Interndevalvering (Ådals-metoden)

Related: Stabiliserinspolitik - Europakten 2011 - Finanskrisen - Eurokrisen

FT In depth Austerity Europe

Euron är ett fullskaleexperiment för att se om Hoover och Brüning och Bildt hade rätt,

om en interndevalvering är möjlig och om åtstramning leder till stimulans

Rolf Englund, 3 mars 2015

They never told us we could do that,” said Sidney Webb, a bruised former minister, when Prime Minister Ramsay MacDonald took Britain off the gold standard in 1931.

That momentous decision – forced on the government, in the end, by a mutiny of the Royal Navy –

took 25 per cent off the value of the pound and scarred the Labour party for decades.

But it also saved Britain from the Great Depression.

Stephanie Flanders, FT 18 April 2014

In September 1931, as part of its attempts to deal with the Great Depression, the new National Government launched cuts to public spending.

10% pay cut for officers and senior ratings. Those ratings below Petty Officer who had joined before 1925 would also have their pay reduced to the new rate; this amounted to a cut of 25%

For two days, ships of the Royal Navy at Invergordon were in open mutiny, in one of the few military strikes in British history.

The Invergordon Mutiny caused a panic on the London Stock Exchange and a run on the pound, bringing Britain's economic troubles to a head

that forced it off the Gold Standard on 20 September 1931.

Part of the adjustment mechanism built into the currency union is the pro-cyclical impact of monetary policy:

real interest rates are higher in countries forced through internal devaluations.

Martin Wolf FT 19 June 2018

The mechanism of adjustment in the eurozone is therefore essentially that of the 19th-century gold standard.

Prolonged recessions are a feature, not a bug.

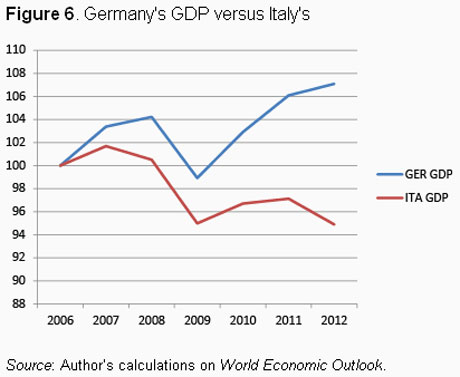

Italy - the eurozone’s third-largest economy - is weak and

shackled to a monetary union whose impact is substantially malign.

The rise of the populist politics represented by the anti-establishment Five Star Movement and the far-right League

is an all-too-comprehensible consequence of gross economic mismanagement both within Italy and in a very imperfect monetary union.

John Plender, FT 30 May 2018

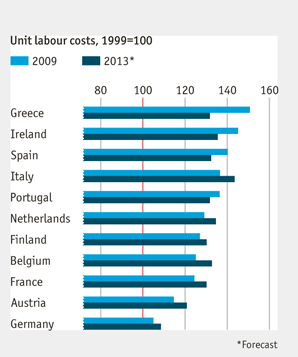

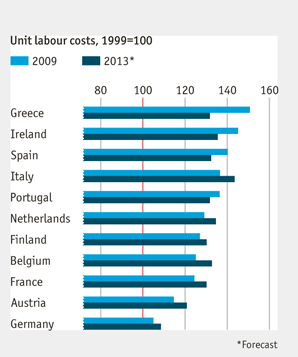

Within the monetary union, Italy cannot address this competitiveness issue through devaluation.

The only remedy is internal devaluation via wage deflation.

Yet despite unemployment of 11 per cent and youth unemployment at a devastating 35 per cent,

unit labour costs have not come anywhere near to delivering that internal devaluation.

In reality, the level of unemployment that would be required to restore competitiveness might well be unthinkable.

Italy illustrates the way to liberal democracy’s demise

Wolfgang Münchau FT 20 May 2018

If liberal democracy fails to deliver economic prosperity for a sufficiently large portion of the population over long periods, it ends — along with the financial and economic institutions it has created.

The ECB has soaked up €300bn of Italian debt

buying time for the country to claw its way out of a debt-deflation trap.

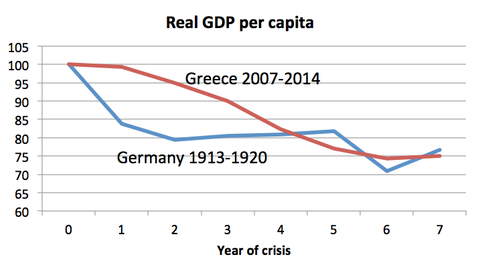

Italy has pulled off an “internal devaluation” within the eurozone, albeit at the cost of a deeper depression than the 1930s.

Ambrose Evans-Pritchard Telegraph 13 May 2018

The next global economic downturn – probably in 2019 – will be traumatic for everybody,

given that we have already used up our monetary and fiscal powder, and exhausted popular consent for globalisation.

Ambrose Evans-Pritchard 31 January 2018

The terrible price of austerity

Chancellor Brüning's austerity policies went far beyond keeping interest rates high to stay on the gold standard and stem capital flight.

A series of draconian fiscal budgets imposed severe spending cuts and tax rises

Frances Coppola 28 December 2017

A Greek tragedy: how much can one nation take?

Greece’s economic crisis has disappeared from the minds of many in Europe,

but inside the country, the pain is only getting worse

FT 20 January 2017

The North still refuses to accept that the crisis was caused by destabilising capital flows,

and insists on a one-sided adjustment that forces the South to claw back lost competitiveness

through deflationary austerity.

Ambrose Evans-Pritchard, Telegraph 19 January 2017

Nobel economist Joe Stiglitz said this strategy had led to a contractionary bias for the eurozone as a whole and was ultimately unworkable

Martin Schulz, the European Parliament's president, said it was

absurd for politicians in the North to keep peddling the bogus morality tale that the South got into trouble because they are feckless and too lazy to work.

"These are all lies, and this is what is leading to huge lack of trust," he said.

När det gäller den period med krympande BNP som inleddes 2012 är experterna i stort sett eniga:

Finland hade kunnat lyfta sig snabbare ur recessionen med en egen, fritt flytande valuta.

DI/TT 30 december 2016

IMF and EU policymakers take Greece bailout spat online

War of words breaks out between officials over austerity measures

FT 15 December 2016

Tensions between the International Monetary Fund and eurozone policymakers over a Greek bailout erupted into a full online showdown on Thursday,

raising questions over whether the IMF will join the latest €86bn rescue.

Greece cannot be condemned to austerity for ever

Myths about the country’s rescue package must be confronted

Pierre Moscovici, European commissioner for economic and financial affairs, taxation and customs,

FT 15 December 2016

Put simply, the euro was flawed at birth.

