership has already had high costs for Spain: an erosion of democracy, the loss of the "Social State"; and staying in the Euro would roll back 80 years of building a welfare state.

Boken är på spanska och heter Contra el euro : historia de una ratonera

Spanish Economy minister Luis de Guindos: “Spain doesn’t need any sort of bailout,”

Perhaps the key point here hangs on your interpretation of the word “need”.

Edward Hugh, 18 February 2013

Spanish Economy minister Luis de Guindos can point to occasions where he has carried the argument. Back in October last year, when he told an audience at the London School of Economics that Spain didn’t need a bailout they simply laughed.

Four months later it is looking increasingly unlikely that the country will seek additional EU aid in the short term. “Spain doesn’t need any sort of bailout,” he told Bloomberg TV recently, and this time no one laughed.

Perhaps the key point here hangs on your interpretation of the word “need”.

If paying around 5% on your 10 year bonds is considered to be an acceptable cost for financing your country’s debt – Germany, for example is paying around 1.7% – then there is no need to apply to the EU and trigger ECB bond buying via the Outright Monetary Transactions program.

If, on the other hand, you think the country could well benefit from lower funding costs, and the kind of pressure for reform which would be exerted from the outside though a Memorandum of Understanding, then clearly a bailout is needed.

Rajoy on slush fund:

“It is all untrue, except for some things”

EL PAÍS, Madrid 4 FEB 2013

SPAIN'S PM FACES HUGE CORRUPTION SCANDAL

Internet Explodes With Mockery

Business Insider Feb. 3, 2013

Suddenly, the Spanish government is swirling in a massive corruption scandal.

Late last week, the Spanish newspaper El Pais published documents, which purport to show that the party of ruling PM Mariano Rajoy has been taking illegal donations for years.

Opposition politicians are calling on Rajoy to resign, a move that would bring unwanted political instability to one of the Euro's most vulnerable nations.

Rajoy is remaining defiant, and yesterday he held an emergency televised address to rebuke the claims. However, this image of reporters covering Rajoy via monitor is being used to make him look like a coward.

Protests broke out in Spanish cities after Prime Minister Mariano Rajoy denied claims that

he and other party members had accepted secret payments.

"I have never received nor distributed undeclared money," Mr Rajoy said earlier, vowing not to resign.

BBC, 3 February 2013

An online petition demanding the leader's resignation has gathered more than 740,000 signatures.

The Spanish Housing Market Is About To Bottom

Tyler Durden, zerohedge, 28 January 2013 with nice chart

Spain

Since 2009 the deficit has fallen by €16bn

while public investment has contracted by €17bn

Juan Rubio-Ramirez, Financial Times 8 January 2013

The writer is professor of economics at Duke University and a researcher at FEDEA in Madrid

The EMU disaster is not at root a public debt crisis, and never was.

As EMU leaders themselves say – correctly – Euroland's aggregate public debt is lower than in the UK, US, and Japan as a share of GDP.

What Europe faces is a north-south incompatibility crisis,

the result of ramming together misaligned economies and countries into a single currency.

Ambrose Evans-Pritchard, January 8th, 2013

Whether you think this matters depends on whether you think the democracies of southern Europe will tolerate slow grinding depression – with no light at the end of the tunnel – for year after year.

The denouement is hard to predict in such situations. Political upheavals are famously non-linear. But the situation in Spain is remarkable, with the added nitroglycerine of a ruling party determined to exploit the crisis to take power back from the regions, and Catalonia determined to resist with all means at its disposal.

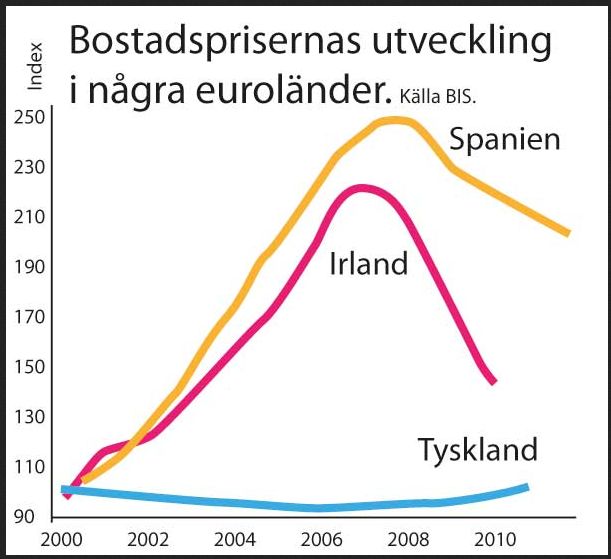

Data from Tinsa released today shows that Spanish house prices fell 11.3pc last year, and are now down 33.3pc from the peak in 2007.

"Spain requests €39.5bn bank bail-out, but no state rescue"

Spain's economy ministry said it had requested the disbursement of €39.5bn for its banking sector,

for its four nationalised banks - Bankia, Catalunya Banc, NCG Banco and Banco de Valencia - and for a so-called “bad bank”.

It should be paid to the state’s banking fund by mid-December, the ministry said.

Telegraph 3 December 2012

“It is very complicated to reduce the deficit by 2.6 percentage points in the context of a recession, with so many revenue problems and with such high financing costs,” Mr Rajoy said. “Our objective is to do things well and see what happens at the end of the year.”

As well as refusing tor rule out a rescue for Spain, he also said he could not rule out further austerity measures.

Mr Rajoy’s government has introduced more than €60bn of spending cuts since it came to power at the end of last year.

A general strike has been called for November 14 /in Spain/. Yet they have nothing coherent to offer.

Like Greece's Syriza party, they make empty protests, catering to ignorance,

unwilling to accept that the euro itself has now become their real enemy.

