News Home

|

Rolf Englund IntCom internetional

|

Grekland

Rolf Englund blog 5 februari 2012

En av mina bästa artiklar, tycker jag själv

Grekland kan betala sin förfallande skulder om de får nya lån.

Men det hjälper inte kostnadsläget.

Rolf Englund blog 19 sept 2011

Peter Wolodarski, DN 2010-05-02

Andrew Lilico, Daily Telegraph, May 20th, 2011

- The Greek government will nationalise every bank in Greece.

- The Greek government will forbid withdrawals from Greek banks.

- To prevent Greek depositors from rioting on the streets, Argentina-2002-style (when the Argentinian president had to flee by helicopter from the roof of the presidential palace to evade a mob of such depositors), the Greek government will declare a curfew, perhaps even general martial law.

EU:s valutaunion har visat att den inte håller måttet.

Att EU:s valutaunion spricker är inte realistiskt, men

att det ”otänkbara” faktiskt diskuteras säger åtskilligt om allvaret.

Signerat, Claes Arvidsson, SvD 7/5 2010

Clinging to my naive faith in the integrity of contracts, I assume that ISDA will soon trigger the credit default swaps on Greek debt.

This will happen once Athens activates its retroactive law to coerce bondholders (the Collective Action Clauses).

Here is a chart from Paulo Batori at Morgan Stanley on winners and losers. It does include the hedge funds.

Ambrose Evans-Pritchard, 7 march 2012

If the Greek contracts are not triggered, it will destroy the CDS market for sovereign debt. It will deter investors from buying any Club Med bonds if they cannot take out reliable and easily-traded insurance at any time.

So Spain and Italy had better pray that ISDA does its job properly.

Greklands Default

Avskrivningen av 70 procent av skulderna till de privata fordringsägarna är den stora händelsen

Det har media missat.

Rolf Englund blog 20 februari 2012, 21:30

Kommentar

70 procent av 200 miljarder euro är 140 miljarder euro.

Det är cirka 1 260 miljarder kr.

Det kan inte komma att gå obemärkt förbi hos banker, försäkringsbolag och pensionsfonder.

Och inte blir det bankdirektörerna som bli lidande.

Eurozone finance ministers reached a long-delayed €130bn second bail-out for Greece early on Tuesday

after strong-arming private holders of Greek bonds to take even deeper losses than they had accepted last month.

a “voluntary” deal

Although Greek bondholders agreed in October to accept a 50 per cent cut in the face value of their bonds

in face-to-face negotiations with Nicolas Sarkozy, France president, and German chancellor Angela Merkel,

they will now be offered a “voluntary” deal with a haircut of 53.5 per cent, eurozone officials announced.

Financial Times 21 February 2012

Voluntary

Greece has asked private-sector creditors that hold about EUR200 billion in Greek government debt

to take a 50% reduction in the face value of bonds, and a 70% reduction in their net present value.br />

Dow Jones Newswires February 20, 2012

However, there has been talk of asking creditors to take a steeper cut in the face value of bonds, or on the interest rate paid, to help Greece meet debt-reduction targets.

Greek Default

The write-down of 70 percent of debts owed to private creditors is The Big Event

The media have missed it.

Rolf Englund blog 20 February 2012, 21:30

The writedown, or "haircut", of up to 70% on Greek bonds

s being bought at the expense of up to €30bn in sweeteners,

financed by the eurozone bailout fund, the European Financial Stability Facility.

Guardian, 16 February 2012

Voluntary

Do We Really Know Greece's Default Will Be Orderly?

Whether we openly call it default or play semantic games with "voluntary haircuts," we know bondholders will absorb tremendous losses that are equivalent to default.

We also suspect some bondholders will refuse to play nice and accept their voluntary haircuts.

Beyond that, how much do we know about how this unprecedented situation will play out?

Charles Hugh Smith, Of Two Minds | Feb. 17, 2012

"events have a habit of demolishing dreams" - Portugal, internal devaluation

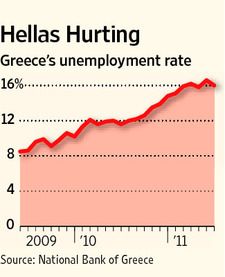

Greece’s unemployment bomb has detonated.

Ambrose Evans-Pritchard, 19 Feb 2012

Greece must default if it wants democracy

These demands fail Immanuel Kant’s “categorical imperative”

Nor could they be adopted in Germany – they would be unconstitutional

Wolfgang Munchau, Financial Times 19 February 2012

Why the Greek Bailout Doesn’t Change Much of Anything

Thursday’s deal is supposed to allow Greece to avoid default and prevent the Eurozone from breaking up – but the deal isn’t final, it can’t work, and the real problems lie elsewhere.

Ett sista tabu i eurokrisen är på väg att försvinna.

Politiker, ekonomer, företagsledare börjar ta orden i sin mun:

Låt Grekland lämna euron!

Ekonomiekot lördag 18/2 2012

En historisk reträtt ur valutaunionen eller inte, den har redan fått ett namn "Grexit" . Medverkande är professor Lars Jonung, chefsanalytiker Pär Magnusson och radions korrespondent i Berlin, Daniel Alling.

Brandförsäkringsargumentet

- William Hague: monetary union a burning house without any fire exits

Det är ett utmärkt arguemnt, som förstås av alla villaägare som har sitt hus brandförsäkrat.

Rolf Englund blog 4/10 2011

Allt talar för att grekerna kommer att proteströsta fram ett politiskt kaos.

Men omvärlden måste naturligtvis respektera det grekiska folkets rätt att rösta sig till statsbankrutt.

Eric Erfors, Expressen-ledare 15 februari 2012

Man kan naturligtvis säga att med så kallade "frivilliga" nedskrivningar och en statsskuld på 160 procent av BNP så är Grekland i praktiken redan statsbankrutt.

Men i maj, när det politiska kaoset är ett faktum och när det franska presidentvalet är avklarat, så lär euroländerna och ECB tvingas acceptera att Grekland valt att försätta sig i fullständig konkurs och lämna euron.

Konsekvenserna är oöverblickbara, och EU måste ha beredskap för att pumpa in miljarder i bistånd.

Det är djupt tragiskt att Grekland ska få lida så mycket

genom att helt amatörmässiga föreställningar om nationalekonomi ska tillgodoses

Det finns inte några korrekta och samtidigt accepterade teorier om hur stora kriser av dagens typ ska hanteras

Det såg vi redan i Sverige i början av 90-talet

Danne Nordling, 16 februari 2012

The combined exposure of foreign banks to Greek entities - public and private -

is now around 80bn euros. In 2009 they were in for well over 200bn euros

Stephanie Flanders, BBC 16 February 2012

“EU is now saying to the Greek people: ‘Unless you vote for the right parties, we will not give you the rest of the money and you will go bankrupt,'”

When Nigel Farage asked German Chancellor Angela Merkel why the country cannot be allowed to leave the euro,

default on its obligations and restore the economy, he received a “very telling response:”

“She said: ‘We cannot let Greece go, because if it does leave, there will be other countries that will want to leave too, and that will mean the end of the European project.’”

MEP Nigel Farage, RT 16 February 2012

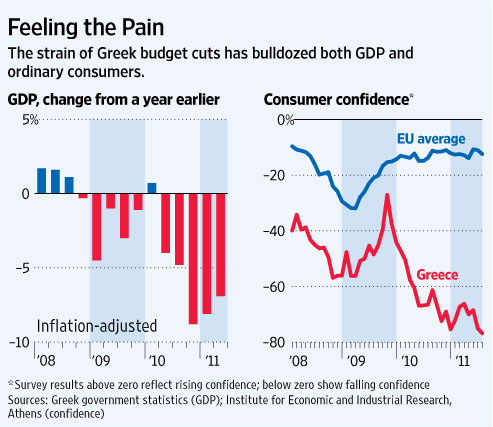

The big problem in Greece is that the worst economic effects of austerity haven’t even happened yet

Felix Salmon, Reuters, February 15, 2012

“On the current path – which is not sustainable in my view – we may very well see Greek GDP go down 25-30 percent, which would be historically unprecedented. It’s a disastrous crisis for them,” Dadush, a former senior World Bank official, said…

“They’re suffering. It’s nasty,” said Weisbrot, who has studied the lessons to be learned from economic crises in Latvia and Argentina. “If you could say with a reasonable probability that the worst was over, then that would be different. But you can’t say that. They’re in for a long nightmare.”

