Canada’s DBRS has confirmed Portugal’s only investment-grade sovereign rating,

ensures the country will still benefit from quantitative easing bond-buying by ECB

FT 29 April 2016

Full text

About DBRS

Portugal - The Euro's Next Existential Crisis

Mark Gilbert, Bloomberg 25 April 2016

So long as at least one of the four rating agencies judges Portugal to be worthy, its government debt remains eligible to participate in the ECB's bond-buying program.

But if the country drops to sub-investment grade at all four, the ECB’s own rules forbid it from buying any more Portuguese government securities - purchases which have ballooned to almost 15 billion euros ($17 billion) in the program's one-year lifetime.

So if Dominion Bond Rating Service DBRS lowers the nation’s grade - a distinct possibility, given the weakness of the Portuguese economy and the fact that the judgments of three other assayers of creditworthiness are all worse than DBRS’s - it could trigger a renewed crisis in the euro area.

DBRS affirmed Portugal's investment-grade rank in February, but with some important caveats:

"The high level of government debt remains a major challenge, exposing the country to shocks. Growth prospects remain modest, posing a risk to the sustained improvement in public finances.

DBRS would be concerned if durable growth fails to materialize."

Portugal's annual economic growth rate slowed to 1.3 percent in the final quarter of 2015,

down from 1.4 percent in the third quarter and 1.5 percent in the second.

Full text

Portugal at Englund blog

Top of page

The bailout of Banco Internacional de Funchal (Banif),

a small Madeira-based lender that has blown a big hole in Portugal’s public finances,

has revealed the fragility of the unprecedented leftwing alliance that brought Mr Costa to power

after an inconclusive general election.

Financial Times 27 December 2015

It has also exposed the scale of the problems still facing the financial sector in Portugal, where, in contrast to Ireland and Spain,

high levels of public and private debt, not troubled banks, had been seen as the main reason for the €78bn international bailout programme the country left last year.

Full text

Top of page

News

President Silva reappointed Pedro Passos Coelho as prime minister three weeks after his centre-right alliance

(PAF) emerged from a general election as the largest political force but lost its outright majority.

Financial Times 23 October 2015

The fallout from Portugal’s election has raised concerns among fiscally-conservative eurozone leaders that moderate centre-left parties could also ally themselves to anti-austerity groups in upcoming elections in Spain and Ireland.

Comparing the BE to Spain’s Podemos movement, Mariano Rajoy, the Spanish prime minister whose conservative Popular party faces a tough general election in December,

condemned “parties that oppose the euro and EU rules” at a Madrid meeting of the centre-right European People’s Party (PPP) on Thursday.

Full text

News

Portugal has entered dangerous political waters.

For the first time since the creation of Europe’s monetary union, a member state has taken the explicit step of forbidding eurosceptic parties from taking office on the grounds of national interest.

Anibal Cavaco Silva, Portugal’s constitutional president, has refused to appoint a Left-wing coalition government even though it secured an absolute majority in the Portuguese parliament and won a mandate to smash the austerity regime bequeathed by the EU-IMF Troika.

Ambrose Evans-Pritchard 23 Oct 2015

There can be no fresh elections until the second half of next year under Portugal’s constitution, risking almost a year of paralysis that puts the country on a collision course with Brussels and ultimately threatens to reignite the country’s debt crisis.

The bond market has reacted calmly to events in Lisbon but it is no longer a sensitive gauge now that the European Central Bank is mopping up Portuguese debt under quantitative easing.

Full text

Top of page

News

Bailout time? Portugal braces for the worst

CNBC Friday, 1 Aug 2014

Bill Blain, a senior fixed income strategist at Mint Partners believes that a state bailout of BES would convince him that "too-big-to-fail" lives on,

adding that the whole issue of the unholy incestuous relationship between states and banking would reignite.

Full text

Portugal is the EU country hit hardest by a Europe-wide demographic problem

as falling fertility rates and ageing populations threaten economic growth and the provision of pension, public health and elderly care services.

FT 12 August 2015

The looming crisis, described in one newspaper editorial as “a perfect demographic storm”, results from a combination of Portugal’s plummeting birth rate, a deep recession and a wave of emigration that is fast turning the country into a society of one-child families.

Full text

Top of page

News

Opinion: Forget Greece, Portugal is the eurozone’s next crisis

The elections later this year may well trigger the second Portuguese crisis

— and that will reveal how the problems in Europe involve far more than just Greece.

MarketWatch June 24, 2015

Full text

Top of page

News

The Economist 16 February 2015

Full text

Portugal

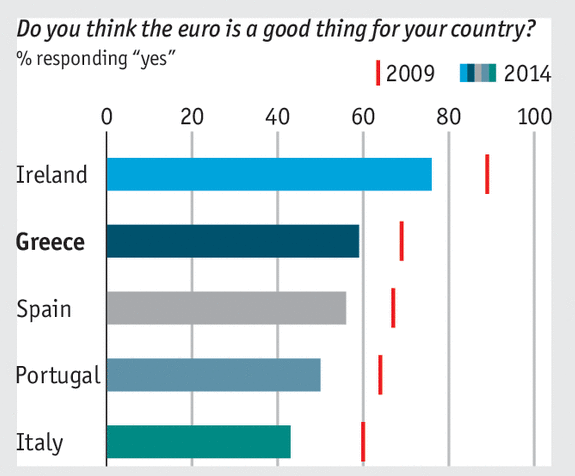

Syriza has won a general election in Greece and radical leftwing movements could soon be voted into power in Spain and Ireland,

but in another crisis-hit eurozone country it remains business as usual for the political establishment.

FT February 2, 2015

Despite a punishing three-year bailout and a deep recession,

almost 80 per cent of voters in Portugal plan to back the country’s four traditional parties in a general election scheduled for the autumn

Full text

Portugal Pós-Troika??? respektive Economic Democracy? In Europe?

Ett kort referat av boken presenteras här med tonvikt på de Vylders bidrag.

