Alla valutaunioner i historien har antingen

lett till en stat eller spruckit.

Varför skulle EMU vara så

annorlunda?

Anders Lindberg, Hässelby, SvD Synpunkt

14/8 2003

|

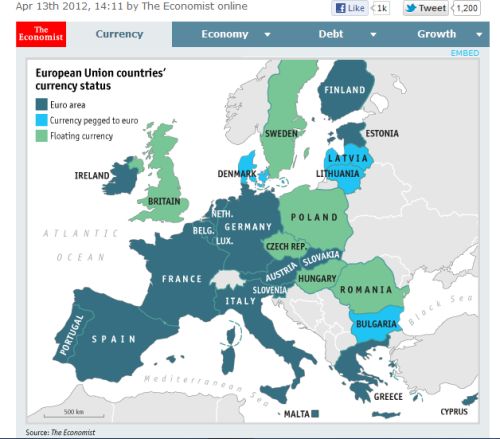

The End of the Euro Is Closer Than You Think Europe has always been a disunited continent, with broad ethnic, cultural, linguistic, political, and economic divides. ... Italy’s Threat to the Euro Italy, the Eurozone’s third largest economy, is coming under increased market pressure fueled by doubts about the country’s economic outlook and the sustainability of its public finances. SvD har tittat närmare på de fem värst drabbade länderna som utlöste den europeiska skuldkrisen. The euro may be approaching another crisis. The backlash in Italy is another predictable (and predicted) episode in the long saga of a poorly designed currency arrangement, in which the dominant power, Germany, impedes the necessary reforms and insists on policies that exacerbate the inherent problems, using rhetoric seemingly intended to inflame passions. A Euro Tragedy - a clear mistake, a triumph of a political ideal of European unity over basic economics. As the /book/ title indicates, this is not a pros versus cons assessment. The author provides a clear (and accessible for non-economists) account of how the idea of the Euro began to dominate the political discourse of particularly the French elite and how Germany leaders agreed on the condition that they determined the design Ashoka Mody, “Euro Tragedy: A Drama in Nine Acts” Moderaterna inför EU-valet: "Vi är i grunden positiva till en gemensam valuta" The reason the Italian political crisis caused so much angst was the ill health of Europe’s banks The Italian Trigger Germany, joined by the Dutch, Finns, and Austrians, runs a monster $1 trillion plus trade surplus with the rest of Europe and the eurozone. Italy is not Europe’s only problem. The big Kahuna is Germany, which spent years offering generous vendor financing to the rest of the continent to entice the purchase of German goods. The result: a giant trade surplus for Germany and giant, unpayable debts for those who bought German goods. Greece, for instance. The Italians have no solution for their debt. Greece has been in a seven-year depression. And while some of the other countries are improving, unemployment rates in most of Europe are still lackluster to say the least. Since the eurozone crisis began receding in 2012, too little has been done to fix the underlying problems of the single currency Despite grand plans for eurozone reform from Emmanuel Macron, the French president, talks at a summit later this month are likely to produce only limited results. Italy - snap parliamentary elections, perhaps in October It would be fitting if the European Union were to come to a sticky end because of Italy. Italy's insurgents enrage Germany and risk ECB payment freeze Germany’s finance minister’s obsession with surpluses will damage EU neighbours We know for certain that Germany will not agree to a central eurozone budget to weather macroeconomic shocks. The daily nominal trade-weighted exchange rate of the euro has increased by almost 7 per cent over the past year. For an economy with an extreme degree of export-dependency this is a big move. Italy is too big to fail and too big to save. If the global economy turns down, it will take Italy with it. The next global recession will entirely reshape the Brexit debate Do not be fooled by the current recovery. Extreme monetary stimulus has papered over the deformed structure of monetary union. It has bought time but that time has been squandered. The eurozone can’t fix its problems until it agrees on what went wrong in the first place. Right now the crisis appears to have gone away. But it has mainly been masked by an avalanche of printed money from the ECB and a cyclical economic upturn. When you drive interest rates down to close to zero, and chuck €1.2 trillion of freshly minted money, it is not that surprising if you get 2.7pc growth. It would be more worrying if you didn’t .Here is a recipe for disaster. Eurozone reformers act as if the crisis never happened You start off by taking the two most toxic financial instruments of the past 20 years, and then merge them.

My guess is that those countries with strong bonds of patriotic cohesion and tested institutions will best survive this ordeal by fire. Almost by definition, these are nation states, all for one and one for all. It is hard to believe that Latin Europe will tolerate a second round of hairshirt austerity imposed by Germany through its near absolute control of the policy machinery. Interndevalvering (Ådals-metoden) Jean-Claude Juncker’s Roadmap for European Disaster The institutional changes recommended by euro-area elites will likely exacerbate global imbalances. As national currencies were replaced by the single currency, investors came to believe that devaluation risk had been eliminated. One of the interesting ideas we discussed was the “re-nationalisation of fiscal policy”. Europe Needs More Than a Bundle of Bonds The European Financial Stability Facility and ECB’s Coeure calls for clarity on Greece debt relief before QE inclusion ECB faces impossible choice between German overheating or Italian debt storm Emmanuel Macron and the battle for the eurozone Beleaguered pessimists of the eurozone, searching for the next threat on the horizon, A group of leading economists and thinkers for the Jacques Delors Institute warned in a seminal report last year that EMU states will have to accept a supra-national system with a pooling of debts - anathema to the creditor bloc of Germany, Finland, Holland and Austria. “At some point in the future, Europe will be hit by a new economic crisis. We do not know whether this will be in six weeks, six months or six years. But in its current set-up the euro is unlikely to survive that coming crisis,” they said. Ambrose Evans-Pritchard, 3 April 2017 Either political integration catches up with economic integration, or economic integration needs to be scaled back. Italy Most of us hoped never again to have to pay attention to spreads between the bonds of different countries that share the same currency. It seems appropriate to repeat the petunias comment today, because once again it seems we need to start worrying about Greece, and about peripheral European bond spreads. For those uninitiated in The Hitchhiker’s Guide to the Galaxy, the only recorded thoughts of a bowl of petunias as it suddenly came into being and started to hurtle towards the ground were “Oh no, not again!”. Populists threaten EU break-up “After Brexit last year, if enemies of Europe manage again in the Netherlands or in France to get results The European Stability Mechanism gave the green light to a series of modest measures Policymakers seem to think the European project will be safe Mr Macron is the opposite of a souverainiste: Remarkably, real domestic demand in the eurozone was 1.1 per cent lower So long as the eurozone fails to deliver widely shared prosperity, It was, said a hoarse, red-eyed Matteo Renzi, an “extraordinarily clear” result. Britain’s decision to leave is the most striking but, in the long run, The Retreat from Hyper-Globalization Factor-price equalization - Faktorprisutjämning How December 4th Could Trigger The "Most Violent Economic Shock In History" Spreads on Italian bonds have widened to about 200 basis points over German bunds. The Eurozone desperately needs to strengthen its institutions relative to nation states, Italy is preparing a €40bn rescue of its financial system as bank shares collapse on the Milan bourse

Brexit vote might drive the rest of the EU member states towards decisions they should have taken 10 years ago, “I’d never believed in the efficient market hypothesis or the rational expectation hypothesis. Adair Turner, Martin Wolf FT Lunch June 2016 I hate to say it, but I fear that we are in for a new round of euro zone troubles. Continued very low level of inflation expectations in the euro zone. As a consequence, nominal GDP growth also remains very weak across the euro zone. Germany should leave the euro zone in order to save the union, Bara en person. Angela Merkel. Mervyn King: the eurozone is doomed The eurozone is doomed to fail and will lurch from crisis to crisis unless it is broken up, according to the former governor of the Bank of England. In his new book, Lord King claims that steps towards fiscal union will not quell tensions in the 19-nation bloc and could even tear it apart. He warns of a looming “economic [and] political crisis” triggered by endless bail-outs, austerity demands and pressure from the “elites in Europe” and the US to create “a transfer union” to solve the eurozone’s woes The rout in European financial markets last week was a watershed event. Donald Tusk, the president of the European council, David Cameron scrapped a debate at the European parliament on Tuesday and scheduled a meeting with Jean-Claude Juncker, president of the European commission, amid fears that a proposed settlement geared to keeping the UK in the EU could unravel because of growing European objections to the concessions promised to Britain. Europe’s leaders find solutions that are temporary, barely satisfactory and designed chiefly

Whether it concerns terrorism, immigration, homegrown political extremism, the eurozone’s unity, unemployment, lacklustre economic growth or even Europe’s military defences,

Like Cavafy’s imaginary state, or like the Holy Roman Empire, which lasted for 1,000 years before Napoleon put it out of its misery in 1806,

The EU did not collapse suddenly like the Roman empire. Early 2005 may be considered the apogee of what was then called the European project. The previous spring, 10 states of central and eastern Europe joined the EU, making it the largest commonwealth of liberal democracies in European history. That union was proposing a constitutional treaty, popularly known as a “European constitution”. A single currency, the euro, appeared to be working well — and for many Europeans there was a sense of all-round optimism.

