Italy to face disciplinary action stability pact

Martin Wolf:

Italy withdrawal from the eurozone is perfectly conceivable.

Prodi: stability pact "stupid"

News Home

|

Italien - Italy

The people will not tolerate 25% unemployment forever - with no hope in sight.

CalculatedRisk, 25 January 2015

zc

The End of the Euro Is Closer Than You Think

The most plausible solution to the latest impasse appears to be “Italexit”— Italy’s secession from the euro zone.

Avi Tiomkin Barron's Nov. 16, 2018

...

Italy’s Threat to the Euro

Desmond Lachman, America Enterprise Institute, November 18, 2018

Italy, the Eurozone’s third largest economy, is coming under increased market pressure fueled by doubts about the country’s economic outlook and the sustainability of its public finances.

This has to once again raise questions as to whether the Euro can survive in its present form.

Europe Is Too Exposed to Italy to Let It Go

French and German banks have more than $400 billion at stake and would lose big

if the country left the currency union.

When Greece’s fiscal mismanagement triggered a crisis in 2010, French and German banks were holding about $115 billion in various Greek investments

Bloomberg 29 October 2018

At the end of the day, those with the power to set and enforce EU fiscal and monetary rules know full well that the eurozone could not survive a Greek-style crisis in Italy.

It is their responsibility in the months ahead to make sure it doesn’t come to that.

Jim O'Neill Project Syndicate 17 October 2018

Italy

The short history of the eurozone has taught us that resistance is futile.

Wolfgang Münchau FT 28 October 2018

The main instrument of coercion in the eurozone is not its fiscal rules, but the power of the European Central Bank to withdraw funding from national banks.

This is not a discretionary power, but one that is automatically triggered once a country‘s sovereign debt loses investment grade status.

The rise in Italian spreads is evidence that the eurozone crisis never ended. It just fell dormant for a while.

ECBThe Italian crisis was the Left’s final warning

The 2008 financial crisis was our generation’s 1929

It’s time to explain how the bloc, and the euro, could be run differently, democratically and sustainably

Yanis Varoufakis New Statesman op-ed, 6 June 2018

The euro has been a failure. It means that the single currency has failed to deliver economic stability or a greater sense of a European identity.

It has become a source of discord.

The story of Italy is revealing and, given its size, of crucial importance.

Martin Wolf FT 19 June 2018

Very Important Article

Italy’s debts to European Central Bank near €500bn

Germany’s Target 2 surplus is on track to reach €1tn.

FT 9 July 2018

“As long as the eurozone stays together, all of this is an accounting issue”

Italian banks have pulled assets out of the central bank

and deposited them across the Eurosystem's banking institutions.

Target2 liabilities now stand at €465bn

Jamie Powell ftalphaville 12 June 2018

The euro may be approaching another crisis.

Italy, the eurozone’s third largest economy, has chosen what can at best be described as a Euroskeptic government.

This should surprise no one.

Joseph E. Stiglitz, Project Syndicate 13 June 2018

Italy turmoil shows banking ‘doom loop’ still a powerful force

FT 5 June 2018

The reason the Italian political crisis caused so much angst was the ill health of Europe’s banks

which remain bloated and over-levered.

John Authers FT 2 June 2018

I wanted to keep Greece in the eurozone sustainably and was clashing with Germany’s leaders in favor of the debt restructuring that would make this possible.

By crushing our Europeanist government in the summer of 2015, Germany sowed the seeds of today’s bitter harvest:

a majority in Italy’s parliament that dreams of exiting the euro.

Yanis Varoufakis Project Syndicate 29 May 2018

It was the unconditional pro-Europeanism of Italy’s past leaders that gave rise to the current nationalist backlash.

Wolfgang Münchau FT 3 June 2018

It is not Italian politics that kills the euro, but a lack of reforms in the eurozone and Germany’s massive current account surplus.

If you are really pro-euro, my advice is to stop treating the euro as an article of faith but fight for its sustainability.

The Italian Trigger

Germans and French are better off than the Italians compared to 17 years earlier.

John Mauldin 1 June 2018

Since the eurozone crisis began receding in 2012, too little has been done to fix the underlying problems of the single currency

— a fragmented banking system, inadequate crisis rescue capacity and a lack of fiscal flexibility to offset asymmetric shocks.

FT Editorial 1 June 2018

"helicopter money"

Italy’s new finance minister Professor Giovanni Tria is an advocate of full-blown fiscal reflation and

printed money to rescue Europe’s high-debt states, putting him on an inevitable collision course with Brussels and Germany’s policy elites.

Ambrose Evans-Pritchard Telegraph 1 June 2018

Italy no longer has a lender of last resort standing behind its sovereign debt,

and therefore has no backstop defence for its commercial banking system.

Ambrose Evans-Pritchard 30 May 2018

The European Central Bank is progressively removing its shield as quantitative easing is wound down and purchases of Italian bonds fall to zero. There will be no protection by the end of the year. The Draghi pledge to do “whatever it takes” no longer holds.

No future rescue by the ECB is possible unless the Italian government of the day – endorsed by parliament – formally invokes the bail-out mechanisms (OMT-ESM) and accepts austerity imposed by Brussels.

Italy - the eurozone’s third-largest economy - is weak and

shackled to a monetary union whose impact is substantially malign.

The rise of the populist politics represented by the anti-establishment Five Star Movement and the far-right League

is an all-too-comprehensible consequence of gross economic mismanagement both within Italy and in a very imperfect monetary union.

John Plender, FT 30 May 2018

Within the monetary union, Italy cannot address this competitiveness issue through devaluation.

The only remedy is internal devaluation via wage deflation.

Yet despite unemployment of 11 per cent and youth unemployment at a devastating 35 per cent,

unit labour costs have not come anywhere near to delivering that internal devaluation.

In reality, the level of unemployment that would be required to restore competitiveness might well be unthinkable.

It looks like the debt crisis days of 2012 all over again

Bloomberg 29 May 2018

Mario Draghi, head of the Bank of Italy before his ECB appointment

QE, since the programme began in March 2015, the ECB has bought €341bn in Italian bonds

FT 31 May 2018

OMT, Italy and ELA

Bloomberg 29 May 2018

Italy’s pro-euro elites have overreached disastrously.

President Sergio Mattarella has asserted the extraordinary precedent that no political movement or constellation of parties

can ever take power if they challenge the orthodoxy of monetary union.

Ambrose Evans-Pritchard 28 May 2018

In one sense, this veto should have been expected. The Berlusconi government was toppled in 2011 by Brussels and the European Central Bank.

Whistleblowers have since revealed that they manipulated bond spreads to exert maximum pressure. The EU even tried to recruit Washington.

The US refused to help. “We can’t have blood on our hands,” said the US Treasury Secretary, Tim Geithner.

What is new is that euro sanctity should be formalized as an Italian constitutional imperative.

Italy - snap parliamentary elections, perhaps in October

On one side would be popular sovereignty and national self-determination

On the other side would be Brussels, Berlin, Frankfurt and their supposed lackeys in an Italian establishment

that stands accused of presiding over a quarter-century of political incompetence and economic decline.

Tony Barber FT 28 May 2018

Tony Barber is Europe Editor of the Financial Times.

He is a former foreign correspondent in Austria, Belgium, Germany, Italy, Poland, the former Soviet Union, the US and the former Yugoslavia.

It would be fitting if the European Union were to come to a sticky end because of Italy.

After all, the agreement that established the entity that we now call the European Union was signed in Rome.

Roger Bootle Telegraph 27 May 2018

For several decades after that 1957 treaty, Italy was one of the strongest supporters of the European project.

Having endured first fascism and then, after the war, unstable and ineffectual government, it suffered none of the angst about the loss of sovereignty that plagued British debates about joining the European Community.

Otmar Issing vänder sig mot hur ECB-chefen Mario Draghi har drivit igenom obligationsköp

som ska stötta euroländer med stora interna problem som Italien och Grekland

Johan Schück DN 26 maj 2018

European Commission warns Italy it must act to cut national debt

FT 23 May 2018

EU’s stability and growth pact requires governments to work to bring their debt levels below 60 per cent of GDP.

Pierre Moscovici, the EU’s economy commissioner, said that Italy’s debt is “set to decline slightly to 130.7 per cent in 2018 and 129.7 per cent in 2019” based on a “no policy change” scenario.