It was almost inevitable that taking away two key adjustment mechanisms,

the interest and exchange rates, without putting anything else in their place,

would make macro adjustment difficult.

the social and economic costs of forcing Greek prices to fall enough are enormous

Stiglitz, FT 17 August 2016

Ambrose knows how to turn a phrase.

“Calamitous misjudgments” is a good way to describe the way the IMF, along with the EU and ECB, has handled the continent’s sovereign debt crisis,

which remains unresolved even now, six years later.

An Inheritance of Incompetence, John Mauldin, 13 August 2016

In 2013 economists at the IMF rendered their verdict on these austerity programmes:

they had done far more economic damage than had been initially predicted, including by the fund itself.

What had the IMF got wrong when it made its earlier, more sanguine forecasts?

It had dramatically underestimated the fiscal multiplier.

The Economist print 13 August 2016

Keynes supposed there was a “multiplier effect” from changes in investment spending.

A bit of additional money spent by the government, for instance, would add directly to a nation’s output (and income).

In the first instance, this money would go to contractors, suppliers, civil servants or welfare recipients.

They would in turn spend some of the extra income. The beneficiaries of that spending would also splash out a bit, adding still more to economic activity, and so on.

Should the government cut back, the ill effects would multiply in the same way.

Keynes’s reasoning was affirmed by the economic impact of increased government expenditure during the second world war.

Massive military spending in Britain and America contributed to soaring economic growth.

/Se also ”Det som satte stopp för trettiotalsdepressionen i USA var ett massivt underskottfinansierat program för offentliga arbeten som kallas andra världskriget”.

In an article published in 1979 and entitled “After Keynesian Economics”, Robert Lucas and Tom Sargent, both eventual Nobel-prize winners,

wrote that the flaws in Keynesian economic models were “fatal”.

Keynesian macroeconomic models were “of no value in guiding policy”.

John Cochrane of the University of Chicago said of Keynesian ideas in 2009:

“It’s not part of what anybody has taught graduate students since the 1960s.

They are fairy tales that have been proved false. It is very comforting in times of stress to go back to the fairy tales we heard as children, but it doesn’t make them less false.”

The practical experience of the recession gave economists plenty to study, however.

Full text of excellent article, even by The Economist standard

The Myth of Austerity and Growth

Noah Smith, Bloomberg 22 June 2016

The principles of Keynesian fiscal policy -- which have slowly been coming back into vogue -- say that tightening spending is the worst thing you can do in the middle of a recession. More generally, it isn’t clear just how austerity is supposed to work its positive magic. The main claim seems to be the rather vague idea that lower budget deficits increase business confidence.

Blanchard has shifted his stance. In a 2013 paper with Daniel Leigh, he showed that the IMF had been consistently wrong in its forecasts of the effects of austerity. The more beneficial the IMF predicted that austerity would be, the more incorrect its predictions were!

In 2010, the IMF admitted that its demands exacerbated the pain of South Korea’s financial crisis in the 1990s.

And in 2016, the Fund released a report questioning whether its entire economic philosophy had major weaknesses.

Down and out in Helsinki

With relentless budget cuts and a gloomy economic forecast,

the Nordic country’s economy is on life support.

Politico 18 May 2016

A General Theory of Austerity

Simon Wren-Lewis, 17 May 2016

Christine Lagarde letter to Eurozone finance ministers demands:

drop all the talk about new austerity measures and quickly agree a plan for debt relief

so that a deal can be met before a possible Greek default in July.

Peter Spiegel, FT Alphaville 6 May 2016

The good news is that the recovery continues; we have growth; we are not in a crisis.

The not-so-good news is that the recovery remains too slow, too fragile, and risks to its durability are increasing.

Lecture by Christine Lagarde, Managing Director, IMF

Hosted by the Bundesbank and Goethe University

Frankfurt, Germany, April 5, 2016

Structural reform is like exercise: nearly everyone could use a bit more of it.

This newspaper has been known to recommend it to governments from time to time.

The extent to which economies stuck in a mire of low growth and low inflation should focus on structural reform,

rather than stimulating demand, is a tricky question.

Few economists would argue that Italy’s economy is a model of efficiency.

Yet some economists reckon that making it easier to sack workers and cut prices is risky

when a country is already facing high unemployment and deflation.

In its latest “World Economic Outlook”, the International Monetary Fund devotes a chapter to the debate

.By adopting structural reforms at the same time as slashing spending,

European politicians may be creating an association in voters’ minds between reform and economic hardship

— a reflex that would not bode well for the health of Europe’s economy or for the survival of the euro.

Finland

Internal devaluation is already well under way

EU Observer 1 April 2016

Det finska eländet är gåtfullt.

Tillväxten har varit noll sedan finanskrisen bröt ut, och statsskulden stiger.

Även om det inte var euron som knäckte landets mobiltelefonjätte har valutan sannolikt blivit ett hinder för omställningen.

En lägre växelkurs skulle ha kunnat gynna tillväxten i nya branscher.

DN-ledare 17 september 2015

The euro was doomed from the start

The creation of the euro has been an error of historic dimensions and done great harm to the EU

which in its first 40 years had brought economic prosperity to the citizens of the Continent.

I had the privilege of negotiating Britain’s opt-out from the then new European single currency in 1991.

Norman Lamont, Telegraph 20 June 2015

Rather than call upon the combined authority of Euro governance to manage a deep Euro Area-wide sovereign debt workout,

the IMF, through its repeated public assertion of need for primary surplus numbers in that ballpark,

backs the application of Euro Area political authority to condemn a single member—Greece—to further depression,

thereby also prolonging and aggravating the vulnerabilities for the Euro Area as a whole.

Former IMF staffer Peter Doyle, FT Alphaville 17 April 2015

An amazing mea culpa from the IMF’s chief economist

the fund blew its forecasts for Greece and other European economies because it did not fully understand

how government austerity efforts would undermine economic growth.

Washington Post January 3, 2013

Fundamental misalignments that have made life so unbearable for many Europeans.

Imbalances tend to arise in economic life. There is nothing wrong with them in principle as long as they disappear eventually.

But there is no sign of a benign route out of the eurozone’s internal imbalances.

Wolfgang Münchau, FT 29 March 2015

U.K.'s Chancellor Osborne:

"Varoufakis was recruited because Chairman Mao was dead and Mickey Mouse was busy."

CNBC March 2016

The nickname for the IMF in the markets is “It’s mostly fiscal”

Why do the IMF and the other lenders persevere with this destructive path?