“The next decade, however, proved these to be grandiose illusions. A series of crises left European leaders reeling, starting with the rejection of the European constitution in referendums in France and the Netherlands, and continuing with a decade-long crisis of the eurozone, Russian annexation of parts of Ukraine, Islamist terror attacks, a British referendum on leaving the EU, millions of refugees fleeing the Middle East and Africa, as well as the growth of eurosceptic, anti-system and xenophobic parties across the continent. “Unfortunately, the European leaders who gathered for one of their innumerable summits in Brussels in December 2015 failed to acknowledge the depth of the union’s existential crisis, let alone to find answers that effectively addressed the growing disillusionment of their peoples The EU did not collapse suddenly like the Roman empire, with barbarian hordes occupying the bureaucratic palaces of Brussels. Its decline was more like that of the Holy Roman Empire. Rome, Habsburg and the European Union Unworkable and unreformable, the euro surely cannot survive another serious downturn I vastly overestimated the risk of /Euro/ breakup, because I got the political economy wrong I’m sorry to say that I completely missed the important of liquidity and cash shortages in driving bond prices in the euro area. If Europe cannot bend it will break That failure to be flexible about change is dangerous. A Europe that cannot bend is much more likely to break. There will be no serious adjustments of policy, since it will just be too hard to agree what to do.

“The decision to use the single currency to drive the European project forward was a risky one, Mr Fischer quoted EU founding father Jean Monnet in arguing that the history of Europe would be “forged in crises”. “All that has been done so far makes it very likely that EMU — the Economic and Monetary Union — will survive this crisis,” Mr Fischer said. Policy makers in Italy, Portugal and Spain say their economies and financial systems are strong enough to survive a Greek departure from the eurozone, On the other hand, a Grexit that was carefully managed and led to economic recovery in Greece, albeit after five to 10 years, A Greek departure from the eurozone would still be "negative", Accidental exit from the eurozone is quite likely — not because Greece or its partners want it A country is most likely to leave the euro if its government cannot meet its obligations, its banks close their doors, its economy is depressed and its politics are turbulent. Greece might soon be in this state. A chaotic exit may then occur. It is vital to avoid such a “Greccident”. Moreover, exit — particularly if unassisted — could cause grave economic and geopolitical consequences. Greece might plunge into an economic abyss. Abandoned by Europe, it might turn towards unfriendly powers. This would be a strategic disaster. Finally, Greece has already suffered the pains of austerity. From now on, things should get better, provided policy improves. To save the euro, let Greece go But, if so, this will not be the final act. The unfolding drama has exposed the fundamental weakness of imposing a common currency on such disparate societies Top of page Fundamental misalignments that have made life so unbearable for many Europeans. Germany had a surplus of 7.5 per cent of its economic output last year. Sustaining the Unsustainable Eurozone But this process has not occurred, and, as the interminable Greek crisis has shown, the eurozone remains rife with structural weaknesses and extremely vulnerable to internal shocks. This is clearly not sustainable. Despite efforts to promote fiscal-policy coordination, eurozone members’ budgets still fall under the purview of separate national authorities, and northern Europeans continue to oppose transfers from more to less prosperous countries beyond the very limited allowance of the European Union’s regional funds. Moreover, labor mobility is severely constrained by linguistic and cultural barriers, as well as administrative bottlenecks. And “ever-closer” political union has ceased to attract public support – if it ever did – and is thus not feasible today. It is a sign of low expectations in the handling of the Greek debt crisis

In theory the euro is forever. That is what all the law associated with it says. Whether Berlin likes it or not, the moment Greece leaves, those who control the world's huge pools of liquidity or cash Berlin, Paris and the rest simply cannot be confident the euro will be for all time if Greece is either bundled out the exit door or chooses to walk through it. "ever closer union" - The United States of Europe The banks in Greece will not open on Monday, I guess The euro is engaged in two dances of death. The risks of mutual misreading between Merkel and the markets on this are potentially catastrophic. ECB; expansion of so-called Emergency Liquidity Assistance by about 5 billion euros to Greece on Thursday The real risk for the eurozone is that Greek default and euro departure go relatively well The spectre of Greece's exit from the single currency - or "Grexit" - once again. Snap elections in Greece open the way for an anti-austerity government

Eurozone’s weakest link is the voters Secular stagnation

The second and third choices are not mutually exclusive. As the political union is firmly off the table, this leaves us with a choice between depression and failure – or both in succession. Financial markets have woken up to the possibility of a eurozone-wide economic depression with very low inflation over the next 10 to 20 years.

Secular stagnation – the idea that a chronic shortfall of investment might produce a long period of weak demand – also has disturbing implications for financial investors.

Eurozone policy makers face three choices. First, they can transform the eurozone into a political union, and do whatever it takes: a eurobond, a small fiscal union, transfer mechanisms and a banking union worthy of its name. Second, they can accept secular stagnation. The final choice is a break-up of the eurozone. The second and third choices are not mutually exclusive. As the political union is firmly off the table, this leaves us with a choice between depression and failure – or both in succession. Defiant France ignores the abyss Borders and budgets risks provoking political crises How the euro was saved Unbalanced and unsustainable – if something cannot go on forever, then it will stop /RE: If something cannot go on for ever it will stop. The Public Interest - nr 97 Fall 1989/ and http://en.wikiquote.org/wiki/Herbert_Stein/ Eurointelligence puff:

If something cannot go on for ever it will stop.

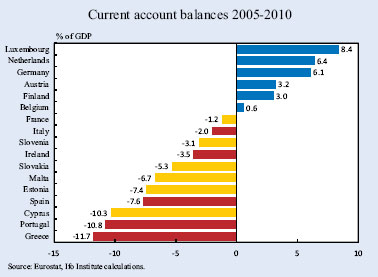

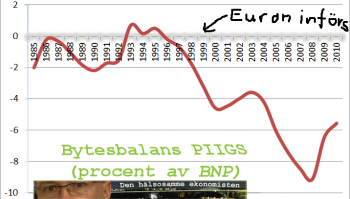

Since the euro was inaugurated in 1999, German unit labour costs have risen by less than a cumulative 13 per cent. During this time, Greek, Spanish and Portuguese labour costs have risen by 20 to 30 per cent, and Italian ones by even more. It is hardly surprising that Germany has a current account surplus of 6 per cent of gross domestic product The economic theory – such as there was – behind the creation of the euro was that the single currency itself, and the supposed impossibility of devaluation by members, would act as a harmonising force. But this has not happened and present relationships have become unsustainable. Herbert Stein, an economist active in Washington towards the end of the last century, said that if a policy or situation was unsustainable, it would not be sustained. But he did not indicate how long it would take for such situations to unravel. /RE: If something cannot go on for ever it will stop. The Public Interest - nr 97 Fall 1989/ and http://en.wikiquote.org/wiki/Herbert_Stein/ Meanwhile, it is in the interests of the eurocrats to make the problems seem as complicated as possible so that only a small number of so-called financial experts can even discuss them; and we have had one financial package after another and one guarantee after another to keep the structure going. But loans and guarantees do not make the unsustainable sustainable. There is only a limited number of ways that the situation could develop. First, “austerity” in the peripheral countries could succeed.

/Interndevalvering (Ådals-metoden)/ Second, the peripherals could continue to stagnate. Unemployment is now 22 per cent in Greece, 24 per cent in Spain, 18 per cent in Portugal, 15 per cent in Ireland and 10 per cent in Italy. The third option is unlikely, but included for completeness. Germany and other northern euro members could pursue more “expansionary” (read inflationary) policies, thus reducing the agony of the south. Alternatively it could continue to subsidise the peripherals indefinitely. The fourth option is for one or more of the peripherals to leave the eurozone. If I had to bet (which I don’t), my money would be on number 4. But I would not bet at all on when it will occur. The Holy Roman Empire was founded by Charlemagne in 800 and lasted until it was dissolved by Napoleon in 1806. The timescale of euro disintegration is anyone’s guess. More by Samuel Brittan at Financial Times More by Samuel Brittan at IntCom and nejtillemu.com Rome, Habsburg and the European Union This month marks the fourth anniversary of the May 2010 financial rescue of Greece. Ireland, Portugal, Spain, and Greece have made considerable progress in lowering their unit labor costs to 1999 levels relative to Germany.