As yet, I can see no clear proposal on the table in any EMU country

– from any major movement, party, or political leader – that offers a way out of the current impasse.

Somebody will fill the vacuum.

Ambrose, October 19th, 2012

Merkel has cast doubt on one of the main benefits of eurozone banking union only hours after the bloc’s leaders agreed to a slightly clearer time table for the creation of a single bank supervisor.

Ms Merkel said that bad assets held by Spanish and Irish banks will not be cleaned up by the eurozone’s new €500bn rescue fund, adding that it should only be used to shore up teetering financial institutions in the future.

Financial Times 19 October 2012

Katalonien start

Katalonien vill sluta betala för Spanien

I dag är det 300-årsjubileum för Kataloniens nationaldag, och snart röstar katalanerna om självständighet.

Att bryta sig loss från Spanien ses som ett medel för att skydda regionens ekonomiska välstånd.

Jakob Lewander, understreckare SvD 11 september 2014

Under det spanska tronföljdskriget 1701–14 stred Europas stormakter på spansk mark om resterna av det stapplande spanska imperiet som styrdes av den svagsinte, sjuklige och troligtvis inavelsstörde habsburgaren Karl II.

Det franska kungahuset Borbón hade starkast stöd i Kastilien medan Aragonien stödde habsburgarnas mer federalistiskt inriktade kungahus som lät imperiets områden existera på lokala villkor.

As Scotland prepares to vote on independence, Catalans and Spaniards are watching with a mixture of excitement and unease.

Despite cries of "illegal" from Madrid, Catalonia's top politician is committed to holding a similar vote in this Spanish region

BBC 11 September 2014

In a matter of weeks, Spain's Constitutional Court is expected to rule that a referendum in Catalonia would be "illegal".

Mr Mas seems unperturbed, claiming that a "non-legally binding vote" would still be possible under Catalan law.

When asked what a "yes" vote in such a case would actually mean, his answer was unclear.

But that perhaps reflects the fact that no one really knows, because it would be uncharted territory, with the territorial integrity of Spain at stake.

Independence referendum in November

Mr Pujol, who was Catalan president for 23 years until 2003,

stunned supporters last month by revealing he had kept undisclosed bank accounts outside Spain for the past 34 years.

FT 12 August 2014

His party has dominated regional politics for decades and, under Mr Mas, has moved from a moderate nationalist stance to outright support for an independent state. Mr Mas says he will hold an independence referendum in November, a plan adamantly opposed by the Spanish political establishment.

Split from Spain would be an error but autonomy is needed

a shadow over the nation’s political future shows no sign of resolution:

the demand by millions of Catalans for independence.

Scots are set to vote this September in an independence referendum

Financial Times editorial, May 5, 2014

One of the leading arguments for secession, in addition to the region’s history and separate language, has been economic. It is home to a seventh of Spain’s population and is among the wealthiest and most productive parts of the country. For years a healthy chunk of its tax revenues has in effect been given away to help fund the rest of the country’s public services.

Artur Mas, the Catalan president, has called an independence referendum for November 9. But last month the Spanish parliament declared it would not tolerate such a move, striking down the formal request. Mariano Rajoy, Spain’s prime minister, insists such a referendum would violate the 1978 constitution.

While the Scots are set to vote this September in an independence referendum that has been formally approved by the UK parliament, no such compromise has been achieved in Spain.

Mr Mas has admitted he will not press ahead with the referendum if it lacks legality.

Spain's Prime Minister maintained that a referendum on independence for Catalonia would be "illegal"

on Tuesday (25 February) as he delivered his annual state of the nation speech.

Mariano Rajoy vowed to block the vote, which the Catalan authorities intend to hold on 9 November.

EU Observer, 26 February 2014

"This referendum can't take place, it is not legal," he said, adding that "it is the entire Spanish people who have the capacity to decide what Spain is."

Spain promises non-interference on Scotland

Men varnar Katalonien och drar paralleler med South Ossetia, Abkhazia and Somaliland

Financial Times, 2 February 2014

Madrid has long been among the most vocal opponents of separatist movements in Europe, reflecting its struggle to contain secessionist pressures in its own region of Catalonia.

José-Manuel García-Margallo, foreign minister, told the Financial Times: “If Scotland becomes independent in accordance with the legal and institutional procedures, it will ask for admission [to the EU]. If that process has indeed been legal, that request can be considered. If not, then not,” he said

He warned Catalan leaders in particualr not to go down the route of a unilateral declaration of independence: “A state born through a unilateral declaration of independence would have no international recognition whatsoever. It would be absolutely isolated in the concert of nations. Such a state would not have access to the United Nations system or to the World Bank or the IMF,” he said.

He drew a parallel with unrecognised break-away regions such as South Ossetia, Abkhazia and Somaliland

Catalonia's President, Artur Mas, has written to EU leaders and world powers seeking

their support for a vote on independence from Spain.

The appeal comes amid strong resistance to his plan to hold a referendum in November.

EU Observer, 3 January 2014

Spain's governing centre-right Partido Popular and the opposition PSOE have both said it would breach the Spanish constitution.

Catalonia’s parliament Wednesday overwhelmingly passed a bill unilaterally claiming the region’s right to decide

whether it seeks an independent state within the European Union, setting a 2014 timeframe to carry out a referendum

Christian Science Monitor 23 January 2013

The vote “to start a process” that would eventually culminate with a referendum was approved with 85 votes in the 135-member chamber, and 41 votes against. The bill defines the region of Catalonia, Spain’s economic motor, as a “political and legal sovereign entity” with the right to secede, if a majority of its 7.5 million citizens decide to do so through democratic means.