The answer is IMP: “It’s mostly political.” That is to say, it is driven by the overriding will to keep the euro on the road.

Roger Bootle, 1 March 2015

SPIEGEL: Mr. Varoufakis, you have referred to the European Union's bailout policy for Greece as "fiscal waterboarding." What exactly do you mean by that?

Varoufakis: For the past five years, Greece has been subjected to austerity measures that it cannot, under any circumstances, meet.

Our country is literally being pushed under water. Just before we suffer an actual cardiac arrest, we are granted a momentary respite.

Then we're pushed back under water, and the whole thing starts again.

My aim is to end this permanent terror of asphyxiation.

Der Spiegel 16 February 2015

Weimar and Greece

Paul Krugman, 15 February 2015

Weimar, it’s never about the deflationary effects of the gold standard and austerity in 1930-32,

which is, you know, what brought you-know-who to power.

Euron är vår tids guldmyntfot i Europa,

ett fast växelkurssystem som försvaras med ekonomisk åtstramning i länder med massarbetslöshet.

Doften av 30-tal blir allt starkare.

Nils Lundgren, Magasinet Neo, nr 1/2015

What is needed is not structural reform within Greece and Spain so much as structural reform of the eurozone’s design

and a fundamental rethinking of the policy frameworks that have resulted in the monetary union’s spectacularly bad performance.

Joseph E. Stiglitz, Project Syndicate 3 February 2015

Austerity had failed repeatedly, from its early use under US President Herbert Hoover, which turned the stock-market crash into the Great Depression,

to the IMF “programs” imposed on East Asia and Latin America in recent decades.

And yet when Greece got into trouble, it was tried again.

Does anyone in their right mind think that any country would willingly put itself through what Greece has gone through, just to get a free ride from its creditors?

If there is a moral hazard, it is on the part of the lenders – especially in the private sector – who have been bailed out repeatedly.

Austerity – the policy of saving your way out of a demand shortfall – simply does not work.

The question now is not whether the German government will accept it, but when.

Will it take a similar debacle for Spain’s conservatives in that country’s coming election

to force Merkel to come to terms with reality?

Joschka Fischer, Project Syndicate JAN 30, 2015

In a shrinking economy, a country’s debt-to-GDP ratio rises rather than falls, and Europe’s recession-ridden crisis countries have now saved themselves into a depression, resulting in mass unemployment, alarming levels of poverty, and scant hope.

It does not take a prophet to predict that the latest chapter of the euro crisis will leave Germany’s austerity policy in tatters – unless Merkel really wants to take the enormous risk of letting the euro fail.

Det är Greklands konstnadsläge/växelkurs, Stupid

Det är inte Greklands skulder som är huvudproblemet.

Det är kostnadsläget.

Rolf Englund 2015-01-27

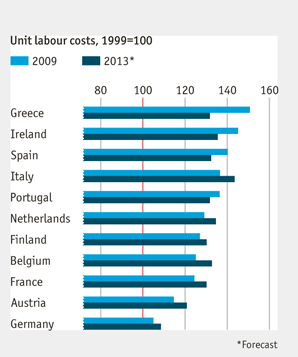

Levelling out competitiveness in the euro area will be costly

Greece must lower its real exchange rate, by cutting prices and wages.

This is proving a painful process.

Nice chart EMU Unit Labour Cost 1999-2013

The Economist online May 22nd 2012

Draghi only had to say "whatever it takes" to end Europe's financial crisis.

But Draghi will actually have to do whatever it takes to end Europe's economic one.

That's what he's trying to do now, but the eurocrats might not let him.

They have their rules, after all.

Matt O'Brien, Washington Post, August 27, 2014

Radical left is right about Europe’s debt

The tragedy of today’s eurozone is the sense of resignation with which the establishment parties of the centre-left and the centre-right are

allowing Europe to drift into the economic equivalent of a nuclear winter.

You may not consider yourself a supporter of the radical left.

But if you lived in the eurozone and supported those policies, that would be your only choice.

Wolfgang Münchau, FT November 23, 2014

Peter Wolodarski @pwolodarski

Wolfgang Münchau har nog rätt om detta

Draghi’s recent speech at the annual gathering of central bankers in Jackson Hole has excited great interest,

but the implication of his remarks is even more startling than many initially recognized.

If a eurozone breakup is to be avoided, escaping from continued recession will require increased fiscal deficits financed with ECB money.

The only question is how openly that reality will be admitted.

Adair Turner, former Chairman of the United Kingdom’s Financial Services Authority,

member of the UK’s Financial Policy Committee and the House of Lords, Project Syndicate 8 September 2014

Structural reform is certainly needed in some countries to increase long-term growth potential; but the impact of structural reform on short-term growth is often negative.

Simultaneous public and private deleveraging is bound to depress demand and growth. That is why eurozone fiscal austerity has become self-defeating. The more aggressively the Italian government, for example, cuts expenditure or increases taxation, the more its public-debt burden – already above 130% of GDP – will likely grow to unsustainable levels.

Until two weeks ago, eurozone policymakers denied this reality.

On August 22, at Jackson Hole, Draghi admitted it.

Without higher aggregate demand, he argued, structural reform could be ineffective; and higher demand requires fiscal stimulus alongside expansionary monetary policy.

Without a greater role for fiscal policy, the eurozone will face either continued slow growth or an eventual breakup.

Ms Merkel does not say “no” to eurozone bonds.

She says: “Not without treaty change.”

Jag tycker det är skriande uppenbart att räntan världen över är för låg och att en större del av stimulanserna borde ske via finanspolitiken.

Rolf Englund blog 5 december 2009

The inevitability of instability

speech by Adair Turner

Buttonwood Jan 25th 2014, The Economist print edition

Helicopters can be dangerous

Lord Turner believes that all forms of monetary or fiscal stimulus,

conventional or unconventional,

work by increasing nominal demand in the economy

Gavyn Davies, Financial Times February 17, 2013

Yesterday, president François Hollande had to ask his prime minister, Manuel Valls, to form a new government

after senior ministers publicly criticised his economic strategy - Mr Hollande’s “absurd” austerity policies

Telegraph 25 August 2014

Italy’s Downward Spiral

Italy’s new prime minister, Matteo Renzi, wants to stimulate growth. But what he really intends to do is accumulate even more debt.

True, debt spurs demand; but this type of demand is artificial and short-lived.

Sustainable growth can be achieved only if Italy’s economy regains its competitiveness,

and within the eurozone there is only one way to accomplish this: by reducing the prices of its goods relative to those of its eurozone competitors.

What Italy managed in the past by devaluing the lira must now be emulated through so-called real depreciation.