Italy and France, meanwhile, have made considerably less progress on improving their international competitiveness. Europe’s banking crisis is unresolved. Loans to finance fixed investment continue to fall. Remarkably, the European Banking Authority’s latest stress test for the eurozone’s banks does not contemplate the possibility of deflation in its adverse scenario. Europe’s much vaunted banking union harmonizes deposit-insurance coverage but does not provide a common deposit-insurance fund. The associated resolution fund will possess only € 55 billion of its own capital, whereas European bank liabilities are on the order of € 1 trillion. The longer the crisis in the Eurozone drags on,

In Latin America it took nine years for growth to recover sustainably to the levels prevailing prior to the crisis in 1982.

East Asia’s crisis, in contrast, took the form of a v-shaped recession and recovery, with growth falling sharply in 1998, the year following the onset of the crisis, but recovering equally sharply in 1999 to levels nearly as high as before the crisis.

Thanks Eurointelligence and Brad Delong for the link. Rolf Englund, Den Stora bankkraschen, Timbro, 1983 Internationella valutafondens roll i krishantering: fallet Asien

http://www.internetional.se/evas299.htm#asien Since the European debt crisis broke out in 2009,

Kommentar av Rolf Englund:

Förhoppningsvis går det att hitta hållbara vägar ur dagens djupa europeiska kris, men det blir inte lätt. Det vi beskådar är inte eurons kris. In the US, bank assets were close to 80 per cent of gross domestic product. The ECB is saying that it will seek to eliminate the threat of a break-up, except when this threat is most real,

Kommer Europa låta Bryssel ta över den ekonomiska makten eller läggs EMU-projektet ner? Resonerar man kring vad som är ”långsiktigt hållbart” så landar man lätt i slutsatsen att eurons dagar är räknade. "Lätt som en plätt" What is needed is a solution that is both politically feasible and economically workable Unsustainable and Disintegration Euron kollapsar i Spanien Martin Wolf: Would he conclude that the European currency union was a mistake? A Greek exit from the euro area has the potential to be RE: The Ultimate Article about EMU and the Eurocrisis Why the euro is doomed to fall apart: The bottom line, as brilliantly explained in the European Economic Advisory Group's latest annual report,

is that it is a balance of payments crisis, pure and simple, which the eurozone lacks the adjustment mechanisms to deal with Jeremy Warner, Daily Telegraph, March 16th, 2012 With Spain now front and center, the essential wrongness of the whole European policy focus becomes totally apparent.

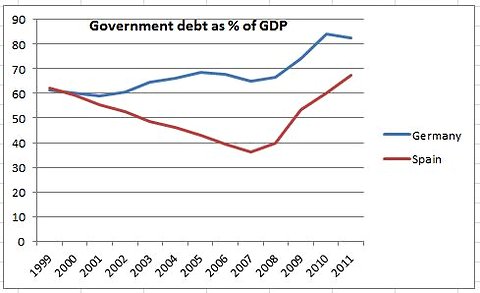

Spain did not get into this crisis by being fiscally irresponsible; here’s a little comparison:  Paul Krugman, 7 March 2012 Events on the Continent have come to feel much like the drift into war.

There is a feeling of powerless inevitability about it. Jeremy Warner, 1 Dec 2011  Is this really the end?

Unless Germany and the ECB move quickly, the single currency’s collapse is looming The Economist print Nov 26th 2011 The greatest threat to the euro is that Greece will make a success of default and devaluation. The Ticking Euro Bomb

The architects of the euro and their successors have lost the Maastricht Treaty bet. They have jeopardized an agreement made by 12 countries in the hope that the markets wouldn't notice how fragile their shiny new currency really is. Der Spiegel Staff, 7 October 2011 En lysans artikel - Highly recommended a defining moment for Europe

I make no apologies for repeatedly taxing the reader with commentary on the future of the single currency, for its crisis is without doubt the most important European story of the decade. We are fast approaching a defining moment. Jeremy Warner, Daily Telegraph 9 Dec 2010 What EU leaders once ruled out — a default by a euro-zone nation — has firmly entered the sphere of the possible  Eurogruppens ledare Jean-Claude Junker och Jean-Claude Trichet, chef för den Europeiska Centralbanken ECB SvD Näringsliv 13 juli 2011 Euron är "världens mest stabila valuta".

Eurogruppens ordförande Jean-Claude Juncker i en tidningsintervju på fredagen, rapporterar Bloomberg News. DI 2011-01-03 Were the Eurosceptics right?

Gavin Hewitt, BBC Europe editor, 22 June 2011 Greece’s austerity plan looks doomed to fail.

It does too little to prevent the epic folly of Greece’s railways and other ruinous schemes. It will screw down too hard on ordinary Greeks, with new taxes, spending cuts and a rushed privatisation scheme. And it will almost certainly condemn Greece to recession, strife and an eventual debt default. The Economist print June 30th 2011 “Events in Greece have brought the euro area to a crossroads:

the future character of European monetary union will be determined by the way in which this situation is handled.” Jens Weidmann, Bundesbank president and European Central Bank governing council member, Hamburg, 20 May, 2011 Financial Times, Ralph Atkins, May 24 2011 22:35 It’s now clear that Greece, Ireland and Portugal can’t and won’t repay their debts in full, although Spain might manage to tough it out

Paul Krugman, New York Times, 22 May 2011 The eurozone's crisis in BBC graphics:

Click here En omstrukturering kan innehålla olika typer av förändringar av villkoren i ett lån, men vanligtvis innebär det en nedskrivning av skuldernas värde.

Tekniskt sett är en omstrukturering lika med en betalningsinställelse. Hittills har den officiella linjen från ledande EU-politiker och beslutsfattare varit att en omstrukturering inte är aktuell, även om de flesta räknar med att det bakom kulisserna dras upp planer på hur en sådan skulle se ut Viktor Munkhammar DI 14/4 2011 Rolf Englund: Ett annat ord är Statsbankrutt. raising the spectre of the "effective end of the euro area,"

The Economist Intelligence Unit has warned, 4 Apr 2011 Hoppet är ute för EMU - Euron kollapsar i Spanien

Rolf Englund blog 31/5 2010 Euron spricker när dollarn faller

Rolf Englund NWT 8/1 2001 'If the euro fails, then Europe fails,'

warned the German Chancellor Angela Merkel last night DT Tuesday 16 November 2010 with nice pic "Risken är att EU plötsligt ger upp andan"

Europeiska unionen är döende, skrev Charles Kupchan i en tankeväckande krönika i söndagens Washington Post. Det finns tyvärr en del som tyder på att han har rätt. Annika Ström Melin, Kolumn DN 1 september 2010 The futile attempt to save the eurozone

Samuel Brittan, FT November 4 2010 Otmar Issing, the former chief economist of the European Central Bank and the German Bundesbank,

is a genial number-cruncher who believes in the overall benefits of European integration has turned virulently pessimistic over the European single currency. In a marked change from his relative sanguinity during his eight years at the ECB, he terms member countries’ unreliability on economic policies “a basic design flaw of monetary union.” David Marsh, Market Watch, Jan. 10, 2011 Highly recommended Euro's Collapse Is Not 'Unthinkable': Warren Buffett

CNBC, 24 March 2011 Det finns egentligen inte någon Eurokris. Stefan Fölster menar att en nedskrivning av Greklands skulder är oundviklig.

– Det är egentligen inte en Greklandskris utan en bankkris Stefan Fölster intervjuad i Sv D Näringsliv 28 juni 2011 The eurozone is now subject to a generalised and full-blown run on its bond market, Italian spreads reached a horrendous 5.3% this morning, Spanish spreads are moving towards 5%, and French spreads, at 1.916%, are no longer at a level that this consistent with an AAA rating. Belgium’s spread has hit 3.2% this morning, and is now at a level of Italy and Spain a couple of months ago. Even Austria is now under attack, with spreads of 1.8% yesterday. It was a day when global equity market plunged, amid fears that the eurozone crisis could throw the world economy into recession. Origins of the Euro Crisis Kash Mansori has an excellent post about the origins of the euro crisis. He documents the fact — which the Germans cannot bring themselves to acknowledge — that fiscal irresponsibility had very little to do with it. Somewhere in the years just before the crisis I was at a meeting in Barcelona where Olivier Blanchard tried to tell the Spaniards how dangerous the situation was getting; Olivier Blanchard, the IMF’s chief economist called for several bold innovations. Germany should leave the euro zone in order to save the union, The euro is engaged in two dances of death. On the one hand, in an incredible reversal of practice during the global financial crisis—when central banks were at pains to conceal which institutions were receiving their emergency assistance for fear of compounding the adverse signals and therefore the crisis—

On the other hand, Syriza would like nothing better now than to see the yields on Spanish, Portuguese, or Italian sovereign debt relative to Germany jump, signalling broader market disquiet— that Grexit may be imminent and that the rump eurozone would be badly destabilized by it—so forcing ECB retreat. So Syriza, in league with Podemos in Spain and prevailing anti-euro Italian political forces, is openly threatening to blow up its own exchange rate regime, the euro, in order to make it work. The army of euro-philes and euroapologists including the IMF, casting themselves as what Krugman labels “Very Serious People” (VSPs), defended it as the best possible monetary-craft for Europe. The risks of mutual misreading between Merkel and the markets on this are potentially catastrophic. "After twenty years of service, I am ashamed to have had any association with the Fund at all," Some eurozone policy makers seem to be confident that a Greek exit from the euro, hard or soft, The euro is still vulnerable, and Greece is not the only problem Pamflett skriven av Joschka Fischer: Scheitert Europa? (Misslyckas Europa?). The euro is in greater peril today than at the height of the crisis

America’s experience in the 1960s should have warned the eurozone’s creators that tying national monetary authorities’ hands might not be such a good idea.

