News Home

|

German Constitutional Court

Former MEP Franz Ludwig Graf Stauffenberg

My father tried to kill Hitler

On 20 July 1944, a 36-year-old German army officer, Col Claus Schenk Graf von Stauffenberg,

arrived at a heavily guarded complex hidden in a forest in East Prussia. His mission was to kill Adolf Hitler.

BBC 19 July 2014

Constitutional Complaints and Organstreit Proceedings Against

the OMT Programme of the European Central Bank Unsuccessful

The Federal Constitutional Court, Press Release No. 34/2016 of 21 June 2016

If interpreted in accordance with the Court of Justice’s judgment,

the policy decision on the OMT programme does not “manifestly” exceed the competences attributed to the European Central Bank.

Moreover, if interpreted in accordance with the Court of Justice’s judgment,

the OMT programme does not present a constitutionally relevant threat to the German Bundestag’s right to decide on the budget.

Germany's Constitutional Court to hear case against ECB bond buying

Todd Buell, MarketWatch, Jan 15, 2016

The program was the result of ECB President Mario Draghi's speech

in July 2012 in which he said the ECB would do " whatever it takes" to save the euro.

The courtroom debate will come two years after the court criticized the OMT program,

but referred the case to the European Court of Justice in Luxembourg, the European Union's top court.

But the European court said in June of last year that the program was legal.

The ECB has never used the OMT

“whatever it takes” to save the euro, including purchasing “unlimited” amounts of struggling governments’ bonds

According to the German Constitutional Court, the policy violates European Union treaties – a ruling that the European Court of Justice is now reviewing.

The ECJ’s decision will have important implications for the eurozone’s future, for it will define what authority, if any, the ECB has to intervene in a debt crisis.

Gita Gopinath, Project Syndicate 3 November 2014

European Court of Justice ruled that ECB’s plan to buy government bonds in potentially unlimited quantities was legal.

FT 16 June 2015

The European Court of Justice said the ECB’s“The programme for the purchase of bonds on secondary markets

does not exceed the powers of the ECB in relation to monetary policy and does not contravene the prohibition of monetary financing in member states,”

The European Court of Justice has declared

legal supremacy over the sovereign state of Germany, and therefore of Britain, France, Denmark and Poland as well.

If the Karlsruhe accepts this, the implication is that Germany will no longer be a fully self-governing sovereign state.

"This Union" - meaning the Union to which EU integrationists aspire

- is currently blocked by the German court, the last safeguard of our nation states against encroachment.

Ambrose Evans-Pritchard, 14 Jan 2015

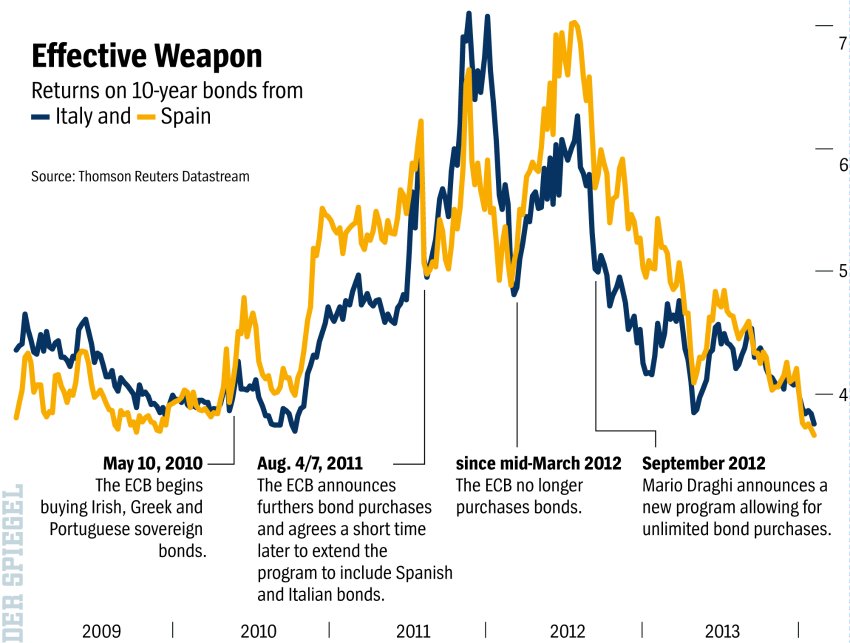

The matter at hand is whether the European Central Bank broke the law with its back-stop plan for Italian and Spanish debt (OMT) in 2012.

Germany's judges have never accepted the ECJ's outlandish claims to primacy. Their ruling on the Maastricht Treaty in 1993 warned in thunderous terms that the court reserves the right to strike down any EU law that breaches the German Grundgesetz or Basic Law.

They went further in their verdict on the Lisbon Treaty in July 2009, shooting down imperial conceits. The EU is merely a treaty club. The historic states are the “masters of the Treaties” and not the other way round.

They set limits to EU integration. Whole areas of policy “must forever remain German”. If the drift of EU affairs erodes German democracy - including the Bundestag's fiscal sovereignty - the country must “refuse further participation in the European Union”.

David Marsh, author of a book on the Bundesbank and now chairman of the Official Monetary and Financial Institutions Forum,

says the Bundesbank has been quietly seeking legal advice on whether it can block full-scale QE.

It is looking at Articles 10.3 and 32 of the ECB statutes, arguably relevant given the scale of liabilities.

Mario Draghi's efforts to save EMU have hit the Berlin Wall

If the ECB tries to press ahead with QE, Germany's central bank chief will resign.

If it does not do so, the eurozone will remain stuck in a lowflation trap and Mario Draghi will resign

Ambrose Evans-Pritchard, 5 November 2014

Deep Divisions Emerge over ECB Quantitative Easing Plans

Some view /ECB/ bond purchases as unavoidable, as the euro zone could otherwise slide into dangerous deflation

Others warn against a violation of the ECB principle, which prohibits funding government debt by printing money.

Der Spiegel, 3 November 2014

“whatever it takes” to save the euro, including purchasing “unlimited” amounts of struggling governments’ bonds

According to the German Constitutional Court, the policy violates European Union treaties – a ruling that the European Court of Justice is now reviewing.

The ECJ’s decision will have important implications for the eurozone’s future, for it will define what authority, if any, the ECB has to intervene in a debt crisis.

Gita Gopinath, Project Syndicate 3 November 2014

Borders and budgets risks provoking political crises

that could plausibly culminate in the break-up of the euro, or even the EU.

Gideon Rachman, FT October 20, 2014

Merkel has a duty to stop Draghi’s illegal fiscal meddling

The ECB is overstepping its mandate with anti-deflationary measures

Hans-Werner Sinn, FT September 29, 2014

Mr Draghi has said that, as a first step, he intends to expand the ECB’s balance sheet by €1tn.

As UBS chief executive and former Bundesbank president Axel Weber has noted, the ECB is turning into a bad bank.

Draghi only had to say "whatever it takes" to end Europe's financial crisis.

But Draghi will actually have to do whatever it takes to end Europe's economic one.

That's what he's trying to do now, but the eurocrats might not let him.

They have their rules, after all.

Matt O'Brien, Washington Post, August 27, 2014

Europe’s banking union is set to face a challenge in Germany’s constitutional court,

a development that threatens to generate renewed uncertainty over one of the main responses to the eurozone’s financial crisis.

EU’s banking union is illegal under German law because it was created without the necessary treaty changes.

FT July 27, 2014

German convictions that important political decisions should be legally unassailable – and fears that some EU decisions relating to the monetary union might not be.

“The banking union has no basis in law in the European treaties,” said Markus Kerber, a finance professor at TUB, the Berlin Technical University, who also heads Europolis, a eurosceptic think-tank.

The petition, however, also challenges the planned Single Resolution Mechanism, a common framework for dealing with failing banks, as well as the related €55bn Single Resolution Fund, to cover the costs of this process.

Ms Merkel does not say “no” to eurozone bonds. She says: “Not without treaty change.”

The German constitutional court in Karlsruhe would never allow Germany’s sovereign guarantee to be given to its eurozone partners

without them submitting to effective and centrally budgeted discipline.

Financial Times 31 May 2012

Don’t bet on EU treaty change

Hugo Dixon, Reuters, 31 March 2014

ECBs Outright Monetary Transactions (OMT)

Did the German court do Europe a favour?

ECJ will also not rubber-stamp the OMT – and, if it does, the legal victory will not resolve the fundamental dilemmas

The OMT programme was justified but the fiscal union question remains

Ashoka Mody, Bruegel, 15th July 2014

Yet the principle that there should be no bailouts is fundamental in a union of countries that share a currency but remain sovereign when it comes to public finances.