Anledningen till att den katalanska nationalismen nu har flammat upp med sådan intensitet är en europeisk skuldkris som slår skoningslöst mot Spanien, eurozonens fjärde största ekonomi.

Dessa påfrestningar underblåser separatistiska strömningar i ett Spanien som egentligen inte är en nationalstat i vanlig bemärkelse, utan en ganska löst sammanfogad enhet med 17 autonoma regioner med stora språkliga och kulturella skillnader.

Per T Ohlsson, Sydsvenskan 14 Oktober 2012

Boken”Eurokrisen”

Förslaget från Tyskland att inrätta något slags superkommissionär kommer att möta kraftigt motstånd.

Det är ett gigantiskt steg mot en centralisering av finanspolitiken och ökat demokratiskt underskott,

säger Stefan de Vylder i SvD Näringsliv 18 oktober 2012

Han har i veckan släppt boken ”Eurokrisen” (Den europeiska valutaunionen EMU har utvecklats till ett dyrbart experiment, och historiens dom kommer att bli hård.) som beskriver bakgrunden till dagens svåra situation och vad han tror väntar framöver.

– Vi ser just nu en gigantisk och accelererande kapitalflykt från spanska banker. Krisen kommer att fortsätta fördjupas tills några länder lämnar EMU.

Det finns inga räddningsfonder stora nog att stötta det spanska banksystemet, menar han.

– Det skulle krävas en gemensam europeisk insättargaranti och där är motståndet stenhårt hos flera länder. Spanien kommer tvingas införa valutakontroller och det betyder att man inte kan vara kvar i EMU, säger de Vylder.

Spaniens kreditbetyg sänks till BBB-

strax över skräpstatus

SvD Näringsliv 11 oktober 2012

”De negativa utsikterna för det långsiktiga kreditbetyget återspeglar vår uppfattning om de betydande riskerna mot Spaniens ekonomiska tillväxt och budgetutfall, och bristen på klar riktning i euroområdets policy. Den fördjupade ekonomiska recessionen begränsar den spanska regeringens policyalternativ”, skrev S&P.

Kreditvärderingsinstitutet tog också in i beräkningen den höga arbetslösheten, vilken i sin tur skapar spänningar mellan statsmakten och regionerna.

S&P downgrades Spain

FT Alphaville 10 October 2012

What happens if a large, high-income economy, burdened with high levels of debt and an overvalued, fixed exchange rate, attempts to lower the debt and regain competitiveness?

This question is of current relevance, since this is the challenge confronting Italy and Spain.

Yet, as a chapter in the International Monetary Fund’s latest World Economic Outlook demonstrates,

a relevant historical experience exists: that of the UK between the two world wars.

Martin Wolf, Financial Times, 9 October 2012

I dag vet vi att den spanska krisen kommer att bli mycket allvarligare än den grekiska

ty ingen har ifrågasatt Greklands existens som nation och det är precis det som nu händer i Spanien

Mauricio Rojas, Kolumn SvD, 7 oktober 2012

Welcome back to the eurozone crisis

Germany will not after all allow Spain to dump the risk of its banks on to the ESM

Wolfgang Münchau, Financial Times 30 September 2012

Spain has pushed through €40bn of fresh austerity measures in the teeth of recession,

It comes on top of a €62bn squeeze already in the pipeline.

despite violent protests across the country and separatist crises in Catalonia and the Basque region

that threaten to break the country apart.

Ambrose Evans-Pritchard, 27 September 2012

Premier Mariano Rajoy has frozen public pay in 2013 for the third year in a row. The agriculture ministry and culture expenses will be cut by 30pc and the defence bureacracy by 15pc.

Den som vill se fredsvalutan in action kan med fördel titta på livestreamningen från demonstrationerna i Madrid.

Spanien måste spara mycket mer om landet ska ha en chans att kvarstå i euron.

På kort sikt lär detta höja arbetslösheten ytterligare.

Det är därmed högst osäkert om Spanien kan överleva detta som nation om landet kvarstår i eurosamarbetet.

Mattias Lundbäck, 25 September 2012

What began as an economic storm has blown into a full-scale political crisis.

Amid popular discontent and separatist protests, Spain has stumbled towards a crossroads:

without decisive action by the government, the post-Franco democratic settlement is at risk.

Financial Times, editorial 27 September 2012

Nu är det kris igen, och nu är det kris igen;

euron och Spanien

Rolf Englund blog 2012-09-27

The political turmoil in Spain triggered a sell-off of European shares,

as investor concerns mounted about the eurozone’s fourth-largest economy.

Financial Times, September 26, 2012 9:35 pm

Spain’s Ibex share index, which had rallied over the summer, ended down 3.9 per cent and the FTSE Eurofirst 300 index dropped 1.7 per cent. The euro gave up its gains over the past two weeks, falling to $1.28.

The financial pressures on Mr Rajoy’s government have been intensified by a constitutional crisis brewing over the Catalonia region, which called snap elections this week that could hasten a move toward independence.

Den europeiska skuldkrisen, Mats Persson, SNS Förlag

Det här är både ekonomiskt och politiskt vansinne och leder bara till recession, anser Mats Persson.

Vad som nu händer är att tyska och franska banker får betalt, medan grekerna får svälta.

Kaianders Sempler, Ny Teknik 29 augusti 2012, via Rolf Englund blog

I boken Den europeiska skuldkrisen (SNS förlag) menar nationalekonomiprofessor Mats Persson att

det vore bättre om de krisande bankerna tillfälligt togs över av de krisande staterna,

återkapitaliserades med ESM som finansiär och sedan bjöds ut på marknaden.

SvD-ledare, Benjamin Katzeff Silberstein, 12 september 2012

The debate over whether the U.S.’s largest banks are too big is heating up.