En intervju på engelska med bokens redaktör Soifer kan läsas här.

de Vylders slutsats är dyster:

i en valutaunion som EMU, då länderna utvecklas i olika takt och då hela anpassningsbördan faller på länder med urholkad internationell konkurrenskraft,

måste antingen den gemensamma valutan eller den politiska demokratin förr eller senare ge vika.

Full text hos Forum för EU-Debatt

Stefan de Vylder

Freden

78 miljarder euro - 650 miljarder kronor. Det har Portugal fått i lån av EU, med benämningen bail-out.

Kan någon tro attl Portugal kommer att kunna betala tillbaka 650 miljarder kr?

Det är i alla fall det antagande som EU:s hela skuldkrishantering bygger på.

Euron är ett misstag av historiska proportioner.

Historiens dom över de ansvariga kommer att bli hård.

Det är därför de ansvariga vägrar sätta stopp för detta fullskaliga försök.

Rolf Englund 15 april 2013

Banco Espirito Santo: The Angolan Story

If you thought what I described in my recent pieces on Bulgaria was corruption, just read this.....

it makes Bulgaria look like the Garden of Eden.

Honestly, I was shocked. What was supposed to be a post about the failure of the Angolan arm of BES

turned into a post about the systematic looting of Angola by its corrupt political elite.

Coppola Comment 10 August 2014

Full text

Recent comments about the accession of Eastern European states and the preoccupation with low paid jobs

shows an astonishing naivety what Bulgaria is really about.

New Economist, 22/8 2006

Top of page

Espírito Santo Saga Entangles Swiss Company

Eurofin Employed Espírito Santo Auditor, Helped Structure Its Debt

WSJ 4 August 2014

Full text

More

EU leaders are fond of saying that there should be no more taxpayer-funded rescues.

Yet in the case of BES, they agreed to bail out depositors and senior bondholders all the same.

Which raises a question: do regulators want to end bailouts or not?

I fear that many of them still quietly subscribe to the view that bailouts are inevitable.

Sheila Bair,chairman of the Federal Deposit Insurance Corporation from 2006 to 2011, FT 7 August 2014

Sex miljarder 513 miljoner kr

Credit Agricole said it took a 708 million euro ($950 million) hit related to its stake in troubled Banco Espirito Santo (BES)

that nearly wiped out the third-biggest French listed bank's second-quarter net profit.

Reuters 5 August 2014

Full text

The Portuguese authorities could have been tougher.

While European legislation mandating haircuts on large deposits and senior debt does not become law until January 2016,

it has already been agreed.

FT Editorial August 4, 2014

Traumatised by the way Lehman Brothers’ collapse almost brought down the financial system,

the European authorities concluded back then that every bank was systemically significant and none could be allowed to fail.

This led to the egregious /Outrageously bad; shocking/ mistake of making Irish taxpayers bail out German, French and UK investors

in private Irish banks

Full text

Banco Espírito Santo has been split into “good” and “bad” banks as part of a €4.9bn rescue

that protects taxpayers and senior creditors but leaves shareholders and junior bondholders holding only toxic assets.

FT 4 August 2014

Full text

How to rip off a country, Espirito Santo style

Coppola Comment, 3 AUGUST 2014

Shares of Banco Espírito Santo slid 38 per cent on Thursday after Portugal’s central bank ordered the bank to raise fresh capital

and said former board members could face legal consequences for “harmful management”.

FT July 31, 2014

Bank of Portugal said BES’s compliance with minimum capital requirements had been compromised by “seriously damaging” acts of management that were in clear contravention of central bank rules

Full text

Banco Espírito Santo, Portugal’s largest listed lender by assets,

has posted a first-half net loss of € 3.58 bn (33 miljarder kr)

FT 30 July 2014

The Bank of Portugal has said private investors are prepared to inject fresh capital into the bank.

Full text

Top of page

Espirito Santo International files for creditor protection

Holding company of Portugal's second-largest bank says it can't meet its obligations

Telegraph 18 July 2014

Full text

Lite anledning till oro kanske det finns i alla fall

Portugal’s central bank has ordered the immediate appointment of a new chief executive and other board members at Banco Espírito Santo.

The move accelerates replacement of executives from the troubled Espírito Santo family group, BES’s biggest shareholder,

with an independent management team that has no connections with Espírito Santo or the current board.

FT 14 July 2014

Full text

Det finns ingen anledning till oro

The /Portugese/ central bank said investors had "no reason to doubt" the security of funds,

and savers had "no need to be worried".

BBC 11 July 2014

Full text

MarketWatch 10 July 2014

Fears over the health of one of Portugal’s biggest banks triggered a sell-off in Europe’s stock markets on Thursday

and sent Lisbon’s borrowing costs sharply higher

Shares in Banco Espírito Santo plunged more than 17 per cent before Portugal’s stock market regulator, the CMVM, suspended trading

FT 10 July 2014

Full text

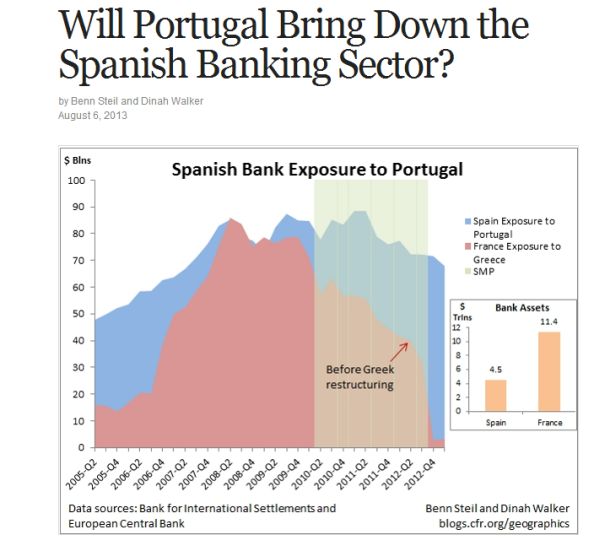

Will Portugal Bring Down the Spanish Banking Sector?

Spanish bank exposure to Portugal today is higher than French bank exposure to Greece in early 2010.

France’s exposure to Greece totaled $86 billion.