That would not be the case if the eurozone operated according to Robert Mundell’s vision of an optimal currency area, with labor and capital adjustments replacing exchange-rate adjustment, and shocks being homogeneous (rather than asymmetric). Moreover, Germany’s experience with reunification suggests that political union is integral to such a union’s success. The eurozone’s performance has not met any of these criteria. This parrot has ceased to be

Youtube: This parrot is dead The future of the European economy and its single currency is more likely to be decided on the streets. Borders and budgets risks provoking political crises Remember Europe?

But the recent sell-off in global stock markets seems to have revived repressed memories. Today, with the eurozone economy still flatlining five years after its crisis erupted,

Some two or three years ago, the European Central Bank (ECB) would have been seen as revolutionary and courageous, Ilargi: Europe Is Crumbling Into Collapse Yves here. The word “collapse” may seem overwrought when applied to Europe, but cold-blooded, clear eyed colleagues who have good connections and have spent a bit of time there recently say things that are broadly similar to Ilargi’s take. Despite the conventional wisdom that the cost of a Eurozone breakup is catastrophically and thus will never take place, that confidence may prove to be the currency union’s undoing. Ideological rigidity about austerity is leading to policies that are crushing large swathes of the population. And Europe, unlike the US, had enough of a tradition of popular revolt that that uprisings, either on the street or in the ballot box, are real possibilities, as the sudden rise of the anti-EU right shows. Draghi’s recent speech at the annual gathering of central bankers in Jackson Hole has excited great interest, Italy's Renzi must bring back the lira to end depression The argument between Italy and Germany asks a question at the heart of the currency’s future Italy, with the same eye on domestic politics, worries about political credibility. This rests on a resumption of growth. Germany may be right to argue that a stable debt and deficit framework is a prerequisite for growth, but if markets conclude the remedy is killing the patient, then the whole system would lose credibility. Ferdinando Giugliano?

As La Guardia and Peet argue, the eurozone’s politicians made

Rolf Gustavsson i SvD 29 juni The Euro Crisis and Its Aftermath http://www.amazon.com/Euro-Crisis-Its-Aftermath-ebook http://www.project-syndicate.org/columnist/jean-pisani-ferry Jean Pisani-Ferry was the first Director of Bruegel from 2005-2013.

http://www.bruegel.org/about/person/view/27213-jean-pisani-ferry/ Jean Pisani-Ferry at Financial Times

We were asked: “What probability do you attach to Greece leaving the eurozone by the end of the year?” The consequences of abandoning the euro are highly uncertain, and few European leaders are willing to go there. Many explanations have been proffered. Yes, the French and the British were protesting their ineffective establishment parties.

Plus ca change, plus c'est la meme chose: The results in France are infinitely the more important

I Malmö levererade Persson, våren 2011, som vanligt utan manus, precisa formuleringar som hade kunnat gå rakt till trycket.

The EU authorities are now in a near hopeless situation. The two dominant parties of the post-Franco order in Spain saw their share of the vote drop to 49pc from 80pc last time,

Europe's "Fiscal Compact" has set in motion a doomsday machine, Full text of Ambrose Evans-Pritchard 28 May 2014 European Spring:

As these books all argue, the crisis was always about more than whether financial markets would buy government debt.

The Euro Crisis and its Aftermath. By Jean Pisani-Ferry. To eliminate the monetary independence of 17 sovereign countries and create a major new world currency is a pretty big undertaking. Ett intressant inlägg kommer från tankesmedjan Bruegel i Bryssel. This month marks the fourth anniversary of the May 2010 financial rescue of Greece. Complacent policy makers and investors imagine the crisis is over. Europe’s Plan Z - The Grexit gamble Peter Spiegel reveals how a secret strategy was developed to contain the firestorm from a Greek exit. June 15 2012 was the Friday before a parliamentary election – the second national vote in as many months – and the country appeared to be edging towards panic.

Unbeknown to almost the entire Greek political establishment, however, a small group of EU and International Monetary Fund officials had been working clandestinely for months preparing for a collapse of Greece’s banks. Plan Z was never used. Several senior officials said they were stunned Ms Merkel and Mr Sarkozy had aired the idea that the eurozone could be left voluntarily, something that had previously been vigorously denied. According to one participant, no single Plan Z document was ever compiled and no emails were exchanged between participants about their work.

How the euro was saved

“Das ist nicht fair.” That is not fair, the German chancellor said angrily, tears welling in her eyes. A cornered Ms Merkel threw the French and American criticism back in their faces. If Mr Sarkozy or Mr Obama did not like the way her government ran, they had only themselves to blame. After all, it was their allied militaries that had “imposed” the German constitution on a defeated wartime foe six decades earlier. Greece was imploding politically; Italy, a country too big to bail out, appeared just days away from being cut off from global financial markets; and Ms Merkel, try as Mr Sarkozy and Mr Obama might, could not be convinced to increase German contributions to the eurozone’s “firewall” – the “big bazooka” or “wall of money” they believed had to grow dramatically to fend off attacks by panicking bond traders. And yet less than a year after that November 2011 night, the existential crisis for Europe’s single currency would, for all intents and purposes, be over. Strict budget rules were made inviolable; banking oversight was stripped from national authorities; and the printing presses of the European Central Bank would become the lender of last resort for failing eurozone sovereigns. Europeiska centralbankens (ECB) högste chef Mario Draghi Om man har en sedelpress går man inte i konkurs. President Obama was in France for a meeting of the G20. Euro stability more important than Greece, says Angela Merkel

Charlemagne If markets once seemed ready to push the weakest countries out of the euro, now it is voters who may pull their escape cord. Support for the European project, always fragile, will keep falling if it fails to deliver greater prosperity. It is slow moving variables — long term unemployment, gradual shifts in public opinion, and so on — that pose the greatest threat to the Euro’s survival.

Europe’s political leaders should remember what Ernest Hemingway said about bankruptcy.

German wages fell 0.2pc in 2013. Germany too is in wage deflation.

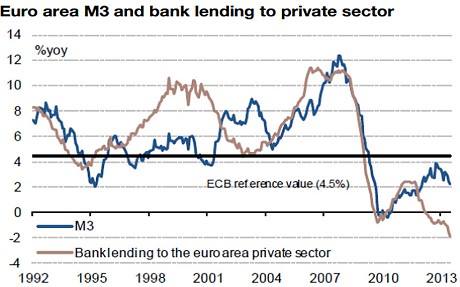

Whatever happened to the eurozone crisis? The Anglo-Saxon jeremiads have been proved wrong. It needs to be said at the outset that Europe is still enjoying the "Draghi effect": To politicians and officials the key question hanging over the euro was its survival. For the moment that question has been laid to rest. But to the public there is perhaps a more important question - does the single currency deliver prosperity or stagnation? Marknaderna skiter i hur det går för Spanien, Grekland, Italien och andra krisländer

Do you think that the euro will fail? Euron har redan kollapsat

I går kväll, efter att ha uppdaterat sidan om "När och hur spricker EMU?" stod sanningen helt plötsligt klar för mig. Strong Governments, Weak Banks

FORES presenterar en antologi där några av Sveriges kunnigaste ekonomer beskriver bakgrunden till krisen

Lars Calmfors: "Överlever euron?" Bokpresentation 14/11, Youtube, Highly Recommended Greece, Spain and Portugal need to devalue in real terms by about 30 per cent

A concern is that the monetary policy of the ECB is unsuitable for Germany and might even cause asset price bubbles. Europe Breakup Forces Mount as Union Relevance Fades Sieps uppdrag är att på ett självständigt och allsidigt sätt belysa aktuella europapolitiska frågor. SIEPS remissvar på Lissabon Sieps var en gång en förhållandevis aktad organisation med viss akademisk prägel. Debt loads rise faster than nominal GDP - The "denominator effect" So says Simon Tilford from the Centre for European Reform. Tentative signs of life after six quarters of contraction are deemed a vindication of shock therapy, even as the underlying crisis gets worse in almost every key respect.