The point here is that both Europe and Greece need a light at the end of the tunnel. Without that, social unrest in Greece will only get worse, the credibility of its promises will continue to deteriorate, and the Europeans will be understandably reluctant to throw good money after bad

The World from Berlin

'Greece Cannot Be Ruled Against the Will of its People'

Der Spiegel 14 February 2012

The center-left daily Süddeutsche Zeitung writes:

"Those who would refuse additional aid to Athens and would push Greece into uncontrolled insolvency fail to recognized the financial interdependency (that exists in the euro zone) and underestimates the domino effect such an insolvency could trigger. In any case, help would have to be provided later when the collapse of the Greek banking system, capital flight and the economic ineptness of a dysfunctional state triggers a wave of refugees heading north."

The left-leaning daily Die Tageszeitung writes:

Greece's party political system is threatening to collapse.

The Financial Times Deutschland writes:

Political radicalization will almost surely be the result of the parliamentary elections scheduled for April.

With or without a puppet government -- sooner or later the Euro Group must realize that Greece cannot be ruled against the will of its people."

The fact that this small, economically weak and chronically mismanaged country has been able to cause such difficulty also indicates the fragility of the structure.

Greece is the canary in the mine.

The reason it has caused such difficulty is that the country’s failings are extreme, not unique.

Martin Wolf, Financial Times, 14 February 2012

Quantifying Eurozone Imbalances and

the Internal Devaluation of Greece and Spain

Claus Vistesen, 23

Many Greeks are in despair.

They are against further austerity and yet they fear the unknown,

bankruptcy and exclusion from the eurozone.

Gavin Hewitt, BBC Europe editor, 13 February 2012

Han är bildad, Ambrose; Grekland, Tyskland och the London Debt Agreement of 1953

Rolf Englund blog 13/2 2012

What Greece has in essence committed itself to is an internal devaluation lasting years, if not decades into the future.

There is no discernible end to the austerity

Greece also faces a massive hit to nominal wages and living standards as it seeks to impose competitiveness

There is not a hope of Greece growing its way back to debt sustainability while still in the euro.

As things stand, capital is leaving the country by whatever means available, sometimes stuffed into suitcases

Jeremy Warner, 13 Feb 2012

No business can survive in such an environment. Not until Greece devalues, and Greek assets start to look reasonable value once more, will the money return.

Yet instead, Greece has chosen the internal devaluation route, or the forced reduction in wage and asset prices necessary to restore competitiveness. Does anyone other than the technocrats and the hair-shirted Germans really think such a road possible?

In less extreme form, much the same hard labour awaits the rest of the eurozone periphery, which must similarly achieve big reductions in real exchange rates via the socially destructive path of decreases in nominal wage and asset prices.

Interndevalvering - Ådalsmetoden

Interndevalvering

DN om Greklands exportfrämjande åtgärder

Rolf Englund blog 13/2 2012

Grekland står inför sin ödesdag och det är nödvändigt att hela landet inser stundens allvar.

För att få nästa räddningspaket måste politikerna garantera att de överenskomna åtgärderna utförs oaktat hur det går i valet i april.

De politiker som fortsatt väljer att stå upp för den enda väg som står till buds måste nu kämpa för sin politik på allvar

SvD-ledare signerad Daniel Persson, 12 februari 2012

Det grekiska budgetunderskottet på runt tio procent av BNP behöver omgående minskas.

Utan tillväxt i den grekiska ekonomin blir detta svårt att klara av.

vilket visar på behovet av tillväxtfrämjande reformer.

Johan Schück, DN Ekonomi 10 februari 2012

On Friday, German commentators argue that it is time for EU politicians to face the truth about the situation

- and accept that Greece will either have to default or leave the common currency

Der Spiegel, Friday 10/2 2012

Why Greece Will Default, Leave the Euro Zone

My conjecture is based on a simple fact: If I were Greek, I'd leave the euro zone

John Carney, Senior Editor, CNBC.com, 10 Feb 2012

The debt burden is unsustainable and the austerity measures demanded by the "troika" will only make it more so. With unemployment [cnbc explains] already at 21 percent, further government spending cuts are likely only to drag the economy down even more.

More importantly, perhaps, it is simply intolerable for a free nation to allow itself to be pushed around by its creditors.

The creditor nations may feel like they have the moral authority to shove around Greece, but they are wrong. They have neither the moral authority nor the actual, operational authority.

Greece can hurt them as much as they can hurt Greece.

What Happens If Greece Defaults?

Riktigt intressant blir det om och när Grekland lämnar euron.

Sannolikt kommer samma sak att hända som på Island - en rekordsnabb ekonomisk återhämtning.

Det brukar nämligen sluta så när regeringar förstår att det här med fasta växelkurser är dumt.

Sverige är ett exempel, Argentina ett annat.

Den hälsosamme ekonomisten, 10 februari 2012

Portugiserna kommer i så fall börja fråga sig varför de ska genomlida femton år av misär, när det enda man behöver göra är att lämna euron. Därefter kommer spanjorerna och italienarna.

European finance ministers held back a rescue package for Greece in a rebuff that

left lawmakers in Athens under government pressure to endorse a newly minted austerity plan or exit the euro

Bloomberg, 10/2 2011

“In short: no disbursement without implementation,” Luxembourg Prime Minister Jean-Claude Juncker said in Brussels late yesterday after chairing emergency talks of euro-area policy makers.

He set another extraordinary meeting for Feb. 15.

Europe is now deliberately trying to push Greece out

Jeremy Warner, February 10th 2012

Merkel: I Won't Take Part In Pushing Greece Out Of Euro

RE: Likt Pontius Pilatus, enligt Bibeln, tvår hon sina händer

Angela Merkel is often depicted by the Western media as a boring, mousey and indecisive physicist obsessed by rules and the Euro ideal.

In fact, she is none of these things.

Her unusual and at times murky past suggests that she is driven by the ideal of technocratic power, has no firm belief in anything, and is ruthlessly disloyal when it suits her.

Her role in the former East Germany has been cleaned up by those around her.

The Slog, 30 January 2012

Finance minister Evangelos Venizelos was quoted by Kathimerini:

“Whoever puts before a people the dilemma of choosing between financial assistance and national dignity disregards basic historical lessons.”

Eurointelligence 30 januari 2012

„Merkel fordert bedingungslose Kapitulation“

Both Winston Churchill and Joseph Stalin disapproved of the demand for unconditional surrender

Bild-Zeitung/Wikipedia

Its called the Greek "bailout" or the "Greek rescue package"

But, who, exactly, is now being rescued?

Is it the Greeks? Or is it international investors - and the euro?

BBC Economics editor Stephanie Flanders, 10 February 2012

Greek leaders thought they had fulfilled their side of the bargain, same politicians have now been told they have three days to come up with a bit more budget pain

And they have to all promise (in blood?) that they will stick with the programme, no matter what the voters might say in April

Sure, Greece would have a terrible time after a messy default. But then, the life they are signing up to under the terms of the deal is going to be pretty terrible too.

And if eurozone ministers get their way, it's a life that Greek voters are not going to be allowed to reject.

Where the Greek bailout money goes

Daniel Hannan,February 8th, 2012

Daniel Hannan, February 8th, 2012

It's Time To End the Greek Rescue Farce

There isn't even the slightest sign that the situation might improve

Stefan Kaiser, Der Spiegel 7 February 2012

For the past two years, Greece has wrangled with the euro-zone states and the International Monetary Fund (IMF) over its so-called "rescue."

Austerity measures have been agreed to, aid has been paid and private creditors have been forced to accept "voluntary" debt haircuts.

Despite all this, Greece is in even worse shape today than it was then. Its economy is shrinking, the debt ratio is rising and the country and its banks have been cut off from capital markets.

There isn't even the slightest sign that the situation might improve.

Det finns de som försöker skylla den aktuella krisen på euron.

Peter Wolodarski, DN 2010-05-02

Man måste ställa sig frågan om inte Grekland och i synnerhet grekerna har mest att vinna på att ställa in betalningarna och skriva ner sitt skuldberg

och kanske även samtidigt lämna euron för att återfå sin konkurrenskraft och därmed tillväxtförmåga.

Alternativet är att gå med på ytterligare åtstramningar som i första hand syftar till att rädda landets fordringsägare har ingen uppsida

Per Lindvall, e24, 2012-02-07, Publicerad 09:52

How much is the troika demanding from Greece? How tight is the squeeze?

Here’s a look based on the most recent IMF report

We’re now looking at a scenario in which Greece is forced into killing levels of austerity to pay its foreign creditors, with no real light at the end of the tunnel.

Paul Krugman, 6 February 2012

JP Morgan Advises Its Clients To Read Zero Hedge Three Weeks Ago

ECB/IMF's subordinating, gap between domestic- and foreign-law bonds

Tyler Durden, Zero Hedge, 6 February 2012

Three weeks ago, Zero Hedge was the first to bring the world's attention to the legal (and explicit trading/risk) ramifications of European sovereign bonds. We noted the ECB/IMF's subordinating impact on unsuspecting sovereign bond holders but much more explicitly showed the huge gap in market perception between domestic- and foreign-law bonds (and the fact that they have very different ramifications given the rising tendency for retroactive CACs or simply local-law changes to accommodate restructurings).