Italy’s new rulers could shake the euro

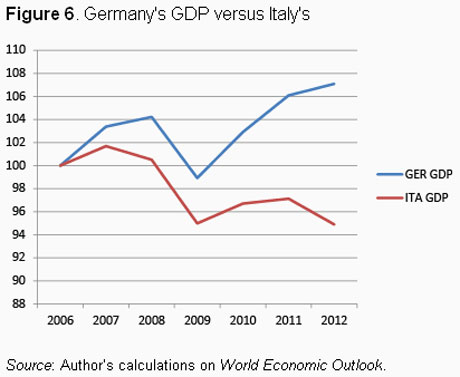

Between 1997, when the eurozone was launched, and 2017, Italy’s real gross domestic product per head rose 3 per cent

— a worse performance than that of Greece.

Martin Wolf chief economics commentator Financial Times 22 May 2018

March 2018, the Italian central bank owed partners — the Bundesbank, above all — a further €443bn in the “Target 2” system.

Today, debtor and creditor positions inside the European System of Central Banks surpass their scale during the crisis of 2012.

In 1991, I argued of monetary union: “The effort to bind states together may lead, instead, to a huge increase in frictions among them. If so, the event would meet the classical definition of tragedy: hubris (arrogance), ate (folly); nemesis (destruction).”

Italy

The bond markets have woken up to the enormity of what is happening a country

that cannot be easily crushed into submission “à la Grecque”,

and that is big enough to destroy monetary union.

Ambrose Evans-Pritchard 21 May 2018

The European Central Bank is still mopping up much of Italy’s debt issuance through quantitative easing.

The problem arises at the end of the year when the ECB turns off the QE spigot.

At that moment, Italy will no longer have a lender of last resort standing behind it.

A rescue will be available only if the country activates a formal bail-out (ESM-OMT) under draconian conditions,

requiring a vote in the German Bundestag and Dutch Tweede Kamer.

There is zero possibility that the Lega and ‘Grillini’ would accept the terms.

The Bundesbank’s Target2 credits to the ECB system - mostly to Italy and Spain - are €927bn and rising.

Italy's insurgents enrage Germany and risk ECB payment freeze

Ambrose Evans-Pritchard 17 May 2018

The ECB has soaked up €300bn of Italian debt

buying time for the country to claw its way out of a debt-deflation trap.

Italy has pulled off an “internal devaluation” within the eurozone, albeit at the cost of a deeper depression than the 1930s.

Ambrose Evans-Pritchard Telegraph 13 May 2018

Matteo Salvini, the Lega strongman and soon to be Italy’s co-leader

“The euro is and remains a failure. It is clear in our minds that the system of monetary union is destined to end, and therefore we wish to prepare for that moment,” he said.

His goal is to set off a chain of events that leads to German withdrawal as the “cleanest” way to end what he calls the “infernal instrument of the euro”.

Populists of Left and Right are poised to take power in Italy,

forming the first "anti-system" government in a major West European state since the Second World War.

Ambrose Evans-Pritchard Telegraph 10 May 2018

Leaders of the radical Five Star Movement and the anti-euro Lega party have been meeting to put the finishing touches on a coalition of outsiders, the "nightmare scenario" feared by foreign investors and EU officials in equal measure.

The ECB is to wind down its debt purchase programme by the end of the year, depriving the Italian treasury of a backstop buyer for its debt.

The country has to refinance debt equal to 17pc of GDP this year, one of the highest ratios in the world.

A study by HSBC concluded that the ECB has mopped up half the gross supply of Italian debt during the QE phase

We know for certain that Germany will not agree to a central eurozone budget to weather macroeconomic shocks.

There will be no single safe asset. There will be no common deposit insurance.

The big project of a European banking union will remain forever uncompleted.

Wolfgang Münchau FT 22 April 2018

Understanding the differences between German and Italian investment spending

Marcello Minenna, head of Quantitative Analysis and Financial Innovation at the Italian securities regulator.

FT Alphaville 27 March 2018

The disappointing performance of investment spending in Italy since 2009 is one of the many faces of that collapse of domestic demand that has also affected imports and consumption.

If the global economy turns down, it will take Italy with it.

What we see in Italy now is the predictable response to two decades of economic policy

that failed to produce jobs for young people.

Wolfgang Münchau FT 25 March 2018

Europe's crisis deepens as intellectual opinion turns, and Italy is where it all ends

Ambrose Evans-Pritchard Telegraph 14 March 2018

Once-silent intellectuals are starting to challenge the core assumption of EU ideology, indicting the project for moral vandalism and a reckless attack on the democratic nation state.

Theorists and professors are proclaiming the virtues of the nation – the precious liberal nation, inspired by the universal and redemptive values of the French and American revolutions – in a way we have hardly heard in recent times.

They defend it as the only real vehicle of democracy known to man.

No empire in history has ever been democratic. And the problem with soft empires is that they remain soft only until they meet resistance.

At that point they must persist with a despotic logic – and we saw flashes of that in the eurozone crisis

Rome, Habsburg and the European Union

Italians were once among the most enthusiastic supporters of the European project. This is true no longer.

This does not mean Italy will leave; the costs would be too great.

Martin Wolf FT 13 March 2018

The election results are quite as shocking as the Brexit referendum and the election of Donald Trump in the US: 55 per cent of the voters chose Eurosceptic and anti-establishment parties.

The biggest frustration may be that the people Italians vote for have next to no room for manoeuvre. The question has rather been whom to elect (or sometimes not even elect) to carry out the policies decided in Brussels and Berlin.

Why not vote for a clown or a party created by a clown? It might not make much difference to what happens in Italy, but it might at least be more amusing.

My conclusion is that Italy will remain the principal source of risk for the eurozone for the foreseeable future.

Wolfgang Münchau FT 11 March 2018

The euro is run in the interest of whichever country faces the biggest problems and

poses the biggest threat to the survival of monetary union at any particular time.

Right now that is Italy,”

Bernard Connolly, a hedge fund advisor and former currency chief for the European Commission, Ambrose Telegraph 22 February 2018

By spending taxpayer money on preventing investors in senior bonds from taking any losses,

Rome has repeated the mistakes made by Ireland and others in the crisis.

Martin Sandbu 28 June 2017

This episode shows that Europe still has not shaken off its bad habit of making taxpayers pay for the mistakes of investors and bank managers.

And while the Italian government is the most to blame, a whole constellation of decision making entities had to conspire to pull this off.

Italy’s €17bn bank rescue deal

Critics say use of state funds to deal with failing Veneto banks undermines EU rules

FT 26 June 2017

The Bank Recovery and Resolution Directive (BRRD), aims to protect taxpayers from having to bail out banks by making creditors, including senior bondholders, liable for losses.

In the case of the Italian banks, the Single Resolution Board — the eurozone agency responsible for dealing with bank crises — decided resolution was “not warranted in the public interest” because their failure was not expected to have “significant adverse impact on financial stability”.

This opened the door for the banks to be dealt with under national insolvency procedures instead.

Italy will commit as much as 17 billion euros ($19 billion) to clean up two failed banks

Banca Popolare di Vicenza SpA and Veneto Banca SpA

The lenders will be split into good and bad banks.

Bloomberg 25 June 2017

Friday when the European Central Bank said the two banks are failing or were likely to fail and turned the matter over to the Single Resolution Board in Brussels for disposal.

The SRB, in turn, passed the issue back to Italian authorities to allow the banks to be wound down under local law.

Intesa agreed to purchase the assets of the two banks for 1 euro

The senior bonds in Veneto Banca and Banca Popolare di Vicenza had been trading at steep discounts to face value, reflecting investors’ fears that they could be “bailed-in” — a process whereby losses are imposed on private creditors to lessen the cost to the taxpayer.

Instead, the two banks’ senior bonds will become liabilities of Intesa Sanpaolo, which was given €4.8bn by the Italian government to take over the healthy assets of the two failing banks.

For all the finance ministry’s ebullience over the MPS agreement,

it will find it much harder to win approval from Brussels for a state bailout of Banca Popolare di Vicenza and Veneto Banca.

FT 1 June 2017

ECB faces impossible choice between German overheating or Italian debt storm

When ECB runs out of plausible justifications for why it is still covering Italy's entire budget deficit

and rolling over its existing €2.2 trillion of public debt.

Ambrose, 25 May 2017

Beleaguered pessimists of the eurozone, searching for the next threat on the horizon,

have settled on Italy as the likeliest source of doom, or at least disorder.

Weaker banks struggle with consequences of a long recession and loose lending

FT 11 May 2017

Leaving the euro to devalue the currency would help exporters,

but at the cost of blowing up banks and insurers with liabilities in euros and large holdings of sovereign debt.

The Italian government wants to rescue three banks which are struggling under the weight of non-performing loans.

The trade-offs, as always, are complicated: financial stability now against financial stability later;

shielding taxpayers from the costs of a rescue against protecting small investors from heavy losses.

Yet the right balance can't mean saving every struggling bank every time.