Since the 2008 financial crisis, the perception has taken hold among some analysts and economists that certain U.S. institutions are too big to fail, meaning they would have to be bailed out to protect the financial system in the event of another calamity.

The continued downward spiral in Europe raises a similar question: Are some banks too big to save, meaning their collapse could dramatically worsen the euro crisis

(as happened in Ireland in the fall of 2008 and is happening now in Spain and Greece)?

Simon Johnson, who served as chief economist at the IMF in 2007 and 2008, Bloomberg 3 September 2012

ECB pytsade i december och mars ut ut hela 1 000 miljarder euro i treåriga lån.

Spaniens banker har stått längst fram i lånekön. De hande i juli lånat hela 376 miljarder euro av ECB.

En del av dessa pengar har bankerna använt för att köpa spanska statsobligationer. Det var också precis avsikten,

och ett sätt för ECB att självt slippa stödköpa direkt.

Andreas Cervenka, SvD Näringsliv 3 september 2012

Totalt köpte spanska banker på sig statsväxlar för 87 miljarder euro mellan december och mars.

Fotnot RE: 87 miljarder euro är cirka 733 miljarder kronor

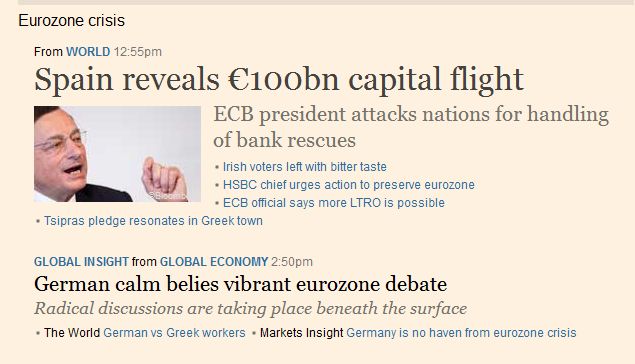

Början på sidanThe central bank of Spain just released the net capital outflow numbers and they are disastrous.

During the month of June alone $70.90 billion left the Spanish banks and in July it was worse at $92.88 billion which is 4.7% of total bank deposits in Spain. For the first seven months of the year the outflow adds up to $368.80 billion or 17.7% of the total bank deposits of Spain and the trajectory of the outflow is increasing dramatically.

Reality is reality and Spain is experiencing a full-fledged run on its banks whether anyone in Europe wants to admit it or not.

ZeroHedge, 2 September 2012

Investerare flyttade ut den rekordstora summan 219,8 miljarder euro,

motsvarande runt 1,8 biljoner kronor, från Spanien under det första halvåret 2012.

DN/TT 31 augusti 2012

Andalucia, Spain’s most populous region, need a €1bn advance from the country’s central government,

making it the fourth regional administration to request financial aid.

Financial Times, 3 September 2012

The request comes after Catalonia, Valencia, and Murcia have all requested aid from Spain’s central government, which is in the process of establishing the €18bn pot, partly using money from the country’s state lottery

Manifestationen på Diada, Kataloniens nationaldag, brukar samla en tapper men begränsad skara självständighetsivrare.

Dagens möte i Barcelona väntas locka flera hundra tusen deltagare, inklusive moderata nationalistpolitiker som normalt håller sig hemma.

DN, Signerat Gunnar Jonsson, 11 september 2012

Enligt en färsk opinionsmätning skulle 51 procent av katalanerna i dag rösta för självständighet från Spanien.

Före eurokrisen var de flesta fullt nöjda med sin autonomi. Nu växer ilskan och motsättningarna.

The centre-right PP, which won power last November, wants not only to shrink the state but also to recentralise it.

If mishandled, it could undermine the constitutional settlement that brought Spain out of the dictatorship of Francisco Franco into a vibrant democracy and stoke demands for Basque and Catalan independence that devolved government was supposed to prevent.

David Gardner, Financial Times, August 22, 2012

Autonomous communities of Spain, Wikipedia

Economists have uncovered a hole in Spain’s budget that threatens to allow the country’s regional governments to overspend this year, calling into question the credibility of Madrid’s deficit reduction plan agreed with Brussels.

CNBC/FT August 27, 2012

The discrepancy in this year’s spending plans for Spain’s 17 autonomous regions—which have become one of the main battle grounds for prime minister Mariano Rajoy’s austerity program—could allow the regions to exceed their agreed budget deficit for 2012 by almost 10 percent.

Spanska huspriser rasar

I juli föll huspriserna i Spanien med 11,2 procent, den kraftigaste nedgången sedan mars 2011.

Sedan 2008 har därmed de spanska huspriserna i snitt rasat med 31 procent samtidigt som landet beräknas ha 2 miljoner osålda bostäder.

Snittpriset per kvadratmeter i juli låg på 1 606 euro (cirka 13 200 kronor). Det innebär att priset för en normal bostad med två sovrum i Spanien ligger på omkring 105 000 euro (cirka 870 000 kronor).

I storstadsområden kostar samma typ av bostad i snitt 275 000 euro.

Källa: SvD Näringsliv 15 augusti 2012

Att låta Europeiska centralbanken stå för stödet till krisländerna trollar inte bort kostnaderna. De döljs bara för väljarna.

ECB kan alltid trycka hur mycket pengar som helst.

Lars Calmfors, kolumn DN 9 augusti 2012

Att låta ECB och de nationella centralbankerna ta kostnaderna för krisstöden uppfattas ibland som ett sätt att inte belasta skattebetalarna i Tyskland och andra välskötta euroländer. Men någon sådan gratismetod för att ge stöd finns inte.

Omedelbara budgetkostnader skulle uppkomma om euroländerna väljer att med statliga budgetmedel direkt återställa det egna kapital som gått förlorat.