If Athens cannot sign up the required 90 percent of bondholders needed to push through the debt haircut and bailout, it may have to use new legislation for Collective Action Clauses, or CACs.

What Happens If Greek Debt Swap Deal Fails?

In either of these scenarios, credit default swaps, could be triggered

— which may spark a feared market panic.

CNBC, 7 March 2012

Thus far the ISDA has not judged the deal a “credit event” forcing the triggering of anti-default insurance policies known as credit default swaps.

If Greece is forced to use CACs to impose the deal on holdouts, ISDA is likely to change its position,

but Mr Dallara said he did not believe such a decision would cause renewed market panic.

Financial Times, 4 March 2012

“I don’t anticipate that would be a destabilising event,” he said.

Involuntary

Greek default looms as voluntary debt deal looks set to fail

Louise Armitstead, Telegraph, 3 Mar 2012

Investors and traders fear the decision not to trigger a credit event

in Greek credit default swaps will undermine the entire multitrillion-dollar CDS market.

Financial Times, 1 March 2012

Involuntary

When is a default not a default?

Buttonwood, The Economist 1 March 2012

There is a ruling from the International Swaps and Derivatives Association which says that credit default swaps, an instrument designed to insure against just such an event, will not be paying out. Or rather it makes a statement in insurance company legalese that goes

The EMEA DC determined that it had not received any evidence of an agreement which meets the requirements of Section 4.7(a) of the 2003 Definitions and therefore based on the facts available to it, the EMEA DC unanimously determined that a Restructuring Credit Event has not occurred under Section 4.7(a) of the 2003 Definitions

.Voluntary

The decision by a major derivatives agency not to declare a credit event

on the writedown of Greek sovereign debt sets a bad precedent

Pimco co-founder Bill Gross, CNBC 1 March 2012

Earlier in the day, the International Swaps and Derivatives Association said Greece had not triggered a payout on credit default swaps by its recent moves to prepare for a debt restructuring,

The ruling means holders of these insurance contracts, worth a net $3.25 billion, will not receive payment at this stage, though further rulings based on any new questions are still possible.

Involuntary

A committee of the International Swaps and Derivatives Association (ISDA) is expected to

decide in the coming weeks that the restructuring is a "credit event",

which means pay-out on a default insurance contract will be triggered.

CNBC 29 February 2012

Voluntary

De grekiska statsobligationerna styrs av grekisk lag, och det har pratats om lagstiftning

Problemet är att en del av skulderna – uppskattningsvis runt 30 till 40 miljarder euro – styrs av brittisk lag.

Jonas Fröberg, SvD Näringsliv 17 februari 2012

RE: Insiktsfullt med litterära kvaliteter

Många fonder har en sorts försäkringar – CDS:er – vilket gör att de får tillbaka pengarna även om allt går åt skogen.

Men enligt reglerna får inte hedgefonderna ut något på sina försäkringar om EU:s politiker löser Greklandskrisen på frivillig väg.

Går Grekland i konkurs faller däremot försäkringarna ut.

Involuntary

To nudge those that won't agree to the swap, Greece is planning to

adopt retroactively "collective-action clauses" that bind the minority of creditors to the decisions of the majority.

Such CAC clauses are "accepted market practice" — when new bonds are issued,

says Charles Blitzer, a former IMF official who worked on several sovereign restructurings.

"However, retroactively inserting CACs in sovereign bonds via legislation is unprecedented."

Wall Street Journal, 4 Februay 2012

If it become seen as a precedent, Mr. Blitzer says, "prices of the debt of other peripheral euro-zone countries could be negatively affected."

Grekland CDS

Konsekvenserna av en statsbankrutt är stora

Klicka för grafik: Vad händer om ett GIIPS-land blir bankrutt.

Ekot, Staffan Sonning 6 februari 2012

Sedan millennieskiftet har handeln med försäkringar mot statsbankrutter ökat, så kallade Credit Default Swaps.

Går Grekland i konkurs ska innehavaren ha betalt, men frågan är om försäljarna har råd med kostnaderna.

– Ingen vet hur många det finns, hur många som ställt ut dem och hur många som kommer att förlora pengar på det här.

Voluntary

A default by any other name is still a default.

When Greece defaults, the inter-connected chains of credit default swaps will fall like dominoes.

Charles Hugh Smith, oftwominds 4 February 2012

Default will trigger credit-default swap contracts, derivatives known as CDS that protect the owner from events such as default.

This will implode the shadow-banking system and the visible banking system, as those who sold the CDS (financial institutions) do not have enough cash or assets to pay the owners of the CDS.

Grekland ett permanent bekymmer, som slutligen kan leda till att grekerna tvingas gå bankrutt och kanske även lämna euron.

Detta kan till sist visa sig som det minst dåliga, när brandväggarna väl finns på plats.

Johan Schück, DN Ekonomi 3 februari 2012

”Chicken Race” Voluntary

Eurozonen vill inte betala ut en slant till, så länge inte de privata långivarna har kommit överens om att efterskänka en stor del av sina skulder till Grekland.

De privata långivarna vill inte efterskänka någonting förrän eurozonen har kommit överens med Grekland om nya stora åtstramningar.

De privata långivarna kräver att också den Europeiska centralbanken ska ta förluster på lånen till Grekland. Men ECB vägrar.

Det är bara några dagar kvar till dess det är för sent för Grekland att kunna betala nästa stora avbetalning på sin gigantiska statsskuld.

Staffan Sonning, Ekot 3 februari 2012

Ledaren för eurozonens finansministrar, Luxemburgs Jean-Claude Junker, beskriver förhandlingarna som "extremt svåra".

Regeringskälla: Den grekiska regeringens förhandlingar med internationella borgenärer går bra

Källan sade även att dessa diskussioner inte skulle komma att slutföras under fredagen

DI 2012-02-03 21:51, men,men

Ah, but what do we have here, at 3:36 AM (via my London partner, Niels Jensen),

but an article by Nick Doms on Examiner.com, asserting that, yes indeed, Greece will default:

“Greece plans an orderly exit out of the Eurozone according to two sources close to Mr. Papademos, Greek Prime Minister, who spoke on condition of anonymity earlier today. The sources confirmed that plans are ready to return to a legacy currency given the current circumstances and that such exit would be dealt with, quote ‘in as orderly a fashion as possible’ unquote….

Voluntary

As reported on January 22, it initially looked as though Greece might hold off on an actual default announcement until late March

after the next scheduled payment date of its maturing sovereign debt and, perhaps, not even until after the 2012 German and French elections.

A number of events and realizations appear to be moving the schedule forward such that the official default announcement could come at any time.

seekingalpha.com, 1 February 2012

The Greek default will have only the most minor effect on the United States - except that it will give the White House and its Federal Reserve appointees someone other than themselves to blame for the economy not recovering in 2012.

Voluntary

Greek officials are scrambling to meet a deadline on Friday to restructure

€200bn of debt controlled by private bondholders, an essential condition for the next rescue plan.

The leader of the rightwing Laos party, junior partner in the Greek coalition government, has appealed to the EU

to ease the terms of the country’s second €130bn bail-out, or risk triggering a “social explosion”.

Financial Times, February 1 2012 6:24 pm

While Laos (People’s party) has only 16 seats in the Greek parliament, its anti-European line is echoed by lawmakers in Pasok, the socialist party that lost power in November but is now part of the three-party coalition headed by Lucas Papademos, Greece’s technocrat prime minister.

Antonis Samaras, the conservative leader, has also warned that Greece cannot take more austerity

Grekland är ett sorgligt särfall.

DN huvudledare, 29 januari 2012

Portugal - The next special case?

The country’s task is to regain wage and price competitiveness so that it can grow its way out of its debts

Amid recession, the country ran a current-account deficit of more than 8% last year

The Economist prinst 4 February 2012

Irland - Italien - Spanien - Portugal

Voluntary

'There Is No European Emergency Plan'

Greece is struggling to reach an agreement on debt relief with its private-sector creditors.

But even if it ultimately does, the country may need vastly more funding than has been envisioned so far.

Der Spiegel, 27 January 2012

German commentators on Friday say it's time for a bit of honesty from Europe's leaders.