Hans-Werner Sinn, Project Syndicate 21 August 2014

UK

IMF and its Keynesian fellow-travellers were convinced that his squeeze on public spending meant that the recovery would take years to materialise.

We now know that the Chancellor was right and the IMF spectacularly wrong.

Allister Heath, Telegraph 24 July 2014

"Battle raging between the world’s leading macroeconomists"

The European Central Bank has found itself caught in the crossfire

The Bank for International Settlements’ call last month has reignited the debate over how to explain – and tackle –

the financial and economic turmoil that has persisted over the past six years.

The debate is so fierce, the viewpoints so distinct, that two of the world’s leading multilateral organisations,

the BIS and the International Monetary Fund, have completely different ideas on what the ECB’s next step should be

FT Money Supply blog 14 July 2014

Europe’s Debt Wish

ECB will soon have to confront the fact that structural reforms and fiscal austerity

fall far short of being a complete solution to Europe’s debt problems.

Kenneth Rogoff, Project Syndicate 7 July 2014

In October and November, the ECB will announce the results of its bank stress tests.

Because many banks hold a large volume of eurozone government debt, the results will depend very much on how the ECB assesses sovereign risk.

I never thought I would live to see a serving European Commissioner suggest that it was "reckless" to launch the euro without a lender-of-last resort or fiscal union to back it up.

Or that EMU policies have led to a vicious cycle and a catastrophic double-dip recession that is entirely due to the dysfunctional character of the project.

Or that the Greek debt crisis was botched because Germany’s leaders were playing politics with the North-Rhine Westphalia elections.

Or that that the internal devaluation policies forced on the victim states are cruel and inherently self defeating.

Or that EMU's stabilisation regime has not come close to putting monetary union on a viable footing, able to command political consent over time.

But we have one today from László Andor, and it is a corker, delivered in Berlin of all places. The European Commissioner for Employment and Social Affairs is very close to outright revolt, not surprisingly since his job is to deal with the terrible consequences of these policies.

Ambrose Evans-Pritchard, June 13th, 2014

France

The effect of austerity has been to erode the tax base, leaving the budget deficit stuck at over 4pc of GDP.

France has gained remarkably little from fiscal tightening equal to 5pc of GDP over the last three years.

Undeterred, it is now pushing through extra cuts of €50bn by 2017 under the new premier Manuel Valls,

dubbed the “economic Clemenceau” for his willingness to endure casualties stoically

Ambrose Evans-Pritchard, 3 July 2014

Deflation - A nightmare for the debt-stricken states of southern Europe, still trapped in a slump with mass unemployment

With Germany at zero inflation, they have to go into even deeper deflation to claw back lost competitiveness within EMU under "internal devaluations".

This, in turn, plays havoc with debt dynamics through the denominator effect.

Their debt loads are rising on a base of flat or contracting nominal GDP.

It is a key reason why Italy's public debt has risen from 119pc to 133pc of GDP since 2010 despite achieving a primary budget surplus

Ambrose Evans-Pritchard 12 March 2014

Euro Area — “Deflation” Versus “Lowflation”

March 4, 2014 by iMFdirect

Recent talk about deflation in the euro area has evoked two kinds of reactions.

On one side are those who worry about the associated prospect of prolonged recession.

On the other are those who see the risk as overblown.

This blog and the video below sift through both sides of the debate

Click

George Soros says EU may not survive crisis

"My hope is that Germany is going to change and realise that the policy of austerity is counter-productive.

"The only people who can change it are the Germans, because they are in charge.

They don't want to be in charge, in fact they are determined not to be in charge. And that's the tragedy."

Georg Soros, BBC 12 March 2014

In his book, The Tragedy of the European Union, published in the UK on Tuesday, Mr Soros also writes that he believes the banking sector is a "parasite" holding back the economic recovery and that little has been done to resolve the issues behind the 2008 crisis.

Tragedy of the European Union: Disintegration or Revival?: How Europe Must Now Choose Between Economic and Political Revival or Disintegration, at Amazon

Optimists have a touching faith in the German locomotive that is supposed to pull the eurozone out of the swamp, but the latest data shows that ,,,

German wages fell 0.2pc in 2013. Germany too is in wage deflation.

Which raises the question: how on earth are France, Italy, Spain, Portugal, and Greece supposed to claw back lost labour competitiveness against Germany

by means of "internal devaluations" if German wages are falling?

Ambrose Evans-Pritchard, February 20th, 2014

"It's hard to imagine that if growth remains as weak as it is, and the periphery is kept in permanent recession,

that things won't eventually blow up in Europe," says Rogoff, echoing a view widely shared by many economists.

Rana Foroohar, Time Magazine, Jan. 15, 2014

Professor Lars Calmfors skriver i en kolumn i DN idag 21/1-14 om hur eurokrisen borde kunna lösas. Rubriken är:

"Svångremmen politiskt ohållbar". Trots vissa ljuspunkter krävs "ytterligare kraftiga finanspolitiska åtstramningar" i krisländerna med den strategi som valts.

De måste vidmakthållas kanske under ett decennium med dålig tillväxt och hög arbetslöshet som följd.

Han bedömer det rentav som osannolikt att krisländerna skulle fullfölja de åtstramningar som skulle behövas

Danne Nordling 21 januari 2014

If France goes to the trouble of aligning with Germany on German terms, expect no mercy for others.

The new consensus spans the entire mainstream political spectrum.

If you live on the European continent and if you have a problem with Say’s Law,

the only political parties that cater to you are the extreme left or the extreme right.

Wolfgang Münchau, Financial Times, January 19, 2014

The euro zone needs a history lesson

Choices that appear to have been made by Europe’s policy-making elite:

To preclude any form of debt mutualisation; to have individual debtor countries pay off their existing debts;

and to have them adjust macroeconomically via austerity and deflation.

Kevin O'Rourke, University of Oxford, The Economist Free Exchange, Jan 17th 2014

In Münchau’s words, “If you look at this with a knowledge of economic history, this is an awe-inspiring set of choices, to put it mildly.” He’s right.

If such an adjustment mechanism was suitable to any period, it was the decades before World War I. Relatively flexible wages and prices meant that deflation was more feasible than it would become subsequently, and involved fewer unemployment costs.

The limited franchise /rösträtten/ meant that any unemployment that did result would incur lower political costs than would subsequently be the case.

An adjustment strategy based on the expectation that already over-indebted countries will pay back what they owe in an environment of falling prices seems doomed to failure; all the more so if “internal devaluation” at the level of individual member-states is replaced by euro-zone-wide deflation.

And interwar deflation ultimately had terrible political consequences, as well as economic ones.