A democratic European monetary union could not have been built without respecting this principle.

It will be a long time before a fully fledged political union is established.

Fiscal transfers will remain a matter for national parliaments.

Jointly issued eurozone bonds would violate this principle and undermine democracy.

Otmar Issing, Financial Times 25 March 2014

"Is Germany's High Court Anti-European?"

Germany's Federal Constitutional Court recently has faced criticism for its rulings on the euro and European unification.

Have its justices crossed the line between jurisprudence and politics?

In their 2009 ruling on the Lisbon Treaty, the court ruled that if the EU wanted to evolve towards becoming a United States of Europe,

it would have put deeper integration up to a popular vote.

Der Spiegel 13 March 2014

In their 2009 ruling on the Lisbon Treaty, the EU legal framework that replaced the failed attempt at creating a European constitution, the justices stated that there was little wiggle room left for transferring greater powers from Berlin to Europe.

The court ruled that if the EU wanted to evolve towards becoming a United States of Europe, it would have put deeper integration up to a popular vote.

SIEPS remissvar på Lissabon

Det är inte tillfredsställande att grundlagen ger ett så vagt och otydligt besked om förutsättningarna för Sveriges medlemskap i EU.

Som lagrådet påpekade i sitt yttrande över det konstitutionella fördraget ”synes det ... väl kunna hävdas att principerna för statsskicket påverkas enligt det nya fördraget”.

Lagrådet uttalade att överlåtelserna av ”normgivningskompetens och traktatmakt är så omfattande och betydelsefulla att riksdagens ställning reellt sett urholkas i väsentlig grad”.

Läs mer här

Europeiska centralbankens (ECB) högste chef Mario Draghi

Nu har det snart gått två år sedan italienaren uttalade de numera välkända orden

”Inom ramen för vårt mandat, är ECB redo att göra allt som krävs för att rädda euron. Lita på mig, det kommer att räcka”.

Louise Andrén Meiton, SvD Näringsliv, 6 mars 2014

Can the European Central Bank legally act as lender of last resort to ensure the survival of the euro?

This question is of fundamental importance for the sustainability of the monetary union.

Recently, the German Constitutional Court ruled that it cannot.

In the court’s view the ECB has the power to conduct monetary policy,

but not to support member states in financial distress even if necessary to ensure the survival of the common currency.

Katharina Pistor, Vox, 26 February 2014

Europe or Democracy?

What German Court Ruling Means for the Euro

Either the European Court of Justice has to stop bond purchases or German justices will.

SPIEGEL Staff, February 10, 2014

Gauweiler, a member of German parliament who also has a legal firm located in Munich, managed to convince a majority of justices on the court's second senate that the ECB's program to save the European common currency is contrary to European law.

"Karlsruhe has shown ECB President Mario Draghi what a bazooka really is," Gauweiler crowed.

In a worst-case scenario, the Constitutional Court could forbid Berlin from contributing to efforts to save the euro or even force Germany to leave the currency zone entirely.

Hans-Werner Sinn, the euro-skeptic head of the Munich-based Ifo Institute, believes that the German court's position "will not remain without consequences for ECB monetary policies." Furthermore, the ruling "will strengthen the position of euro critics and the general skepticism Germans have of the ECB."

Wolfgang Munchau says the most serious legal argument against OMT was that it is obviously not a monetary policy operation in the first instance.

If it were a pure monetary policy operation, it would not have conditionality attached.

That argument, brought by the Bundesbank and accepted by the court, is hard to refute.

Eurointelligelnce 13 February 2014

Outright Monetary Infractions

The Court has now declared that it fully endorses the plaintiffs' arguments, and that the OMT program does indeed violate EU primary law.

Since its launch in 2012, the OMT program has allowed the ECB to buy, if necessary, unlimited amounts of troubled euro zone countries' government bonds,

provided the affected countries subscribe to the rules of Europe's rescue fund, the European Stability Mechanism.

Hans-Werner Sinn/Project Syndicate/CNBC, 10 Feb 2014

The German Constitutional Court has delivered its long-awaited decision on the European Central Bank's "outright monetary transactions" (OMT) program.

Thousands of Germans appealed to the Constitutional Court against the OMT program, arguing that it violates Article 123 of the Treaty on the Functioning of the European Union, which bars monetary financing of euro zone governments, and that it imposes substantial risks on German citizens as taxpayers.

The Court has now declared that it fully endorses the plaintiffs' arguments, and that the OMT program does indeed violate EU primary law.

Hans-Werner Sinn is Professor of Economics and Public Finance, University of Munich, and President of the Ifo Institute

Infraction: breach; violation; infringement: an infraction of the rules. Jfr Fraktur

Germany's constitutional court

The European Court of Justice will now decide the legality of the so-called debt "backstop", introduced in 2012.

Although the ECB has not used the emergency power, its existence calmed turmoil in European financial markets.

When he announced the Outright Monetary Transactions (OMT) programme, ECB President Mario Draghi said he would do "whatever it takes" to save the single currency.

BBC 7 February 2014

Germany has surrendered and the euro is saved.

That seems to be the markets’ interpretation of last week’s ruling by the German constitutional court on the European Central Bank’s “whatever it takes” policy to save the single currency.

But the crisis has profoundly undermined the pro-European sentiment that would be necessary to build a United States of Europe.

Gideon Rachman, FT 10 February 10, 2014

The /German Constitutional/ court concludes that OMT violates the German constitution.

It accuses the ECB of making a power grab by extending its own mandate.

It says the scheme endangers the underpinnings of the eurozone rescue programmes.

Worse, it says OMT undermined deep principles of democracy.

Wolfgang Münchau, FT 9 February 2014

Were it to be used, it would deprive the German parliament of its fiscal sovereignty by forcing it to accept any losses the scheme generated. The ruling considers OMT to be debt monetisation, whereby a central bank prints money to finance sovereign debt. It is hard to think of any act short of a military coup that could violate so many important constitutional principles all at once.

If you look back to all the previous German constitutional court cases on the euro, the answer was always a variant of “Yes, but”. This ruling was the legal equivalent of “No, no, no” – with one important addition. The court is asking the ECJ to clarify important points of European law

If the ECJ were to side with the ECB, we would end up with a “constitutional crisis”, whereby German constitutional law directly contradicts EU law. The German court left no doubt that the Bundesbank and other German institutions were bound by the constitution.

Outright Monetary Transactions OMT

The European Central Bank's outright monetary transactions (OMT) or bond-buying programme was announced by Mario Draghi, president of the European Central Bank, in September 2012.

Under the outright monetary transactions programme the ECB would offer to purchase eurozone countries’ short-term bonds in the secondary market,

to bring down the market interest rates faced by countries subject to speculation that they might leave the euro.

Read more here

Germany’s top court has issued a blistering attack on the European Central Bank,

arguing that its rescue plan for the euro violates EU treaty law and exceeds the bank’s policy mandate.

The tough language leaves it doubtful whether the ECB’s back-stop scheme for Spanish and Italian bonds can be implemented if Europe’s debt crisis blows up again,

and greatly complicates any future recourse to quantitative easing if needed to head off Japanese-style deflation.

Ambrose Evans-Pitchard, 7 Feb 2014

The German constitutional court refrained from issuing a final ruling on the legality of the plan, known as Outright Monetary Transactions (OMT). It referred the case to the European Court instead, but only after having pre-judged the issue in lacerating terms that effectively bind German institutions.

“The Court considers the OMT decision incompatible with primary law,” it said.

I’m the German Constitutional Court, get me out of here!

Court sees ECB bond buying as illegal but refers questions to ECJ

Open Europe Flash Analysis, 7 Feb 2014

Summary: The German Constitutional Court (GCC) – Bundesverfassungsgericht – has referred several questions surrounding the ECB’s Outright Monetary Transactions (OMT) programme to the European Court of Justice (ECJ).

It is evident that the Court believes the OMT is illegal and incompatible with EU and, therefore, German law.

However, the Court only has jurisdiction to rule on matters of German domestic law.

It therefore argues that it must refer the key questions to the ECJ – the body which interprets EU law

– given that the ECB’s mandate and any overstepping of EU treaties is obviously a question about EU law.

It is patently obvious that the GCC believes that the OMT does violate primary EU law, because it goes beyond the mandate of the ECB and breaks the EU Treaties, and therefore violates German law.