Far from being on the mend, the economic crisis across the South is deepening. Real interest rates are increasing from already high levels," he said.

Europe has not recovered. It has begun to stabilise, but only just, amid mass unemployment, with debt trajectories still spiralling out of control in Italy, Portugal, Spain and once again in Greece. Hur kan man undvika att inse att 25 procents arbetslöshet är en katastrof för land och folk?

Hollande Bids Adieu to EU Vacation Culture as Crisis Lingers The euro zone crisis could be largely over by the end of the year

"We are now only at a very small risk of the break up of the currency. "Except in Italy, where we have to ask in a post-Monti [environment] what happens next, the political risks to the euro have receded," Det vi beskådar är inte eurons kris. Once the French get into a full-scale crisis, it’s over. “Another possible fallout is getting rid of some of the countries that are being ruined by being in the euro, notably the southern European economies,” Christensen said. “It’s the political world that has been extremely supportive of the euro, not for economic reasons but for political reasons,” said Christensen, a long-time critic of the single currency and who now lives in Switzerland. Gloomsters buried the euro too soon

"Intellectuals" Why the Euro Zone Crisis is Over…Until September

On Sunday, Merkel's conservative coalition lost regional elections in Lower Saxony, one of the country's most populous states.

So far, Merkel's euro zone policy decisions have only been constrained by public opinion and Germany's constitutional court, I ett alltmer instabilt lapptäcke av IMF-åtgärder, europeiska länder utan egna sedelpressar och tecken på riktig depression

Martin Wolf och Rolf Englund om att den som har en sedelpress går inte i konkurs. The real risk for the global economy is in Europe. If the ECB imposes further austerity conditions (as it seems to be demanding of Greece and Spain) in exchange for financing, the cure will only worsen the patient’s condition. Likewise, common European banking supervision will not suffice to prevent the continuing exodus of funds from the afflicted countries. That requires an adequate common deposit-insurance scheme, which the northern European countries have said is not in the cards anytime soon. While European leaders have repeatedly done what previously seemed unthinkable, their responses have been out of synch with markets. They have consistently underestimated their austerity programs’ adverse effects and overestimated the benefits of their institutional adjustments. Will the dam break in 2007?

The EMU disaster is not at root a public debt crisis, and never was.

Whether you think this matters depends on whether you think the democracies of southern Europe will tolerate slow grinding depression – with no light at the end of the tunnel – for year after year. The denouement is hard to predict in such situations. Political upheavals are famously non-linear. But the situation in Spain is remarkable, with the added nitroglycerine of a ruling party determined to exploit the crisis to take power back from the regions, and Catalonia determined to resist with all means at its disposal. Data from Tinsa released today shows that Spanish house prices fell 11.3pc last year, and are now down 33.3pc from the peak in 2007. Eurozone governments’ determination to stop the liquidity crisis The ECB’s support cannot help in the solvency case because the central bank is not allowed, by its own legal definition, to write off or participate in a restructuring of any debt it holds. Germany was now ready to accept a two-year extension of the Greek programme, but there would be no new money, leaving Greece itself to fund the gap – something that is simply not going to happen. The refusal to let the European Stability Mechanism fund Spanish banks directly falls into the same category. Debt that has arisen in Spain will remain debt of the Spanish state as ultimate guarantor. Full textIn 2010, US banks had assets of €8.6tn. But those of the EU’s were €42.9tn. In the US, bank assets were close to 80 per cent of gross domestic product. Half of the world’s 30 biggest banks are headquartered in the EU. If the EU makes a mess of banking, it can explode the world economy. In brief, while individual US banks may be “too big to fail”, the EU has a banking sector that is not only too big to fail, but too big to save. Full textThe ECB action will not prevent countries like Spain from having a pretty terrible few years.

The ECB is saying that it will seek to eliminate the threat of a break-up, except when this threat is most real,

Spain and Italy are at the heart of the story, which could yet end with a breakup of the euro zone. The bottom line: If a bailout of Spanish sovereign debt costs €300 billion, then the Europeans may lack the funds needed to rescue Italy. Det som händer i Europa är stort, mycket svårt att greppa, och åtgärderna som föreslås är stundtals radikala. German, French or other savers may hold bank accounts, pensions, insurance policies. Investors’ panic does the opposite. They cannot repatriate capital that has been invested or consumed, but their attempt to do so has meant an abrupt halt of new funding. The periphery’s need to reduce current account deficits equally abruptly is the main cause of the recessions. By refusing to extend new financing, investors are ruining their chance of recouping their own investments. The way the eurozone’s imbalances are being unwound is poisoning what solidarity the monetary union used to possess. It is not sufficiently appreciated that these imbalances were driven by private investors. Welcome to Martin E. Sandbu's website. Euro Zone as We Know It Has Two Years Left If EMU Exists In 5 Years Fiskal Union Man bör fråga sig hur det kommer sig att vi i Sverige överför stora belopp inom vårt land mellan olika regioner ”Det handlar alltså inte om en gigantisk överstatlig finanspolitisk union”, det ser bara ut så. Debattartikeln är en bra sammanfattning av den inte mycket mer detaljerade tiosidiga rapporten, Breaking the Deadlock: A Path out of the Crises, varpå artikeln baseras. Mecenaten bakom rapporten är Institute for New Economic Thinking (INET); ett ungt institut grundat av George Soros 2009, en inte fullt lika ung legend inom valutaspekulation och välgörenhet. Liksom i juli 1914 vandrar Europa lealöst mot en katastrof av ofattbara proportioner INET, Council on the Eurozone Crisis Krisen i eurozonen kan fortfarande lösas, men för det fordras att Europas ledare förmår separera två problem: Detta är huvudpunkterna i det förslag för hur krisen ska lösas som i dag presenteras av en grupp av 16 europeiska nationalekonomer från de flesta av EU:s stora medlemsländer, inklusive fyra framstående tyska ekonomer av olika politisk färg. Utgångspunkten är att en lösning inte bara måste vara hållbar ekonomiskt men också politiskt möjlig att genomföra. Alla som var med om att skriva under Maastricht-avtalet som lade grunden till euron har ett ansvar. Alla måste vara med och dela på de kostnader som uppstått till följd av eurons brister och för det massiva krisprogram som fordras för att få tillbaka tillväxten i alla medlemsländer. En insättarförsäkring skulle som i Sverige kunna baseras på en gemensam fond uppbyggd genom avgifter på bankerna, men den skulle också fordra någon form av delat betalningsansvar, exempelvis via ECB, om kostnaderna för en kris skulle överstiga fondens resurser. En bankunion ger också hopp om en förnyad demokratisk legitimitet för det europeiska projektet. Medborgarna i den Europeiska unionen har med växande skepsis sett hur makt överförts till europeiska institutioner utan att åtföljas av motsvarande politiskt ansvar. Men de har också med tilltagande indignation följt hur bankerna och deras ledningar kommit mer eller mindre oskadda ut ur krisen samtidigt som skattebetalarna fått bära kostnaderna för deras misstag. För att eurosystemet skall fungera på lång sikt måste den europeiska centralbanken ECB ta ett ökat ansvar, inte bara för en bankunion, men också fungera som ”lender of last resort”. En viktig del i dess ökade ansvar vore att ge den nya ekonomiska stabilitetsfonden ESM en banklicens så att den kan låna från ECB. Allt detta kan ske utan att i grunden ändra ECB:s statuter. Det behövs med andra ord inte någon gigantisk överstatlig finanspolitisk union. Eurokrisen, fisksoppan och elitens olidliga dumhet Med en gemensam real ränta måste man ha en gemensam central myndighet/regering och stora transfereringar mellan valutaområdets olika delar The Institute For New Economic Thinking Så heter en ny rapport från The Institute For New Economic Thinking där 17 ledande internationella ekonomer utvärderar den ekonomiska krisen i Europa och ger tips på hur unionens politiker ska ta sig ur knipan. Deras grundtes är att Europa aningslöst rör sig mot en såväl ekonomisk som humanitär katastrof där ”en dominobricka efter den andra” den senaste tiden har fallit in i krisen. Senast ut: Spanien, som enligt experterna bara är dagar ifrån en allvarlig likviditetskris. För att angripa problemet vid roten anser ekonomerna att unionens länder bör lägga alla skulder som överstiger 60 av landets BNP, allt enligt Maastrichtavtalet, i en gemensam pott med Tysklands kreditvärdighet som garant. Europe is “sleepwalking towards disaster” “This dramatic situation is the result of a eurozone system which, as currently constructed, is thoroughly broken. The cause is a systemic failure. It is the responsibility of all European nations that were parties to its flawed design, construction and implementation to contribute to a solution. Absent this collective response, the euro will disintegrate,” they added in a co-signed report for the Institute for New Economic Thinking. Institute for New Economic Thinking They claimed the system could be stabilised immediately by creating a lender of last resort to back-stop the bond markets, either by mobilising the ECB or by giving the eurozone bail-out fund (ESM) a banking licence to borrow from the ECB. The lack of any light at the end of the tunnel is leading to a populist backlash in both the debtor and creditor states. The only question is whether the North or the South succumb to revulsion first. Had Greece still had its drachma the shortcomings of the country's financial accounts would have been much clearer for all to see much earlier Rubrik: The Wisdom of the Currency Crowd Extraordinary Popular Delusions and the Madness of Crowds IMF: IMF Executive Board Concludes Article IV Consultation on Euro Area Policies Själv röstade jag ”ja” till att Sverige skulle gå med i valutaunionen vid folkomröstningen 2003 Kommentar av Rolf Englund: Kommer Europa låta Bryssel ta över den ekonomiska makten eller läggs EMU-projektet ner? Resonerar man kring vad som är ”långsiktigt hållbart” så landar man lätt i slutsatsen att eurons dagar är räknade. Grekland lämnar sannolikt EMU. Men istället för att leda till att euron havererar så lär Greklands djupa kris bli ett tacksamt slagträ när EMU-lobbyn ska skrämma opinionen till att acceptera Bryssels nya maktfunktioner. ECB President Mario Draghi Nils Lundgren 2011: "I am sure the euro will oblige us to introduce a new set of economic policy instruments. "Lätt som en plätt" Artikeln om eurokrisens scenarier visar hur arbetskraftskostnaden per tillverkad enhet har förändrats sedan euron infördes. I Tyskland har kostnaden ökat noll procent medan tillverkning i Italien och Spanien nu är ungefär en tredjedel dyrare. Valutakursen för euron balanserar dock mitt emellan dessa båda ytterligheter vilket innebär att tysk export får turbofart av en svag valuta samtidigt som det omvända gäller för Italien och Spanien. Med den breda penseln kan man måla upp två huvudscenarier för framtiden. Eurokrisens scenarier: Jesper Stage och Magnus Henrekson Jesper Stage, professor i nationalekonomi vid Mittuniversitetet i Sundsvall, tycker att euroområdets makthavare borde fokusera på att få fart på ekonomin igen. – Inflationsmålet inom euroområdet borde höjas till åtminstone tre procent eller kanske mer. Med den inflationsnivå som gäller nu bygger man in massarbetslöshet i krisländerna under lång tid framöver, säger Stage. Jesper Stage är en av många ekonomer som skrivit under manifestet för ekonomisk sans som nobelpristagaren i ekonomi Paul Krugman skapat på Internet. Det beskriver i dramatiska ordalag hur misstagen från krisen på 1930-talet nu håller på att upprepas. Krugman tillhör den keynesianska skolan som förespråkar en aktiv finanspolitik. Men andra svenska ekonomer tycker att Stages och Krugmans syn på hur krisen ska lösas är naiv. Tillväxtreformer och uteblivna besparingar är kostsamma på kort sikt och kräver att Tyskland och andra stabila länder öppnar den stora plånboken. Det är inte rimligt, menar bland andra professor Magnus Henrekson som är VD på Institutet för Näringslivsforskning. – Med stor sannolikhet kommer man inte få tillbaks de här pengarna och det ska politikerna ta ansvar för gentemot sina nationella väljare. Som det ser ut i dag är väljarna inte intresserade av det utan kommer rösta bort en politiker som fattar ett sådant beslut. Magnus Henrekson, professor nationalekonomi SvD Näringsliv 27 juli 2011 Magnus Henrekson, VD på Institutet för Näringslivsforskning. Varför går det bra för Sverige? : om sambanden mellan offentlig sektor, ekonomisk frihet och ekonomisk utveckilng av Andreas Bergh, Magnus Henrekson Överlever EMU utan fiskal union? The dream of the unification of Europe goes back at least to the 15th century The so-called "rescue" packages for the troubled economies of Europe have involved insistence on draconian cuts in public services and living standards. The hardship and inequality of the process have frayed tempers in austerity-hit countries and generated resistance – and partial non-compliance – which in turn have irritated the leaders of countries offering the "rescue". The very thing that the pioneers of European unity wanted to eliminate, namely disaffection among European nations, has been fomented by these deeply divisive policies (now reflected in such rhetoric as "lazy Greeks" or "domineering Germans," depending on where you live). On the economic side, too, the policies have been seriously counterproductive, with falling incomes, high unemployment and disappearing services, without the expected curative effect of deficit reduction. So what has gone wrong? Two issues need to be separated out:

The problems we are seeing in Europe today are mainly the result of policy mistakes: Members of the Financial Policy Committee (FPC), the Bank of England’s risk regulator, The record of the interim Financial Policy Committee reveals members thought Det finns två huvudvägar för att rädda Europas ekonomi från en katastrofal utveckling - om man nu vill det. Om vi börjar i slutändan måste dels Grekland och dels Spanien och Italien förhindras från att bli så bankrutta att de måste lämna euron. För att motverka den ökande risken för en statsbankrutt måste Greklands tillväxt bli positiv istället för negativ. Den konventionella teorin säger att om ett antal år kommer åtstramningsåtgärderna att leda till att företagen börjar investera och expandera igen. Draghi also poured cold water on a third option Nouriel Roubini, once known as "Dr. Doom" for bearish views predicting the 2008 financial crash, The US is a federal nation state, not a federation of nations like the EU. The writer is author of ‘Land of Promise: An Economic History of the United States’ and a co-founder of the New America Foundation Hamilton probably would have scoffed at the idea that federal institutions devised to unite Massachusetts, Virginia and New York could unite Germany, Greece and Poland. In 1802 he wrote: “The safety of a republic depends essentially on the energy of a common national sentiment; on a uniformity of principles and habits; on the exemption of the citizens from foreign bias, and prejudices; and on that love of country which almost invariably be found to be closely connected with birth, education and family.” The respected economist and Telegraph columnist Roger Bootle summarises Not only must any agreement fit the needs of these three leaders. Hanteringen av Spaniens och Italiens statsfinansiella problem är förmodligen avgörande för EU:s framtid. What is needed is a solution that is both politically feasible and economically workable "Det finns ingen anledning till oro" Europa saknar de verktyg som är nödvändiga i en allvarlig kris: He said the eurozone crisis can have one of three outcomes. Number is two is not going to happen, so we are left with the bifurcation we have forecasting for a long time. Either they agree a full backstop – which can logically only come from the ECB, and which in turn requires a political union – or the eurozone collapses. Berlusconi says Italy should quit eurozone unless Merkel changes course Just in time for the G-20 Summit, On Monday morning EU Commission President José Manuel Barroso lost it when a Canadian reporter in shorts wanted to know why the North Americans should be responsible for the problems of rich Europeans. "We are not coming here to receive lessons in terms of democracy or in terms of how to handle the economy," Barroso fumed. "By the way, this crisis was not originated in Europe. This crisis originated in North America and much of our financial sector was contaminated by, how can I put it, unorthodox practices from some sectors of the financial market." Eurozone crisis explained Under no circumstances whatsoever could the eurozone members span a protective umbrella over Europe's big countries, like it has for the small ones.

World leaders must draw up a “concerted global action plan” to deal with the eurozone crisis at next week’s G20 summit In an article for news agency Reuters Mr Brown urged leaders to follow the example set at the 2009 London G20 summit, after the last credit crisis, when an international bail-out was agreed. Ivan Krastev, head of the Centre for Liberal Strategies, a Bulgarian think-tank, Paradoxically, the belief that the Union cannot disintegrate, backed by the economists and shared by Europe's political class, is one of the risks of disintegration. The Soviet collapse is the most powerful demonstration that the disintegration of the EU need not be the result of a victory of anti-EU forces over pro-EU forces. Apokalyps nu? Apocalypse Now..Ride Of The Valkyries The Euro’s 11th Hour Frustrated, European leaders have descended into the five stages of grief: denial, anger, bargaining, depression and — by some — acceptance that the euro could fall apart At the heart of the European quandary is the conundrum that ideas that are economically sensible are not politically feasible, while ideas that are politically possible make little economic sense. Since 2000, wages of German workers have increased barely more than efficiency has grown. Meanwhile, Greece’s unit labor cost (the average cost of labor per unit of output) has increased by roughly 40 percent. Greece is merely the most disobedient of a passel of problem children; by this all-important measure, the other 15 members are mostly sprinkled closer to Greece than to Germany. The stronger countries must also accept the need for fiscal transfers — subsidies to poorer euro zone members — just as states like New York pay far more in federal taxes than they get back in services and transfer payments. The euro zone may find another piecemeal solution and escape the hangman for now, but unless it attacks its more fundamental problems, it is doomed to a cascading series of crises that will ultimately destroy the common currency. Steven Rattner, a contributing opinion writer, is a longtime Wall Street executive and a former counselor to the Treasury secretary. Jag tycker att euron långsiktigt är bra en idé.Den bygger ett gemenskaptänkande vilket är viktigt i Europa givet vår historiska belastning och bakgrund Men den blev inte som det var tänkt. Fredrik Reinfeldt, Ekot Lördagsintervju 9 maj 2012 Europe’s economic outlook and market conditions remain “daunting,” European governments need to take “courageous moves towards fiscal and financial union” to break the link between sovereign risk and bank risk, he said. “Without the design and implementation of appropriate governance arrangements, monetary union is difficult to sustain,” Visco said. "I am sure the euro will oblige us to introduce a new set of economic policy instruments.