The center-right Frankfurter Allgemeine Zeitung writes:

"Europe's citizens are growing accustomed to only being told a small part of the truth. In the end, Olli Rehn's vague comments could mean that the European Central Bank will have to waive a portion of its Greek bond claims. That could, in turn, make itself felt in the budgets of euro-zone member states. European taxpayers, though, will never be told the full extent of the damage.... Even should there be debt relief for Greece, it will not put a stop to the country's thirst for borrowing. Debt relief would change nothing when it comes to the shocking inability of the Greek economy to compete internationally. Yet, without economic growth, there is no foundation for healthy state finances."

Grekisk tvångsförvaltning

The Greek reaction was one of outrage.

Finance minister Evangelos Venizelos was quoted by Kathimerini:

“Whoever puts before a people the dilemma of choosing between financial assistance and national dignity disregards basic historical lessons.”

Education Minister Anna Diamantopoulou /tidigare EU-kommissionär/ slammed the plan as “the product of a sick imagination.”

Eurointelligence 30 januari 2012

Anna Diamantopoulou 1999-2004 EU-kommissionär med ansvar för sysselsättning och socialpolitik i Prodi-kommissionen. Wikipedia

Forderung nach Sparkommissar Griechen-Presse pöbelt gegen Berlin

„Merkel fordert bedingungslose Kapitulation“

Bild-Zeitung

Unconditional surrender

The use of the term was revived during World War II at the Casablanca conference when American President Franklin D. Roosevelt sprang it on the other Allies and the press as the objective of the war against the Axis Powers of Germany, Italy, and Japan.

The term was also used at the end of World War II when Japan surrendered to the Allies.

Both Winston Churchill and Joseph Stalin disapproved of the demand for unconditional surrender, as did most senior U.S. officials (except General Dwight D. Eisenhower).

It has been estimated that it helped prolong the war in Europe through its usefulness to German domestic propaganda that used it to encourage further resistance against the Allied armies, and its suppressive effect on the German resistance movement since even after a coup against Adolf Hitler:

Wikipedia

"EMU är i alla fall bra för freden"

Tyskland vill att en ny budgetkommissionär, utsedd av eurozonen,

ska få makt att lägga in veto mot den grekiska regeringens budgetbeslut

om de inte är i linje med de mål som satts upp av långivare.

DN/TT 28 januari 2012

I dokumentet, som lämnades till medlemmarna i eurozonen på fredagen, skriver Tyskland: "Med tanke på det misslyckade uppfyllandet hittills måste Grekland acceptera att lämna över bestämmanderätten över budgeten till Europanivå under en viss tid".

Horst Reichenbach

We’re not occupiers, says Greek task force

Logiken i det hela rör sig i federativ riktning... Sch! säger Kohl åt mig när jag tar upp det.

Göran Persson

Over the next two months Greece has promised to adopt legislation

“ensuring that priority is granted to debt-servicing payments”,

with a view to enshrining this in the constitution “as soon as possible”

Charlemagne, The Economist 21 February 2012

Acropolis now

The Greek debt crisis is spreading. Europe needs a bolder, broader solution—and quickly

The Economist print Apr 29th 2010

Speaking on the fringes of the forum, George Soros, the financier, blamed Germany for many of the eurozone’s woes.

“The austerity that Germany wants to impose will push Europe into a deflationary spiral,” he told journalists.

“The fact that an unsustainable target is being imposed creates a very dangerous political dynamic.

Instead of pulling countries together, it will drive them to mutual recrimination.”

Financial Times 25 January 2012

Involuntary

Hedge funds, more than any others, stand to profit,

and are betting that the voluntary debt rescheduling will fail

Stefan Kaiser, Der Spiegel 25 January 2012

"Hedge funds don't need to worry about their public image," one banker says. Their reputation has already been destroyed. Therefore, they can be relatively cavalier in gambling with the possibility of a Greek bankruptcy.

Greece Involuntary

Step one is to force private bondholders to take more losses.

They have been treated with kid gloves so far because European governments insist the debt deal must be voluntary,

thanks in part to a misplaced fear of triggering credit-default swaps. That must change.

The Economist print, 28 January 2012

Discard the veneer of voluntarism and Greece can be tougher on its creditors. It should pass a law that retroactively introduces collective-action clauses into all domestic-debt contracts (making it easier to impose debt deals on recalcitrant bondholders).

If it does this now there is still, just, enough time to organise a big, coercive, but orderly, restructuring of Greek bonds by March 20th.

Credit default swap, Wikipedia

Sardelis och The Ticking Euro Bomb,

How the Euro Zone Ignored Its Own Rules

Rolf Englund blog 24 januari 2012

The creditors, represented in the negotiations by the Institute of International Finance, have said that they won't agree to interest rates of less than 4% on the new bonds.

The EU and Greece say the interest rate can't be more than 3.5% if Greece's debt burden is to remain sustainable.

Half a percentage point might not seem like a big deal. But when you're looking at €100 billion in debt and a 30-year time frame,

it comes out to a cool €15 billion — still not pocket change.

Wall Street Journal, 27 January 2012

And then there's the European Central Bank, which owns around €45 billion of Greece's debt, purchased on the secondary market.

European finance ministers balked at putting up more public money for Greece,

calling on bondholders to provide greater debt relief

Bloomberg, Jan 24, 2012 2:02 AM GMT+0100

Greek bondholders draw line in the sand

Private owners of Greek debt have made their “maximum” offer for the losses they are willing to accept, the bondholders’ lead negotiator has said, implying that any further demands could kill off a “voluntary” deal and trigger a default.

Financial Times, January 22, 2012 7:21 pm

Now, the bankers and leaders of Europe are getting ready to walk to the edge of the Abyss.

If they /Greece/ walk away and there is an uncoordinated default, it will guarantee chaos.

Bank collateral will collapse and credit default swaps will be triggered, including many sold by European banks that are already essentially insolvent.

John Mauldin, 21 January 2012

if relatively big economies like Italy and Spain got into trouble

The eurozone crisis has been blowing for two years. It has not abated.

In that time there have been, at least, 15 summits. Maybe more.

A long grinding, gruelling marathon to hang on to a European dream.

Gavin Hewitt, BBC Europe editor, 29 January 2012

One of the unresolved problems hanging over the eurozone was what would happen if relatively big economies like Italy and Spain got into trouble. There was neither a fund big enough to rescue them nor a firewall large enough to prevent contagion.

A permanent rescue fund, the European Stability Mechanism (ESM), has been brought forward and should be in place by the summer. It will have a lending capacity of 500bn euros.

There are still 250bn euros in the existing rescue fund, the European Financial Stability Facility (EFSF). One plan is to run these two funds in parallel.

The Germans are currently under enormous pressure to boost the fund to over a trillion.

That won't be settled at this summit but it won't go away either.

The sticking point is the interest paid on the new bonds, bearing in mind they will not mature for 30 years.

If the rate is too low - say less than 3.8% - the investors will cry foul and insist the deal is no longer voluntary.

If it isn't voluntary then Greece is in default.

Gavin Hewitt, BBC Europe editor, 23 January 2012, 10:00 GMT

Greece, Voluntary...

Talks dragged on past midnight as Prime Minister Lucas Papademos met for a third day with negotiators which represents the private creditors.

They are being asked to take a loss on their bond holdings to lighten Greece’s debt load by €100 billion ($129 billion).

Washington Post, 20 January 2012

Vem avstår frivilligt 70 procent av sin fordran?

Rolf Englund blog 20 januari 2012

Greece was closing in on an initial deal with private bond holders on Friday

that would prevent it from tumbling into a chaotic default

but lose investors up to 70 percent of the loans they have given to Athens.

CNBC, Friday, 20 Jan 2012, 9:42 AM ET

The agreement, to be followed up by technical talks over the weekend, could come later in the day, sources close to the negotiations said.

Private bondholders would most likely incur a real loss of 65 to 70 percent, with the new bonds having a 30-year maturity and offering a progressive coupon, or interest rate, averaging out at 4 percent, a banking official close to the talks told Reuters.

Hemligt PM. Marshall-hjälpen, Grekland och Carl Bildt

Rolf Englund blog 16 januari 2012

Standard & Poor´s motiveringar till sina nedgraderade kreditbetyg för en lång rad euroländer drar ner byxorna på euroetablissemanget,

vars lösningar får betyget Icke Godkänt på de flesta fronter.

Per Lindvall, e24, 2012-01-16

Angela Merkel om "frivillig" nedskrivning med 50 procent av Greklands skulder

"The second Greek aid package, including this [debt] restructuring, must be in place quickly.

Otherwise it won't be possible to pay out the next tranche for Greece," she told a news conference.

The rescue, worth 130bn euros would include a voluntary restructuring of Greek debt - meaning bondholders would have to write off 50% of the Greek bonds' value.

BBC, 9 January 2012

As one senior figure who has long played a role in the euro negotiations says, politicians hate being pushed around by markets

but “Trotskyists in London understand markets better than conservatives in Europe.”