Bloomberg 5 April 2017

Italy

Joblessness in the eurozone’s third largest economy crept up to 12 per cent

underscoring Italy’s long struggle with low growth and double-digit unemployment

Youth unemployment rose to 40.1 per cent.

FT 31 January 2017

Full text with nice, sort of, chart

Can Italy maintain the €?

Yes, if it grows, unlike in the last 17 years.

Francesco Papadia January 17, 2017

Many inconsistent trios go around the world. Possibly the most famous is the one popularized, among others, by Tommaso Padoa-Schioppa, whereby only any two of the three following components are mutually consistent:

free capital movements, fixed exchange rates and autonomous national monetary policy.

Another inconsistent trio that acquired great relevance in assessing the current wave of populism is the one put forward by Dani Rodrik

the world can only choose two out of the trio composed of hyper-globalization, democratic politics, national sovereignty.

Basically my argument is that 130 per cent for the debt to GDP ratio,

the € and continued stagnation in economic growth (as recorded on average over the last 17 years)

form a not compatible trio in the long run.

ECB needs to be more clear about its calculation that ailing bank Monte dei Paschi di Siena

needs more than €8 billion pumped into it, Italy's economy minister Pier Carlo Padoan says.

EUobserver, 30 december 2016

The bank had initially estimated it would need €5 billion.

"It would have been useful, if not kind, to have a bit more information from the ECB about the criteria that led to this assessment,"

Deutsche Bank AG, UniCredit SpA and eight other European Union banks

would fall short of the European Central Bank’s capital demands on Banca Monte dei Paschi di Siena SpA

Bloomberg 30 December 2016

Italy to bail out Monte dei Paschi di Siena bank

Last-gasp private rescue plan for the world’s oldest bank looks set to fail

FT 21 December 2016

Shares in MPS were suspended on Wednesday morning after the bank, Italy’s third-largest lender by assets,

warned that its liquidity levels were deteriorating rapidly.

People close to the bank said small and midsized companies had been pulling deposits.

Italy is to nationalise Banca Monte dei Paschi di Siena

Ambrose, Telegraph 9 December 2016

wiping out investors in a dramatic escalation of the country’s banking woes and political crisis.

The Italian treasury has been left with no other option after the European Central Bank refused

to give the crippled lender more time to clinch a deal with private funds.

Charles Gave, paterfamilias of Gavekal, can sound like the Voice of God Himself, declaring from on high.

When Italy adopted the euro in 1999, he had argued that Italy would change

from being an economy with a high probability of many currency devaluations

to one with the certain probability of eventual bankruptcy.

John Mauldin 7 December 2016

Basel - Italy MPS

EU reform was supposed to make investors shoulder bank rescue costs.

But it has struggled to overcome one big hurdle: politicians seem unwilling to implement it.

FT 6 December 2016

Britain’s decision to leave is the most striking but, in the long run,

the unfolding crisis in Italy could pose a more severe threat to the survival of the EU.

The reasons for this are political, economic and even geographic.

Gideon Rachman, FT 5 December 2016

It was, said a hoarse, red-eyed Matteo Renzi, an “extraordinarily clear” result.

Official figures showed the rejectionist front winning by 60% to 40% in metropolitan Italy

(and by 59% to 41% counting ballots cast by Italians abroad).

The Economist, 5 December 2016

Extend & Pretend, Italian-Style

I love Italy. I love the culture, the people, the food,

the beautiful art and architecture, and the heritage the country has bestowed on all of Western civilization.

Some of the best moments of my life happened in Italy. I wish nothing but joy to the country and all its people.

But politically and economically, Italy is an ungovernable mess heading straight for a Greek-style banking and debt crisis – but with an Italian flare.

John Mauldin, 2 December 2016

Därför blir nästa finanskris /Italien/ värre

Andreas Cervenka, SvD 3 december 2016

En av få personer på Wall Street som förutspådde den amerikanska bostadskraschen var förvaltaren Steve Eisman, lysande porträtterad i filmen ”The Big Short”.

Italiens banker sitter på svindlande 3 500 miljarder kronor i dåliga lån.

Steve Eisman räknar med att de får tillbaka futtiga 20 procent av dessa pengar, enligt tidningen The Guardian.

Problemet är att om bankerna skulle erkänna denna jätteförlust skulle de i samma andetag gå under och riskera att dra med sig euron i fallet.

Renzi’s reforms leave Italy’s real problems untouched

Outside Italy, many have swallowed Mr Renzi’s line that this referendum is decisive.

The truth, however, is that the reforms he is proposing are confused,

likely to be ineffective and are potentially dangerous because they enforce submission to EU laws.

The Italian people understand this and I expect them to deliver a decisive No vote.

Matteo Salvini, leader of the Northern League, FT 2 December 2016

How December 4th Could Trigger The "Most Violent Economic Shock In History"

Italy has had no productive growth since 1999. Real GDP per person is smaller than it was at the turn of the century.

That’s almost two decades of economic stagnation. By any measure, the Italian economy is in a deep depression.

It’s no surprise Italians are in a revolutionary mood...

zerohedge 2 December 2016

The moment of real danger for Italy will come as soon as the European Central Bank starts to taper bond purchases

This is imminent.

The only outcome that would make much difference is if a technocrat government were to take over and request a €40bn bail-out package

for the Italian banks from the European Stability Mechanism, effectively putting Italy under economic occupation.

Ambrose, Telegraph 30 November 2016

Eric Dor shows that, contrary to hopes that this was mainly foreign investors repatriating their cash after selling their Italian bond holdings,

the Target2 movements reflect the actions of Italian investors.

Martin Sandbu FT 25 November 2016

Spreads on Italian bonds have widened to about 200 basis points over German bunds.

The balance-of-payments crisis underway since the first half of 2016 is the main factor

Carmen Reinhart, Project Syndicate 23 November 2016

As of September (the most recent data available), Italy’s Target2 deficit is above 20% of GDP

According to IMF estimates, real per capita income in Italy is about 12% below what it was in 2007,

with only Greece faring worse.

The European flag /EU-flag really/ has disappeared from the office of the Italian prime minister.

This has the unmistakable touch of Jim Messina, the Obama strategist brought over to Rome

for a fee of €400,000 to help Mr Renzi survive next month’s make-or-break referendum.

The last 32 polls all point to defeat.

Ambrose, 16 November 2016

Italian banks – already grappling with non-performing loans equal to 18pc of balance sheets –

are up to their necks in the sovereign “carry trade”. They hold €400bn of Italian government bonds.

These assets have suffered a paper haircut. Losses must be “marked-to-market”, eroding core capital ratios.

Lately, Italy's central bank has been building up a lot of liabilities to the Eurosystem.

As of the end of September, they stood at about 354 billion euros, up 118 billion from a year earlier

Bloomberg 17 October 2016

given the chance that they might eventually be converted into lira.

The end game may have finally arrived for Banca Monte dei Paschi di Siena SpA.

An institution that’s seen its stock fall by 99 percent since 2009, recorded 15 billion euros in losses

Has until year-end to raise 5 billion euros of capital - seven times its current market value

Bloomberg 23 November 2016

- and offload almost 28 billion euros in soured loans to save the world’s oldest lender.

European Union rules require bondholders and stockholders to absorb losses in the event of a bailout,

an outcome that could cause a political firestorm.

The world's oldest surviving bank, Monte dei Paschi di Siena (MPS), which has been in business since 1472,

BBC 7 August 2014

Concern is mounting that the world’s oldest bank will have to be bailed-in under new EU rules

FT 21 September 2016

Shares in Monte dei Paschi di Siena, Italy’s third-largest bank by assets,

have fallen to under two cents amid growing investor concern that the world’s oldest bank will be

unable to pull off a €5bn recapitalisation and €30bn bad loan disposal demanded by regulators.

About Monte dei Paschi di Siena at IntCom

About Monte dei Paschi di Siena at Google

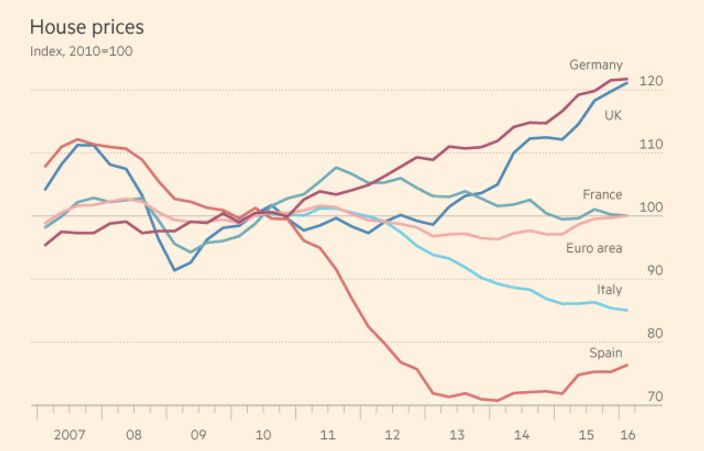

Why Italy’s housing crisis matters

FT 21 July 2016

“Burden-sharing by shareholders and subordinated creditors as a prerequisite for the authorization, by the commission,

of state aid to a bank with a shortfall is not contrary to EU law,”

according to the EU Court of Justice.