The equity market seems to be thinking it. The bond market certainly is. If Spain, Ireland, Greece, Portugal and maybe Italy, broke free (with a combined GDP to rival Germany). In brief, the eurozone is now on a journey towards break-up Euro Crisis: Europas politiker har slagit in på en ekonomisk kurs som ser ut att leda mot sammanbrott. It probably is about time to judge the euro zone as a failed idea, Euron kollapsar i Spanien Bear Stearns, Lehman Brothers and Grexit calls into question Europe’s hapless politicians, having asserted that exit from the single currency was impossible, RE: The Ultimate Article about EMU and the Eurocrisis I had written repeatedly that the eurozone was a flawed construction that was likely to collapse. If that was the case, I was asked, would it not be better to break the whole thing up now? At this point, I heard myself becoming shifty and evasive – “The trouble,” I replied, “is that I keep being told that a break-up would cause a catastrophe. Until I can tell you convincingly why that’s untrue, I can’t responsibly advocate it.” But prevarication is no longer good enough. In the coming months, Europe may be forced to decide. It is true that the transition from here to there will be painful and dangerous. My colleague Martin Wolf laid out an updated version of the full horror scenario in Friday’s FT – involving a breakdown of law and order in Greece, and financial collapse across Europe. How could anyone responsibly run that risk? The answer is that the alternatives to eurozone break-up are inherently implausible and deeply unattractive. Without the option of devaluing their currencies, uncompetitive economies are left with “internal devaluation” – otherwise known as wage cuts and mass unemployment. It is true that countries such as Greece badly need economic reforms. But these reforms – conducted within the straitjacket of monetary union with Germany – are causing political and economic turmoil. In theory, the eurozone might rectify this error by moving to a real political union. Even if EU politicians were able to overcome such objections and create a real federal union, this giant new entity would essentially hollow out the powers of national democracies. Sacrificing national self-rule on the altar of the euro is inherently objectionable – and would invite a nationalist backlash across Europe. Suddenly, it has become easy to see how the euro A Greek exit from the euro area has the potential to be This is the first major revolt by any electorate against the eurozone’s austerity policies, Furthermore, Greece is just the tip of the iceberg. The swing against austerity by voters in the eurozone is manifesting itself in many different places. Until the end of last year, austerity economics had a surprising amount of political support inside the eurozone, and not just in core countries like Germany. ECB has apparently now said that it won't directly lend to some Greek banks that it judges to be technically "insolvent". David Cameron, Britain’s prime minister, will on Thursday warn that the single European currency could unravel Om att äta kakan, ha den kvar, eller sälja den på kredit till Grekland Should France Be Added to the 'PIIGS'? The euro currency is a malady that condemns at least a generation of Greeks, Italians, Spaniards, Portuguese and Irish to the economic infirmary. The economists and politicians who created the system still proclaim it can survive. Peter Boone is a non-resident senior fellow at the Peterson Institute for International Economics, a visiting senior fellow at the London School of Economics and an adviser at Salute Capital Management.

Today, there are about 8.5 trillion euros ($11 trillion) of sovereign bonds outstanding in the euro area, and more than $180 trillion in derivatives linked to interest rates These interest-rate derivatives -- known as swaps -- are held by large leveraged financial institutions (banks, hedge funds), or by pension and insurance companies with large, long-term liabilities. If interest rates rise, bond prices fall, and derivative contracts change in value (good news for people who have hedged into fixed interest rates and a potential disaster for those exposed to rising interest rates). Is there any hope for the euro dream? One potential way forward would be to create a European- level fiscal union that assumes all national debt, much like what Alexander Hamilton did as first U.S. secretary of the Treasury. That isn’t going to happen in modern Europe. Who could even ask them to do so? Bör alla avgå? Hur skall eurons Ja-sägare hanera sin besvikelse After Greek voters rejected austerity in last week's election Europe has been searching for a Plan B At the Chancellery in Berlin, the television images from Athens now remind Merkel's advisers of conditions in the ill-fated Weimar Republic of 1919-1933. Back then, the Germans perceived the Treaty of Versailles as a supposed "disgrace." Now, the Greeks feel the same way about the austerity measures imposed by Brussels. And, as in the 1920s in Germany, the situation in Greece today benefits fringe parties on both the left and the right. Expelled from the eurozone, Greece might prove more dangerous to the system than it ever was inside it The writer is a senior fellow at the Peterson Institute for International Economics and author of ‘Eclipse: Living in the Shadow of China’s Economic Dominance’ A substantially depreciated exchange rate would set in motion a process of adjustment that would soon reorientate the economy and put it on a path of sustainable growth. What is the evidence? Just look at what happened to the countries that defaulted and devalued during the financial crises of the 1990s. Suppose that by mid-2013 Greece’s economy is recovering, while the rest of the eurozone remains in recession. The effect on austerity-addled Spain, Portugal and even Italy would be powerful. Voters there would not fail to notice the improving condition of their hitherto scorned Greek neighbour. The ongoing Greek tragedy could yet turn out not too badly for the Greeks. But tragedy it might well be for the eurozone and perhaps for the European project. If the eurozone gives way on /Greece/, what chance would there be of painful austerity being continued, The big danger for the rest of the eurozone is not that Greece makes a complete horlicks of monetary independence The big danger for the rest of the eurozone The game would be up. Bank deposits would flee from these countries and end up with German banks which, through the Bundesbank, would recycle them to beleaguered banks in the periphery. In the process, Germany and the other northern countries could end up taking on the risk of the whole banking system of peripheral Europe. "Eurodämmerung" Eurodämmerung Some of us have been talking it over, and here’s what we think the end game looks like: 4b. End of the euro. Krugman alltför optimistisk om tidsplanen för Eurodämmerung De människor som mobbade EU till att anta en gemensam valuta, Regeringen bör utlysa nyval The political turmoil in the Netherlands has sent a disastrous message that could thwart Merkel's master plan to save the single currency.

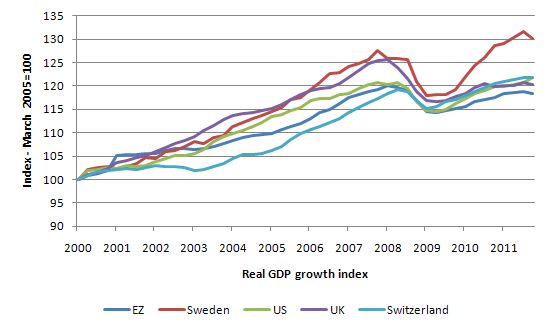

Europe’s Economic Suicide Spain’s fiscal problems are a consequence of its depression, not its cause. The most likely outcome... German inflation will rise The political elites of member states and much of their population continue to believe in the postwar agenda, if not as passionately as before. The most likely outcome... German inflation will rise and its external surpluses fall. Adjustment will occur Om man har en sedelpress går man inte i konkurs When the euro was being created, the economics profession split into three groups Their performance cannot be judged after five or 15 years. It’s understandable that people who felt a strong prejudice for or against the euro’s existence should feel the itch to make a point when things turn their way, but the point is bound to be misleading, and intentionally so. The reality, however, is that changes in the broad flow of history, which the euro certainly was, require a much longer view. There is no provision in any European Treaty for a country to leave the eurozone. Minns ni folkomröstningen om EMU 2003, Martin Sandbu, the economics leader writer for the Financial Times, vad har han att säga? Han fortsätter: The Irish left the sterling zone. The Balts escaped from the rouble. The Czechs and Slovaks left each other. The founders of the euro thought they were forging a rival to the American dollar. Common sense suggests that leaders should think about how to manage a break-up. Some may be doing so. But having described a split as bringing economic Armageddon, leaders dare not be seen planning for it. Greker, spanjorer, italienare och andra försöker nu ta sig ur det brinnande eurohuset. Detssvärre saknas förberedda nödutgångar. Euro Was Flawed at Birth and Should Break Apart Now Since the launch of the euro in January 1999, Germany and the Netherlands have experienced a growth slowdown and loss of wealth for their citizens that would not have happened had they never joined the euro. We know this to be true, because we can compare the progress of these two Northern European economies with that of Sweden and Switzerland, which kept their freely floating currencies in 1999 and continued to grow as before.