Geo-Graphics, Council on Foreign Relations, 6 August 2013

Top of page

Nu ser det ut som att krisen i Portugal är på väg att blossa upp på nytt.

Åtstramningspolitiken har inte framkallat den utlovade läkningen av ekonomin

DN, Signerat Carl Johan von Seth, 4 juli 2013

Väljarna i Portugal har än så länge haft tålamod med den drakoniska krispolitiken.

I takt med att man ifrågasätter det ekonomiskt förståndiga i politiken, blir ytterligare åtstramningar knappast genomförbara.

Full text

Dagens Nyheter

Spain's sovereign risk premium rises sharply to above 310bp

as Portugal's increases by 200bp to over 800bp;

Joana Gorjão Henriques of the Guardian says Portugal, like Italy and Greece, live in troikaland,

where the prime minister does not matter;

Top of page

In Portugal, the Euro Debate was fired by a book "Why We Should Leave the Euro"

released last month and immediately topping the bestseller list,

overtaking several diet books and even the popular erotic novel "Fifty Shades of Grey", notes the Wall Street Journal.

Eurointelligence, 30 May 2013

It started the debate of whether the real problem is only the austerity or the eurozone itself.

Public lectures, TV debates, newspaper columns and some politicians are starting to explore a question whether the country has a realistic path to recovery inside the eurozone

or whether a euro-exit and devaluation is required.

Whether the debate gains traction depends on how fast the economy is to recover, according to analysts. Portugal's government insists the long-awaited recovery will arrive in 2014, but many economists doubt that. If the recession continues, politicians will need to enact even more budget cuts to meet EU deficit targets.

Wall Street Journal

“Porque Debemos Sair do Euro” (Why We Should Leave The Euro) – is written by Professor João Ferreira do Amaral

from the Insituto Superior de Economia e Gestão (ISEG).

The new book makes a poignant parallel with Portugal’s subjugation by Phillip II of Spain,

and its travails as a captive province of the Spanish Empire for 60 years.

“In 1581 Portugal surrendered to Spain.

In 1992 it laid itself at the feet of a European Commission increasingly answering to Germany’s tune.

There was no referendum, the voters were never consulted.

The Portuguese elites, who hoped to benefit richly from European Structural Funds,

cavalierly handed over our currency – and with it our monetary sovereignty.

The rest is history.”

The professor has already secured the backing of Luís António Noronha Nascimento, the chief justice of Portugal’s Supreme Court.

This follows the apostasy of Jerónimo de Sousa, the Secretary-General of the Portuguese Communist Party,

who has called for a referendum on both the euro and the EU.

De Sousa says the EU is “unreformable”, has been hijacked by a “directorate” of dominant powers,

and has led to the death of Portuguese sovereignty.

Portugal’s combined (non-financial) public and private debt has hit 370pc of GDP, the highest in the world after Japan.

The difference is that Japan remains a fully sovereign nation with a sovereign central bank and currency,

and can therefore do something about it.

Ambrose Evans-Pritchard, May 28th, 2013

Full text

RE: Japan har en egen sedelpress

Top of page

Germany is not to blame for unpopular reforms;

these are necessary for economic survival in a single currency that eliminates the options of independent monetary policy and currency devaluation.

The critics are more on target over Germany’s excessive insistence on austerity.

The Economist print 13 April 2013

Greece, Italy, Spain and most recently Portugal (see article) do belatedly have scope to slow the pace of deficit-cutting, but it took German and other creditors too long to give them a bit more leeway.

Full text

Tyskland

Top of page

Mr. Soares called for all of the opposition parties in Portugal to "bring down" the government.

He also said that Portugal will "never be able to pay its debts however much it impoverishes itself.

If you can't pay, the only solution is not to pay."

Pretty strong words for this elder statesman!

Mark J. Grant, via zerohedge, April 15th 2013

Specifically he said, "In its eagerness to do the bidding of Senhora Merkel, they have sold everything and ruined this country. In two years this government has destroyed Portugal. We absolutely have to end this austerity."

Mário Alberto Nobre Lopes Soares is a Portuguese politician who served as Prime Minister of Portugal from 1976 to 1978 and from 1983 to 1985. He was then the President of the Republic from 1986 to 1996. He is a senior and well respected statesman and hardly a voice of either the radical left or right.

Full text

Soares och jag synes ha kommit till samma slutsats, oberoende av varandra.

Kejsaren är naken

78 miljarder euro - 650 miljarder kronor. Det har Portugal fått i lån av EU, med benämningen bail-out.

Kan någon tro attl Portugal kommer att kunna betala tillbaka 650 miljarder kr?

Det är i alla fall det antagande som EU:s hela skuldkrishantering bygger på.

Euron är ett misstag av historiska proportioner.

Historiens dom över de ansvariga kommer att bli hård.

Det är därför de ansvariga vägrar sätta stopp för detta fullskaliga försök.

Rolf Englund 15 april 2013

Portugal is in a deeper hole after its €78bn bail-out than it was before.

Public debt will reach 124pc of GDP this year. The "financing burden" will keep rising until 2017.

Which raises the question, what will Germany and the northern creditor states do if/when it becomes undeniable that Portugal need a second rescue?

Ambrose April 12th, 2013

They have given a solemn pledge (another one) that there will be no repeat of the `PSI' private haircut on sovereign debt that is deemed to have been a disaster in Greece. So they have three choices:

a) They violate their pledge and impose a Greek-style debt restructuring, destroying bond market confidence and risking contagion to Spain and Italy.

b) They take the money from Portuguese bank accounts, regardless of whether the banks have done anything wrong.

c) They pay for it themselves and acknowledge to their parliaments at long last that it costs real taxpayer money to hold EMU together.

I suppose there are other possibilities. They could try to bully the ECB into buying debt, but there are obvious limits to this. Germany's Jorg Asmussen has to agree.

Full text

EU finance ministers agreeing to give Portugal and Ireland up to seven more years to pay back their bailout loans

The decision is contingent on Portugal finding new ways to hit its bailout budget targets,

which were blown off course after the country’s constitutional court struck down several austerity measures.