“The OMT Decision does not appear to be covered by the mandate of the European Central Bank.”

“The existence of an ultra vires act as understood above creates an obligation of German authorities to refrain from implementing it and a duty to challenge it. These duties can be enforced before the Constitutional Court at least insofar as they refer to constitutional organs.”

However, given that the GCC cannot rule on EU law it has referred this decision to the ECJ.

Europe’s landmark deal to establish a common €55bn fund to rescue troubled banks

is facing a concerted legal challenge from the European Parliament,

which argues the German designed side-pact breaches fundamental EU law.

Financial Times, January 16, 2014

Lawmakers said in a letter sent to the EU’s rotating presidency that the intergovernmental agreement on the banking union resolution fund is illegal because it bypasses the established legislative processes of the union.

Ms Merkel does not say “no” to eurozone bonds. She says: “Not without treaty change.”

The German constitutional court in Karlsruhe would never allow Germany’s sovereign guarantee to be given to its eurozone partners

without them submitting to effective and centrally budgeted discipline.

Financial Times 31 May 2012

Maktkamp mellan Europaparlamentet och Stats- och regerinscheferna

Vid sitt framträdande hos SNS talade Göran Persson om Europaparlamentets växande maktambitioner.

Man måste behandla dem artigt och med respekt, annars blir det låsningar, ungefär så sade Göran Persson,

som uppskattat sina möte med de andra Stats- och regeringscheferna i Det Europeiska Rådet.

Rolf Englund blog 2011-07-09

In an interview with Handelsblatt, Hans-Jürgen Papier, former President of the German Constitutional Court, suggests that

the German Constitutional Court should not rule on ECB’s OMT programme but instead refer the case to the European Court of Justice.

Eurointelligence, August 2, 2013

Jens und Jörg, both 40-somethings

Europe once again looks anxiously to /German Constitutional Court in/ Karlsruhe

The Economist, June 15th 2013 print

The two German central bankers, both 40-somethings and friends since university days, pointedly sat next to each other in the courtroom on June 11th.

Jens Weidmann has risen through the office of Chancellor Angela Merkel to become president of the Bundesbank.

Jörg Asmussen has moved via the finance ministry to the executive board of the European Central Bank (ECB).

But however amicable, they came to the constitutional court in Karlsruhe on opposing sides of the argument.

In theory, the court could rule that, since European treaties have been breached, the Bundesbank must withdraw from euro rescue efforts, or even that Germany must quit the euro.

In practice, the judges are more likely to send the case to the European Court of Justice in Luxembourg.

Tuesday was not an easy day for Asmussen, a member of the ECB's executive board, who was called

to testify before Germany's highest court in defense of an ECB program which,

while having proven to be economically successful, might be in violation of the law.

Der Spiegel, June 12, 2013

The case focuses on the ECB bond buying program known as Outright Monetary Transactions (OMT).

The program, announced last autumn, envisions the ECB buying unlimited quantities of sovereign bonds from ailing euro-zone member states to hold down their borrowing costs.

To date, the ECB has not made any bond purchases, but the mere announcement that it might has proven enough to calm the markets and provide European leaders with some time to seek agreement on longer-term measures to solve the crisis.

Court President Vosskuhle made it clear that the bench would be strictly considering questions of constitutionality,

and that the possible successes achieved by the OMT would not play a role in the verdict.

"Otherwise, the end would justify any means necessary," he said.

In one corner, we have Jens Weidmann, the head of Germany's Bundesbank, who warned in Der Spiegel on Sunday that "central bank financing can become addictive like a drug." Earlier this month, ECB President Mario Draghi cited Mr. Weidmann as one of the chief critics of a new round of ECB bond buying.

In the other corner stands Jörg Asmussen, a member of the ECB's executive board. On Monday Mr. Asmussen made the opposite case in a speech in Hamburg, arguing that high government bond yields in Spain and Italy were preventing the bank's monetary policy from filtering down to businesses and consumers in those countries.

Frankfurt vs. Frankfurt

Wall Street Journal, August 23, 2012

Tuesday and Wednesday of this week,

Germany's Constitutional Court in Karlsruhe will rule on the euro crisis aid measure that Draghi announced last fall.

As Draghi and his monetary experts on the executive floor of the bank were told by their constitutional experts long ago,

this court decision could have an enormous impact on the bank's policies - and potentially spell the end of the euro.

Der Spiegel, 10 June 2013

The fact that the announced bond-buying program could involve hundreds of billions of euros for which -- if things go wrong -- German taxpayers could also be held accountable makes an examination of the independent central bank's actions unavoidable.

Bundesbank President Jens Weidmann also opposes such pragmatism. In a statement submitted to the court, he chose clear and critical words:

"In view of the fact that it still consists of sovereign nation states, the current composition of the monetary union cannot be guaranteed - at least not by the central bank."

The ECB is treating the decision as a classified matter.

"Until now, we have had to make do with a press release," complains someone closely involved with the case.

The legal experts in Karlsruhe are annoyed.

How are the judges supposed to verify whether the ECB's program remains within the established legal frameork if they haven't received a copy of the controversial decision?

The constitutional court would have to determine that not only the ECB but also the European Court of Justice is operating beyond the limits of the treaties, or ultra vires.

Jens Weidmann, the Bundesbank president, opposed the ECB’s Outright Monetary Transactions policy

– under which the ECB would buy the bonds of countries subject to speculation that they might leave the eurozone.

His testimony to the constitutional court in Karlsruhe will be challenged by Jörg Asmussen,

a member of the smaller inner sanctum at the top of the ECB – the executive board

Financial Times, 9 June 2013

Bundesbank’s leaked written submission to the court

“probably the most successful monetary policy measure undertaken in recent times”.

Mr Draghi's robust defence of OMT, which was opposed by Germany’s Bundesbank and stirred controversy in Germany,

comes ahead of court hearings at the constitutional court in Karlsruhe

which is considering the legality of the scheme under Germany’s Basic Law.

Financial Times 6 June 2013

Bundesbank takes aim at Mario Draghi’s ECB rescue plan in an opinion written for the German constitutional court.

ECB’s main justification for the programme

– that its interest rates were not being transmitted to the real economy in stressed countries because of speculation about a euro break-up

– relied on “strongly subjective elements” in assessing the effectiveness of this so-called transmission mechanism.

Financial Times, April 26, 2013

We wait for the Verfassungsgericht to deliver its verdict of life or death for the euro at 10 AM Wednesday, Karlsruhe time.

Chief Justice Andreas Vosskuhle said at the time that Germany had reached the limits of EU integration under existing constitutional law.

Ambrose Evans-Pritchard, September 11th, 2012

The German constitutional court is not to be trifled with. Its ruling on the Lisbon Treaty in June 2009 was a thunderous defence of German national sovereignty, the greatest legal shock to the European order since the launch of the Project in 1957.

The eight judges fired a cannon shot across the bows of Brussels and the European Court, asserting the supremacy of the German Grundgesetz over EU law as a permanent principle.

They reminded those with superstate pretensions that Europe's sovereign states are the "Masters of the Treaties" and not the other way round, and that the national parliaments are the only legitimate form of democracy.

They stated that the Bundestag may not alienate its budgetary powers to any "supra-national body" on a permanent basis, even if it wishes to. It cannot sign off on open-ended liabilities.

"The idea of a modern constitution is precisely to impose limits on political majorities", said Udo di Fabio, the author of the opinion.

Chief Justice Andreas Vosskuhle said at the time that Germany had reached the limits of EU integration under existing constitutional law.

If the nation wishes to take the revolutionary step towards European fiscal union and shared government, it must first equip itself with a "new constitution".

This would almost certainly require a popular vote.

1 kap. Statsskickets grunder

1 § All offentlig makt i Sverige utgår från folket.

Mer hos Riksdagen

- Som medlem i Europeiska unionen omfattas Sverige också av EU-rätten, vilket betyder att lagar som stiftats gemensamt i EU i regel står över medlemmarnas nationella lagar.

Vid EU-inträdet fick Sverige därför göra ett par mindre justeringar i grundlagarna.

Mer hos Regeringen

Martin Wolf:

The eurozone must move forward, or go backwards. I assume it will choose the first option. But that is a political choice. Either people and politicians believe they share a common destiny, or they do not.

This choice may not be made tomorrow. But it has to be made.

Frågan är således om vi (liksom de andra EMU-länderna) skall uppge vår suveränitet och bli likt provinser i det forna romerska riket.

All offentlig makt utgår från folket, står det i regeringsformens portalparagraf. Det folk som avses är i dag det svenska folket.