Om det inte sker – vilket är mer sannolikt – fördelas i stället kostnaderna över ett antal år därför att de vinster som de nationella centralbankerna (ECB:s ägare) brukar leverera in till statskassorna uteblir.

Det finns ingen snabb lösning på krisen. Men den kan förkortas av kraftiga nedskrivningar av krisländernas statsskulder.

Sådana bör göras snabbt så att det finns tillräckligt med privata långivare kvar som då får vara med och bära kostnaderna. Annars riskerar skattebetalarna i Tyskland och andra länder att få betala alltför mycket.

Väljarnas reaktioner på det utgör det största hotet mot både euro- och hela EU-projektet.

Men på vilket sätt drabbas skattebetalarna av centralbankernas kapitalförluster?

Det måste vara väldigt kännbart eftersom det enligt Calmfors riskerar att leda till en politisk reaktion som avskaffar euron. Så vitt jag kan förstå innebär en kapitalförlust endast indirekta effekter på centralbankerna och mycket utspädda effekter på skattebetalarna.

Danne Nordling, 5 augusti 2012

Spain’s nightmare is a symptom of what is wrong with the entire euro zone.

Bail out Spain and immediately investors will rightly worry about Italy and whether the rescue funds are big enough.

Ultimately, as we have argued, a solution requires the currency’s members to draw on their combined strength by mutualising some debt and standing behind their big banks.

haggling over the details, holding referendums and amending constitutions could easily take three years.

The trouble is that the 17 members of the euro zone, let alone their 333m citizens, cannot agree on who must sacrifice what to allow this new Europe to emerge.

The Economist print 28 July 2012

Europe is “sleepwalking towards disaster”

The lack of any light at the end of the tunnel is leading to a populist backlash in both the debtor and creditor states.

The only question is whether the North or the South succumb to revulsion first.

“The sense of a neverending crisis, with one domino falling after another, must be reversed.

The last domino, Spain, is days away from a liquidity crisis,” said the economists.

They include two members of Germany’s Council of Economic Experts and leading euro specialists at the London of School of Economics, all euro supporters.

Ambrose, 24 July 2012

As the price of Spanish government debt plummets, that generates losses for Spain's banks,

which hold around 250bn euros of the country's government bonds, equivalent to a third of central government debt.

Spanish banks are becoming more and more dependent, for their very survival, on exceptional funding from the ECB

Robert Peston, BBC Business editor, 23 July 2012

Spain on the verge of a nervous bailout

Since Friday, the situation has deteriorated dramatically.

Spain’s 10-year yields are approaching 10.4%

The market is now expected a fully fledge EFSF/ESM programme for Spain

Eurointelligence Daily Briefing 23.07.2012

Spanish House prices

This sounds bad, but is actually good news.

If you know that house prices have to adjust 50-60% in total, but have only come down 20% so far,

then the news of an acceleration in house price declines means that the adjustment is finally under way in earnest.

Eurointelligence 19 July 2012

It is time for Spain and the victim states to seize the initiative.

What they can to do is use their majority votes on the ECB's Governing Council to force a change in monetary policy.

Germany has two votes out of 23, with a hardcore of seven or eight at most.

If Germany storms out of monetary union in protest, that would be an excellent solution.

Ambrose Evans-Pritchard, 22 July 2012

Spanien på väg mot akuten

Bankernas nuvarand aktieägare, preferensaktieägare och ägare av så kallade efterställda lån, ska ta smällarna för det att EFSF ska skjuta till pengar.

Spanska småsparare har lockats att skjuta till upp emot 67,5 miljarder euro i preferensaktier och liknande riskbärande värdepapper i krisbankerna, vilka riskerar att bli värdelösa.

SvD Näringsliv 22 juli 2012

/Kommentar RE; Det är sådant som kan framkalla en revolutionär situaton./

Allt fler sparare har börjat tömma sina konton hos de spanska bankerna. Utflödet i juni, omräknat i årstakt, motsvarade hela 50 procent av Spaniens BNP.

Allt fler har också börjat ifrågasätta om 100 miljarder euro verkligen är tillräckligt för att stabilisera de spanska bankerna.

These subordinated debt holders largely are the public. They are not some imagined capitalist fat cat, strolling back to the office in Mayfair after a good lunch, but the banks’ own retail customers, mis-sold the debt as a savings product at a time when the banks were desperate for new capital.

Many of these investors would seem to have a cast iron case for compensation.

If they are bailed-in, a fair old chunk of Spanish savings will either disappear up the Swanee, or the Spanish government will be faced with the ludicrous prospect of in turn having to bail them out again with money it hasn’t got.

Jeremy Warner, Telegraph 11 July 2012

The draft agreement for Spain’s EU bailout paves the way to impose burden sharing on banks’ hybrid capital and subordinated debt holders.

They have to take remaining losses after ordinary equity holders have been wiped out before a bank can receive state aid.

Spanish lenders have €67bn of subordinated and hybrid debt, on central bank data.

Lex, Financial Times 11 July 2012

Tänk i stället på de stackars aktieägarna i de spanska bankerna som får se sina tillgångar sjunka i värde i den mån de inte redan har gjort det. Men, å andra sidan, that is what shareholders are for. Rof Englund, 10 juni 2012

Spanish police have fired rubber bullets to clear demonstrators in Madrid

as a day of nationwide protests against spending cuts ended in unrest.

Protesters set alight rubbish bins as riot police charged them in the city centre, near the parliament building

BBC text and video 20 July 2012

Leaders will take the embattled eurozone to the edge of the political and economic abyss before deciding to resolve the crisis.

How to create a fiscal union from countries as different as Greece and Germany?

Spain and Italy will reassure markets with their tough austerity plans but on the streets they will face dangerous civil unrest.