FT 12 April 2013

Full text

Leaked eurogroup paper:

trouble ahead for Portugal?

Brussels blog FT April 11, 2013

As this chart from the IMF’s most recent report on the Portuguese bailout shows,

repaying EU and IMF bailout loans is a significant burden in 2016, so shifting some of those repayments to the future will help a bit.

But charts accompanying the new document show that even with the 7-year extension,

it won’t have much effect on 2014 and 2015 and borrowing needs will still be above the €12bn threshold in 2016 and 2017

Full text

Kommentar av Rolf Englund:

Nu har Irland och Portugal fått sju år till på sig att betala tilbaka de lån de fått av EU.

Trodde EU-ledarna att lånen kunde ha betalats tillbaka i den tid som överenskoms när lånen lämnades, var de inkompetenta.

Om de förstod att lånen inte skulle kunna betalas tillbaka i den tid som överenskoms när lånen lämnades, var de lögnare som förde sina folk bakom ljuset.

Top of page

Draghi calls Schäuble a lawyer

At last week’s Ecofin, Schauble said, what he had reported before, that in his view, Cyprus was not systemically relevant

(which means that Germany could not legally participate in an ESM programme, as systemic relevance is a legal pre-condition under the German ESM law).

Draghi also warned that a default of Cyprus would also impede Ireland’s and Portugal’s return to the market

Eurointelligence 28 January 2013

“There are signs aplenty of adjustment fatigue,”IMF said.

“With unemployment high and real disposable incomes falling for several quarters in a row already,

the announcement of further austerity measures to underpin the 2013 budget is testing the broad-based political and

social consensus that has buttressed the program to date.”

Bloomberg, Oct 25, 2012

Full text

The tipping point

How much austerity is too much?

Portugal - cautionary example of the dangers facing governments which attempt to push austerity beyond the tolerance of long-suffering voters.

The Economist print Sep 22nd 2012

A fortnight is a long time in the euro crisis. In two short weeks Portugal has gone from being a model pupil, praised in Brussels and Frankfurt for steadfastly pressing ahead with a reform programme tied to a €78 billion ($101 billion) bail-out to a cautionary example of the dangers facing governments which attempt to push austerity beyond the tolerance of long-suffering voters.

Full text

Interndevalvering (Ådals-metoden)

Top of page

OECD

Portugal runs the risk of failing to meet its fiscal targets this year

as constraints on bank lending and weak international demand deepen the country’s recession

Lisbon would face “additional challenges to regain full market access”

when its international bailout programme ended in 2013

Financial Times 26 July 2012

Full text

Grekland, Portugal och Spanien hör inte hemma i eurosamarbetet.

Men mycket prestige har investerats i projektet och man kommer säkert att försöka hålla dem under armarna så länge det går.

Magnus Henrekson, professor nationalekonomi SvD Näringsliv 27 juli 2011

Portugal has until about June – just two months from now – to convince the financial markets

Portugal must find 9.7 bn euros to pay off a bond that comes due in September 2013.

Peter Spiegel, Financial Times, April 19, 2012

IMF rules prevent it from granting any new aid when a financing hole emerges over the course of the next 12 months

So if Portugal needs to go back to the financial markets in September 2013, that means it must be able to show the IMF such a plan is realistic 12 months in advance – or September 2012. And if a second bailout is to be organised, negotiations over what that package will look like will probably have to begin two or three months before that.

Which means Portugal has until about June – just two months from now – to convince the financial markets it is worthy.

Full text

Why Portugal May Be the Next Greece

The worst is over for the euro zone, the experts say.

But Greece isn't really fixed and

Portugal could become a second big problem before year-end

TIME March 27, 2012

Read more

Yes, Mussolini pulled off a 20pc cut in wages in the late 1920s.

How can a democracy bring about such cuts in private sector wages without use of police coercion?

Portugal, Italy, and Spain need an "internal devaluation" of around 20pc

to claw back competitiveness within EMU. This means draconian wage cuts for year after year.

Ambrose Evans-Pritchard, 5 April 2012

El-Erian's claim that Portugal has already lost the battle against the crisis is exaggerated.

The troika's bailout package is expected to keep the country going until September 2013 or so.

Der Spiegel 23 March 2012

That gives Portugal about one-and-a-half years to win back the financial markets' trust and wrestle interest rates on its government bonds back down to a level where the country can once again finance itself on the markets. Experts believe success is absolutely possible.

"There is hope that Portugal will be able to finance itself again by the end of 2013," says Francesco Franco, an economics professor at the Universidade Nova in Lisbon.

Full text

Bond fund giant PIMCO's chief executive said he expected Portugal to be the next euro zone country to falter, according to an interview in German weekly Der Spiegel.

El-Erian, also co-chief investment officer of PIMCO, said he expected Portugal's first bail-out package will be insufficient, prompting it to ask the EU and IMF for more money.

"Then there will be a big debate about how to split the burden between the EU, creditors, the IMF and the European Central Bank.

And then financial markets will become nervous because they are worried about private sector participation,"

Reuters 19 March 2012

Full text

Grece to exit euro and Portugal likely to be the next to restructure

Nouriel Roubini, CNBC 9 March 2012

With Greek unemployment at 22 percent and half the nation's youth unemployed, "the contractions are becoming severe. The country is still insolvent."

He goes so far as to predict that Greece "will be the first country to exit the euro zone, not this year, maybe later next year."

Full text

Greece

Top of page

Last month the European Central Bank exercised its droit du seigneur, exempting itself from loses on Greek bonds.

The instant effect was to concentrate more loss on other bondholders.

"It does not matter how often the EU authorities repeat that Greece is a 'one-off' case, nobody in the markets believes them."

Ambrose Evans-Pritchard, 8 March 2012

The ECB holds €220bn of Greek, Portuguese, Irish, Spanish, and Italian bonds. Its handling of Greece implicitly subordinates private creditors in each country.

This might not matter too much if Greece were really a "one-off" case but markets are afraid that Portugal will tip into the same downward spiral as austerity starts to bite.

Citigroup expects the economy to contract by 5.7pc this year, warning that bondholders may face a 50pc haircut by the end of the year.