I en federation blir det svenska folket en minoritet.

Visst är det häpnadsväckande att en majoritet i riksdagen, med en moderatledd regering i spetsen, i dag är på väg att avskaffa rikets oberoende.

Fredrik Reinfeldt i riksdagens partiledardebatt 13 juni 2012:

Ett stort steg som pekar på fördjupning och överföring av suveränitet från nationalstaterna till den europeiska nivån.

Med kort varsel kommer det nu att avkrävas svar av Sverige som nation och av riksdagens partier om hur vi ska förhålla oss till mycket av det här.

Läs mer här

This is the week in the which the German constitutional court will announce the most important ruling in its history.

Reports in Suddeutsche Zeitung on a new anti-euro case this morning that links last week’s decision by the ECB to start Outright Monetary Transactions (OMT) to the current ESM case.

The case was brought by Peter Gauweiler, a well-known Eurosceptic member of the Bundestag from the Bavarian CSU, and a serial litigator.

Eurointelligence 10 September 2012

Gauweiler argues that the OMT had fundamentally altered the ESM, and that the decision on the ESM should therefore be postponed (meaning a delay in the ratification by Germany). He also makes the legal points that the OMT decision did not constitute a breach of competence, but a permanent assumption of competences. When the Bundestag voted on the ESM, it did so under different circumstances. With the OMT, the Bundestag’s authority is permanently circumvented.

Perhaps Merkel wants to grant Greece additional help until she's survived Germany's 2013 elections.

It is no accident that the troika consisting of the European Commission (EC), the European Central Bank (ECB) and the International Monetary Fund (IMF) will not ready a decisive report until September.

Eurozone countries won't let Greece go broke. At least not this time.

the latest act in the Greek tragedy is set to last until at least mid-September.

That is also when the German Constitutional Court is expected to give a temporary ruling on ESM

Bernd Riegert, Deutsche Welle, August 25, 2012

Västblocket

Merkel Pushes for Convention to Draft New EU Treaty

Germany is pushing for a new treaty governing the construction of the European Union, and it is calling for a convention to draft the pact to be convened before the end of the year.

The treaty would pave the way for deeper European integration and would create a new legal foundation for the bloc.

Der Spiegel 27 augusti 2012

On Friday Merkel and Hollande jumped on the bandwagon.

They said Germany and France would do everything they could to save the eurozone.

Last month, eurozone members agreed that the rescue fund known as the European Financial Stability Facility (EFSF) will start buying government bonds.

That fund is scheduled to be replaced by a bigger package called the European Stability Mechanism (ESM) later on.

However, the proposed purchase of government bonds will have to wait until September 12,

when Germany's constitutional court is expected to rule on whether Germany can participate in the rescue fund.

Deutsche Welle 28 July 2012

Expressens olidliga dumhet

Syftet med en grundlag är att begränsa politikernas makt

Parlamentet stiftar grundlagen, domstolen tolkar den

Parlamentet kan ändra grundlagen om den inte är nöjd med tolkningen

Detta är fundamenta som ledaravdelningen på Expressen borde kännaa till

Rolf Englund, 21 juli 2012

It all started in early 2010, when Ms Merkel suggested Greece leave the eurozone.

After Nicolas Sarkozy threatened her with ending the special French-German relationship, she gave in and helped to bail out Greece.

That turned out to be a bailout of French banks.

Before the crisis, Germans were the most admired Europeans in Greece, today, they are the most hated.

Hans-Olaf Henkel, former head of the Federation of German Industries, Financial Times, 17 July 2012

German Constitutional Court

Hans-Werner Sinn stepped up to the microphone

he spoke of "false therapy" and a "machinery of asset destruction"

When he was finished, the judges no longer had any questions

Der Spiegel, 17 juli 2012

The lawyers and judges had already spent about seven hours addressing the question of whether the European Stability Mechanism (ESM), the permanent euro bailout fund, is compatible with Germany's constitution. Constitutional law expert Karl Schachtschneider, one of the plaintiffs, made an impassioned plea for a a national referendum on the issue, while German Finance Minister Wolfgang Schäuble warned against the "immeasurable consequences" of a Karlsruhe veto.

It seemed as if everything had already been said by the time Munich economist Hans-Werner Sinn stepped up to the microphone. The professor gave a technical lecture on the economy, but what made his listeners perk up were his bold assessments.

Sinn was sharply critical of what he called a "bottomless pit," and he spoke of "false therapy" and a "machinery of asset destruction" and accused the European community of nations of employing instruments that are doing precisely the opposite of what they are intended to achieve. "They are getting in the way of a cure," Sinn said. When he was finished, the judges no longer had any questions.

Angela Merkel vs. 160 Angry German Economists

Why is Angela Merkel so reluctant to do what it takes to save the euro?

The economists include the president of the influential Ifo Institute for Economic Research Hans-Werner Sinn

Marc Champion, Bloomberg July 5, 2012

The Federal Constitutional Court in Karlsruhe will issue a ruling on bids to halt Germany’s participation in the

European Stability Mechanism and the fiscal pact on Sept. 12.

That’s more than two months after it held a hearing on the measures.

Bloomberg 16 July 2012

Civil Rights with the help of prominent supporters like former Justice Minister Herta Däubler-Gmelin

The merits of the lawsuit must now be decided by Germany's highest court, the Constitutional Court, in Karlsruhe.

Deutsche Welle, 14 juli 2012

While the ESM will serve as a permanent rescue fund for the eurozone countries and will commit the signatory states to contribute a total of 700 billion euros ($857.1 billion), the fiscal pact is meant to force all the eurozone members to rein in their budget deficits.

In the view of Mehr Demokratie, however, both instruments reach too far into the budgetary powers of the Bundestag and transfer responsibilities from Berlin to Brussels.

Such a shift in the balance of power would require a constitutional amendment and, for that very reason, Mehr Demokratie is calling for a referendum. It was for this reason that the association, with the help of prominent supporters like former Justice Minister Herta Däubler-Gmelin, logged its constitutional complaints.

"It was a serious mistake to not ask the people at the time whether they wanted to give up the deutschmark and join the euro," Mehr Demokratie spokesman Michael Eflerr said.

"The 50 Days That Changed Europe" explains how the EU grew from a six-nation trade alliance to a 27-country behemoth with its own currency.

in Strasbourg on Dec. 9, 1989, after the Berlin Wall fell,

Germany agreed to monetary union in order to get President Mitterand to agree to German reunification

Wall Street Journal, 23 Sept 2011

Merkel breaks German law on ESM rescue

Here is the wording of Amendment 2 to the finance law or Finanzierungsgesetz on the 26th June, the day before the Brussels summit

Ambrose Evans-Pritchard July 11th, 2012

While Mrs Merkel seemingly agreed to let the European Stability Mechanism (bail-out fund) rescue banks directly – starting with Spain – she did not have the authority from the Bundestag to do so.

Here is the wording of Amendment 2 to the finance law or Finanzierungsgesetz on the 26th June, the day before the Brussels summit, sent to me by a very well-informed German reader.

Finanzhilfen zur Rekapitalisierung von Finanzinstituten einer Vertragspartei schliessen Finanzhilfen an eine Einrichtung zur Stabilisierung des Finanzsektors MIT ein, wenn die sektorspezifische Konditionalität gewährleistet ist, keine direkten Bankrisiken übernommen werden und die Rückzahlung durch eine Garantie der Vertragspartei gesichert ist.

It states that the ESM may not be used to recapitalise banks directly. Any such loans must guaranteed by the signatory to the treaty, ie the sovereign state, piling up further public debt.

Germany is ceding more and more power to the EU.

But how far is that compatible with the German constitution?

Now senior politicians are proposing a referendum to change Germany's Basic Law.

Deutsche Welle 26 June 2012

It was in order to deal with this issue that German Finance Minister Wolfgang Schäuble proposed at the weekend that the Germans would have to vote on a new constitution - and they'd have to do so sooner rather than later. If authority is increasingly to be handed over to Brussels, he said, there will come a point when Germany simply reaches the limits of its constitution.

President Joachim Gauck's decision to respect the court's request means that Germany will not be able to ratify the European Stability Mechanism by July 1,

which Chancellor Angela Merkel had hoped would send a strong message to the markets.

Some opposition politicians are even calling the development a "slap" in the chancellor's face.

Der Spiegel 22 June 2012

German president suspends ESM on orders from Constitutional Court

After an intervention of the Constitutional Court, the German president Joachim Gauck will not sign the new law Bundestag passed to implement the ESM

and the fiscal pact for the time being, Frankfurter Allgemeine Zeitung reports.