What euro crisis watchers should look for in 2014

The decision not to set up a common backstop for the eurozone’s banks has closed the last window for any form of debt mutualisation as a tool of crisis resolution.

All of the adjustment will take place through austerity and price deflation in the periphery.

Most of the adjustment still lies ahead.

Wolfgang Münchau, Financial Times, January 5, 2014

Highly recommended

In 2010, most of the world’s wealthy nations, although still deeply depressed in the wake of the financial crisis,

turned to fiscal austerity: slashing spending and, in some cases, raising taxes in an effort to reduce

budget deficits that had surged as their economies collapsed.

Basic economics said that austerity in an already depressed economy would deepen the depression. But the “austerians,” as many of us began calling them, insisted that spending cuts would lead to economic expansion, because they would improve business confidence.

The result came as close to a controlled experiment as one ever gets in macroeconomics

Paul Krugman, New York Times 19 December 2013

Peter Praet, the chief economist of the European Central Bank, a PRE, a Perfectly Reasonable Economist

Praet is aware of the problems of the two zeroes — the zero lower bound on interest rates and

the great difficulty in engineering downward movements in nominal wages.

Paul Krugman, New York Times 4 December 2013

His underlying framework for thinking about European problems seems essentially indistinguishable from mine.

It’s a framework that sees a useful role for moderate inflation, both to avoid the zero lower bound and to ease the path of internal devaluation.

And you do have to wonder what calculation leads to the notion that a target of “close to but less than 2%” is appropriate, as opposed to, say, 3 or 4 percent.

Whatever Praet may privately think, he and his boss have to deal with Europe’s Very Serious People — people who believe in austerity regardless of circumstances,

The sad and remarkable thing that we’ve learned over the past year or so is how little intellectual debate matters. On both fiscal austerity and monetary policy, the PREs have completely blow the VSPs out of the water..

Yet policy barely changes, and the VSPs continue to talk as if they are in possession of The Truth.

Peter Praet gave an important speech on disinflation risks and the ECB’s reaction function (see also his slides)

Paul KrugmanThe question is, if it might not be better to dissolve the European Union in an orderly fashion instead of continuing the German led calamity.

How the European Union can achieve an internal rebalancing?

If Germany with its high productivity has low inflation, the other EU countries, who would have devalued their currency before the inception of the Euro,

will have to dramatically deflate their economies – and that after years of virulent austerity.

This might seem a simple solution for economists and bureaucrats, but EU member states are democracies and patience in many of the peripheral nations – and not only those – is running very short.

Mathew D. Rose, via Naked Capitalism (Yves Smith), 3 December 2013

Highly Recommended

Yves Daccord, Director General of the International Committee of the Red Cross, gave an important warning earlier this year: “Europe has a long record of maintaining a plausible trust in the future of its young people, even during turmoil. Not anymore. With prices rising and rampant unemployment, young urban people no longer see any future for themselves, and governments start losing credibility and legitimacy.”

This cannot be the brave new world envisioned by the founders of the EU.

In May of next year there will be an election for the EU parliament. What many in the United States with its political history of two main parties do not understand is that in Europe many people do not vote for political parties, but against them.

To show their displeasure with the political class they select a “protest party”, not because they necessarily reflect their personal preference, but to express their disenchantment with the traditional parties. With regard to the current management of the financial crisis in the EU this will doubtlessly occur and rightly so.

The question is, if it might not be better to dissolve the European Union in an orderly fashion instead of continuing the German led calamity.

One saw what became of Germany’s last attempt to create a new European order seventy-five years ago.

The current situation shall only be complicated following the European parliamentary elections, when it is infused with ultra-right populist parties

The lessons from Sweden

Lennart Erixon, Department of Economics, Stockholm University, September 4, 2013

The main conclusion in this article is that the fiscal austerity measures in the mid-1990s delayed the Swedish economic recovery

and that neither these measures nor the fiscal rules were responsible for the impressive Swedish macroeconomic performance in the following period.

The positive economic development in Sweden was driven by export, profit and technology, reflecting an international upswing

and the country’s flexible exchange rates and industrial composition.

Full text

Johannes Lindvall: Ett land som alla andra. Från full sysselsättning till massarbetslöshet

Lennart Erixon, Ekonomisk Debatt nr 4/2007

Erixon, Lennart Titel: Styrfel -- inte systemfel -- orsak till Sveriges eftersläpning?, Ekonomisk Debatt nr 1:1991

Erixon, Lennart Titel: Sackar Sverige efter? -- vad kan vi lära av utvecklingen i Förenta staterna?, Ekonomisk Debatt nr 8:1990

Besk medicin behövs - och kanske kan en dos EMU tillhandahålla den kuren.

För det första kan vi inte på förhand veta hur utdragen och smärtsam den nödvändiga anpassningen blir.

Erfarenheter från Tysklands enande och den östeuropeiska integrationsprocessen tyder på att kostnaderna kan bli både betydande och långvariga.

Ett annat problem är att det demokratiska systemet kanske inte är berett svälja en så besk medicin.

Med tanke på den höga arbetslöshet som redan råder i stora delar av Europa, och givet den redan höga pressen på statsfinanserna, kan europeiska väljare visa sig ovilliga att acceptera en ännu större anpassningsbörda alldeles oberoende av om de då senare kan påräkna sig långsiktiga vinster.

Sammanfattningsvis är jag ganska pessimistisk när det gäller EMU:s chanser att bära sig om den gemensamma valutan införs som planerat den 1 januari 1999.

Men givet alternativen anser jag att projektet är väl värt ett försök.

Två tidigare försök att få till

stånd ett intimare monetärt samarbete mellan Europas stater

- med Werner-planen 1971 och EMS (det europeiska monetära samarbetet) 1979 - har båda misslyckats.

Sannolikheten för ännu ett, större, misslyckande har inte minskat:

inga egentliga säkerhetsventiler har skapats.

Trots detta tror jag att EMU är bra för

Europa.

Magnus Blomström i DN 1998-02-02

Varken Greklands finanser eller ens euron är värda

det vågspel som en finanspolitisk union skulle betyda.

Risken är påtaglig att politiken håller på att skena ifrån sitt folkliga stöd.

Gunnar Wetterberg, Expressen, 23 dec 2011

FORES presenterar en antologi där några av Sveriges kunnigaste ekonomer beskriver bakgrunden till krisen

och hur eurons framtid kan komma att se ut.

Lars Calmfors, Harald Edquist, Nils Lundgren, Stefan de Vylder, Pehr Wissén, och Hans Tson Söderström, bokens redaktör

14 november 2013

Lars Calmfors: "Överlever euron?" Bokpresentation 14/11, Youtube

Spanien får beröm för att ha lyckats sina kostnader och för att ha vänt ett underskott i bytesbalansen på 10 procent till ett litet överskott.