Ms Merkel’s scepticism also stems from bitter experience.

She followed investors’ advice and called for private holders of Greek bonds to share the burden of a second bail-out for Greece.

Those who have spoken to the chancellor say she feels duped by those investors, who urged her to agree to a restructuring of Greece’s massive debt burden

but then told the chancellor that she had also made all other eurozone bonds suspect.

Financial Times, 4 December 2011

The European Central Bank and Mr Sarkozy had warned that such contagion would happen.

Varför ska man sitta på portugisiska papper när Angela Merkel gjort klart att det är de privata långivarna som ska förlora.

Eftersom EFSM, ECB och bilaterala långivare tydligen ska hållas skadelösa blir det enbart de privata långivarna som får ta alla förluster.

Danne Nordling, 3 februari 2012

Merkel signed up to a commitment that private sector bondholders

would not in future be asked to bear some of the losses in sovereign debt restructurings,

as she insisted on earlier this year in the case of Greece.

Financial Times 5 December 2011

The “haircut” on Greek debt sparked investor fears that the debts of other heavily indebted countries such as Italy and Spain might also not be honoured, contributing to a sharp increase in their bond yields. Ms Merkel said it was imperative to show that Europe was a “safe place to invest”.

zcc

"Signs of stabilisation are emerging in the banking sector,"

said the IMF in a report.

Cyprus agreed to a 10 bn-euro bailout with the European Union and the IMF last year.

Cyprus's second-largest lender - Laiki Bank - was closed down.

BBC 2 April 2014

At Cyprus's banks, non-performing loans - ones where payments have been missed -

reached 50% of all loans, worth 22 bn euros.

"For a small, open economy like Cyprus,

Euro adoption provides protection from international financial turmoil." ECB-Trichet 2008

Getting creditors not taxpayers to rescue banks seemed like a good idea,

but it has not worked well in Cyprus

The Economist, 8 March 2014, print

Amid tough competition, Cyprus’s banking crisis was a contender for Europe’s worst.

The botched rescue a year ago was surely the nadir of an unimpressive record of decision-making by European finance ministers and the IMF.

At first, a raid on insured deposits was envisaged, though ultimately they were spared and the main victims were uninsured depositors — a decision made easier by the fact that many of them were Russians.

But getting creditors both to absorb losses and to recapitalise the country’s biggest bank (which also had to absorb the second-biggest and even more comprehensively bust bank) is not proving to be a great success.

Three lessons can be learnt from the Cypriot saga.

The first is the importance of having a state-backed “bad bank” into which the bad loans of a restructured bank can be placed. These asset-management companies lift the weight of bad loans off the books of banks, at a big discount to their value when they were extended, freeing banks to provide credit for new ventures. Because these asset managers can operate on a longer horizon than banks, they can avoid distress sales. NAMA, the Irish version, concentrated at first on selling off assets in Britain, where property recovered faster than in Ireland.

"For a small, open economy like Cyprus, Euro adoption provides protection from international financial turmoil." ECB-Trichet 2008

The EU's bailout of Cyprus has elicited unusually frank and vehement criticism from the finance experts grouped in the IMF's Executive Board.

Although no names were mentioned, the criticism was directed at all European politicians involved in the bailout,

from Merkel and Schäuble to Hollande, Barroso and Olli Rehn.

The criticism applies in particular to the Eurogroup president, Dutch politician Jeroen Dijsselbloem, who has even recommended the Cyprus bailout as a model for future bailout programs.

Der Spiegel, 3 June 2013

Det är bara en tidsfråga innan ett av de stora krisländerna väljer en politisk ledning som inte längre godtar åtstramningsdiktaten.

Cypernkrisen avslöjade den fulla omfattningen av

den politiska katastrof som eurokrisen har ställt till

en nästan ofattbar inkompetens i ”trojkan”,

alltså EU-kommissionen, ECB och IMF.

Joschka Fischer, Kolumn DN 6 maj 2013

Den pågående förtroendekrisen är långt farligare än en förnyad oro på marknaderna, eftersom den inte kan övervinnas med ännu en likviditetsinjektion från ECB.

Det beror på att Tyskland, utan jämförelse EU:s starkaste ekonomi, har genomdrivit en strategi för att övervinna eurokrisen

som fungerade för Tyskland i 2000-talets början, men under helt andra inre och yttre ekonomiska förhållanden.

För de hårt ansatta sydeuropeiska staterna visar sig den tyskstödda blandningen av åtstramningar och strukturreformer dödlig därför att

de avgörande tredje och fjärde komponenterna – skuldavskrivning och tillväxt – saknas.

Alla i Europa vet att krisen antingen kommer att tillintetgöra EU eller leda till en politisk union,

Euron går inte att rädda utan en solidarisk lösning av befintliga skuldproblem och att en del nya lån tas upp gemensamt.

Sådana åtgärder gör långtgående överföringar av suveränitet oundvikliga.

Är Tyskland – eller Frankrike – villigt att göra det?

Joschka Fischer, Kolumn DN 6 maj 2013

"For a small, open economy like Cyprus,

Euro adoption provides protection from international financial turmoil."

18/01/2008, Trichet

Cyprus, Spain, Greece, Italy

At what point does it become economically rational for a country to leave the eurozone

Wolfgang Münchau, Financial Times, March 31, 2013

Since this eurozone crisis began, a view has emerged, not least among the single currency’s most stringent advocates,

that the edifice could only be held together with the advent of “fiscal union”. This is an argument I accept.

I’m starting to lose patience, though, with those who expect to be taken seriously when they venture that such an arrangement can actually be implemented in Europe.

Spain is a democracy. Italy is a democracy. France, the world’s fifth-largest economy, is a democracy.

Liam Halligan, Telegraph 30 Mar 2013

Are all these countries, their electorates supplicant, really going to subscribe to and live under, for decades to come, a system based on Germany telling them how much they can borrow and spend?

I think not.

Depositors are not bondholders – who knew their money was at risk and reaped a commercial yield on their investment.

On the contrary, depositors put their money in a bank, at a lower rate of return, precisely to keep it safe.

Monetary union, also, requires “banking union” we are told. Is that really going to happen? Do current events in Cyprus make it more, or less likely? The answer is obvious, for anyone prepared to see.

And are capital controls even legal? Articles 63 and 65 of the European Union treaties say such controls are justified “only on grounds of policy or public security” and should “not constitute a means of arbitrary discrimination or a disguised restriction on the free movement of capital and payments”.

How long, then, before some of the very large international business interests caught up in this Cypriot banking chaos get together to launch the mother of all legal disputes?

March 24, 2013 1:55 am by Gavyn Davies

Europe’s Cyprus Blunder and Its Consequences

The late Mike Mussa, a former Chief Economist of the International Monetary Fund, noted about some episodes of the late-1990s Asian financial turmoil that

“there are three types of financial crises: crises of liquidity, crises of solvency, and crises of stupidity.”

This quip comes to mind when considering the developments of the past few days around Cyprus.

Nicolas Véron, Bruegel, 21st March 2013

I fallet Cypern går Tyskland och dess allierade, däribland Finland och Slovakien, mycket hårdare fram än vid de fyra tidigare tillfällen då EU har tvingats ingripa med nödlån.

När Spanien förra året beviljades 100 miljarder euro för att rädda sina banker var det ingen som krävde att vanliga sparare måste acceptera vad som i praktiken är en partiell konfiskation.

Per T Ohlson, Sydsvenskan 24 mars 2013

Bankpanik är en oerhört destruktiv företeelse... Det kusligaste exemplet är Creditanstalt, en bank i Österrike. Den havererade 1931. Paniken fortplantade sig i Europa och över Atlanten. I USA fördjupades depressionen. Och i Tyskland följde katastrofernas katastrof.

Vad skall euroministrarna göra med stöldgodset?

Cyperns konkurs förhindras. Tills vidare. Men sen då?

Rolf Englund 24 mars, 08:35

Demanding that Cyprus raise €6bn – almost a quarter of its annual GDP – over a weekend is “a big ask”

Liam Halligan 23 Mar 2013

The eurozone after Cyprus

In Spain, the nominal value of Bankias shares will be reduced to €0.01 from €2

Gavyn Davies, FT blog March 24, 2013

The principle of divorcing the debt of governments from that of banks (and thus breaking the “diabolical loop” which threatened to bring down Spain last year), was very rapidly thrown out of the window in Cyprus.

There was apparently no willingness to use ESM money directly to recapitalise the banks, even though that is being done successfully with the Bankia resolution in Spain this very week.

---

Bankia SA shareholders will be nearly wiped out and its junior bondholders will lose about 30% of their original investment in the restructuring plan for Spain’s largest ailing bank, the country’s bailout fund said Friday.