The Luxembourg-based court’s decision is binding and can’t be appealed.

Bloomberg 19 July 2016

Italy’s banking woes have the potential to wipe out investors and

undo over 60 years of supranational state-building in Europe.

zerohedge 12 July 2016

The fact that in Italy, thanks in part to a quirk of the tax code,

some €200 billion of bank bonds are held by retail investors adds an extra political dimension to the mix,

as The Economist points out.

Italy's economy will not return to the levels seen before the 2008 financial crisis

until the mid-2020s, the IMF has said

BBC 12 July 2016

Lack of NGDP growth is the real reason for Italy’s banking crisis

The Market Monetarist, 7 July 2016

The Italian banking sectors’ trouble has little to do with the Brexit vote. Rather the main reason the Italian banking sector is under water is the same reason why Italian public finances are a mess – lack of economic growth.

Hence, there essentially hasn’t been any recovery in the Italian economy since 2008. In fact, real GDP is today nearly 10% lower than it was at the start of 2008 and even worse – real GDP today is at the same level as 15 years ago! 15 years of no growth – that is the reality of the Italy economy.

I agree with those who reacted to Mr Renzi’s proposal by saying

there is no case to suspend the bail-in rules that are encapsulated in the Bank Recovery and Resolution Directive,

which came into force at the start of the year,

and that doing so would fatally damage the credibility of the brand-new bailout framework.

Philipp Hildebrand, FT 5 July 2016

Italy is preparing a €40bn rescue of its financial system as bank shares collapse on the Milan bourse

An Italian government task force is watching events hour by hour, pledging all steps necessary to ensure the stability of the banks.

“This is the moment of truth we have all been waiting for a long time. We just didn’t know it would be Brexit that set the elephant loose,”

said a top Italian banker.

Ambrose Evans-Pritchard, Telegraph 27 June 2016

The new bail-in reform this year has brought matters to a head, catching EU authorities off guard.

It was intended to protect taxpayers by ensuring that creditors suffer major losses first if a bank gets into trouble,

but was badly designed and has led to a flight from bank shares.

The Bank of Italy has called for a complete overhaul of the bail-in rules.

Italy Concocts €5 Billion “Atlas” Rescue Fund

to Cure €360 Billion in Non-Performing Loans

Mish's Global Economic Trend Analysis, 12 April 2016

Italy is big enough to matter

Greece, Portugal and Ireland were mere test subjects for what will come.

Spain would have been a challenge, but were narrowly avoided.

Italy will drag the whole structure down if it continues on its current trajectory,

and there is nothing to suggest it will change course.

EUGEN VON BÖHM-BAWERKON, FEBRUARY 23, 2016

Italian households put their money in the bank or in public pension funds,

which is used to fund current retirees, but expected to provide a cash flow for their own retirement.

If capital per worker is falling, as it would in a situation where, through depreciation, capital is consumed, one should expect lower output per worker.

This is exactly what has been going on for the last 15 years.

Mr Draghi issued his own cri de coeur in Helsinki six weeks ago, laying out the "minimum requirements for monetary union".

His prescription amounts to an EU superstate, with economic sovereignty to be "exercised jointly".

His plea is Utopian. There is no popular groundswell anywhere for such a vaulting leap forward

The northern creditor states have in any case spent the past four years methodically preventing any durable pooling of risk or any step towards fiscal union.

In airing such thoughts, Mr Draghi is really telling us that he no longer thinks EMU can work.

Ambrose Evans-Pritchard 7 Jan 2015

The euro is in greater peril today than at the height of the crisis

Insurrectional electorates more likely to vote for a new generation of leaders

Wolfgang Münchau, FT November 9, 2014

America’s experience in the 1960s should have warned the eurozone’s creators that tying national monetary authorities’ hands might not be such a good idea.

Europe’s leaders must recognize that the eurozone, as it is currently constituted, is larger than Europe’s optimal currency area.

Some of its member countries – certainly Greece, and probably Italy and Spain – need an independent monetary policy.

Koichi Hamada, Special Economic Adviser to Japanese Prime Minister Shinzo Abe and Professor of Economics at Yale University, Projet Syndicate 28 October 2014

In an act of studied contempt, Mr Renzi’s government published online

the Commission’s “strictly confidential” letter demanding an explanation for Italy’s draft 2015 budget.

Mr Renzi said he wanted greater transparency and would, in future, be publishing not just the Commission’s letters,

“but all the financial data on how much is spent in these buildings. It’ll be a lot of fun.”

It is the sort of remark you might expect from a eurosceptic like Nigel Farage rather than the leader of

the country that currently occupies the EU’s rotating presidency.

Charlemagne, The Economist 26 October 2014

ECB should abolish its OMT program – which, according to Germany’s Constitutional Court, does not comply with EU treaty law anyway.

Furthermore, the ECB should reintroduce the requirement that TARGET2 debts be repaid with gold, as occurred in the US before 1975

The fiscal compact – formally the Treaty on Stability, Coordination, and Governance in the Economic and Monetary Union

French Prime Minister Manuel Valls and his Italian counterpart, Matteo Renzi, have declared – or at least insinuated –

that they will not comply with the fiscal compact to which all of the eurozone’s member countries agreed in 2012

Their stance highlights a fundamental flaw in the structure of the European Monetary Union

– one that Europe’s leaders must recognize and address before it is too late.

Hans-Werner Sinn, Project Syndicate 22 October 2014

Italy’s Downward Spiral

Italy’s new prime minister, Matteo Renzi, wants to stimulate growth. But what he really intends to do is accumulate even more debt.

True, debt spurs demand; but this type of demand is artificial and short-lived.

Sustainable growth can be achieved only if Italy’s economy regains its competitiveness,

and within the eurozone there is only one way to accomplish this: by reducing the prices of its goods relative to those of its eurozone competitors.

What Italy managed in the past by devaluing the lira must now be emulated through so-called real depreciation.

Hans-Werner Sinn, Project Syndicate 21 August 2014

Renzi is not alone in this. On the contrary, virtually the entire European political elite, from Brussels to Paris to Berlin,

still believes that Europe is suffering from a mere financial and confidence crisis.

The underlying loss of competitiveness is not discussed, because that is a problem that discussion alone cannot resolve.

Hans-Werner Sinn, Professor of Economics and Public Finance at the University of Munich,

is President of the Ifo Institute for Economic Research and serves on the German economy ministry’s Advisory Council.

He is the author of Can Germany be Saved?

Crucially

Italy’s PM Matteo Renzi wants the EU’s budgetary rules to be interpreted more loosely – so that money spent for ‘growth-enhancing’ purposes does not count as part of the budget deficit.

At a summit at the end of June, EU leaders agreed that they should make “best use” of the flexibility in the Stability and Growth Pact.

Crucially, however, the rules were to remain the same.

Nevertheless Italian officials have been holding this up as a significant blow-to-austerity victory.

EU Observer 7 August 2014

Italy's Renzi must bring back the lira to end depression

Output has collapsed by 9.1pc from the peak, back to levels last seen 14 years ago. Industrial production is down to 1980 levels.

It takes spectacular policy errors to bring about such an outcome in a modern economy.

Ambrose Evans-Pritchard, 13 Aug 2014

I do not wish to revisit the stale debate over why Italy kept losing labour competitiveness against Germany for a decade and a half, except to say that it proves just how hard it is to bend Europe's deeply-rooted cultures to the demands of a currency experiment.

Economists said EMU nations would converge.

Anthropologists and historians said they would do no such thing.

However we got there, the situation is now untenable.

Italy is 30pc overvalued against Germany. It cannot claw this back by deflating since Germany itself is near deflation.

Italy must look after itself. It can recover only if it breaks free from the EMU trap, retakes control of its sovereign policy instruments and redominates its debts into lira, with capital controls until the dust settles.