Men en arbetslöshet på över 25 procent imponerar inte.

Betyget blir ”godkänt”.

Dagens Industris Henrik Mitelman, 2013-08-27

Frankrike är det stora sorgebarnet och får betyget ”klart underkänt”.

”I den djupaste recessionen sedan andra världskriget är det rimligt att kostnaderna sjunker, inte minst när arbetslösheten har ökat till 11 procent. Men i ett sönderreglerat Frankrike sker det motsatta. Under de senaste fem åren har enhetsarbetskostnaderna, det vill säga den faktiska kostnaden för att producera i landet, stigit med 15 procent, vilket är häpnadsväckande eftersom konkurrenskraften urholkas ytterligare”, skriver Henrik Mitelman.

Full textMan häpnar.

Hur kan man undvika att inse att 25 procents arbetslöshet är en katastrof för land och folk?

Att det är fullständigt oacceptabelt.

Det är till och med ett orimligt pris även om man inbillar sig tillhöra dem som håller på att skapa ett nytt Romerskt rike.

Rolf Englund blog 2013-08-27

However much money and power the Commission have,

it is improbable that they will be able to have any significant impact on

the competitiveness imbalance problem which a single currency will pose.

Anthony Jay, The Darlington Economics Lecture, November 17, 1995

This will leave the problem to nature's remedy - the migration of population. It seems hard to believe that the political, economic and social success of Europe, whether one approves or disapproves the objecfive, will be promoted by establishing at the heart of its economic fundioring a mecharism which depends for equilibrium on the enforced migration, on pain of destitution, of its population in the tens of millions:

If this is the character of monetary urion, conceived by politicians who saw it as little more than a trite gesture of nationhood, to go with a blue flag and a jolly anthem, then we can say that it is not in the long-term interests of Europe and very far from being a sensible economic sacrifice even for the sake of a large political goal.

Indeed, one may wonder that anyone who professes to hope for the success of political union in Europe could wish to implant in its foundations such an engine of mass destruction.

Loans and guarantees do not make the unsustainable sustainable.

“austerity” in the peripheral countries could succeed.

By this, I mean the demand squeeze imposed on them results in a fall in costs and prices,

relative to their eurozone neighbours, leading to greater competitiveness,

an eventual recovery in living standards and a sharp drop in unemployment.

Samuel Brittan, Financial Times, August 8, 2013

"Growth-friendly process of consolidation"

Schäuble: “We need to stop this debate which says you have to choose between austerity and growth,”

The two-day effort by the United States Treasury secretary, Jacob J. Lew,

to persuade Europe to consider shifting its focus from budget balance to growth highlighted a deep trans-Atlantic policy gulf

New York Times, 9 April 2013

Psychological Roots of Austerity

Simon Wren-Lewis has a thoughtful post on the reasons for austerity mania

Thinking about President Obama’s first inaugural

Paul Krungman, March 23, 2013

– Europa är i djupa och fundamentala problem, som måste läsas med att samhällsmodellen i Sydeuropa görs om,

säger Anders Borg, som räknar med att länder som Italien kräver 10–15 års svåra och smärtsamma reformer.

SvD Näringsliv 20 mars 2013

naked capitalism: Is the Eurozone Nearing a Make or Break Point?

One of my colleagues studied in Germany, has extensive, high level political and economic contacts there, and reads the press daily.

He is not prone to overstatement or overreaction and also has a propensity to makes Delphic remarks.

He said the Eurozone is over. In pretty much those words, a simple sentence, no caveats or conditionals.

I nearly fell out of my chair.

naked capitalism, 5 March 2013

This apparently reflects the German recognition as a result of the Italian elections that they will not be able to surmount domestic opposition in Italy and potentially other periphery countries and would rather pull the plug than continue funding their trade partners.

He said there was a fair bit of discussion of Germany leaving the Eurozone after the election.

I quizzed him on how they thought they could do that, since the new DM would presumably trade at a big premium to the Euro.

My source finally said widespread recognition of the existential impasse at most a couple of months away.

He’s never this definitive.

Read more at http://www.nakedcapitalism.com/2013/03/is-the-eurozone-nearing-a-make-or-break-point.html#AHEVj9WwYMUDi0pJ.99

Naked Capitalism is a blog published by Susan Webber, the principal of Aurora Advisors, Inc., a management consulting firm.

Webber authors the blog under a pen name, Yves Smith

The blog was ranked seventh in business authority by Technorati in 2011.

During 2011, Naked Capitalism was the third most visited business and economics blog on the web... Wikipedia

The turmoil produced by the Italian elections has directed attention back to where it should have been all along – to the politics of the eurozone crisis.

It is possible that southern Europe will give the Germans until the autumn to come around to a new approach.

But toleration for austerity is unlikely to last much beyond then.

Europe may be approaching a stark choice: giving up the euro; or keeping it and seeing the political crisis spin out of control.

Mark Mazower, professor of history at Columbia university, Financial Times 28 February 2013

"Euroministrar mot EMU"

Rebellion against the German-led prescription for fighting the debt crisis

Economic strains “may also justify in a certain number of cases reviewing deadlines for the correction of excessive deficits,” Olli Rehn told reporters

Bloomberg 5 March 2013

European finance ministers opened the way for looser budget policies after a backlash against austerity thrust Italy into political limbo and shattered months of relative stability in European markets.

Italy’s deadlocked election, France’s refusal to make deeper budget cuts and protests against the shrinking of the welfare state across southern Europe escalated the rebellion against the German-led prescription for fighting the debt crisis.

I welcome the fact that the European institutions start to incorporate Keynes

and his ideas into their speeches and policies (see Mr Rehn’s recent comments),

but I have yet to read a single sentence in which someone from the troika makes sense of Keynes and his ideas.

Until now, it all comes down to: “see, we are Keynesians, too, so there is no alternative.”

Econoblog101, March 5, 2013

In a recent speech (from February 28th), European Commissioner for Economic and Monetary Affairs and the Euro

and vice president of the European Commission Olli Rehn said the following things:

"While I am not sure if Keynes himself would be a Keynesian today, at least an unreconstructed one, I am in fact a Keynesian myself,

if that is measured by one’s belief in the dangers of a liquidity trap and the rationale of counter-cyclical economic policy.

Econoblog101, March 1, 2013

Britain’s perilous austerity bunker

Cameron’s arguments against fiscal policy flexibility are wrong

Martin Wolf, Financial Times, March 12, 2013

Highly recomended

per·il·ous Adjective

Full of danger or risk. Exposed to imminent risk of disaster or ruin.