Portugal's €78bn loan package from the EU-IMF Troika is already large enough to crowd out private creditors, reducing them to ever more junior status.

Full text

Top of page

Grekland är ett sorgligt särfall

DN huvudledare, 29 januari 2012

ECB har lånat ut 529,5 miljarder euro, motsvarande 4.670 miljarder kronor, till 800 banker.

Ungefär samtidigt steg Portugals marknadsräntor på löptider från tre år och med mellan 80 och 100 punkter.

Tioårsräntan hade strax efter 14-tiden stigit till 13,45 procent. Det är den högsta nivån på nästan en månad.

Viktor Munkhammar, DI 29 februari 2012

Full text

Fiscal irresponsibility; Greece, but nobody else.

Italy ran deficits in the years before the crisis, but they were only slightly larger than Germany’s

(Italy’s large debt is a legacy from irresponsible policies many years ago).

Portugal’s deficits were significantly smaller, while Spain and Ireland actually ran surpluses

Paul Krugman, New York Times, February 26, 2012

"events have a habit of demolishing dreams" - Portugal, internal devaluation

Greece’s unemployment bomb has detonated.

Ambrose Evans-Pritchard, 19 Feb 2012

Is Portugal Next?

EU passed a €78 billion bailout package for Portugal last May to help the country stay afloat

until it could return to the international financial markets by the end of 2013.

That deadline, though, has looked increasingly untenable in recent weeks

Der Spiegel 10/2 2012

In a video clip apparently made without his knowledge at the meeting of euro-zone finance ministers, German Finance Minister Wolfgang Schäuble told his Portuguese counterpart Vitor Gaspar that Berlin would be willing to make adjustments to the Portugal bailout package.

Schäuble made clear that the Portuguese aid package could only be revisited once a "substantial decision on Greece" is made and with the support of the German parliament.

The German Finance Ministry has declined comment.

Gaspar told Portuguese reporters that Lisbon is not currently seeking an adjustment to the bailout package.

The European Union passed a €78 billion bailout package for Portugal last May to help the country stay afloat until it could return to the international financial markets by the end of 2013.

That deadline, though, has looked increasingly untenable in recent weeks as yields on 10-year Portuguese sovereign bonds exploded to over 17 percent in January before falling back to their current levels of around 13.5 percent.

Anything over 7 percent is considered to be unsustainable in the long term.

Full text

De spanska bankernas osäkra fordringar,

som i huvudsak består av lån till den kollapsade fastighets- och byggnadssektorn,

Spanska banker har ingen stor utlåning till Grekland, men däremot till Portugal

uppgår till 7,6 % av bankernas tillgångar. En fördubbling sedan år 2008

Ekot 17 februari 2012

Men det kanske blir så att de spanska bankerna,

med stora lån till Portugal, går under när Portugal gör det

Rolf Englund blog 26 januari 2012

Top of page

Voluntary

Why might Germany prefer a defaulted Greece to a rescued Greece?

The trouble with the PSI is that it may set off a wave of similar demands from deeply indebted countries.

If Greece can have its outstanding debt reduced, why shouldn’t other countries also get this treatment?

John Carney, Senior Editor, CNBC.com 14 Feb 2012

“The Irish are asking that question already, and I'm sure the Portuguese and Spanish will soon be asking the same thing,” writes former investment adviser Marshall Auerback at the website New Economic Perspectives.

He speculated that Germany might continue to demand ever more austerity in return for aid, declaring every possible agreement reached in Greece as unsatisfactory. Eventually, the Greek government would find itself unable or unwilling to make further budget cuts.

“In this way, Germany could force a Greek default without ever moving off their public stance supporting a bailout,” the hedge-fund manager said

Full text

Merkel: I Won't Take Part In Pushing Greece Out Of Euro

Wall Street Journal, via Rolf Englund blog 10 Februaary 2012

Varför ska man sitta på portugisiska papper när Angela Merkel gjort klart att det är de privata långivarna som ska förlora.

Eftersom EFSM, ECB och bilaterala långivare tydligen ska hållas skadelösa blir det enbart de privata långivarna som får ta alla förluster.

Danne Nordling, 3 februari 2012

Med sådana utsikter faller priserna på obligationerna och räntan stiger.

Full text

Those who have spoken to the chancellor say

she feels duped by those investors, who urged her to agree to a restructuring of Greece’s massive debt burden

but then told the chancellor that she had also made all other eurozone bonds suspect.

Financial Times, 4 December 2011

Också portugiserna behöver nu ytterligare stöd utifrån. För dem räcker resurserna i den nuvarande tillfälliga räddningsfonden, men inte för Italien eller Spanien

Johan Schück, DN Ekonomi 3 februari 2012

Jean-Claude Juncker, head of the Euro Group:

There will be no debt haircut for Portugal.

We have always said that Greece was a special case.

Der Spiegel, 6 February 2012

There, it was necessary to have a certain participation of the private sector (in debt relief).

But, that is definitely out of the question for other countries.

Full text

Portugal - The next special case?

The country’s task is to regain wage and price competitiveness so that it can grow its way out of its debts

Amid recession, the country ran a current-account deficit of more than 8% last year

The Economist prinst 4 February 2012

Full text

Grekland är ett sorgligt särfall.

DN huvudledare, 29 januari 2012

Grekland är inget särfall, bara ett extremfall

Rolf Englund blog 5 februari 2012

En av mina bästa artiklar, tycker jag själv

More market alarm bells on Portugal

The implied interest rate rose by more than one percentage point to well over 21%

Stephanie Flanders, BBC Economics editor, 30 January 2012

European leaders some day fairly soon will have to decide whether and how to give Portugal additional support,

and come to terms with the reality that the government is unlikely to be able to go back to borrowing on the global financial markets in 2013,

as its current rescue plan assumes.

Full text

Med undantag för möjligen Grekland och Portugal, så har det stora problemet inte varit att ländernas statsfinanser utvecklats olika,

utan att olikheterna i länders privata sektorer ökat sedan harmoniseringen av penning- och finanspolitiken.