Eurointelligence Daily Briefing 22.06.2012

As a consequence it is now impossible that the ESM starts to exist as of July 1st.

According to the paper the Karlsruhe judges were outraged at attempts by Angela Merkel to pressure Gauck into signing the laws quickly.

Had the president done so and thereby deprived the constitutional court of any chances to an in depth examination of the constitutionality of the laws this would have amounted to “constitutional crisis”, FAZ quotes the constitutional court. Merkel’s spokesman denied that the chancellor had attempted to exercice pressure on the president.

Meanwhile Wolfgang Schäuble criticized the court for its intention to do an examination of the laws.

In an apparent reference to the proposed euro bonds,

Merkel said that seemingly simple "collectivization ideas" are actually

"unconstitutional and completely counterproductive."

Der Spiegel 14 June 2012

Ms Merkel does not say “no” to eurozone bonds. She says: “Not without treaty change.”

The German constitutional court in Karlsruhe would never allow Germany’s sovereign guarantee to be given to its eurozone partners

without them submitting to effective and centrally budgeted discipline.

Financial Times 31 May 2012

Who is running Germany? A remakable article by a remarkable journalist

Is the Federal Chancellor in charge of the country’s foreign policy and strategic destiny, answering to the Bundestag?

Or is the Bundesbank answering to what it believes to be a higher master – the German constitution and the Basic Law – invoking the rulings of the Verfassungsgericht

Ambrose Evans-Pritchard, April 19th, 2012

EU Fiscal Pact May Breach German Constitution

Germany's opposition Left Party says the fiscal pact agreed by 25 of the EU's 27 members may breach the constitution

because -- the party argues -- it can never be rescinded (rescind: to annul or repeal)

Der Spiegel, Thomas Darnstädt 2 April 2012

Legal experts are divided. But Germany's top court may be called on to settle the issue, and to rule on Europe's future yet again.

Steffen Kampeter, a senior official in the German Finance Ministry, confirmed what every reader of the treaty text will notice on the first read-through: "The treaty does not provide for a right to rescind."

This may have even come as a shock for a number of europhiles among the parliamentarians: Could it be true? Is the German parliament, the Bundestag, allowed to put into law a treaty that prevents future parliaments from ever amending these rigid austerity measures?

As a result of the Constitutional Court ruling the powers of Bundestag in the context of euro rescue decisions with financial implications were further enhanced yesterday, Süddeutsche Zeitung writes.

All decisions with financial implications will have to be approved by the German parliament as a whole.

Earlier, the parliament itself had voted a law that delegated a great amount of decision power to a special committee that was empowered to decide on the Bundestag’s behalf in the name of speed, efficiency and discretion.

But the Karlsruhe court declared this to be unconstitutional and contrary to its intention to further re-enforce the democratic control of the government’s European policy decisions.

Eurointelligence 28 March 2012

According to the new law, the only case where decisions of Bundestag can be delegated to a special committee is when government bond purchases on the secondary market have to authorized, SZ writes.

The euro crisis is pushing Germany to test the limits of its “Basic Law”.

The ESM is a state-like transfer system that would “change the identity” of the Basic Law, say Wolfgang Kahl and Andreas Glaser of Heidelberg University.

The government thinks it needs a two-thirds majority in the Bundestag and the upper-house Bundesrat, the normal procedure for amending the constitution.

The Economist print 24 March 2012

The constitutional court has let the euro rescues through, while strengthening the Bundestag’s role in approving them.

But the judges take an increasingly narrow view of what is allowed.

The court’s 2009 decision on the Lisbon treaty ruled that Germany could not transfer core powers to a democratically flawed EU.

If Germany wants more Europe, the court’s president, Andreas Vosskuhle, says, “a referendum would be necessary.”

Europakten kräver tysk grundlagsändring

German Chancellor Angela Merkel faces an unexpected challenge

the new treaty will require a two-thirds majority in both houses of parliament

CNBC 3 mars

It has caused surprise as the German constitution already includes a "debt-brake" law, under which the federal government has until 2016 to cut its structural deficit to no more than 0.35 percent.

It was this law which inspired the European legislation on budget discipline.

However, as the fiscal compact treaty allows a country to be sued by its European partners in the European Court of Justice if it does not uphold budget rules,

it affects sovereignty and the constitution, and hence requires a greater majority.

"The government has in fact come to the conclusion that the fiscal comapct will have to be ratified under Article 23 of the constitution," a government spokeswoman said in emailed comments.

Article 23 covers the transfer of sovereign powers to European level.

Den tyska författningsdomstolen

förklarade att den panel på nio ledamöter som skulle fungera som kontrollorgan för den tyska krispolitiken

"till stora delar" är grundlagsvidrig

DN/TT 28 februari 2012

Detta innebär att Tysklands regering i brådskande frågor inte längre kan kringgå en utdragen parlamentarisk process med samtliga 620 ledamöter i förbundsdagen eller budgetutskottets 41 medlemmar.

Frankfurter Allgemeine quoted the parliament’s president as saying that the parliament will find a solution consistent with the court’s ruling shortly. The court said the committee could only be invoked for the purchase of government bonds through the ESM. The court says this was an exceptional circumstance, given the confidentially requirements. But the court said it any reduction in the ordinary rights of MPs would have to be well founded, and would have to be proportionate. It said the establishment of a permanent mini-committee for ESM affairs failed that test. The argument that it would be less bureaucratic and faster to convoke nine MPs is insufficient. If there is time pressure, the budget committee itself is suitable enough for that purpose. (That means even the argument of an emergency is not sufficient.) The court also accepted a number of procedural complaints, for example relating to the questions what if only a minority of the nine MPs turn up, as there is no system of deputies in place. Furthermore, the committee does not reflect the majority in the Bundestag.

Greece must default if it wants democracy

These demands fail Immanuel Kant’s “categorical imperative”

Nor could they be adopted in Germany – they would be unconstitutional

Wolfgang Munchau, Financial Times 19 February 2012

These demands fail Immanuel Kant’s “categorical imperative” – Germany does not will them to be universally adopted.

Only recently the German constitutional court ruled that parliament’s sovereignty was absolute, that parliament must not permanently transfer sovereignty to outside institutions and that one parliament must never constrain the freedoms of its successor.

The proposals violate the principles of Germany’s own constitution. In short, they are unethical.

Det kategoriska imperativet formulerades och identifierades av filosofen Immanuel Kant (1724-1804) som moralens högsta princip.

I sin grundformulering lyder det "Handla endast efter den maxim genom vilken du tillika kan vilja att den blir en allmän lag". Wikipedia

Varje mamma tillämpar denna princip när hon säger: "Hur skulle det se ut om alla gjorde så där." Rolf Englund

The dangerous subversion of Germany's democracy

Markets appear to be acting on the firm belief that Germany’s finance minister Wolfgang Schäuble is lying to lawmakers

Ambrose Evans-Pritchard, September 28th, 2011

Very Important Article

Germany and France are seeking a separate agreement among the 17 euro-zone members.

That, though, may be illegal say many.

"Many" = The legal services experts of the European Commission,

the European Central Bank and the European Council

Der Spiegel, 9 december 2011

Merkel ändrar grundlagen för att lättare flytta makt till Bryssel

Rolf Englund blog 2011-11-14

/Den tyska/ Konstitutionsdomstolen har slagit fast att regeringen måste gå till förbundsdagen för att inte bryta mot grundlagen.

Det innebär både att den demokratiska förankringen ökar och att möjligheterna till transparens i processen blir betydligt bättre.

Claes Arvidsson, ledarskibent SvD 26 oktober 2011

Trots allt handlar dagens beslut om rekapitalisering av bankerna (100 miljarder euro), grekisk skuldnedskrivning (50–60 procent) och en förstärkning av krisfonden EFSF (från 400 till kanske 2000 miljarder euro) – med Tyskland som största bidragsgivare.

Regeringen erkänner att lagligheten i riksdagens ratificering av Nice-fördraget kan ifrågasättas

Ur Prop. 2001/02:72 Ändringar i regeringsformen samarbetet i EU m.m. Sid 31 ff

Europe is now leveraging for a catastrophe

A leveraged EFSF is attractive to politicians for the same reason that subprime mortgages once appeared attractive to borrowers.

- the crisis ultimately vindicates the German constitutional court’s conservatism in its definition of what constitutes a functioning democracy

Wolfgang Münchau, FT October 23, 2011

Asked why EU leaders were still holding the Sunday meeting, the German official said:

“That’s a good question. Sarkozy wants one.”