It will be the revolts, a sort of Mediterranean Spring, rather than the continued financial traumas, that will eventually goad leaders into action

Louise Armitstead, Daily Telegraph, 28 Dec 2011

Eurons farliga dödsdans fortsätter

Hur denna politik ska lösa krisen eller långsiktigt stärka Spaniens statsfinanser är en gåta

DN, huvudledare, 17 juli 2012

Spain is where the doom of the euro will be determined

(Also in Spanish)

Daniel Hannan, Telegraph, July 8th, 2012 and Parliament speech

Ireland, Greece, Portugal and Cyprus, combined, account for less than 5 per cent of the EU's economy.

Spain was always likely to be where the issue would be settled for good or ill.

Samlingspartiet står fast vid kravet på säkerheter

Jan Vapaavuori, ordförande för Samlingspartiets riksdagsgrupp, fick på fredagen inget offentligt stöd av toppolitiker inom sitt eget parti

för sitt utspel om att Finland inte borde kräva säkerheter av Spanien.

Hufvudstadsbladet 13 Juli 2012

Vapaavuoris utspel kom som en överraskning för finansminister Jutta Urpilainen (SDP). Urpilainen sade att hon inte kan föra diskussioner om säkerheterna med ett halvt mandat, det vill säga utan Samlingspartiets stöd. Enligt henne kan kommentarerna få negativa följder, om omvärlden tror att Finland inte är enat angående säkerheterna.

Many places in Spain are suffering as a result of the euro crisis,

but few have been hit as hard as La Línea, a Spanish town which neighbors the prosperous British overseas territory of Gibraltar.

Walter Mayr in La Línea, Spiegel Online, 6/27/2012

The picture of the crisis also includes the deep-seated rivalry between the "two Spains," the political camps of the left and the right. Their largely irreconcilable attitudes to each another makes it difficult to achieve the kinds of compromises that are needed to combat a crisis. If the left is in power in the city (La Línea) and the region (Andalusia), but not in the province (Cadiz) and not in Madrid, politics comes to resemble a funnel that is clogged twice, with nothing coming out of the bottom at all anymore.

Goldman Sachs’ analysts said the large size of Spain’s external debt, coupled with “structural rigidities impeding the adjustment process”

mean Spain will be unable to solve its debt crisis without support measures in addition to those announced this week.

Spain’s external debt, accumulated by international over-borrowing, is a “more fundamental problem” then the public debt on which market attention has focused

CNBC 13 July 2012

The analysts highlighted that Spain’s net external debt is at similar levels to Greece, Portugal and Ireland, all of which have required EU assistance during the crisis.

Spain currently has net external liabilities (both debt and equity) of around 90 percent of gross domestic product (GDP), gross external liabilities of 200 percent of GDP and gross external debts of 160 percent of GDP.

Support for Spain will need to be more flexible than that provided for other peripheral countries, due to its larger size, said the report.

Bundestag votes for Spanish bank rescue program

Wolfgang Schäuble had to insist heavily that it was the Spanish government that remained liable for the rescue program of potentially up to €100bn.

Eurointelligence 20 July 2012

“Spain has made the request, Spain gets the money for the bank recapitalization and Spain as a state is liable for the EFSF’s credits”, the finance minister said.

Michael Fuchs, deputy parliamentary leader of Merkel’s Christian Democratic Union party, said in an interview with Bloomberg

“Schaeuble reassured us today that there will be no possibility to sidestep the liability issue in the process of transferring Spanish bank rescue aid. We want to make sure there are no tricks,” that there is no “circumventing state liability,” he said.

“The German parliament will be involved all the way.”

German deputy finance minister Steffen Kampeter on Thursday reiterated that the Spanish state is liable.

“There is no direct infusion into the Spanish banking system. The European partners have a memorandum of understanding with the state of Spain and money is delivered to the state of Spain and guaranteed by the state,”

CNBC 19 July 2012

Grekland, Portugal och Spanien hör inte hemma i eurosamarbetet.

Men mycket prestige har investerats i projektet och man kommer säkert att försöka hålla dem under armarna så länge det går.

Magnus Henrekson, professor nationalekonomi SvD Näringsliv 27 juli 2011

Man kan anta att spansk kravallpolis gjorde sig beredd på en hård arbetsdag samma stund som

premiärminister Rajoy under onsdagseftermiddagen meddelade sig vara nödd och tvungen till ytterligare nedskärningar,

i utbyte mot nödvändig EU-hjälp till landets banker.

Skatterna ska höjas trots tidigare utlovade sänkningar.

Obligationsmarknaden svarade försiktigt positivt. Men många experter är kritiska och menar att skattehöjningarna missar målet i en ekonomi som redan krymper.

SvD-ledare Benjamin Katzeff Silberstein, 13 juli 2012

Fierce clashes in Madrid:

Spanish police fire rubber bullets, Youtube

What Spain is embarked on is a strategy of despair, a form of madness

in the hope it will support the higher purpose – a currency union which is manifestly harming Spanish interests and is already effectively busted beyond repair

Jeremy Warner, Telegraph 11 July 2012

And the pain doesn’t end there. One of the conditions attached to European money for Spanish bank bailouts is that subordinated and hybrid debt holders are wiped out first. This might appear the equitable way of proceeding, for it seems manifestly unfair that taxpayers be expected to pick up the costs of banking insolvencies, leaving creditors largely untouched. To bail creditors in seems partially to answer public anger over the way bankers have been allowed to privatise the profits but socialise the losses.

Only in Spain, these subordinated debt holders largely are the public. They are not some imagined capitalist fat cat, strolling back to the office in Mayfair after a good lunch, but the banks’ own retail customers, mis-sold the debt as a savings product at a time when the banks were desperate for new capital.