Under the strict terms of a European-Union financed cleanup of Spain’s banking industry, the Fund for Orderly Bank Restructuring is forcing investors to bear heavy losses before injecting public funds into the banks.

In Bankia, the nominal value of its shares will be reduced to €0.01 from €2 and the nominal value of its preferred shares and subordinated debt will be reduced to €4.84 billion ($6.29 billion) from €6.91 billion, the bank-restructuring fund said.

---

It is a well established principle of bank work-outs that losses should be taken in the following order:

shareholders first, then bondholders, then uninsured depositors, then insured small depositors.

The fact that the Eurogroup was willing even to contemplate anything different sends a very bad signal.

Direct controls over the exit of capital from a eurozone member will have occurred for the first time in Cyprus. It seems to breach one of the basic principles of a single currency. (See Jeremy Warner.)

Cyprus 'business model' was no mystery to EU

EU Observer 22 March 2013

Links to Malta

Be it the German finance minister, European Central Bank (ECB) officials or the head of the Eurogroup - they all agree on one thing: Cyprus must scrap its "unsustainable business model" based on low taxes and attracting large amounts of bank deposits from abroad, mainly Russia.

In a so-called convergence report dated 2007, one year before Cyprus joined the eurozone, the ECB mentioned the large influx of capital.

"Much of the financing of the deficits in the combined current and capital account over the past two years has also come from capital inflows in the form of 'other investment,' comprising non-resident deposits and loans," the report says.

"Other investment inflows amounted to a sizeable 11.3 percent of GDP in 2006. Since capital inflows exceeded the current and capital account deficit between 2004 and 2006, Cyprus experienced an accumulation of official reserve assets in this period," it adds.

It was the morning after the night before and I was riding an elevator to the 13th floor in the European Commission.

Two men smiled at each other and one said "I hear Greece has been saved". "Couldn't be better," beamed the other, before disappearing into the vastness of bureaucracy. It felt like news shared from a distant front: "Bastogne has been relieved" or "Malta is holding out".

Gavin Hewitt, the BBC's Europe editor blog 26 March 2010

Cyprus is a low-tax jurisdiction, not a tax haven.

Cyprus is on the OECD’s ‘white list’ of jurisdictions complying with the global standard for tax co-operation and exchange of information.

Its fiscal and regulatory regimes are fully aligned with the acquis communautaire and the Code of Conduct for Business Taxation of the EU and the requirements of the OECD, the FATF, and the FSF.

However the Cayman Islands’ maintains only 12 bilateral tax information arrangements; and The Isle of Man, 14

Naked Capitalism 23 March 2013

Cyprus an arrangement with all of its OECD bilateral (double-taxation treaty) partners – 46 fully, 6 being ratified.

Within these 52 countries, Cyprus has double-taxation treaties with about every country in the EU, and includes China, the US, Russia and, practically, every Middle East country. All the double-taxation treaties concluded by Cyprus were drafted on the basis of the Organization of Economic Co-operation and Development (OECD) model treaty.

The Germans want large investors - many of them Russians - to share in the cost of bailing out Cyprus.

They want the Cypriot banking sector scaled back.

The Cypriots are desperate to protect their financial sector, which is so important to the island's economy.

If large depositors are hit hard the fear is that the financial industry will be destroyed.

Many Cypriots believe that is precisely what Brussels wants.

Gavin Hewitt, BBC Europe editor, 22 March 2013

But senior European finance-ministry officials in a call Friday evening expressed

doubts that the plan would raise enough money to ring fence the lender, according to two officials on the call.

"What if you impose a levy on deposits on [Bank of Cyprus] and two weeks later bank collapses anyway, where does that leave you?" one of the officials said.

Wall Street Journal March 22, 2013, 9:07 p.m. ET

Let the failing banks fail. Only The Wall Street Journal's editorial board seems to understand this

The unlearned lesson of Lehman remains badly unlearned. The problem wasn't that Lehman failed—it was that the government was never able to send a consistent message about its approach to troubled financial firms. Bear was rescued, Fannie and Freddie brought into something called a conservatorship, Lehman bankrupt, and AIG bailed out. No wonder chaos broke out.

This is what's at risk in Cyprus.

There seem to be no agreed-upon rules, no official process, nothing that can be counted upon.

John Carney, Senior Editor, CNBC.com, 22 Mar 2013

---

Here's how it could work: Shareholders, along with senior and subordinated debt holders, would be wiped out. Deposits up to €100,000 that are insured would be protected. Larger depositors would take a haircut in the range of 40%—somewhat more for Laiki depositors, somewhat less for account holders at Bank of Cyprus, reflecting the extent of the losses and the capital needs at the two banks.

In exchange for their losses, these depositors would get all the new equity; they would become the proud owners of two newly well-capitalized banks. No public funds would be needed to save the banks, and both creditor seniority

and the rule of law would be respected.

Wall Street Journal 21 March 2013

Kommer Vargen?

Klockan är 18.38 och Dow Jones är upp 94 punkter.

Snart löser sig allt med plan B, eller om det är plan C, anser börsen

Men jag tycker de läckta planerna är vaga och svaga.

Vi får se när börserna stänger i New York och Tokyo.

Sedan har dom några dygn på sig att lämna euron

Rolf Englund, fredag 22 mars 2013

Cyprus was just hours away from a deal on Friday to raise billions of euros and

unlock a bailout from the European Union that could avert financial meltdown and exit from the euro,

its ruling party said.

Reuters, Fri Mar 22, 2013 2:02pm EDT

With hundreds of demonstrators facing off with riot police outside parliament, lawmakers were preparing to debate bills to nationalize pension funds, pool state assets and split the island's second-largest lender, Cyprus Popular Bank, into good and bad assets in a desperate effort to placate exasperated European allies.

The official sick man list of Europe has long been the PIIGS, or if you prefer, the GIPSI:

Greece, Ireland, Spain, Italy, Portugal.

As the Cyprus restructuring drama has moved into high gear, it’s obscured news of a serious deterioration

in the French economy and the weakened condition of Slovenia, which has a population and GDP roughly 1.5 times as large as that of Cyprus.

Naked Capitalism, 23 March 2013

The latest Flash PMI data spell further bad news for the French economy, with the downturn in output accelerating to the sharpest in four years

Reuters argues Slovenia will be next to ask for a rescue:

Slovenia’s mostly state-owned banks are nursing some 7 billion euros of bad loans, equal to about 20 percent of GDP

Cyprus exposes folly of eurozone banking union

We may have a single supervisor, or are about to have.

But without a mutually guaranteed, eurozone-wide deposit protection scheme,

and a centrally funded resolution authority,

Europe is still a long way from financial stability.

Howard Davies, Financial Times, 22 March 2013

Over the past three years the EU has shown a remarkable facility for turning problems into crises and crises into catastrophes.

The writer is a former chairman of the UK Financial Services Authority, former deputy governor of the Bank of England and former director of London School of Economics. He is now a professor of practice at Sciences Po in Paris

This crisis has revealed yet again the faultline at the heart of the euro.

Economic and monetary union has yoked together very different economies and cultures.

The stress of trying to blend them together is putting the European project under severe strain.

Some economies are in a depression and the political fallout from this still lies ahead.

Gavin Hewitt, BBC Europe editor, 22 March 2013

The worst outcome would be to allow the Cypriots to slide towards the exit.

That would be disastrous for the island. And the euro zone would be wrong to imagine that Cyprus is tiny enough to let go safely.

The currency’s credibility rests on the idea that it is irreversible.

The Economist print, dated 23 March 2013

Even if only uninsured deposits are hit, a line has been crossed. A formal European bail-in regime is needed as soon as possible, one that requires banks to hold a layer of loss-absorbing senior debt designed to spare depositors, both insured and uninsured, in all but the last resort.

Basel

There is no provision in any European Treaty for a country to leave the eurozone.

That was deliberate.

It was intended to make it clear that the eurozone was forever – like the Soviet Union and the Holy Roman Empire.

Roger Bootle, Daily Telegraph 5 September 2011

Stocks shot higher Friday, erasing their losses from the previous session,

amid optimism that a solution to Cyprus's bailout crisis may be possible within "the next few hours."

CNBC, Friday, 22 Mar 2013 | 10:30 AM ET

De slutna rummens beslutsfattande är ansiktslöst

”Det som hänt visar att EU befinner sig i ett slags undantagstillstånd. Ingenting är längre heligt.

Då kan vad som helst hända”, säger professor Sverker Gustavsson när jag ringer honom för att tala om den pågående krisen.

Annika Ström Melin, Signerat DN 22 mars 2013

“It’s déjà vu all over again.” The European game goes like this:

Angela Merkel draws lines in the sand; then she vacates them, breaks a few treaties,

and lets the European Central Bank take over,

though Mario Draghi, its president, is demonstratively dragging his heels.