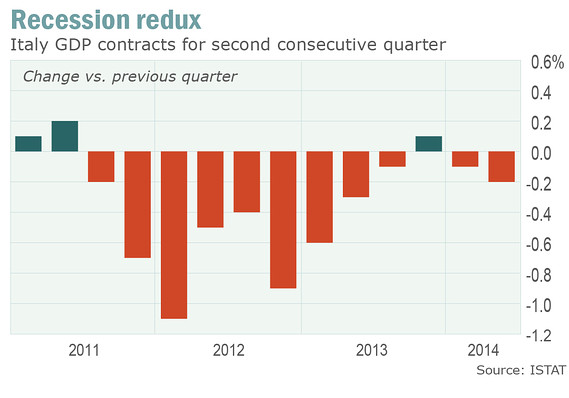

Italy shows euro zone may never have left recession

MarketWatch Aug. 6, 2014

Nice chart

Italian economy has managed to eke out only one paltry quarter of growth in the past three years.

Italy is the third largest economy in the eurozone,

one that has underperformed since the single currency was established 15 years ago,

and for a decade before that.

BBC 25 February 2014

If we go back to the turn of the century and look at the total growth achieved up to last year,

we find that both Germany and France have managed 15 %.

That yields an average of about 1% per year, which is not impressive.

Spain, even after the financial crisis in which it was one of the eurozone's casualties, is 18% ahead of where it was in 2000,

and Ireland is more than 30% up.

Italy's total growth in the same period is approximately nothing.

EU behöver inte en till tysk seger

Matteo Renzi, Italiens populäre socialdemokratiske premiärminister, har tagit över ordförandeklubban i EU

och utmanar Tyskland gällande åtstramningspolitiken.

Lycka till, säger kommentariatet, britterna förlorade nyss med 7-1.

Eller 26-2 för att använda de faktiska röstsiffrorna i rådet.

Men man ska nog inte räkna ut Matteo Renzi.

Katrine Kielos, Aftobladet 13 juli 2014

The argument between Italy and Germany asks a question at the heart of the currency’s future

Can an arrangement that will always fall well short of a textbook monetary union

be at once economically robust and politically sustainable?

Philip Stephens, FT 10 July 2014

Matteo Renzi is rubbing shoulders with the likes of Barack Obama at G7 summits, and is

emerging as the biggest counterweight to German Chancellor Angela Merkel on the EU political landscape.

John Mauldin 23 June 2014

His Democratic Party (PD) took 40.8 percent of votes – the best-ever result for the Italian left, and the highest score ever recorded by a single party since the Christian Democrats in 1958 – has given him a strong hand to challenge Berlin-backed austerity policies, as Italy takes on the EU’s six-month presidency on 1 July.

Italy that is unable to grow, incapable of reforming, and burdened with what increasingly looks like an unsustainable debt.

Barry Eichengreen, 15 October 2013

I underhuset får det parti eller koalition som har fått flest röster en bonus som ger egen majoritet.

Därför får vänstern, som i valet fick 31 procent, hela 54 procent av rösterna i underhuset.

Aftonbladet 27 februari 2013

Tim Geithner recounts in his book Stress Test: Reflections on Financial Crises just how far the EU elites are willing to go to save the euro, even if it means toppling elected leaders and eviscerating Europe’s sovereign parliaments.

The former US Treasury Secretary says that EU officials approached him in the white heat of the EMU crisis in November 2011 with a plan to overthrow Silvio Berlusconi, Italy’s elected leader.

"They wanted us to refuse to back IMF loans to Italy as long as he refused to go," he writes.

Ambrose Evans-Pritchard, May 15th, 2014

Wolfgang Münchau

Supporters of currency union have failed to explain how Italy can prosper inside a monetary union with Germany.

The lazy argument is that Italy’s problems have nothing to do with the exchange rate regime. It is all about structural rigidities. As long as Italy reforms, all is well.

This is nonsense. Globalisation was an asymmetric shock.

It brought new customers for German luxury cars, but for Italy it mainly brought new competitors.

It would not be unreasonable for a country to respond to an asymmetric shock through an exchange rate devaluation.

Italians have been suffering for much longer than other southern Europeans.

Electorates can be relied upon to reject systems that fail to produce economic growth for long periods.

Wolfgang Münchau, FT May 11, 2014

Total bank assets in Italy stand at a relatively modest 2.6 times GDP, compared with 3.2 times in the whole of the euro area. Italian banks generally shunned the sorts of toxic financial instruments that brought down banks in America and Germany. And the country has not experienced a housing bust on a par with that in Ireland or Spain.

Yet for all their sobriety, Italian banks are struggling amid a mountain of bad debts from Italian businesses, big and small.

As the European Central Bank prepares to conduct stress tests and asset quality reviews of hundreds of banks across the eurozone, there is particular worry among some European regulators about Italy’s banks.

These concerns have led the Bank of Italy to conduct its own intensive examinations across the nation, such as the one at Banca Alberobello, ahead of the ECB tests. From Banca di Sicilia in the deep south to Banco di Trento e Bolzano, in the German-speaking northeast, the Bank of Italy is staging its toughest examination of the nation’s banks in history.

Financial Times, 4 March 2014

Italy’s new prime minister will have the most difficult job in Europe.

Once confirmed, he will preside over a country with three fundamental economic problems:

it has very large debt; it has no growth; and it is a member of a poorly functioning monetary union.

Wolfgang Münchau, FT, February 16, 2014

The plot is thickening fast in Italy.

Romano Prodi – Mr Euro himself – is calling for a Latin Front to rise up against Germany

and force through a reflation policy before the whole experiment of monetary union spins out of control.

Ambrose Evans-Pritchard, November 4th, 2013

When the euro was born everyone knew that sooner or later a crisis would occur.

It was also clear that the stability and growth pact was – as I have said before – “stupid”

Romano Prodi, FT May 20 2010

Men om man ställer till rejäla kriser, så kan varje nationell maktelit skrämma sitt folk till underkastelse.

De tvingas acceptera.

EU-kommissionens tidigare ordförande, virrpannan Romano Prodi, var så omedveten att han skrev en kolumn i självaste Financial Times (20 maj 2010),

där han lugnt konstaterade att han och alla de andra som drev fram europrojektet naturligtvis visste att det skulle leda till en svår kris förr eller senare.

Nila Lundgren

The so-called "Frenkel Cycle", the brutal denouement of every fixed-exchange rate system and every monetary union that fails to meet the four basic conditions

"The debt-to-GDP ratio has risen by 15 percentage points [to 133pc] over the past 15 months because there is no growth.

It is all because of the effects of austerity and the fiscal multiiplier. We are making the same mistake they made in Greece."

Ambrose Evans-Pritchard, 30 Oct 2013

The report cited the so-called "Frenkel Cycle", the brutal denouement of every fixed-exchange rate system and every monetary union that fails to meet the four basic conditions of an optimal currency area.

These are labour mobility across borders, wage and price flexibility, fiscal transfers and aligned business cycles.

The euro area meets none of them.

Jeffrey A. Frankel Home page at Harvard

Italy, saddled with the euro region’s second-largest debt, is the “biggest threat” to the economy of the 16-member bloc,

according to Nobel Prize-winning economist Robert Mundell.

Bloomberg Feb. 17 2010

EMU och teorin för optimala valutaområden

Nils Lundgren, den 21 september 1994

Brussels is demanding that Monte dei Paschi di Siena, the world's oldest bank, be subjected to tougher penalties

before it approves the €3.9bn state bailout of Italy’s third-biggest bank by assets.

Financial Times, July 28, 2013

The European fiscal compact, an inter-governmental treaty that came into effect in January,

provides far less flexibility to countries as they try to meet their deficit-cutting targets than they had under previous agreements.

Under the fiscal compact, Italy will be required to pay back debt worth more than 2 per cent of GDP each year.

To achieve that goal, Italy will need to run very large structural surpluses for almost a generation.

Wolfgang Münchau, Financial Times, May 5, 2013

Italy’s new premier Enrico Letta is on a collision course with Germany after vowing to end death by austerity,

and warned that Europe itself faces a “crisis of legitimacy”

“Italy is dying from fiscal consolidation. Growth policies cannot wait any longer,” he told Italy’s parliament.

He said the country is in “very serious” crisis after a decade of stagnation and

warned of violent protest if the social malaise deepens.

Ambrose Evans-Pritchard 29 Apr 203

The grand coalition of Left and Right - the first since the late 1940s - will abolish the hated IMU tax on primary residences, a wealth levy imposed by ex-premier Mario Monti, and push for tax cuts for business and young people to pull the country out of perma-slump.

A rise in VAT to 22pc in July may be delayed.

Vice-premier Angelo Alfano - the appointee of ex-premier Silvio Berlusconi - said he agreed with every word from “beginning to end”, as the Berlusconi camp claimed “total victory” over the policy agenda.

But while Mr Letta promised that Italy would abide by fiscal commitments made to Europe

he did not explain where the government would find the lost revenues of up to €6bn.