Charles Dumas writes: No wonder the Germans and Dutch are angry. But their anger should be directed at the governments that took them into the euro, not at the hapless citizens of Mediterranean Europe, who now are also suffering the effects of the common currency. Sweden and Switzerland didn’t have to make any such sacrifice of ordinary people’s prosperity, while at the same time they enjoyed stronger employment as well as budget and current-account balances. That leads to only one conclusion: The euro was a mistake from the outset. It should be abandoned in unison and soon. Källa: Bill Mitchell – billy blog Full text by Carles Dumas at Bloomberg Nouriel Roubini: markets are “schizophrenic” they cannot decide whether to reward or punish countries such as Hary Flam vill ha lönesänkningar i krisländerna U.S. Treasury Secretary Timothy Geithner warned heavily indebted countries not to resort to draconian measures to fix their budgets, "Economic growth is likely to be weak for some time. The path of fiscal consolidation should be gradual with a multiyear phase-in of reforms," Geithner said in remarks prepared for delivery to the House Financial Services Committee on Tuesday. "If every time economic growth disappoints, governments are forced to cut spending or raise taxes immediately to make up for the impact of weaker growth on deficits, this would risk a self-reinforcing negative spiral of growth-killing austerity," he said. Istället för att satsa oss ur kristider innebär arbetslinjen att vi arbetar oss ur de besvärliga perioderna. Metoden att genom åtstramningar få budgetbalans kan tyckas vara vad som behövs för de försumliga PIIG:s-länderna. Men oavsett hur illa vi tycker om dessa länders frivola leverne är det inte för att vi känner att det är moraliskt riktigt att sätta strypkoppel på dem som ska avgöra vad som är en riktig ekonomisk politik. Vi måste tänka på konsekvenserna av en åtstramning i en stor del av Europa. Det scenario som jag /Danne/ skrev om 2/9 2011 Euron har redan kollapsat Eurozone members, stumbling from one crisis to the next, Faced with execution today or execution tomorrow, most people would choose the latter option. Who knows what might happen in between – an amnesty might be declared, the executioner might die. Hope springs eternal. This way of thinking has come to instruct European attitudes to the euro. Everyone now accepts that the euro hasn't worked out as hoped, but they would rather have it all breakup at some point in the future than face the immediate pain of having it breakup now. It seems unlikely, but you never know, in the meantime things might sort themselves out. We've just had write-downs on Greek sovereign debt of more than €100bn, and we can be pretty certain there's a lot more of that to come, both from Greece and the rest of the eurozone periphery. Yet perhaps oddly, Germans haven't really noticed it. It all looks like fantasy money which doesn't really affect them. Meanwhile, the periphery seems to believe the consequences of leaving will be worse than the price paid in never ending austerity of staying in. And all think the dream of European solidarity and unity still something worth fighting for. It’s hard to see how getting European banks to buy bonds from potentially insolvent countries Det vi ser är inte primärt en statsskuldskris utan en eurokris som har lett till en statsskuldskris. Detta ledde till att staten i Grekland, Portugal och Italien lånade upp pengar och finansierade en på sikt ohållbar efterfrågenivå som medförde stigande inflation i priser och löner och därmed obönhörligt sjunkande konkurrenskraft. I Spanien och Irland var det istället den privata sektorn som lånade för mycket, när räntorna blev så låga. Effekterna blev desamma. Priser och löner steg snabbare och den internationella konkurrenskraften försämrades kraftigt. Däremot blev det inte några budgetunderskott och växande statsskulder under processen. De problemen exploderade först när staten måste gå in och rädda banker samtidigt som efterfrågan säckade ihop och därmed skatteintäkterna samtidigt som utgifterna steg för arbetslöshetsersättning och andra krisåtgärder. Det vi ser är således inte primärt en statsskuldskris utan en eurokris som har lett till en statsskuldskris. Valutaunionen var ett mycket riskfyllt projekt som inte borde ha genomförts under detta historiska skede. Den hemska sanningen om John Hassler, Göran Persson och kronkursförsvaret Forskarna kommer att ha till uppgift att förklara hur det kom sig att så många i det ledande skiktet i Europas länder kom att vara för Kuriosa Danne Nordling 12 mars om EEAG, SNS och Spanien ”Situationen i euroområdet har fått utvecklas till en sådan djup kris att inga enkla lösningar längre finns att tillgå”, När euron infördes närmade sig obligationsräntorna i eurozonen varandra. På ekonomspråk heter det konvergens. – Initialt var det bra men utvecklingen gick för långt och riskerna på både mikro- och makronivå undervärderades, sade John Hassler när han presenterade rapporten. Utvecklingen ledde till snabbt ökande löner och priser i de fattigare länderna. Det betydde att dessa länders exportvaror blev dyrare och de tappade konkurrenskraft.

Förre finansministern Erik Åsbrink (S) var också en av kommentatorerna. Han varnade för alltför massiva interventioner i krisländerna. Krisländerna måste ta ner prisnivån i landet så att varor och tjänster blir konkurrenskraftiga. Och därmed få i gång en tillväxt. John Hassler, EMU, heder, sanning och rätt EEAG och John Hasslers pudel. Hassler sade bland annat att det var viktigt när man skulle genomföra åtstramningar och strukturreformer i krisländerna att man hade en story som folket köpte, liksom vid den svenska statsskuldkrisen i början på 1990-talet.

Hassler hade i slutet av sitt anförande en liten, liten pudel där han sade att problem hade blivit större och delvis annorlunda (TARGET) än vad han hade förutsett. Spreads on Italian bonds have widened to about 200 basis points over German bunds. Furthermore, the ECB should reintroduce the requirement that TARGET2 debts be repaid with gold, as occurred in the US before 1975 The fiscal compact – formally the Treaty on Stability, Coordination, and Governance in the Economic and Monetary Union Some economists warn that the German central bank faces hidden liabilities of 500 billion euros According to SPIEGEL, the German government has said it sees no such risks. But a Greek euro exit could still cost the German central bank billions. We first need to understand the root causes of the crisis. If you mis-diagnose the problem, you are highly likely to prescribe the wrong medicine, which is precisely what is occurring

European Economic Advisory Group's latest annual report Before the advent of the euro, such imbalances would be corrected through the natural market mechanism of free floating exchange rates. Actually what's been happening is the exact opposite of what should occur. In terms of their competitiveness, or prices, relative to one another, the surplus countries have been devaluing since the euro came into existence, while the deficit countries have been appreciating. /RE: Den som först i världen kom på denna lika allvarliga som ofrånkomliga effekt var, osannolikt nog, Stefan de Vylder, som skrev i Göteborgs-Posten 2002-10-22 / Or as the EEAG Report puts it, "the economies adopting the

euro locked themselves into a system with no feasible

adjustment mechanism. German savers are continuing to finance the deficits, in part through the bailout mechanisms which have been put in place, but also through the good offices of the European Central Bank. It works like this. ... German banks are suddenly flush with cash... Some of this money is on lent to the German economy, /the rest/ gets deposited with the Bundesbank. Quite obviously, this is an unsustainable model. It is simply not viable indefinitely to finance a customer who cannot pay his way. But generally you don't find that out until you demand the money back. (ECB) issuing over €1 trillion in short-term loans The Hundred-Billion-Euro Bomb Target 2 The EEAG Report on the European Economy 2012 Target 2 of the ECB vs. In the US similar imbalances have arisen since September 2008. Since the beginning of the Fed’s liquidity operations, the New York Fed has accumulated a large positive ISA account, while the Richmond and San Francisco Fed have accumulated a negative ISA account. They are not eliminated either. But how can this be? Why was ISA not settled in April 2011? Repeated rounds of self-defeating austerity have become the order of the day. Still others see the crisis as one of confidence, which can be addressed by setting up a rescue fund large enough to convince markets that they cannot undo the euro – a “big bazooka”. This, too, is just wishful thinking. The real cause, as long argued by Sir Mervyn King, Governor of the Bank of England, and now accepted by most leading economists, is a simple, old-fashioned balance of payments crisis. 172 German professors can’t be wrong A letter from 172 German-speaking economists published by the daily Frankfurter Allgemeine Zeitung (FAZ) lambasts the steps taken towards a banking union by euro-zone leaders at a summit last week in Brussels It has unleashed a counterblast from government heavyweights and their economic advisers, leaving the public even more confused.The 172 professors have certainly broken new ground. The most remarkable thing, says one FAZ reader, is that “so many economists could agree on a single text :-) – incredible.” Angela Merkel vs. 160 Angry German Economists