Financial Times 21 October 2011

The postponement is due to a combination of two factors: Nicolas Sarkozy’s diplomacy, and

the German Bundestag’s insistence that it needs to give a mandate to the chancellor ahead of the summit.

Eurointelligence 21 October 2011

The Bundestag made it clear to Angela Merkel that it insists on seeing the draft proposals for the EFSF guidelines in German this Thursday

if it is to give the chancellor a mandate for negotiations at the summit on Sunday, Frankfurter Allgemeine Zeitung reports.

Eurointelligence 20 October 2011

Last week’s ruling of the German constitutional court.

It categorically rules out any policy option beyond what has been agreed so far.

I cannot see how it can be consistent with the survival of the eurozone, given the policies of member states and the ECB

Wolfgang Munchau, FT 11 Septemner 2011

Den förre ordföranden Hans Olaf Henkel i det tyska industriförbundet, motsvarigheten till Svenskt Näringsliv, föreslår i en artikel i Financial Times

att Tyskland, Österrike, Finland och Nederländerna ska lämna eurosamarbetet och forma ett helt nytt valutasamarbete.

Henkel, som tidigare var en av eurons ivrigaste försvarare, har under den intensiva skuldkrisen ändrat uppfattning om det krisdrabbade valutasamarbetet.

Han skriver att hans tidigare stöd till euron är hans karriärs största misstag.

Ekot 30 augusti 2011

Mrs Merkel has cancelled a high-profile trip to Russia on September 7,

the crucial day when the package goes to the Bundestag and the country's constitutional court rules on the legality of the EU's bail-out machinery.

Ambrose Evans-Pritchard, 28 August 2011

German President Christian Wulff questioned the legality of the European Central Bank's bond-buying program

highlighting the strength of opposition in Germany to the controversial plan.

CNBC 24 Aug 2011

Wulff cited an article in the European Union's fundamental treaty, which prohibits the ECB from buying bonds directly from governments.

"This ban only makes sense if those responsible don't circumvent it with comprehensive purchases on the secondary market," he added.

The ECB buys the bonds on the secondary market.

Germany's constitutional court misses the last chance to save Europe from its folly

Daniel Hannan DT blog 7 sptember 2011

To remind you, Article 125 of the Treaties says:

The Union shall not be liable for or assume the commitments of central governments, regional, local or other public authorities, other bodies governed by public law, or public undertakings of any Member State.

That seems pretty open-and-shut, doesn't it?

And, indeed, no one until a couple of months ago seriously tried to claim that the bailouts were lawful.

As Angela Merkel herself put it, 'we have a treaty under which there is no possibility to bail out states in dificulty'. That's why she is now changing the treaties, so as retrospectively to authorise the rescue packages. Until those changes come into effect, though, the legal position seems pretty clear: no bailouts.

- Redan vid EU-toppmötet i mars beslöt man om en smärre fördragsändring för att kunna skapa en gemensam räddningsfond, med en kapacitet på 500 miljarder euro, skrev Mats Hallgren den 23 juni 2011.

500 miljarder euro som resultat av "en smärre fördragsändring"

Rolf Englund blog 30 juni 2011

http://www.openeurope.org.uk/research/Karlsruhefactor.pdf

Germany's highest court has ruled that relief for Greece and the euro bailout program is constitutional.

Presiding Judge Andreas Vosskuhle said the verdict "should not be misinterpreted as a constitutional blank check for further rescue packages."

Der Spiegel, 7 september 2011

The judges ruled that aid package resolutions cannot be automatic and may not infringe on the decision-making rights of parliament.

Aid packages have to be clearly defined, and members of parliament must be given the opportunity to review the aid and also stop it if needed, the ruling said

Bundesbank questions legality of EU bail-outs

Germany's Bundesbank has issued a blistering critique of EU bail-out policies,

warning that the eurozone is drifting towards a debt union without "democratic legitimacy" or treaty backing.

Ambrose Evans-Pritchard, 22 August 2011

"The latest agreements mean that far-reaching extra risks will be shifted to those countries providing help and to their taxpayers, and entail a large step towards a pooling of risks from particular EMU states with unsound public finances," said the bank's August report.

It said an EU summit deal in late July threatens the principle that elected parliaments should control budgets. The Bundesbank said the scheme leaves creditor states with escalating "risks and burdens" yet no means of enforcing fiscal discipline to make this workable.

There are no plans as yet for EU treaty changes to correct these distortions. "Unless there is a fundamental change of regime involving a far-reaching surrender of national fiscal sovereignty, it is imperative that the 'no bail-out' rule – still enshrined in the treaties – should be strengthened by mark

Some are now openly advocating political union as the solution to the crisis.

The former EU Commissioner Emma Bonino was refreshingly candid when I met her in Rome last week.

She believes that a United States of Europe is the answer. She accepted that political union would have to be put to the voters.

Gavin Hewitt, BBC Europe editor, 18 July 2011

The outcome would be uncertain, although the voters no doubt would be told they were voting to save the European Union.

EU:s ledare har nu enats om huvuddragen i en krishanteringsmekanismen där euroländer som behöver stöd kan få lån

För att inrätta det nya systemet krävs en ändring i EU:s fördrag.

Att öppna för ändringar riskerar att utlösa nya krav på ändringar i andra delar av grundlagen.

Lösningen är att använda en förenklad procedur för ändringar och infoga två meningar i det gällande fördraget.

Det innebär inte att mer makt flyttas från EU-länderna till EU:s institutioner och därmed undviks nya, mångåriga diskussioner och folkomröstningar runt om i EU.

Riksdag och Departement

EU genomför fördragsändring i smyg, med hjälp av Reinfeldt

Rolf Englund blog 8 juli 2011

The German constitutional court in Karlsruhe said it would hold a hearing on

challenges to last year’s Greece rescue package on July 5.

Financial Times 9 June 2011

Säga vad man vill om Göran Persson, men få kan som han fånga ett auditorium. Och så är det fortfarande.

Solbränd, avspänd och med en och annan sedvanligt bitsk släng levererade den förre statsministern funderingar kring rapporten ”Makten i Europa”

Annika Ström Melin, Signerat, DN 1 juni 2011

Rolf Englund: I sitt inlägg underströk Göra Persson den stora betydelsen av den tyska författningsdomstolen

The eight judges of the Verfassungsgericht in Karlsrühe – that den of incurable Teutonism and closet eurosceptics

Ambrose Evans-Pritchard, February 21st, 2011

The German constitutional court has almost no other choice than to rule that EU law was violated.

After all it was Christine Lagarde who told the Wall Street Journal recently.

“We have violated all rules of law because we agreed that we really wanted to save the eurozone.”

Eurointelligence 24 May 2011

Süddeutsche Zeitung thinks the court will rule before the summer break.

Legal experts agree that a negative ruling would prohibit Germany to continue to take part in the ongoing rescues. One of the consequences would be that the bonds issued by the EFSF would immediately lose its triple-A-rating.

A group of 50 economists and lawyers are apply for a court injunction at the Karlsruhe constitutional court against the rescue program for Portugal

Eurointelligence 12/4 2011

According to law professor Markus Kerber of Berlin, who is acting on behalf of the group, the rescue program contains irreversible inconveniences for Germany.

Should there be no injunction Germany would lose its fiscal sovereignty, Kerber argues.

The Fundamental Problem with Efforts to Save the Euro

European politicians are still pursuing a path to integration that citizens have long since abandoned.

Udo Di Fabio, a judge on Germany's Constitutional Court in Karlsruhe, speaks of "conceptual limits that can in fact only be exceeded by taking a spirited step in the direction of the federal state."

For former German Chancellor Helmut Kohl, the idea of "maintaining an economic and monetary union in the long term without a political union" was an "absurd notion."

Michael Sauga, Der Spiegel 03/30/2011

Euro breakup revisited

I would take Germany’s limited liability as given, both for reasons of domestic politics and constitutional law.

It is inconceivable that the German constitutional court would accept an unlimited burden sharing.

And even a change of government in 2013 would not fundamentally Germany’s position.

If any politicians tried to raise Germany’s burden, the country would revolt.

Wolfgang Münchau 24.03.2011

The European stability mechanism, which will be the permanent crisis mechanism from 2013

The agreement reached on March 11 not only appeared comprehensive, it also came as a surprise.

Unfortunately, when you look more closely, as I did last week, it begins to look smaller. By the end of the week, it had crumbled.