Mr Berlusconi took his party to the brink of victory in those elections with a fiercely anti-austerity message aimed against Germany’s “hegemony” in Europe. Italy’s recession and anger at the political elite also led to the populist Five Star Movement winning a quarter of votes in parliament where it is now the largest opposition force.

However Mr Letta stressed the pro-Europe orientation of the new government, saying it would push for

greater economic and political unity in a “United States of Europe”.

Efter två års usel konjunktur behöver åtstramningstakten slås av.

Men vad Italien ska göra för att få hjulen att rulla är lika oklart som förr

Gunnar Jonsson, signerat DN 26 april 2013

The euro zone crisis could be largely over by the end of the year

A year ago going into the Greek elections, the risk was more severe.

Now, [the euro zone crisis] looks fairly contained

unless Italy throws a very funny surprise,"

Holgar Schmieding, chief economist at Berenberg Bank, told CNBC 12 March 2013

Om arbetsmarknaden liberaliseras måste de som förlorar jobbet erbjudas grundläggande trygghet i väntan på att reformerna vitaliserar ekonomin och fler arbetstillfällen skapas.

Det perspektivet har varit sorgligt frånvarande i den tyskdikterade politik som har delar av Europa i sitt grepp.

Den har förvisso modifierats något; Portugal, Grekland och Spanien har beviljats uppskov med budgetsaneringen.

Men det kan vara för lite för sent. Den nedåtgående spiralen fortsätter

Per T Ohlsson, Sydsvenskan 3 mars 2013

Too big to fail or to bail

This is dangerous. It is hard to see Italy remaining in the single currency in such dire straits

— and equally hard to imagine the euro surviving if it falls out.

Italy is the euro zone’s third-biggest economy and, although its budget deficit is quite small,

it has the biggest stock of public debt (at almost 130% of GDP). This makes it too big to bail out.

The Economist print 2 March 2013

Mr Grillo was right about Italy’s overpaid and corrupt politicians.

Mr Berlusconi was right that austerity alone will not solve Europe’s crisis.

TOO BIG TO BAIL

Aubie Balton 31 July 2011

The turmoil produced by the Italian elections has directed attention back to where it should have been all along – to the politics of the eurozone crisis.

It is possible that southern Europe will give the Germans until the autumn to come around to a new approach.

But toleration for austerity is unlikely to last much beyond then.

Europe may be approaching a stark choice: giving up the euro; or keeping it and seeing the political crisis spin out of control.

Mark Mazower, professor of history at Columbia university, Financial Times 28 February 2013

Anders Borg är förvånad över att marknaden inte reagerat mer på det italienska valresultatet.

– De finansiella marknaderna har närmast tittat åt annat håll under de senaste dagarna

Men jag tror man ska vara väldigt försiktig med den optimistiska tolkningen som marknaden gör.

Anders Borg, Ekot 28 februari 2013

Det kan tillkomma politisk osäkerhet från Spanien, Grekland och Cypern och då kan det i sin tur utgöra ett allvarligt hinder för en återhämtning, säger Anders Borg.

Vad tror du det ger för signaler till andra politiker och regeringar runt om i Europa?

– De varierar, de länder som har genomfört en framgångsrik saneringspolitik, där man också återställt tillväxten, har regeringarna blivit återvalda. Den här regeringen har gjort en del återgärder men det är också tydligt att man inte lyckats återställa Italiens konkurrenskraft tvärtom har Italiens konkurrenskraft fortsatt att försämrats, säger finansminister Anders Borg.

The great fear is that ECB will find it impossible to prop up the Italian bond market under its Outright Monetary Transactions (OMT) scheme

if there is no coalition in Rome willing or able to comply with the tough conditions imposed by the EU at Berlin’s behest.

Europe’s rescue strategy could start to unravel

Ambrose Evans-Pritchard 26 February 2013

Andrew Roberts, credit chief at RBS, said: “What has happened in these elections is of seismic importance.

“The ECB rescue depends on countries doing what they are told. That has now been torn asunder by domestic politics in Italy.

“The big risk is that markets will start to doubt the credibility of the ECB’s pledge.”

Mr Roberts said: “The big unknown is how much Germany is going to buckle over the next six months.

German leaders want to keep up the appearance that the eurozone crisis has been solved, at least until their elections in September.”

Italy Votes for Chaos and the Euro Crisis Is Back

Bloomberg, Megan Greene 26 February 2013

Italy’s parliamentary election could not have gone worse for the country or the euro area.

It is now possible that in the coming months the currency zone’s third-largest economy will need a bailout from international creditors,

at a time when Italy will have no government in place to ask for, or negotiate, a rescue.

In case you had any doubts, the euro-area crisis is back.

Eurointelligence 27 February 2013:

The German established is shocked beyond belief - Not in the Casablanca way, but for real.

(Some people were apparently shocked to learn that gambling was occurring at Rick's Cabaret)

The German crisis-exit narrative has been so unbelievably complacent

– everyone pursuing austerity, then happiness forever – that these elections came as a total shock.

Angela Merkel did not say anything (quite wisely, we think).

Frankfurter Allgemeine quotes leading German economists and business representatives to devastating effect.

Lars Feld, a member of the German Council of Economic Advisers, predicted that investors will withdraw money from Italy, which will result in a rise in risk spreads. The Italian economy will then not be able to get out of recession. And that raises, once again, question about Italy’s debt sustainability.

The eurozone crisis will have returned with full force.

The head of Germany’s export association is quoted as saying that Germany should now contemplate the possibility of what he euphemistically called “a modified eurozone”.

(German exporters calling for a break-up of the eurozone is one degree more stupid than turkeys voting for Christmas. But we completely agree with Lars Feld on his description of the dynamics.)

Mario Monti, som inte bara haft insikt i Italiens problem utan även viljan att genomföra nödvändiga strukturreformer,

är nu nästan uträknad i italiensk politik.

Hur kommer det sig?

Tendensen att vilja leva över sina tillgångar drivs på av populistisk valfläskpolitik.

SvD-ledare signerad Ivar Arpi 27 februari 2013

Om Italien ska komma på fötter krävs inte bara politisk tillnyktring på hemmaplan.

Det behövs också en bättre och mer sammanhållen politik inriktad på tillväxt och sysselsättning i euroområdet – och i hela EU.

Valet i Italien är ännu ett tecken på att eurons utdragna svårigheter har lett till att

den ekonomiska krisen har blivit både social och politisk.

DN-ledare 27 februari 2013

Väljarna röstade kraftfullt mot Italiens politiska klass och

lika kraftfullt mot EU:s brutala åtstramningspolitik.

Delvis kan resultatet skyllas på valsystemet.

I underhuset får det parti eller koalition som har fått flest röster en bonus som ger egen majoritet.

Därför får vänstern, som i valet fick 31 procent, hela 54 procent av rösterna i underhuset.

Aftonbladet ledarekrönika Anders Lindberg 27 februari 2013

Högerns idéer och hela åtstramningspolitiken verkar ha passerat sitt bäst-före-datum. I val efter val röstar väljarna på andra partier och en annan politik.

Problemet, vilket illustreras tydligt av valresultatet i Italien, är att om inte Europas socialdemokrater klarar att presentera ett trovärdigt och tydligt alternativ så går väljarna till rena missnöjespartier.

Det verkar som om det egentligen är Mario Monti som bäddat för de ansvarstagande krafternas valnederlag

genom en okänslig svångremspolitik som släppte fram fantaster som Berlusconi och Grillo.

Tråkigt nog kommer detta att återverka på resten av Europa genom den oförmåga att vidta motverkande stabiliseringspolitiska åtgärder som finns hos EU:s toppolitiker.

Danne Nordlilng 26 februari 2013

Själv röstade jag ”ja” till att Sverige skulle gå med i valutaunionen vid folkomröstningen 2003

Jag tvivlar på att befolkningen i länder med statsfinansiella problem

kommer att acceptera förmynderi och bestraffning beslutade av politiker i andra länder.

Assar Lindbeck, DN Debatt 17 juli 2012

If it can happen in Italy then why not in Greece, Spain, Portugal or France?

The writing is emblazoned now clearly on the wall which declares

opposition to living under the dictums handed down from other countries

This is clearly defined by the total rejection of Monti and the Brussels/Berlin austerity measures that he put in place.

The vote for Monti at just under ten percent is a ringing condemnation of the European Union by the people of Italy.

Tyler Durden/Mark J. Grant, Zerohedge 26 February 2013

This vote was not just a massive rejection of politics as it is played in Italy.

It was also a rejection of the policies championed by Mario Monti, the unelected prime minister who replaced Silvio Berlusconi.

He was widely praised in Brussels for bringing stability to Italy but his austerity measures are blamed for deepening the recession.