Many of these investors would seem to have a cast iron case for compensation. If they are bailed-in, a fair old chunk of Spanish savings will either disappear up the Swanee, or the Spanish government will be faced with the ludicrous prospect of in turn having to bail them out again with money it hasn’t got.

Spain’s conservative prime minister yesterday took Austerianism to its logical conclusion

with a programme of €65bn in savings and higher taxes until 2014.

As El Pais points out in its front page lead story, this is the most Draconian economic package during Democracy,

in fact since General Franco’s stabilisation plan of 1959.

Eurointelligence 12 July 2012

Paul Krugman calls the austerity programme pointless

In his NYT blog, Paul Krugman says Spain faces a three-tier problem:

a highly indebted banking sector,

an increasingly indebted public sector, and a loss of competitiveness.

To end the depression, the country needs an export-led recovery, which absorbs some of the employment lost in the housing crash.

But it now confronts a multi-annual depression. The programme will cut Spain’s debt by a cumulated 4% of GDP – which is not much. He has constructed a flat-tailed Phillips-curve to show that even the competitiveness effect is likely to be small.

He says it is not clear why anybody would want to impose such harshness for so little benefit?

Spanish Prime Minister Mariano Rajoy has said Spain cannot afford to finance itself for long at current rates.

Spanish 10-year government bonds have been trading at yields above 6.8%, coming close to the 7% considered unaffordable.

Mr Rajoy told the Spanish parliament: "There are institutions and also financial entities that cannot access the markets.

"It is happening in Spain, it is happening in Italy and it is happening in other countries," he said.

BBC 27 June 2012

– Flera av de länder vi ser har varit 4-5 år i kris, de har flera år av reformer framför sig.

Men uthålligheten brister, befolkningarna orkar inte, deras företrädare orkar inte,

så då vill man ha en lösning där andra ska ta över deras skulder eller täcka deras underskott.

man har problem med korruption och är inte konkurrenskraftig. Det hjälper man sig inte runt genom att fördela skulderna.

Fredrik Reinfelt, Ekot 27 juni 2012

Latvia, Internal devalutation

Oh, wow — another bank bailout, this time in Spain. Who could have predicted that?

The answer, of course, is everybody.

Paul Krugman, New York Times June 10, 2012

For years Spain and other troubled European nations have been told that they can only recover through a combination of fiscal austerity and “internal devaluation,” which basically means cutting wages.

It’s now completely clear that this strategy can’t work unless there is strong growth and, yes, a moderate amount of inflation in the European “core,” mainly Germany.

Consider, for example, what Jörg Asmussen, the German representative on the European Central Bank’s executive board, just said in Latvia, which has become the poster child for supposedly successful austerity.

Latvian success consists of one year of pretty good growth following a Depression-level economic decline over the previous three years.

True, 5.5 percent growth is a lot better than nothing. But it’s worth noting that America’s economy grew almost twice that fast — 10.9 percent! — in 1934, as it rebounded from the worst of the Great Depression.

What explains this trans-Atlantic paralysis in the face of an ongoing human and economic disaster?

Whatever the deep roots of this paralysis, it’s becoming increasingly clear that it will take utter catastrophe to get any real policy action that goes beyond bank bailouts.

But don’t despair: at the rate things are going, especially in Europe, utter catastrophe may be just around the corner.

Europe needs a fiscal and banking union if it is to survive

“the worst crisis” since the European Union’s creation,

Spanish Prime Minister Mariano Rajoy said in an open letter to leaders on Wednesday.

CNBC 13 Jun 2012

“We must create a European fiscal authority that can direct fiscal policies in the euro zone, that can harmonize member states’ fiscal policies, and that can control central finances, as well as manage European debt,” Rajoy wrote.

Rajoy added that the European Council’s next meeting on June 28-29 provides an “urgent” opportunity to outline these plans, and that leaders must sent a “clear and determined” message about the irrevocability of the euro and the common market.

Spain's rating was cut three notches, from A3 to Baa3

- one notch above junk

Cyprus' rating fell two notches, from Ba1 to Ba3, pushing it deeper into junk status

BBC, June 13, 2012

Att EU går framåt betyder att politisk makt flyttas från medlemsländerna till Bryssel och detta kan inte genomföras på demokratisk väg. Folken (obs pluralen) är nämligen helt emot detta.

Men om man ställer till rejäla kriser, så kan varje nationell maktelit skrämma sitt folk till underkastelse.

De tvingas acceptera. EU-kommissionens tidigare ordförande, virrpannan Romano Prodi, var så omedveten att han skrev en kolumn i självaste Financial Times (20 maj 2010),

där han lugnt konstaterade att han och alla de andra som drev fram europrojektet naturligtvis visste att det skulle leda till en svår kris förr eller senare.

Jag citerar: ”When the euro was born everyone knew that sooner or later a crisis would occur. It was inevitable that, for such a bold and unprecedented project, in some countries (even the most virtuous ones), mistakes would be made and unforeseeable events occur.”

Och då kommer EU att gå framåt, dvs. tillskansa sig mera makt på medlemsstaternas bekostnad.

Detta var så magstarkt att t o m Annika Ström Melin på DN:s ledarsida tyckte det var omdömeslöst att säga det så rent ut.

Nils Lundgren

Europe’s latest initiative to subdue its financial crisis fell apart in less than a day.

The instant response to the plan for supporting Spanish banks had been euphoric.

Even as bond markets pushed the cost of Spanish public borrowing even higher, in effect declaring the country insolvent,

politicians were still applauding themselves.

Clive Crook, Bloomberg June 13, 2012

Mistakes in the deal’s design made the plan self-defeating. These errors are worth noting, because they lie at the core of the EU’s larger strategy.