Wolfgang Münchau, FT March 20 2011

Permanent Euro Fix

Germany to Contribute 22 Billion Euros to New Fund

Finance ministers agreed on Monday to furnish the new permanent bailout fund with 80 billion euros, with the ability to call on 620 billion euros more should the need arise. The deal paves the way for agreement at an EU summit later this week.

Der Spiegel 22/3 2011

German Finance Minister Wolfgang Schäuble stressed on Monday that the EU will continue to attach strict conditions to bailouts in the future, requiring countries to impose rigorous austerity programs in return for help.

Markus Ferber, a member of the European Parliament for the Christian Social Union, the Bavarian sister party of the CDU, said that provision may breach European Union treaties which stipulate that member states must not assume each other's liabilities. "The possibility of the ESM to buy government bonds in the primary market is a classic assumption of liabilities that is ruled out by the European treaties," said Ferber.

The government, the Bundestag, and the Bundesbank all have their own, and conflicting, views on how the crisis should be resolved.

To add to the confusion, the three parliamentary groups in the Bundestag yesterday made a recommendation to the Bundestag

– a proposal that will be formally voted on - that Merkel must not agree anything without asking the parliament first,

something FT Deutschland reports she was “not entirely happy” about.

In addition, as Reuters reports, the parliamentary parties are dead set against any bond buyback to be organised by the ESM.

A draft contained the following excerpt: "Parliament expects that jointly financed or guaranteed purchase programmes of government debt would be

ruled out for reasons of constitutional and European law, and on economic grounds."

Eurointelligence 22/2 2011

All that has occurred so far is that Irish and Greek taxpayers have taken on fresh debt so that creditors do not crystallise losses.

It remains a disguised rescue for North European banks and insurers.

There can no longer be any doubt that Germany has lost control of the ECB, that the implicit contract under which the German people agreed to give up the D-Mark has been breached.

The eight judges of the Verfassungsgericht ruled on the Maastricht Treaty in 1993 that EMU failure to ensure monetary stability in Germany would violate the Grundgesetz

and either force Germany to change its constitution (very hard) or leave the euro.

Ambrose Evans-Pritchard 20 Feb 2011

EMU travails will goes on, and on, until Germany – and the others – understands that it has been lured into a Monet trap:

it cannot both be a member of monetary union and remain a self-governing sovereign nation.

That is to say, Germany must be prepared to do for Southern European what it has already done for its own kin in East Germany, but on six times the scale.

Or she can pull the plug, by quietly signalling to the Verfassungsgericht that Berlin would not be too angry if the eight judges declared the EU’s rescue machinery to be unconstitutional, ending EMU as we know it.

Ambrose Evans-Pritchard, 16 Jan 2011

Två meningar som kan ställa till det rejält

Merkel var orolig för att den mäktiga tyska författningsdomstolen skulle opponera sig mot den tillfälliga krisfond på 750 miljarder euro

SvD, reporter Teresa Küchler, 16 december 2010

Only Trichet can save us now – ECB about to monetise peripheral debt

The second problem is that a large purchasing programme of the kind demanded by analysis

is almost certainly a breach of European law, and German constitutional law.

Eurointelligence, 2 December 2010

analyst expressed expection that the ECB would sanction a €1000bn to €2000bn bond purchasing programme.

In our view there are insurmountable problems with this thesis.

The first is that it does not resolve the problem.

The financial markets are panicking despite the setup of the EFSF. So they are not concern about liquidity, but about solvency. The ECB’s bond purchasing programme will almost certainly be geared towards the reduction of interest rates,

but it will not be so large as too change the fundamental solvency concerns for the eurozone periphery.

The second problem is that a large purchasing programme of the kind demanded by analysis is almost certainly a breach of European law, and German constitutional law.

European Financial Stability Facility (Greklands räddningspaket)

Germany’s constitutional court has left Ms Merkel little leeway.

Without a treaty change, the EFSF must run out in 2013

Wolfgang Münchau, FT October 31 2010

Angela Merkel is right on the specific question of the need for a change in the European Union treaties to create a permanent crisis resolution mechanism.

Such an institution is needed to replace the European Financial Stability Facility when it expires in 2013.

Germany’s constitutional court has left Ms Merkel little leeway. Without a treaty change, the EFSF must run out.

The constitutional court is an important factor in the German position. It gave a green light to the EFSF, after the government invoked a “force majeure” defence.

The EFSF was set up to protect the eurozone, the government’s lawyers argued. The court accepted that argument. But the German government cannot conceivably extend that reasoning to the establishment of an entirely new EU institution.

In its ruling on the Lisbon treaty, the court gave an exceedingly restrictive view on the legitimacy of further European integration without an explicit democratic mandate.

Furthermore, the court would read the “no bail-out” clause of the Maastricht treaty in a strict literal sense. It could easily block the new mechanism. The legal risks of going outside the treaty are therefore immense.

Angela Merkel insisterade på att en begränsad ändring är nödvändig

för att landets författningsdomstol inte ska stoppa Tyskland

från att vara en del i det skyddsnät som ska ersätta den tillfälliga räddningsfond som inrättades efter eurokrisen i våras.

SvD Näringsliv 29 oktober 2010

Också den svenska regeringen vill bidra till skyddsnätet, trots att Sverige inte är med i valutaunionen.

Även Merkels kontroversiella förslag om att dra in rösträtten för euroländer som permanent hotar eurozonens finansiella stabilitet ska utredas, men på obestämd tid. Statsminister Fredrik Reinfeldt tror att det kommer att dröja länge innan det kan bli verklighet, om det någonsin blir det.

– Flera länder har rest invändningar, säger Reinfeldt.

– Man kan lätt göra sig lustig över att länder ska folkomrösta om att förlora sin rösträtt.

According to EU officials,

Mr Trichet told the summit that signalling to markets that private investors would be more at risk in restructurings

could spook the bond market, driving up interest rates for countries such as Ireland and Greece.

The EU officials said Mr Trichet’s warning was met with bitterness by Nicolas Sarkozy,

who complained he did not understand the challenges facing heads of state.

FT 29/10 2010

The €750bn financial rescue package

The German constitutional court has still to rule on the package. "natural disasters or exceptional occurrences beyond its control"

Wolfgang Münchau May 30 2010

The Council invoked Article 122 of the treaty on the functioning of the European Union, under which financial assistance is allowed “where a Member State is in difficulties or is seriously threatened with severe difficulties caused by natural disasters or exceptional occurrences beyond its control”, but I think there are legitimate doubts about whether the multiple policy failures that led to this crisis constitute an event beyond one’s control.

I also fear the German justices will express misgivings about the European Central Bank’s decision this month to buy bonds.

How can a loan guarantee solve a problem of excessive indebtedness?

The funny thing is that the Germans, Ms Merkel probably included, really believed in the “no bail-out” clause.

They were shocked by events. They failed to see that Article 125 of the Lisbon treaty is the kind of law that is irrelevant until needed, at which point it becomes impossible to apply.

Wolfgang Münchau May 10 2010

Ms Merkel’s staff had impressed on her that any attempt to support Greece with loans at below market interest rates would draw the ire of the German constitutional court. That, too, turned out to be a misjudgment. We know that the court is sceptical about further European integration and made its views clear last year in its ruling on the Lisbon treaty. But Germany’s constitutional justices are not reckless. They duly and almost instantaneously dismissed a frivolous case against the Greek aid package, brought by four Europhobic professors.

http://www.bundesverfassungsgericht.de/

Contrary to general belief, Germany’s eurosceptic professors have not abandoned their legal efforts to block the EU rescues for European banks exposed to Greek debt,

Should they succeed, of course, the eurozone risks disintegration within days, and perhaps hours.

Ambrose Evans-Pritchard July 8th, 2010

In their latest broadside the professors said the rescue fund “self evidently” violates the no-bailout clause of the Lisbon Treaty.

They have seized on comments by France’s Europe minister Pierre Lelouche, who admitted after the summit deal on May 7 that EU leaders had carried out a constitutional coup. “It is expressly forbidden in the treaties by the famous no-bailout clause. De facto, we have changed the treaty,” he said.

“Chancellor Merkel obliged the President to sign this emergency law within hours. He was not able to examine its constitutionality, as he is sworn to do. No government should ever treat a head of state in this fashion, not least on a question of such existential importance.”

The EU’s no-bailout clause from Article 125 says:

German president resigns

http://edition.cnn.com/2010/WORLD/europe/05/31/germany.president.resigns/index.html

In 1998, four renegade German professors tried to stop the introduction of the euro with a legal challenge in Germany's highest court.