He was a major loser in this campaign. Europe's leaders feted Mr Monti but the people did not.

This vote was a rejection of the austerity being pursued by Brussels to save the single currency.

Gavin Hewitt, BBC Europe editor, 26 February 2013

The extraordinary success of the protest movement of Beppe Grillo.

One in four voters backed a movement that has promised to shake up and kick out Italy's political establishment.

Mr Grillo has tapped into a mood of anger and resentment. He never gave a single interview to Italian TV and yet has nearly 170 seats.

The country is in deep recession. Unemployment is rising and industrial production is at its lowest level since the 1990s.

Mr Grillo raged against corruption, against budget cuts, against austerity and promised to hold a referendum on continued membership of the euro.

Messy Italian Election Shakes World Markets

Voters delivered political gridlock that could once again rattle Europe's financial stability.

The Dow Jones Industrial Average swung nearly 300 points, ending with its worst day in almost four months,

Wall Street Journal 25 February 2013

Italy

a general election in which voters delivered a resounding rebuff to austerity policies .

The upstart anti-establishment Five Star Movement, founded only three years ago by the comedian-blogger Beppe Grillo,

was on course to stage the biggest shock by garnering the largest number of votes of any single party.

the grassroots movement was leading on 25.5 per cent

But the nation was torn three ways between Mr Grillo and his band of political novices, Pier Luigi Bersani’s centre-left coalition and Silvio Berlusconi’s centre-right alliance,

raising the prospect of a second election within months.

Financial Times 26 February 2013

It will be the revolts, a sort of Mediterranean Spring,

rather than the continued financial traumas, that will eventually goad leaders into action

Louise Armitstead, Daily Telegraph, 28 Dec 2011

Perhaps the most important point to have emerged is that the crisis is subject to growing political risks.

The fall of the Dutch government and the victory of François Hollande in the first round of the French presidential election demonstrate this point.

The street might overwhelm the establishment.

Martin Wolf, Financial Times, April 24, 2012

Bernard Connolly är en av vår tids hjältar.

I dag intervjuas Connolly i Wall Street Journal om hur han ser på eurons framtid.

Den akuta kris som utlöstes för några månader sedan berodde på att Europeiska centralbanken vägrade stödköpa italienska statsobligationer.

Skulle banken åter köpvägra är krisen här igen - innan Herman von Rumpoy hinner säga flasklock.

ekonomism.us 24 februari 2013

Paul Krugman has got in early to comment on the political demise of Mario Monti

– who now seems certain to trail in fourth in the Italian elections.

According to Krugman, Monti’s reputation for wisdom is wildly overblown.

On the contrary, he more or less deserves his fate because he was “in effect, the proconsul installed by Germany.”

Worse, according to Krugman, Monti’s policies did not even work.

Gideon Rachman, Financial Times February 25 2013

As in the rest of southern Europe, the economy has shrunk and so debt-to-GDP ratios have risen. There was only one “piece of good news” in the Monti era – that “bond markets have calmed down.” However, Monti cannot claim the credit even for this, because it is “largely thanks to the stated willingness of the ECB to step in and buy government debt when necessary.”

As ever, with Krugman, the argument is forcefully made. But it misses out a crucial stage in the argument and therefore unfairly denigrates the role of Monti in stabilising the Italian economy.

Austerity, Italian Style

What good, exactly, has what currently passes for mature realism done in Italy or for that matter Europe as a whole?

For Mr. Monti was, in effect, the proconsul installed by Germany to enforce fiscal austerity on an already ailing economy;

willingness to pursue austerity without limit is what defines respectability in European policy circles.

This would be fine if austerity policies actually worked — but they don’t.

Paul Krugman, New York Times 24 February 2013

The Austerians, Olli Rehn, Olivier Blanchard and fiscal multipliers

No debate please, we're Europeans

Paul Krugman, New York Times blog, 16 February 2013

For anyone with a sense of history,

the sight of the German representative on the ECB being isolated and outvoted should be chilling.

Since 1945, the central idea of the European project was

never again to leave a powerful and aggrieved Germany isolated at the centre of Europe.

Gideon Rachman, Financial Times, September 10, 2012

ECB has revealed that Italian government bonds make up nearly half of its holdings under a bond-buying plan

Italian bonds with a book value of 99bn euros account for the biggest holding under the now ended Securities Market Programme.

BBC 21 February 2013

Silvio Berlusconi said Merkel’s East German roots had made her too rigid and too austerity-minded.

Berlusconi says Merkel is an "intelligent bureaucrat" tied to the notion of a centralized economy.

He disagrees with the notion that the fiscal compact was designed to shore up the common currency.

He said the Fiscal Compact imposes a shoe size 42 for men and 40 for women.

This is why he says he wants to renegotiate the entire Compact if elected.

Eurointelligence 19 February 2013

Italien

Vem litar ni mer på? En framgångsrik företagare, en ”krigare” som inte står med mössan i hand i Bryssel?

Eller en marionett som Mario Monti i händerna på Angela Merkel och de tyska bankerna?

SvD Näringsliv 29 januari 2013

Utomlands är Mario Monti populär, en marknadernas och EU-politikernas stora favorit. Men på hemmaplan får han skulden för recessionen som håller Italien i ett järngrepp sedan mitten av 2011 med minustillväxt fem kvartal i rad, fallande investeringar och en arbetslöshet på över 11 procent.

The ECB's Mario Draghi has taken the risk of a sovereign default in Spain and Italy off the table,

but he has not restored these countries to economic viability within a D-Mark currency bloc, and nor can he.

Take a moment to read Eurozone crisis: it ain't over yet by Professor Paulo Manasse from Bologna University, posted on VOX EU.

Ambrose Evans-Pritchard, January 23rd, 2013

Mario Monti's exit is only way to save Italy

The nation is richer than Germany in per capita terms, with some €9 trillion of private wealth.

It has the biggest primary budget surplus in the G7 bloc.

Its combined public and private debt is 265pc of GDP, lower than in France, Holland, the UK, the US or Japan.

Italy has only one serious economic problem. It is in the wrong currency

Ambrose Evans-Pritchard, 10 Dec 2012

The one great obstacle is premier Mario Monti, installed at the head of a technocrat team in the November Putsch of 2011 by German Chancellor Angela Merkel and the European Central Bank – to the applause of Europe’s media and political class.

Mr Monti may be one of Europe’s great gentlemen but he is also a high priest of the EU Project and a key author of Italy’s euro membership. The sooner he goes, the sooner Italy can halt the slide into chronic depression.

Normal service is resuming.

After a year of relative stability and regained market confidence,

Italy is plunging back into political turmoil with the familiar sight of Silvio Berlusconi gearing up for yet another electoral campaign – his sixth in 19 years –

against a centre-left still seeking to shed its proto-communist image.

Financial Times 9 December 2012

After all, it's not Spain that is responsible for 57% of the sovereign debt of the troubled eurozone economies - it's Italy.

And come the spring, Italy will be looking for a new prime minister.

Stephanie Flanders, BBC Economics editor, 16 November 2012

In their punchy new book, Democrisis, David Roche and Bob McKee say Italy is the "circuit-breaker" that could make a lot of the crisis go away: "Italy represents more than half of every form of measurable economic contagion of the eurozone sovereign debt crisis... If the markets believe Italy is 'saveable', a virtuous outcome is possible and contagion will go into reverse."

That makes Italy sound very much like the pivot state: the country whose future could dictate everyone else's.

"Lägger man ihop statsskulden med hushållens skulder är Italien mindre skuldsatt än Sverige.

Detta riskerar att flyttas in i fastighetspriserna", sa Göran Persson

Han varnade för att svenskarna med fallande bopriser riskerar hamna i ond spiral där säkerheterna inte täcker lånen.

DI/GP 2012-11-13

What happens if a large, high-income economy, burdened with high levels of debt and an overvalued, fixed exchange rate, attempts to lower the debt and regain competitiveness?

This question is of current relevance, since this is the challenge confronting Italy and Spain.

Yet, as a chapter in the International Monetary Fund’s latest World Economic Outlook demonstrates,

a relevant historical experience exists: that of the UK between the two world wars.

Martin Wolf, Financial Times, 9 October 2012

Banca Monte dei Paschi di Siena at Google

Monte dei Paschi rescue deal now close

MPS, the oldest bank in the world, was shown to be one of the sickest, too.

FT 22 May 2017

In 2014, Mr Mussari and two colleagues were sentenced to three and a half years in jail for trying to hide MPS’s problems with a convoluted, undisclosed derivatives contract.

Since the start of 2017, MPS, the Italian government, the European Commission and the European Central Bank’s regulatory arm,

the Single Supervisory Mechanism, have been locked in talks about the design of a rescue.