Josef Joffe, editor of Die Zeit, Financial Times 21 March 2013

Undantagstillstånd

As parliament prepared to sit on Thursday evening,

the government submitted a bill seeking the power to impose capital controls on banks,

"The purpose of this law is, in case of an emergency for purposes of public order or security

CNBC/Reuters Thursday, 21 Mar 2013 | 3:29 PM ET

The EU's smaller members aren’t getting a fair shake in the eurozone,

Robert Oulds, chairman of the Bruges Group, told RT.

With a ballooning public debt, Cyprus may need to look to Iceland - the EU's tiny non-euro country - for a path to recovery.

RT 21 March 2013

Eurogroup Working Group

In detailed notes seen by Reuters Euro zone finance officials conference call

one official described emotions as running "very high", making it difficult to come up with rational solutions,

and referred to "open talk in regards of (Cyprus) leaving the euro zone".

Reuters March 21, 2013

Euro zone finance officials acknowledged being "in a mess" over Cyprus during a conference call on Wednesday and discussed imposing capital controls to insulate the region from a possible collapse of the Cypriot economy.

The call was among members of the Eurogroup Working Group, which consists of deputy finance ministers or senior treasury officials from the 17 euro zone countries as well as representatives from the European Central Bank and the European Commission.

Cypriot Financial Sector Faces Collapse

Data from the BIS in Basel shows that, at the end of September 2012, the Cypriot banks had a total of

$441 million in debt with foreign banks - a dimension that could be coped with easily.

Spain, by comparison, has a whopping €132 billion in liabilities to foreign banks.

Der Spiegel, 21 March 2013

ECB to Push Cyprus Over the Brink

Will they really cut off all forms of support? That would give Cyprus no choice but to leave the Eurozone and could easily cause a chain reaction all across the periphery.

If they didn’t withdraw support they would be admitting that their threats were empty and would be encouraging every periphery country to openly defy them.

Naked Capitalism 21 March 2013

Cyprus: The Sum of All FUBAR

It looks as if Cyprus has managed to combine in one place everything that has gone wrong elsewhere.

Paul Krugman, New York Times, March 21, 2013

1. Runaway banking. Cyprus has a huge banking system — assets around 8 times GDP — based on a business model of attracting offshore money with high rates and good opportunities for tax avoidance/evasion.

2. Big domestic real estate bubble, Spain or Ireland-sized. Not yet fully deflated

3. Massive overvaluation

The initial screwup was a joint error of the Europeans and the Cypriots.

Europe didn’t want an explicit bank resolution, which would among other things have given clear seniority to small insured deposits

The Cypriot government still has the illusion that its banking model can survive, and wanted to limit the hit to the big overseas depositors.

FUBAR (fucked up beyond all recognition/any repair/all reason)

Wikipedia

ECB PRESS RELEASE 21 March 2013

Governing Council decision on Emergency Liquidity Assistance requested by the Central Bank of Cyprus

The Governing Council of the European Central Bank decided to maintain the current level of Emergency Liquidity Assistance (ELA) until Monday, 25 March 2013.

Thereafter, Emergency Liquidity Assistance (ELA) could only be considered if an EU/IMF programme is in place that would ensure the solvency of the concerned banks.

Click

Cyperns ekonomi är liten och i sig en minimal smittorisk för eurozonen.

Spridningsfaran har EU självt skapat.

Det som gjorts en gång med insättningsgarantin kan göras igen, oavsett hur ofta papegojan upprepar ordet specialfall.

DN-ledare 21 mars 2013

Även när privata investerare i grekiska statsobligationer i fjol ”frivilligt” tvingades acceptera förluster (för övrigt den stora knäcken för de cypriotiska bankerna) påstods det vara en unik åtgärd.

Utan tvivel är den cypriotiska banksektorn för stor, åtta gånger landets BNP. Det är lite mer än på Irland vid tiden för kraschen, även om det stabila Luxemburg också har en gigantisk finansbransch. Precis som Cypern hittills vägrat genomföra privatiseringar och maskat med andra reformer, finns det EU-krav om bankerna som inte följts. Har Cypern inte råd att underhålla sin affärsmodell är det knappast europeiska skattebetalares sak.

Men strukturförändringar tar tid. Samtidigt står banksystemet på Cypern inför en härdsmälta.

Att Cypern tvingas lämna euron kan inte uteslutas, och de direkta efterräkningarna för valutaunionen torde i så fall bli begränsade. Men åter ligger faran i exemplets makt: kan Cypern gå ur samarbetet, så kan väl Grekland och…

Russian prime minister Dmitry Medvedev:

“All possible mistakes that could be made have been made by them,” he added.

“The measure that was proposed is of a confiscation nature, and unprecedented in its character.

I can’t compare it with anything but ... decisions made by Soviet authorities ... when they didn’t think much about the savings of their population.

But we are living in the 21st century, under market economic conditions.

Everybody has been insisting that ownership rights should be respected.”

Financial Times, 20 March 2013

Cyprus - The disaster scenario

If it fails to convince the eurozone that it has a viable alternative to bailing in depositors,

then the ECB could decide that Cypriot banks are no longer eligible for the eurosystem’s emergency loans,

known as Emergency Liquidity Assistance (ELA), which is now the only thing keeping the island’s banks afloat.

That is the gun pointing at Mr Anastasiades’ head, something made clear to him by ECB officials at the late-night negotiations

Financial Times, 20 March 2013

On Tuesday, not a single member of the Cypriot parliament voted in favor of the legislation.

Some 36 members rejected the measure, with 19 abstaining.

The vote led protesters outside the parliament to cheer.

Der Spiegel, Tuesday 19 March 2013

De som i dag har pengar i banker på Cypern kommer, om euroministrarna får som dom vill, att få upp till 9,9 procent av pengarna konfiskerade.

Dessutom kommer EU att kräva krafttag mot skattefusk och penningtvätt.

Varför skall de då ha kvar sina resterande 90,1 procent på banken på Cypern?

Risken är uppenbar, tycker jag i efterhand efter att ha läst det på nätet.

Det jag har läst är en artikel av Felix Salmon, Reuters, March 19, 2013

To say that the tensions within the European "Union" are getting unbearable would be an understatement.

Courtesy of Reuters, we get a detailed narrative of what happened before this Saturday's announcement of a deposit levy,

where we learn that the deposit confiscation was initially Joerg Asmussen's idea, and we also learn that Atanasiades stormed out in anger when he learned what was about to happen.

Zerohedge 18 March 2013

Riktigt hur det gick till när euroländerna krävde konfiskering av bankspararnas pengar för att gå med på nödlån till Cypern får vi kanske aldrig veta.

Det drastiska och olyckliga beslutet fattades bakom lyckta dörrar i Bryssel och nu skyller alla på varandra.

DN-ledare 19 mars 2013

Europe's Reckless Raid on Cyprus's Savings

Bloomberg, the Editors March 18, 2013

Bernard Connolly

Cyprus Isn't Taxing Deposits, It's Confiscating Them

The decision to seize private property means that all assets in the euro zone are at risk,

subject to the whims of politicians as they try to prevent their dream of a united Europe from shattering.

Caroline Baum, Bloomberg, March 18, 2013

Cyprus rescue breaks all the rules

So what is seen by many as profoundly shocking about the terms of the rescue of Cyprus by the rest of the eurozone and the International Monetary Fund is that both of these principles have been broken.

Retail savers are being punished, by a levy of 6.75% on savings up to 100,000 euros.

And bondholders aren't being touched.

Robert Peston, BBC Business editor, 18 March 2013

Genom att även konfiskera småsparares pengar upphävs en princip som gällt sedan den amerikanska depressionen på 30-talet:

att den lille mannens pengar är skyddade.

Den så kallade insättningsgararantin är själva fundamentet för det moderna banksystemet och

hjälper till att förhindra förödande så kallade bankrusningar.

Andreas Cervenka, SvD Näringsliv 18 mars 2013

Europe is risking a bank run

With the agreement on a depositor haircut for Cyprus

the eurozone has effectively defaulted on a deposit insurance guarantee for bank deposits.

Its purpose is not to provide absolute certainty, but to prevent bank runs, which is what happens when you go after small depositors.

Wolfgang Münchau, Financial Times, March 17, 2013

IMF and the German government want to reduce the size of any loan to Cyprus by forcing it to “bail in” the creditors of Cypriot banks,

both bondholders (a tiny share of the liabilities) and uninsured depositors (who account for a lot).

But this could cause panic among depositors in Italy, Spain and other euro countries with troubled banks.