The overarching fact in this crisis is that German taxpayers feel cheated. They didn’t want the euro in the first place, suspecting it would become a transfer system that would put them on the hook for other countries’ profligacy.

That, of course, is exactly what happened.

To blunt this resistance, Germany’s leaders promised at the outset there would be no bailouts, and they insisted on lots of rules and mechanisms to back this up.

The crisis has blown that structure to pieces, but Merkel is still trying to keep the promise -- even if the EU, and the German economy along with it, collapses as a result.

National governments need to surrender sovereignty to the European center, Merkel says, so that democratic accountability is restored and proper standards of governance can be maintained.

Meaning what? Perhaps she imagines that this new political union would put Germany in command.

Assuming non-Germans would be allowed to vote, Germany would be less in command than now. It’s the profligate whose political clout would increase.

Deeper union would overwhelm the German anomaly of prudent public finance.

The Spanish 10-year bond yield hit 6.81 %, as optimism about the weekend's Spanish bank bailout continued to evaporate.

Italy's 10-year bond yield rose to 6.28 %, a rate not seen since January, as concerns about its finances rose.

BBC 13 June 2012

The interest rates are seen as unsustainable in the long run for two countries weighed down by huge debts.

The fact that all of it is going to be used to prop up the banking sector is no more than cosmetic for an underlying truth - that it is Spanish taxpayers who are left with the liability.

Spain is being forced to borrow from Europe to bailout its banks because markets won't provide the money directly to Spain.

Jeremy Warner, Telegraph 11 Jun 2012

In so doing, the Spanish rescue may well suffer from the same fate as the three previous sovereign rescues.

Because the bailout money takes on the position of preferred creditor, it subordinates other bondholders, thereby making it even harder to raise money from the capital markets.

CNBC, 11 juni 2012

El Pais led this morning’s edition with the story that

Contrary to the way the government is portraying the deal, there is de facto fiscal conditionality after all.

If Spain does not stick to its agreed deficit reduction programme

– which seeks to reduce the deficit from 8.9% last year to 3% in 2014 (which is virtually impossible given the likely trajectory of the depression),

the European money flow would stop.

Eurointelligence 11 June 2012

The funds will be channeled through the state-run FROB bank-rescue fund and

Spain will “retain the full responsibility of the financial assistance and will sign” the agreement with the other partners

Bloomberg 11 June 2012

“Spain needs a systematic restructuring of its banking system, which could entail haircuts to subordinated bank debt.

Official lenders on the other hand are likely to demand seniority.” (RE: Jfr Företrädesrät vid konkurs.)

A spokesman said the /German Finance/ minister believed it would be “more efficient” for the loans to be made by the European Stability Mechanism, the eurozone’s permanent rescue facility.

ESM loans are senior to other creditors, ensuring that Spain’s debts to other eurozone members would take precedence over private lenders in the event of a default.

Financial Times 11 June 2012

Worries about the effects of preferred-creditor status led the eurozone to leave out such a stipulation in the EFSF when it was established in 2010. But Germany insisted on the rule, inspired by the IMF, for its permanent successor.

However, a spokesman for Ms Merkel conceded that it is not for Germany to decide whether the ESM or the EFSF is used. The timing and formulation of Spain’s eventual request for assistance would determine which of the two rescue funds was tapped, he said.

“There will be a troika [the team of outside inspectors from the European Union, European Central Bank and International Monetary Fund] and it will make sure the programme is being implemented,” Wolfgang Schäuble said on Monday.

Experts said the European Stability Mechanism (ESM), which replaces the EFSF in July, could be used instead.

However, since ESM debt would rank above private bondholders, loans from this fund could make Spain even less attractive to private investors on the capital markets.

Louise Armitstead, Chief Business Correspondent, Telegraph 10 Jun 2012

The world is uncomfortably close to a 1931 moment

Italy must guarantee 22pc of the bail-out funds, even though it cannot raise money itself at a sustainable rate.

You could hardly design a surer way to pull Italy into the fire.

Ambrose Evans-Pritchard, 10 Jun 2012

It reshuffles debt from one end of the Spanish economy to another.

Spain’s total debt was 363 per cent of gross domestic product in mid-2011, and with the prospect of a severe economic depression ahead,

its crisis cannot be solved through a combination of austerity and liquidity support.

The eurozone must recognise that some form of debt relief, or default, will be inevitable.

Wolfgang Münchau, Financial Times, June 10, 2012

Men på vilket sätt drabbas skattebetalarna av centralbankernas kapitalförluster?

Det måste vara väldigt kännbart eftersom det enligt Calmfors riskerar att leda till en politisk reaktion som avskaffar euron.

Så vitt jag kan förstå innebär en kapitalförlust endast indirekta effekter på centralbankerna och mycket utspädda effekter på skattebetalarna.

Danne Nordling, 5 augusti 2012

Till detta kommer att Europas politiker måste klargöra vilket alternativet är. Om ECB inte köper obligationer för att hålla räntorna nere kommer en betalningsinställelse ännu säkrare att inträffa. Då kommer pensionsfonder och andra placerare som till stor del representerar småsparare att förlora en stor del av kapitalet. Det kanske Calmfors anser är bättre? Men en skuldnedskrivning i krisländerna kommer också att drabba eurozonens banksystem och i viss mån även banker utanför.

Kommentar av Rolf Englund

Folk är vana vid att man måste arbeta för att få pengar.

Dom, och tydligen många som anses lärda, har inte tagit till sig att man, om man är en riksbank, kan skapa pengar genom att skriva en summa på datorn och sedan trycka enter.

Konsten är, som vi monetarister brukar säga, att skapa lagom mycket pengar.

Inte för mycket, då blir det inflation,

Inte för lite, då blir det massarbetslöshet.

För mer om monetarismen, se