Synonyms dangerous - risky - hazardous - unsafe - parlous

David Cameron’s “there is no alternative” speech last week on the UK economy has aroused much criticism.

This is justified.The British prime minister’s arguments for sticking to the government’s programme of fiscal austerity were overwhelmingly wrong-headed.

Simon Wren-Lewis of the University of Oxford

and Jonathan Portes of the National Institute of Economic and Social Research,

among others, have demolished the prime minister’s views.

The Fiscal Multiplier

Just as lawmakers force as much as $85 billion of budget cuts on the federal government

Bradford DeLong and Lawrence Summers: Now is the perfect time to spend more, not less

Bloomberg, 13 March 2013

Europe faces an impossible challenge - why can't Olli Rehn see it?

"There is no alternative". That was again the message this weekend from our old friend Olli Rehn

the eurozone's miscreant periphery has no option but to stick to the assigned path of budgetary consolidation

Jeremy Warner, Telegraph 4 March 2013

I say "old friend" because Mr Rehn's rigid adherence to the script has become an almost comically blinkered form of dogma, rendering him more a subject for mockery and ridicule than the feared enforcer he is supposed to be.

As I have said before, he can scarcely believe in what he is preaching, but a more loyal spokesman for the cause of fiscal austerity would be hard to find.

Even those people who come from larger EU countries should be conscious of the fact that

Every euro-zone member is systemically relevant.

If Cyprus were to face a disorderly default, there is a high probability that the consequence would be an exit from the euro zone.

All members of the euro zone have committed to doing everything in their power to preserve the unity of the euro.

This promise has calmed down the markets. We shouldn't do anything that would jeopardize this success.

Olli Rehn, Der Spiegel 4 March 2013

Om arbetsmarknaden liberaliseras måste de som förlorar jobbet erbjudas grundläggande trygghet i väntan på att reformerna vitaliserar ekonomin och fler arbetstillfällen skapas.

Det perspektivet har varit sorgligt frånvarande i den tyskdikterade politik som har delar av Europa i sitt grepp.

Den har förvisso modifierats något; Portugal, Grekland och Spanien har beviljats uppskov med budgetsaneringen.

Men det kan vara för lite för sent. Den nedåtgående spiralen fortsätter

Per T Ohlsson, Sydsvenskan 3 mars 2013

De italienska arbetskraftskostnaderna har stigit stadigt efter införandet av euron,

då Italien också förlorade de möjligheter som landet utnyttjade för att på konstlad väg

upprätthålla tillväxt och konkurrenskraft under de goda åren på 1960- och 1970-talet: inflation och devalveringar.

Jag var en av nästan 2,5 miljoner väljare som röstade ja i folkomröstningen.

Jag har av och till brottats med två efterkloka tankar:

Den ena är att det kanske, från ett snävt svenskt perspektiv, var bra att det blev nej.

Den andra är att jag borde ha lyssnat mer på hjärnan än på magen och ställt mig på nejlinjen.

Per T Ohlsson, Sydsvenskan, 12 augusti 2012

Irish Finance minister Michael Noonan played down concerns about the slide in sterling against the euro, saying the Irish economy is now strong enough to withstand the exchange rate shock even though Britain accounts for a fifth of the country's exports.

"We don't see a problem for sterling at present levels. We have cut costs right through the economy with an internal devaluation of 15pc or 16pc and we are now highly competitive."

Ambrose 28 Feb 2013

The post-election deadlock in Italy is an uncomfortable reminder that

the developed world’s sovereign debt problem ultimately boils down

not just to bad economics but to a failure of democracy.

John Plender, Finncial Times 26 February 2013

Over many years, the share of wages in national income stagnated or declined while a dramatic increase in the profit share contributed to the high levels of inequality that now blight the rich world.

The political response to this challenge in the Anglosphere and in Spain was a social contract based on encouraging the illusion of wealth through credit-fuelled housing bubbles and increased social transfers.

Unaffordable promises were the order of the day, too, across much of the eurozone. Debt problems were then compounded by the flawed construction of the monetary union.

In a recent book, David Roche and Bob McKee of Independent Strategy argue that democracy in the 20th century became, in effect, a victim of its own success.

After the end of the Cold War, it /democracy/ suffered a loss of vitality as the electoral process ceased to offer big ideas or clear choices and became increasingly beholden to special interest groups.

Se t ex Villaägarna och Fastighetsskatten

The fragility of a eurozone banking system that is overloaded with sovereign debt will once again be a cause of nervousness.

Instead of a new social contract, we have a non-contract whereby southern Europe endures austerity with high unemployment and growing social strife while northern Europe provides no fiscal stimulus to allow southern austerity to work

‘Democrisis: Democracy caused the debt crisis. Will it survive it?’

Independent Strategy, 2012

Amazon

In the fixed interest sector something irrational is undoubtedly going on

Despite the oft-heard central bankers’ refrain that bubbles are impossible to identify until after they have been pricked,

historical comparisons leave little doubt that this is a bubble

John Plender, FT January 29, 2013

Austerity, Italian Style

What good, exactly, has what currently passes for mature realism done in Italy or for that matter Europe as a whole?

For Mr. Monti was, in effect, the proconsul installed by Germany to enforce fiscal austerity on an already ailing economy;

willingness to pursue austerity without limit is what defines respectability in European policy circles.

This would be fine if austerity policies actually worked — but they don’t.

Paul Krugman, New York Times 24 February 2013

Den massiva utslagningen på arbetsmarknaden är en social och ekonomisk katastrof

som kommer att prägla generationer i Europa framåt.

Att släppa fram så hög och segdragen arbetslöshet är att be om långsiktiga problem,

vilket Sverige upplevde i mindre skala på 1990-talet.

Peter Wolodarski, Signerat DN, 3 mars 2013

Skadorna på ekonomin blir permanenta, såren för de enskilda djupa. I förlängningen hotas sammanhållningen och tilltron till demokratin, särskilt i länder som saknar en tradition av folkstyre.

Så här var det inte tänkt att bli. För tre år sedan hävdade den politiska eliten – anförd av Tysklands Angela Merkel – att krisen var på väg att lösas, bara euromedlemmarna skapade ordning och reda i sina statsfinanser. Om regeringarna skötte sitt budgetarbete lika bra som Berlin skulle Europa snabbt vara tillbaka på banan.

Det grundläggande tankefelet var att budgetunderskotten skulle ha skapats av skenande statsutgifter snarare än skattebortfall till följd av svag privat efterfrågan.

Om något fanns behov av fortsatta ekonomiska stimulanser för euroområdet – men i stället fattades alltså beslut om åtstramningar.