The world's oldest surviving bank, Monte dei Paschi di Siena (MPS)

Shares in Banca Monte dei Paschi di Siena were suspended on Monday,

after the Italian lender and eight of its domestic peers emerged as the standout losers in health checks

aimed at restoring confidence in the euro area’s financial sector.

Financial Times 27 October 2014

Officials at the country’s central bank complained that the parameters in regulatory stress tests were unrealistically harsh on Italian banks.

They disputed the exact number of failures, after nine Italian lenders fell short in a comprehensive review unveiled by the European Central Bank.

The announcement represents the culmination of more than a year of intensive work costing hundreds of millions of euros and involving thousands of officials and accountants – all aimed at restoring investor faith in European banks ahead of the launch of a unified banking supervisor in Frankfurt.

The world's oldest surviving bank, Monte dei Paschi di Siena (MPS), has reported a bigger-than-expected loss.

The Italian bank, which has been in business since 1472, reported a second quarter loss of 179m euros (£142m),

three times the loss analysts had been expecting. It was the bank's ninth consecutive quarterly loss

BBC 7 August 2014

n June, MPS raised 5bn euros on the stock market which it used to pay back state aid and boost its financial situation

Monte dei Paschi di Siena, Italy’s third-largest bank by assets, is set to launch a €3bn capital raising

in the second half of May after the banking foundation that is its controlling shareholder cleared a crucial obstacle to the deal.

FT 19 March 2014

Monte dei Paschi di Siena, the world's oldest bank, took five centuries to accumulate its wealth -- and three years to gamble it away.

Its fall from grace is a disaster for its home city of Siena, which relied on distributed profits from the bank.

Der Spiegel, 7 August 2012

Brussels is demanding that Monte dei Paschi di Siena, the world's oldest bank, be subjected to tougher penalties

before it approves the €3.9bn state bailout of Italy’s third-biggest bank by assets.

Financial Times, July 28, 2013

The EU’s competition enforcer told Italy that the proposed restructuring plan for the 500-year-old lender is too soft on executive pay, cost-cutting and treatment of creditors, according to private correspondence seen by the Financial Times.

In a SPIEGEL interview published on Monday, Monti warned that European leaders could not allow themselves to be bound entirely to parliamentary resolutions in their efforts to save the euro.

"If governments let themselves be fully bound by the decisions of their parliaments without protecting their own freedom to act, a break up of Europe would be a more probable outcome than deeper integration," he warned in the SPIEGEL interview.

Moody's downgraded Italy's government bond rating two notches from A3 to Baa2. This is just above junk status.

Moreover, the outlook is negative with further downgrades possible in the near future.

So what happened in the Italian government bond auction this morning? Did buyers demand higher interest rates?

No they didn't. How is this possible?

Apparently Italian banks couldn't resist an urge to grossly overpay for their government's newly issued debt.

The ECB was most certainly backing them up behind the scenes.

Seeking Alpha 13 July 2012

If this is how Italian banks do business, can we assume that they're solvent?

There is little need to pose that question for Spanish banks. Recent data indicate that they borrowed €365 billion in June from the ECB - a record amount.

Mario Monti and the Limits of Technocracy

When Mario Monti was appointed - not elected - prime minister in November,with the economy headed for collapse, technocratic leadership and a break from politics as usual were exactly what they wanted.

So they thought.

Now, opinion polls put Monti’s approval rating at slightly more than 30 percent, down from more than 70 percent at the start of his tenure.

Editors, Bloomberg 27 June 2012

There’s only so much a technocratic leadership can achieve. In a democracy, a sustained effort at institutional and economic reform -- changes that make powerful interests worse off even as they advance overall living standards -- must be underwritten by voters. Politicians must put forward the case for painful measures and win a mandate to make them happen.

In a broken political system, which Italy’s is, the rule of technocrats can serve a vital temporary purpose. We applaud what Monti has done. But as Italy’s economic crisis escalates once again, its leaders can no longer put politics aside. That’s both understandable and inevitable, if not all that encouraging.

Full textYet even continued gifts under some sort of fiscal union would not bring prosperity, as we see clearly in Italy.

Italian unification in 1861 married the Germanic north with the Latin south. The consequent misalignment continues to this day.

If the euro holds together, this would leave the southern peripheral countries as a giant version of the Mezzogiorno.

Roger Bootle, Telegraph 24 June 2012

Desperate Monti needs Merkel summit deal to stop revolt at home

Italy's technocrat government risks a parliamentary mutiny unless premier Mario Monti can secure major concessions from Germany

at a crucial summit of the eurozone's Big Four powers in Rome on Friday.

Ambrose, 21 June 2012

The main Left and Right parties have until now backed Mr Monti's fiscal squeeze – a net tightening of 3.2pc of GDP this year – and radical reform of pension and labour markets.

The implicit trade-off was that Brussels and the European Central Bank would in return intervene to keep the bond vigilantes at bay, if necessary. Germany has so far blocked such action. Yield spreads of 10-year Italian bonds over German Bunds neared a record 500 basis points last week.

The soft-spoken Professor Monti – flanked by French president Francois Hollande and Spanish premier Mariano Rajoy – is unlikely to be so blunt. Yet he has lured German Chancellor Angela Merkel into a Latin ambush, symbolically staged in the seat of Roman power.

The unspoken message is that Germany does not command a majority vote at Europe's high table and can no longer rely on the Franco-German axis to impose its will. The deal agreed by the quartet in Rome – if there is one – will largely dictate the final EU response to the crisis next week in Brussels.

Berlusconi says Italy should quit eurozone unless Merkel changes course

Ok, he is no longer Italy’s prime minister, but he is still the leader of one of Italy’s most important political parties.

Eurointelligence Daily Briefing 21.06.2012

He said the eurozone crisis can have one of three outcomes.

Either Germany allows the ECB to backstop everything.

Second, Germany leaves.

Third Italy leaves.

Number is two is not going to happen, so we are left with the bifurcation we have forecasting for a long time.

Either they agree a full backstop – which can logically only come from the ECB, and which in turn requires a political union – or the eurozone collapses.

Corriere also has a reference to an interview of Berlusconi in the Wall Street Journal in which he clarified his position further. He said the departure of the a country from the eurozone, or even the collapse of the eurozone, were not subject to polite conversation in Europe until recently, but they are now possible. Here is a section from the excerpt of the interview:

“I see three possible outcomes. The first is that Germany is persuaded and therefore the ECB becomes a backstop for the euro. The second possibility is that Germany leaves the euro…The third solution is that Italy leaves the euro and we reintroduce our own currency, which would bring many advantages.”

And then he went on the attack against Angela Merkel:

“If we continue on with the policies of Signora [Angela] Merkel [the German chancellor], who before had the backing of Sarkozy, demanding that countries reduce their public debt, we'll end up in a worsening recessionary spiral. This is really the wrong policy.”

(Discussing a euro exit is still considered blasphemy by centrist European parties, especially in Italy. So this is an important statement, as he is still an influential political leader. It is also a sign that the anti-euro campaign by Beppe Grillo is having an effect.)

The vicious euro circle keeps turning

Why are investors still so gloomy about Spain?

Stephanie Flanders, BBc 12 June 2012

The core of the problem for Spain - reflected very clearly in the market movements of the past few days - is economic growth. In Italy, too - worries about the state of the economy helped push up the Italian government's cost of borrowing at the start of the week.

An extended period of economic depression and fiscal austerity can trash the balance sheet of the healthiest bank. As the IMF pointed out so helpfully in their recent assessment of Spain's financial sector

Different countries have been hit by the close, mutually destructive relationship between banks and their sovereign governments.

In Spain, as in Ireland, it is the debts of the banks that have fundamentally weakened the government's balance sheet.

In Greece, Portugal and to some extent Italy, the debt problems have largely spread in the other direction - from the government to the banks.

Either way, it's been a toxic mix.

Om man har en sedelpress går man inte i konkurs

Rolf Englund 4 november 2011

Euro Crisis Deepens

Italy Struggles to Break Out of Downward Spiral

Der Spiegel 13 June 2012

After Spain, the focus of the euro crisis has now shifted to Italy, which is struggling with a shrinking economy and rising bond yields.

Prime Minister Mario Monti has denied that his country will ask for an EU bailout, but optimism about Italy's future is in short supply.

The world is uncomfortably close to a 1931 moment

Italy must guarantee 22pc of the bail-out funds, even though it cannot raise money itself at a sustainable rate.

You could hardly design a surer way to pull Italy into the fire.

Ambrose Evans-Pritchard, 10 Jun 2012

The survival of the eurozone now depends on Italy and Spain.

They are the countries that are too big to fail – or to rescue.