Daniel Somos. Newsmill 31 januari 2012

Portugals statsobligationer

Europaktens krav på drastiska ”pro-cykliska” besparingar

Den privata sektorn får ta på sig i stort sett hela kreditrisken.

Inga av de föreslagna åtgärderna har adresserat den underliggande orsaken till ländernas problem: den svaga konkurrenskraften

Per Lindvall, e24, 30 januari 2012

Utvecklingen för Portugals statsobligationer, där den 10-åriga obligationen har skenat och nu ligger över 15 procent, visar att problemen är långt ifrån lösta.

Många av de åtgärder som ligger i stöpsleven kan förvärra läget. Det gäller exempelvis den så kallade europaktens krav på drastiska ”pro-cykliska” besparingar och det alltmer tydliga förhållandet att ”officiella” nödfinansiärerna, ECB, EU samt räddningsfonderna EFSF och ESM ska ha en prioriterad ställning framför de privata obligationsköparna.

Det senare innebär att den privata sektorn får ta på sig i stort sett hela kreditrisken. Det gör att det riktigt frivilliga privata intresset för att ta på sig risk är mycket lågt och kan försvinna helt när stämningsläget försämras.

En annan kanske viktigare brist är att inga av de föreslagna åtgärderna på ett rakt och trovärdigt sätt har adresserat den underliggande orsaken till ländernas problem: den svaga konkurrenskraften och den höga externa nettoskulden. För utan en bättre konkurrenskraft, och därmed förstärkt exportsektor som kan finansiera räntor och även amorteringar på denna skuld, så är riskerna för betalningsinställelse och behoven av skuldavskrivningar fortsatt mycket stora.

Full text

Början på sidan

Inställer Grekland betalningarna måste eurozonen agera blixtsnabbt för att visa att den inte låter Portugal gå samma väg.

Grekland omtalas alltmer sällan som ett specialfall skriver

Timothy Garton Ash, kolumn, DN.27 januari 2012

Forget Greece; it’s Portugal that’ll destroy euro

Commentary: One default is an accident; two is a systemic crisis

MarketWatch Jan. 25, 2012

It is a long-time since Portugal played a decisive role in world history. The Treaty of Tordesillas, which divided the non-European world up between Spain and Portugal in 1494, was probably its last major contribution, and even that did not end very happily.

But 2012 could be the year Portugal explodes onto the world stage again.

How? By blowing up the eur

Greece is already bust — and its default is already priced into the market. But Portugal is in precisely the same position, just on a longer fuse.

It too is sliding toward an inevitable default on its debts — and when it does so, it will deliver a terminal political blow to the single currency, and inflict damage on the European banking system that may well prove catastrophic.

Full text

Kommentar på Rolf Englund blog

Top of page

S&P’s downgrade of Portuguese sovereign bonds to junk status has forced many funds to offload bonds.

With S&P’s decision, all rating agencies now rank Portugal as below investment grade.

Portuguese 10-year spreads have risen to over 13% - about 3pp up from last week.

Eurointelligence, 18 January 2012

Eurointelligence

Europe’s crisis is all about the north-south split

Anticipating the euro, drachma-denominated 10-year sovereign bonds fell more than 450 basis points

relative to German Bund rates in the three years leading up to Greece’s adoption of the euro in 2001.

Likewise, Portugal and Italy

Alan Greenspan, FT October 6, 2011

Portugisiska och grekiska bönder vill helt enkelt inte att nogräknade tyskar och svenskar i demokratisk ordning reformerar, det vill säga lägger ned, deras jordbruk.

Carl Hamilton i Aftonbladet 1999-06-10

Jag vill understryka att detta inte på något vis kan sägas vara någon ensidigt portugisisk lättsinnighet.

Kreditgivarna – främst tyska och franska banker – var lika glada att få låna ut som portugiserna var att få låna.

Klas Eklund i SEB-rapport 27 maj 2011

Full text

A day after Portugal formally requested aid from the European Union to help ease ongoing debt problems,

Madrid on Friday insisted that it was "out of the question" that Spain would be next.

German commentators aren't so sure, and say that it's time for European leaders to reveal the true extent of the problems.

Der Spiegel 8/4 2011

Waiving the rules for Portugal

Desmond Lachman, FT April 7, 2011

In the colonies it used to be said of Britain that Britannia did not rule the waves as much as it waived the rules.

If the European Union now accedes to Portuguese prime minister José Sócrates’ request last night for emergency funding to tide Portugal over until after its June 5 election, it will demonstrate that the European Commission is offering the Britannia of old some serious competition in the realm of disregarding its own rules.

Last year, under the threat of impending damage to the European banking system from potential debt defaults in the periphery, the EU effectively abandoned the “no bailout” clause of the Lisbon Treaty.

Full text

Portugal will follow Greece and Ireland to failure

IMF and EU appear set to do so by prescribing for Portugal the same failed policy approach of savage fiscal retrenchment in the most rigid of fixed exchange rate systems that has had such dismal results to date in Greece and Ireland.

Desmond Lachman,FT March 31 2011

Top of page

Drawing a line in the Iberian sand

Financial Times editorial, April 7, 2011

It would have been better for Lisbon to tough it out in the markets for a few more months. Having to pay even several percentage points more to refinance the €12bn due between April and June makes little difference to the €144bn debt outstanding.

Full text

Top of page

It may have been inevitable, but it was a sad moment for Portugal:

Europe’s oldest nation state brought low

This newspaper has repeatedly argued that

the debts of Greece, Ireland and Portugal are unpayable and must be restructured

The Economist print Apr 7th 2011

Full text

EMU bollar Gris med Europa

Rolf Englund blog 7/4 2011

Portugal ger upp, ber om krislån

DN/TT 2011-04-06

Det finansiella läget för Portugal är nu så pressat att landet inte klarar sig utan den typ av stödpaket som Irland och Grekland fick av EU och IMF i fjol.

Full text

Mr Socrates did not say how much aid Portugal would ask for.

BBC's business editor Robert Peston said rescue loans could amount to as much as 80bn euros ($115bn; 725 miljarder kr).