The Economist, March 16th 2013, print edition

Kommentar av Rolf Englund:

Det bör observeras att bankerna på Cypern, som hade mycket grekiska statspapper, gjorde stora förluser när EU tvingades innehavarna av sådana papper att skrivera "friviligt" skriva ner värdet med 75 procent.

Det bör också noteras, vilket professor Pelotard har påpekat för mig, att om reglerna om bankerna fått gå omkull och om insättningsgarantin hade följts

så hade "småspararna", med upp till 100.000 euro, klarat sig. Däremot hade de som hade större fordringar förlorat det mesta av sina pengar.

När euroministrarna svek insättningsgarantin gjordes detta således i syfte att skydda insättarna med stora belopp i de cypriotiska bankerna.

Even those people who come from larger EU countries should be conscious of the fact that

Every euro-zone member is systemically relevant.

If Cyprus were to face a disorderly default, there is a high probability that the consequence would be an exit from the euro zone.

All members of the euro zone have committed to doing everything in their power to preserve the unity of the euro.

This promise has calmed down the markets. We shouldn't do anything that would jeopardize this success.

Olli Rehn, Der Spiegel 4 March 2013

Rehn: The French government has begun structural reforms, but the economic outlook has also simultaneously and unexpectedly worsened. France must now persuade the European Commission and its European partners that it will get its public finances in order in medium-term.

SPIEGEL: What use is it, then, if Europe obliges itself to ever greater budgetary discipline, but in reality is constantly making concessions?

Rehn: I don't make any trade-offs when it comes to the Stability Pact rules. The reformed pact places an emphasis on making public finances sustainable in the medium-term. In the short term, certain divergence can be accepted under the condition that a country is implementing reforms.

So we are relying on partnerships, but we are also prepared to initiate sanctions instruments if necessary.

Europakten - Frankrike - Stabilitetspakten

Europe faces an impossible challenge - why can't Olli Rehn see it?

"There is no alternative". That was again the message this weekend from our old friend Olli Rehn

the eurozone's miscreant periphery has no option but to stick to the assigned path of budgetary consolidation

Jeremy Warner, Telegraph 4 March 2013

Cyprus is having a hard time shaking its reputation,

thanks to an industry skilled at forming shell corporations and trusts that can camouflage assets.

So much money flows through Cyprus to Russia that in the official statistics the little island is

Russia's largest source of foreign investment—accounting for nearly a quarter of the total in 2011.

Wall Street Journal 4 March 2013

"The Eurogroup called on the international institutions and Cyprus to accelerate their work on the building blocks of a program,

and agreed to target political endorsement of the program around the second half of March," the ministers said in a statement.

Reuters 4 March 2013

That is likely to appease Germany, which has raised concerns about money-laundering on the island.

The ministers examined a variety of options to finance the bailout and ensure that it is "sustainable" - that Cyprus can repay what it borrows.

17 miljarder euro? Javisst, men inte i dag

Eurozone finance ministers, known collectively as the Eurogroup,

are confident of agreeing a bailout for Cyprus

by the end of March

BBC 4 March 2013

The bailout could be worth up to 17bn euros.

Eurogroup head Jeroen Dijsselbloem said ministers were ready to help Cyprus, "but the details still needed to be worked out".

Simon Nixon says Cyprus, not Italy, decides the fate of the eurozone

Its debt crisis might blow everything away the eurozone has achieved since the summer.

Eurointelligence 25 February 2013

Writing in the Wall Street Journal, Simon Nixon argues that Italian politics is important but only in the long run.

Cyprus is of much more short-term relevance, he writes. The situation is even complicated than it was in Greece.

He said Germany’s insists on a depositor bail-in might trigger panic across the eurozone’s weaker banking sectors. He concludes that it will be hard to square the requirements of Cyprus with those of German politics.

---How this situation is resolved could have profound consequences for the euro zone.

Berlin's preference appears to be a traditional euro-zone can-kicking exercise

But euro-zone policy makers may not have the luxury of time, particularly if loose talk of depositor haircuts continues to circulate

in a country where a quarter of deposits are foreign-owned with overnight notice

Simon Nixon, Wall Street Journal 24 February 2012

Berlin's preference appears to be a traditional euro-zone can-kicking exercise, with a solution cobbled together via mixture of fudged numbers, nondepositor haircuts, privatization promises and euro-zone bailout cash—the aim being to at least defer the problem until after Germany's own elections in September. In the current political climate, it may be difficult to get any bailout for Cyprus through the German parliament.

But euro-zone policy makers may not have the luxury of time, particularly if loose talk of depositor haircuts continues to circulate in a country where a quarter of deposits are foreign-owned with overnight notice

The German government is now resigned to accepting an aid package for Cyprus without a default,

From the story it becomes clear that they have not got a clue how to do this.

The problem is that Cyprus has multiple tax treaties, which exempt foreign depositors from local taxes.

The problem with a debt restructuring is Russia. There is no way to bail-in the Russian government and maintain the country’s support for Cyprus.

The pressure is increased because the danger in Cyprus is not an imminent collapse of the state,

but a collapse of the banks, which are running out of funding.

Eurointelligence 22 February 2013

PSI

Den cypriotiska affärsmodellen var enkel: solturister plus låga kapital- och bolagsskatter.

Miljonstinna ryssar hittade ett paradis.

Finanssektorn växte till över åtta gånger landets BNP, mer än på Irland före bankkraschen.

En stor del av inflödet investerades dessvärre i grekiska statsobligationer eller lånades ut till grekiska banker.

DN-ledare 17 februari 2013

Att skriva ned skulderna båtar föga. Men framför allt hade Europa lovat att just den metoden var unik för Grekland. Om det inte längre stämmer kommer marknaderna att undra i vilka andra sårbara länder den då är tänkbar.

The extraordinary thing is that there hasn't yet been a bank run across the Mediterranean

Daniel Hannan, March 18th, 2013

Until now, the EU has sought to reassure depositors by guaranteeing – absolutely guaranteeing – that savings up to €100,000 are secure,

a pledge solemnly repeated by the Cyprus government. Any Cypriots who believed that assurance now know better.

What would you do now if you had savings in a Greek, Spanish or Portuguese bank?

Or an Italian bank? Or even a French bank? It's not as though you're getting any interest anyway.

And now it turns out that, despite all the promises, your savings are vulnerable to arbitrary confiscation.

Undantagstillstånd

As parliament prepared to sit on Thursday evening,

the government submitted a bill seeking the power to impose capital controls on banks,

"The purpose of this law is, in case of an emergency for purposes of public order or security

CNBC/Reuters Thursday, 21 Mar 2013 | 3:29 PM ET

Undantagstillstånd

As parliament prepared to sit on Thursday evening,

the government submitted a bill seeking the power to impose capital controls on banks,

"The purpose of this law is, in case of an emergency for purposes of public order or security

CNBC/Reuters Thursday, 21 Mar 2013 | 3:29 PM ET

Are you a Russian company with deposits in Cypriot banks?

Do you feel safe? Do you read newspapers?

One of the mysteries of the Cyprus debt crisis is why non-resident deposits aren’t moving out of the country.

Masa Serdarevic, FT Alphaville 11 February 2013

(She started her career in the investment banking division at Lehman Brothers in the summer of 2007,

timing it perfectly with the beginning of the credit crunch.

She studied philosophy, politics and economics at Oxford University)

She started her career in the investment banking division at Lehman Brothers in the summer of 2007, timing it perfectly with the beginning of the credit crunch. When the bank collapsed she was pictured walking out of the the building with a box of her belongings. The picture somehow made it to the front of various newspapers, and has seemingly since become a stock image used by picture desks to illustrate anything from greedy bankers to the victims of capitalism. Her friends briefly nicknamed her “the face of the credit crunch” but fortunately it didn’t catch on.

Radical rescue proposed for Cyprus

Would force losses on uninsured depositors in Cypriot banks, as well as investors in the country’s sovereign bonds,

according to a confidential memorandum prepared ahead of Monday’s meeting of eurozone finance ministers.

Financial Times, February 10, 2013

Cyprussia

Russian money streams through Cyprus

Financial Times, February 6, 2013

A Russian bank is advertised on a road in Limassol. Cyprus is a favourite destination for Russian money

A new parking scheme appeared late last year in some congested Moscow neighbourhoods. Street signs advised Muscovites either to buy a ticket at a nearby machine or text their licence plate details to a number: 7757.

Evgeny Schultz, a Moscow blogger, took a closer look. It turned out that the number 7757 had been bought by a company registered just six months previously, which itself had been founded by two Cyprus-registered companies whose ownership was unclear.

German Finance Minister Wolfgang Schäuble, as he has made clear several times,

is no fan of providing emergency aid to struggling euro-zone member Cyprus.

But pressure to reach a bailout deal has been growing in recent weeks.