Now, 12 years later, they are fighting against a German bailout for Greece - and this time around, people are listening to them.

Der Spiegel online 30 june 2010

Wilhelm Hankel is sitting on the stage at a meeting of the Kiel Institute for the World Economy. He is beaming with joy. The 81-year-old professor has just explained why the euro has always been a monstrosity, and why it will and must fail. Although the current plans to "get a living corpse to walk" are touching, he scoffed, one thing is already clear: The euro bailout package will only save the banks.

Surprisingly enough, his presentation was met with long and enthusiastic applause from his audience of economists. For Hankel, it was about time. The recalcitrant professor has been waiting for what has seemed like an eternity for this recognition. Since Jan. 12, 1998, to be precise.

Full textGermany

Four professors will launch a legal challenge in early May at the Verfassungsgericht (high court).

Should they secure an injunction, EMU may fly apart.

EMU shut the warning signals, disguising risk.

What investors overlooked is that currency risk mutates into default risk in a monetary union

Ambrose Evans-Pritchard, 25 Apr 2010

The Court ruled in 1993 that Maastricht was constitutional only as long as EMU remains an area of monetary order. "A 'transfer union' is a bottomless pit and is bound to threaten currency stability. That is what we are going file," said Tübingen Professor Joachim Starbatty.

When accused of consigning Greece to ruin, he told the Frankfurter Allgemeine that EMU exit and default is Greece's only salvation. "The truth has to come out into the open. Greece is in no position to pay it debts," he said.

The EU-IMF "therapy" of deflation for Greece repeats the catastrophic errors of Chancellor Heinrich Bruning in the early 1930s and must lead to a depression, he said.

No country in Western Europe has defaulted since the Second World War.

More than €7 trillion has been lent to Club Med states, banks and homeowners in the belief that it cannot happen.

EMU shut the warning signals, disguising risk. What investors overlooked is that currency risk mutates into default risk in a monetary union.

It makes default more likely, not less.

Heinrich Bruning

Click here

In a landmark judgment in 1993, the constitutional court ruled that, once it came into force, monetary union had continuously to satisfy the full conditions of the “stabilisation treaty”

concluded when the single currency was agreed. If it did not, the court ruled, Germany would be obliged to leave.

The four professors who took the German government to the German constitutional court in 1998 over Germany’s entry into the euro. Wilhelm Hankel, Wilhelm Nölling, Karl Albrecht Schachtschneider and Joachim Starbatty, FT, March 25 2010

There is, sadly, only one way to escape this vicious circle. The Greeks will have to leave the euro, recreate the drachma and re-enter the still-existing exchange rate mechanism of the European Monetary System, the so-called ERM-II, which they departed in 2001

It is reasonably clear that Greece has run out of options. The country has adopted an austerity programme of near-unprecedented severity, cutting government spending, raising taxes and depressing salaries. This programme completely ignores Keynes’ dictum that states must face crises with counter-measures to support demand. The Greek action is painfully reminiscent of Germany’s ill-fated moves to slash spending in the 1930s slump, which taught the world that cutting budgets to appease creditors in a downturn generates mass unemployment and radicalises society.

Last week's ruling by the German Constitutional Court, coupled with demands by one conservative party for changes to the constitution,

may not only jeopardize Berlin's schedule for the ratification of the Lisbon Treaty.

The Karlsruhe ruling also threatens future steps toward European integration.

SPIEGEL Staff 6/7 2009

When the parliamentary group of the Christian Social Union (CSU) -- the Bavarian sister party to Chancellor Angela Merkel's conservative Christian Democrats -- met in Berlin last Thursday, they had a hero to celebrate. "You have saved our honor," said CSU representative Hans-Peter Friedrich to his party colleague and friend Peter Gauweiler.

Gauweiler, a lawyer from Munich -- and a political maverick who is the enfant terrible of the conservative group in the German parliament or Bundestag -- was largely successful with the legal complaint he filed with the German Constitutional Court against the EU Lisbon Treaty. Now it's official: The ratification by the overwhelming majority of the German parliament -- including the CSU -- was negligent. In essence, the court ruled that by passing the so-called "accompanying law" to the Lisbon Treaty, which determines the rights of German parliament to participate in European legislation, the representatives had relinquished significant monitoring rights to Brussels. According to the judges, this unconstitutionally subjects the people that they represent to the whims of a bureaucracy that lacks sufficient democratic legitimacy.

Germany's debate on how much national say there should be over further EU integration is intensifying two weeks after the country's constitutional court handed down a significant judgement on the EU's Lisbon Treaty.

The CSU, sister party of the governing Christian Democratic Union - Its chief Horst Seehofer said his party wants parliament to have veto power on EU decisions

EU Observer 13/7 2009

Germany’s constitutional court ruled that the Lisbon treaty was consistent with German law.

This means Germany will be able ratify the treaty before the end of the year.

But... If you read the entire 147-page ruling, you realise that

the court has given a damning verdict on future European integration.

For example, it declared a hypothetical fiscal policy co-ordination or the establishment of a single European Union military command as unconstitutional.

Wolfgang Münchau, FT July 12 2009

I want to focus on three aspects of this complex ruling:

the separation of powers between member states and the EU;

the court’s view of the European parliament;

and its view on European integration.

First, Germany’s constitutional court takes a clear stance on sovereignty.

Ultimate authority always has to rest in a single place – and that is the member state for now.

If you wanted to transfer sovereignty to the EU,

you would have to dump your national constitution and adopt a European version in its place.

As this is not going to happen, the court, in effect, ruled that all sovereignty in the EU is national.

Power may be shared, but sovereignty may not.

Second, the court does not recognise the European parliament as a genuine legislature,

representing the will of a single European people, but as a representative body of member states.

Germany will be able to ratify the Lisbon treaty only after a change in a domestic power-sharing law.

Third, and perhaps most important, the court has given an explicit opinion on the question of European integration.

Where does it end? The answer is: right here.

The court said member states must have sovereignty in the following areas:

criminal law, police, military operations, fiscal policy, social policy, education, culture, media, and relations with religious groups.

In other words, European integration ends with the Lisbon treaty.

You might have noted the reference to fiscal policy in the list of policy areas reserved for member states. This is interesting in view of the debate about the policy response to the financial crisis, and the introduction of a constitutional balanced budget law in Germany.

In terms of economic policy, the court’s view may have been consistent with the realities that prevailed before the Maastricht treaty in the early 1990s. But a decision that essentially rules out effective economic crisis management in a monetary union, by anchoring all relevant political decisions at the national level, is hardly consistent with a sustainable single currency. Something will have to give, and I would not be prepared to predict what will happen if an actual conflict were to arise.

Anyone locked in a monetary union with Germany should be very worried.

Specifically the problem lies with the procedures the Lisbon Treaty proposes for making changes to the EU treaties in the future.

Lisbon has what is known as the 'general bridging clause' (AKA: the Passarelle) which empowers the heads of state or government (AKA: the European Council) to decide, unanimously, that they want to stop making decisions in a particular area by unanimity and start making decisions by qualified majority vote (QMV).

Europe Editor Sean Whelan, RTE (RTÉ is a Public Service Broadcaster, a non-profit making organisation owned by the Irish people.) 30 June 2009

For all you Lisbon Treaty Nerds, this is a very interesting ruling by the Federal Constitutional Court. What stands out for me is that it is further confirmation that the Germans see very definite limits on how far EU integration can go.

Rolf Gustavsson:

Precis som när Maastrichtfördraget behandlades i författningsdomstolen (1992) sätter Tysklands högsta jurister gränser på en lång rad områden för hur långt den europeiska integrationen ska kunna gå utan att hota det demokratiska styrelseskicket.

Domstolen slår fast att EU inte är en ”statsanalog” organisation och att

EU-parlamentet inte representerar ett europeiskt statsfolk.

EU förblir ett förbund mellan självständiga demokratiska stater och EU-parlamentet företräder folken i dessa stater.

Men för att den fortsatta integrationen inte ska skena iväg utom kontroll för de demokratiska instanserna krävs att de ges förstärkta kontrollmöjligheter.

Utan förbättrad parlamentarisk kontroll riskerar demokratin att urholkas, anser domarna i Karlsruhe.

SvD 30 juni 2009, 23.30

Kommentar av Rolf Englund:

Hear! Hear!

Tyskt stopp för Lissabon

BERLIN.Den tyska författningsdomstolen stoppar oväntat ratificeringen av Lissabon-fördraget.