Top of page

Portugal will follow Greece and Ireland to failure

IMF and EU appear set to do so by prescribing for Portugal the same failed policy approach of savage fiscal retrenchment in the most rigid of fixed exchange rate systems that has had such dismal results to date in Greece and Ireland.

Desmond Lachman,FT March 31 2011

One has to wonder how much deeper the economic recessions in Greece, Ireland, and Portugal will have to become for the IMF and the EU to recognize that the countries in the periphery suffer from solvency rather than liquidity problems, that are not amenable to correction by fiscal retrenchment alone in a fixed exchange rate system.

The risk is that, before they do, the electorates in Greece, Ireland, and Portugal will revolt against seemingly endless economic hardship to which they are being subjected for the sake of keeping them current on their debt obligations to foreign financial institutions.

The writer is resident fellow at the American Enterprise Institute

Full text

More by Desmond Lachman at nejtillemu.com

Top of page

Standard & Poor’s downgrading of Portugal’s sovereign debt made clear that the primary cause

was the concluding statement of the European Council meeting of March 24-25.

Jeremy Warner, Daily Telegraph March 29th, 2011

This is what the European Council said after its meeting last weekend:

"If, on the basis of a sustainability analysis, it is concluded that a macro-economic programme cannot realistically restore the public debt to a sustainable path, the beneficiary Member State will be required to engage in active negotiations in good faith with its creditors to secure their direct involvement in restoring debt sustainability."

So that’s it. Greece, Portugal and Ireland are all heading for a big debt restructuring, which means that private investors are going to have to bear the costs of a considerable part of the fiscal adjustment. It’s what bond markets have been saying for more than a year now, and of course it is what the political left has been demanding too.

Full text

Top of page

The total exposure of foreign banks to the struggling quartet of

Greece, Ireland, Portugal and Spain tops $2.5 trillion

once all forms or risk are included, according to the latest data from BIS

Ambrose Evans-Pritchard 14 Mar 2011

Portuguese debt yields soared to new records. The 10y bond hit 7.9%

El Pais writes that even the ECB, which returned to secondary markets after three weeks of absence to buy €432m in government debt last week, could not halt this.

Portugal needs to repay or rollover €4.3bn of bonds maturing on April 15

and another €4.9bn in June

Eurointelligence 29/3 2011

Though unconfirmed, only substantial liquidity support from the European Central Bank is keeping the financial systems and, indirectly, the governments of peripheral states such as Ireland, Portugal and Greece alive,

their banks often acting as conduits to supply funds for nations effectively locked out of private capital markets

The Independent 1 April 2011

Full text

For some time, Portugal's government has been borrowing from its banks by selling them bonds, which in turn have been swapping the bonds for cash from the ECB (see my earlier notes on this).

And the ECB has also been endeavouring to put a floor under the price of Portuguese bonds, by buying them in the secondary market.

Robert Peston, the BBC's business editor, 24 March 2011

Top of page

William White, chairman of the Organization for Economic Cooperation and Development's Economic and Development Review Committee,

talks about Portugal's debt and budget and the outlook for a possible international rescue.

Bloomberg March 24 2011

William White, until recently economic adviser to the Bank for International Settlements

He has resisted heroically the temptation to say: “I told you so.”

To cover Portugal’s deficit and bond repayments for three years,

the bail-out would have to be between €60bn and €70bn.

Open Europe 24/3 2011

Full text

Portugal PM Socrates' resignation overshadows EU summit

BBC 24 March 2011

Pressure on Portugal's economy intensified on Thursday as the interest rate on the country's 10-year bonds climbed to a new high of 7.91%.

Portugal faces bond repayments of 4.3bn euros on 15 April

Full text

Abril en Portugal - Julio Iglesias

Youtube

Skuldkrisen i EMU är av allt att döma på väg in i ännu en kritisk fas.

Det stora orosmolnet är inte Portugal utan Spanien.

Viktor Munkhammar, DI 24/3 2011

Upptakten till helgens EU-toppmöte kunde ha varit bättre.

På onsdagen avgick Portugals premiärminister José Socrates efter att regeringens senaste åtstramningspaket röstats ned i parlamentet.

Och på fredagen sänkte kreditvärderingsinstitutet Moody's betygen för 30 spanska banker.

Tanken var att helgens EU-toppmöte skulle innebära ett slut på den improviserade brandsläckning som hittills präglat EMU:s hantering av skuldkrisen. I stället skulle eurozonen börja blicka framåt och ta itu med grundläggande problem som bristande konkurrenskraft.

Tyvärr verkar det som att det blir brandsläckning igen. Men med tanke på hur lågt förväntningarna har sjunkit finns potential för positiva överraskningar.

Full text

Ekot om samma Portugals regeringskris

Spanien

The opposition parties appeared to be responding to the public mood in Portugal, which had turned against the belt-tightening.

Der Spiegel 24/3 2011

The government's efforts to sort out the country's finances with tax increases and cuts in welfare spending had led to a wave of strikes. Tens of thousands of people recently held protests against precarious working conditions, unemployment and the austerity measures.

Full text

Top of page

Portugal väntas i april be om ett stödpaket från EU och IMF, rapporterar Reuters med hänvisning till källor i eurozonen.

– Det är redan en utbredd uppfattning på finansmarknaden, men nu har även EU:s finansministrar börjat inse detta, säger en källa.

DN/TT 18/2 2011

Full text

*

ECB intervened in the markets on Friday to prevent Portugal’s borrowing costs spiralling to “danger levels”

that could force Lisbon to seek international assistance.

FT February 18 2011

Full text

Portugal

Åtstramningarna som har framtvingats av marknaderna gör saken inte bättre, i alla fall inte på kort sikt. Medan länder som Tyskland och Sverige växer så det knakar väntas Portugals BNP sjunka i år,

precis som investeringarna, sysselsättningen och den offentliga och privata konsumtionen.

Hur Portugal i det läget ska klara av att sänka budgetunderskottet är för många en gåta.

Tomas Lundin, SvD Näringsliv 12/1 2011

I fredags meddelade visserligen att premiärminister Sócrates att budgetunderskottet gått ner till 7,3 procent. Men han undvek noga att berätta att regeringen plundrat halvstatliga telebolaget Portugal Telecoms pensionskassa för att klara sina utfästelser gentemot EU.

Full text

Stabiliseringspolitik

Top of page

Portugal planerar i år att låna upp 18-20 miljarder euro med nya obligationslån

Totat löper portugisiska obligationer för 9,5 miljarder euro ut 2011, varav 4,5 miljarder i april.

SEB:s ekonomer ser onsdagens försök i Portugal att ta upp obligationslån för sammanlagt 1,25 miljarder euro (cirka 11 miljarder kronor) som "ett viktigt test".

Ekot 10/1 2011

"Om den auktionen går dåligt ökar risken rejält för att Portugal inom kort måste följa Irland och söka hjälp", skriver SEB i ett marknadsbrev.

Full text

Yep, Portugal’s 10-year debt is yielding more than 7 per cent

Neil Hume FT Alphaville Jan 06 2011

Full text

Irish 10-year yields have been climbing to 9%, Greek 10-year yields to over 12%,

well into territory where investors are factoring in a non-trivial default risk.

Eurointelligence 6/1 2011

Full text

Top of page

Portugal is the next example of a country to demonstrate that austerity in the middle of a financial crisis is a sure recipe for disaster.

The mood in the bond markets is deteriorating sharply, as Portuguese, and Spanish, spreads reach new records,

amid expectation that the crisis is very certain to spill over to Portugal, and possibly even to Spain.

FT Deutschland makes the remark the Portuguese spreads are about as high now as the Greek spreads

were ahead of the rescue.

Eurointelligence 24/11 2010

Full text

Stabiliseringspolitik

Top of page

Portugal’s minority government is to unveil a tough austerity budget on Friday

amid fears that opposition parties will fail to provide the necessary support

FT October 15 2010

The 2011 budget proposals are designed to reassure financial markets that Portugal, one of the eurozone economies most vulnerable to a sovereign debt crisis, will meet its ambitious deficit-reduction targets.

But a political crisis sparked by the budget vote would destroy the positive impact on Portugal’s borrowing costs of planned austerity measures, including a 5 per cent cut in public sector pay and a pension freeze.

Full text

Top of page

Portugal

That is what happens when you cut interest rates suddenly from 16 to 3 per cent

yields back to May crisis levels when the EU faced its "Lehman moment"

Ambrose Evans-Pritchard, 19 Sep 2010

Portugal was a net foreign creditor in the mid-1990s. EMU has turned it into a net foreign debtor to the tune of 109pc of GDP. That is what happens when you cut interest rates suddenly from 16pc to 3pc.

Be that as it may, the comments struck a nerve. Yields on 10-year Portuguese debt surged to 6.15pc, back to May crisis levels when the EU faced its "Lehman moment" and launched a €750bn (£625bn) rescue blitz.

The brutal truth is that Portugal lost competitiveness on a grand scale on joining EMU and has never been able to get it back.

Convergence never came.

Full text

Top of page

The European Cental Bank's bailout package is just a $1 trillion fig leaf covering the problem and

a better move would have been to arrange for Greece and Portugal to leave the European Union

Kenneth Rogoff, professor of economics and public policy at Harvard, told CNBC Friday 14/5 2010

Help Portugal Help Greece

The real fun begins if Spain’s cost of borrowing rises above the pooled loan rate.

It has to lend €9.8 billion to Greece.

Charles Forelle, Real Time Brussels, WSJ 5/5 2010

As of a few minutes ago, the yield on a two-year Portuguese bond stood at 5.66% and the yield on a 10-year at 6.13%. Both yields are up substantially from yesterday. It now seems clear that Portugal’s cost of borrowing the €2 billion it is putting toward the Greek bailout now exceeds the interest rate Greece will pay. (We earlier detailed the rate calculations; three-year Euribor is 1.73% today, so the bailout rate is 4.73%, plus a 0.5% service charge in the first year.)

But European Commission officials say a special clause in the bailout deal prevents any country from taking a loss on its Grecian lending. So the other 14 countries will cede a small bit of their profit to Portugal.

Some back-of-the-envelope math:

If we assume Portugal’s cost of borrowing for three years is around 5.75%, it will need a subsidy of about 0.5% in the first year and 1% annually thereafter, or €50 million over three years on its €2 billion loan.

We figure Germany and the rest can afford that.

The real fun begins if Spain’s cost of borrowing rises above the pooled loan rate. It has to lend €9.8 billion to Greece.

Full text

A country such as Portugal with total debt of 300pc of GDP, a current account deficit of 11.2pc, and a budget deficit of 9.4pc should not think it has the luxury to trim spending at a leisurely pace.

Portugal has an ugly choice. If it tightens hard to soothe bond markets, it too risks depression. EMU's Faustian Pact is closing in.

Ambrose Evans-Pritchard, 25 Apr 2010

We are in the Maastricht madhouse, a currency union without a treasury, ruled by the "no bail-out" clause of Article 125 of the EU Treaties. Europe is at last paying the price for fudging the true implications of EMU 19 years ago in that Medieval city on the Maas, gambling that it would one day be able to lead Germany by the nose into a debt union.

Full text

Stabilitetspakten

Portugal's economy

The importance of not being Greece

The Economist print April 22nd 2010

Portugal is doing better than Greece. So why are markets fretting over Lisbon’s debt burden (yields on two-year bonds have risen to 4.8%)? And why have such figures as Simon Johnson, a former IMF chief economist, and Nouriel Roubini, a New York economics professor once labelled Dr Doom, said that a Greek-style crisis could infect Portugal?

One answer is that Portugal’s biggest problem is not primarily fiscal. It concerns growth—or the lack of it. Real GDP growth over the decade since Portugal joined the euro has been the slowest in the zone, despite a boom in Spain, its main trading partner.

Low growth reflects a disastrous loss of competitiveness since the country joined the euro. Portugal has lost export-market share to emerging economies (including those of eastern Europe) that churn out similar low-value products.

Full text

The Importance of Being Earnest

Wikipedia

EMU - en snabbkurs

Klicka här