Resultatet blev att krisen förstärktes. Den privata och den offentliga sektorn bantade sina utgifter samtidigt.

Financial Times ekonomiske kommentator Martin Wolf påminde nyligen om hur det lät på G20-mötet i Toronto 2010, då den så kallade åtstramningspolitiken sattes i verket.

At the Toronto summit of the Group of 20 leading economies in June 2010, high-income countries turned to fiscal austerity. The emerging sovereign debt crises in Greece, Ireland and Portugal were one of the reasons for this. Policy makers were terrified by the risk that their countries would turn into Greece. The G20 communiqué was specific: “Advanced economies have committed to fiscal plans that will at least halve deficits by 2013 and stabilise or reduce government debt-to-GDP ratios by 2016.” Was this both necessary and wise? No.

Because of its refusal to act as lender of last resort to governments,

they suffered liquidity risk – borrowing costs rose because buyers of bonds lacked confidence

they would be able to resell easily at all times.

That, not insolvency, was the immediate peril.

By adopting OMT earlier, the ECB could have prevented the panic that drove the spreads that justified the austerity.

It did not do so. Tens of millions of people are suffering unnecessary hardship. It is tragic.

Martin Wolf, Financial Times 26 February 2013

One can justify fiscal austerity, brutal though it is, as the only way to force adjustments of relative costs and the needed labour market reforms. My colleague, Wolfgang Münchau, argues that the opposite is true. But I wonder whether the eurozone will survive its cure.

Mr Olli Rehn, The European Commissioner has been joking all along

"The data…supports, in my view, the fundamentals of our crisis response:

a policy mix where building a stability culture and pursuing structural reforms supportive of growth and jobs go hand in hand",

he said in response to news that the eurozone has finally emerged from recession.

Jeremy Warner, August 15th, 2013

He's joking, right? Indeed he must be, and by going just a little bit too far in his claims, he's given the game away.

It was good while it lasted, but now we know that even Mr Rehn cannot believe in what he says,

for otherwise he surely would have tempered his remarks with a few caveats

The European Trade Union Confederation wades into the debate on internal devaluation with an open letter to commissioner Rehn, responding to the latter’s “upbeat August blog on sunny Spain” where he suggested Spain might emulate the “success stories” of Latvia and Ireland.

ETUC argues Latvia’s success is actually the result of deviating from the advice of the IMF and halting the austerity policy which was leading the economy to depression.

Eurointelligence, September 2, 2013

Krugman anklagade EU-kommissionären för en ”Rehn of Terror” för att han trots rapportens slutsatser argumenterar för att åtstramningspolitiken återupprättat marknadens förtroende.

Efter att representanter för EU i förra veckan gått till verbal attack mot Krugman använde sig denne av

ett klassiskt Monty Python-citat för att visa att han inte gått till några personliga angrepp på Rehn

Nu slår Olli Rehn tillbaka mot Krugman i en intervju i Helsingin Sanomat

SvD Näringsliv 12 mars 2013

Krugman har i en rad blogginlägg på New York Times attackerat Rehn just för att han har en övertro på åtstramningspolitiken, och Krugman anser att EU istället bör uppmuntra de skuldtyngda länderna att stimulera tillväxten snarare än att fortsätta minska utgifterna ytterligare.

– Krugman sätter ord i min mun som i riksdagen skulle kallas för ”modifierad sanning”.

Helsingin Sanomat noterar att ”modifierad sanning” är det finska parlamentets artiga terminologi för att ljuga.

Paul De Grauwe and the Rehn of Terror

Nobody has taught me as much about the euro crisis as Paul De Grauwe,

who brought to the fore a crucial point almost everyone was overlooking:

the importance of self-fulfilling debt panics in countries that no longer have their own currencies.

Now he has a new paper with Yuemei Ji following up on that insight,

and offering yet more evidence of the incredible unwisdom of European economic policy

Paul Krugman, February 22, 2013

The Reign of Terror (5 September 1793 – 28 July 1794)

Rolf Englund:

Om man har en sedelpress går man inte i konkurs.

Det var varit det till synes självklara budskapet på denna blog ett antal gånger,

första gången i november 2011.

"What we are seeing is that the effect of the OMT is truly powerful," said Marco Valli, chief euro zone economist at Unicredit. "A year ago if Italy were in this situation (bond yields) would have been going through the roof."

Markets are no longer betting against the euro and so they are not taking aim at the bloc's weakest members, like Italy.

"This was the only region in the world where countries could default at any time

because they didn't have a central bank behind them,"

said Mizuho chief economist Riccardo Barbieri.

"With OMT we now have something that approximates to having a central bank."

Reuters 12 Mar 2013

The Austerians, Olli Rehn, Olivier Blanchard and fiscal multipliers

No debate please, we're Europeans

Paul Krugman, New York Times blog, 16 February 2013

Jonathan Portes blog 15 February 2013

Olli Rehn of the European Commission, a firm advocate of austerity, responds to the disastrous economic news in Europe, which has confirmed the warnings of austerity critics and led to a widespread reassessment of fiscal multipliers; it seems that they are large in a liquidity trap, just as some of us predicted.

Rehn’s answer? We need to stop putting out these economic studies, because they’re undermining confidence in austerity!

As I said, these signs of desperation are gratifying. Unfortunately, these people have already done immense damage, and still retain the power to do a lot more.

krugman.blogs.nytimes.com/2013/02/16/gratifying-signs-of-desperation/

Mr Rehn, in a letter to European Finance Ministers, copied to other international financial luminaries like Christine Lagarde, says:

"I would like to make a few points about a debate which has not been helpful and which has risked to erode the confidence we have painstakingly built up over the last years in late night meetings.

I refer to the debate about fiscal multipliers, ie the marginal impact that a change in fiscal policy has on economic growth. The debate in general has not brought us much new insight."

notthetreasuryview.blogspot.co.uk/2013/02/i-pointed-late-last-year-that-european.html

The Teuto-Calvinists believe that the fiscal multiplier is around 0.5

The entire EU austerity plan is based on a false premise.

This disastrous error is now clear beyond any reasonable doubt.

Ambrose Evans-Pritchard, 3 October 2012

Olivier Blanchard, the chief economist at the IMF, om multiplikatorn

Paul Krugman, December 21, 2011

Peter Wolodarski, signerat DN 14 oktober 2012:

Internationella valutafonden, IMF, tar upp frågan i sin senaste stora rapport och konstaterar att man tidigare underskattat den så kallade multiplikatoreffekten, det vill säga hur omfattningen av en åtgärd förändras när den fortplantar sig genom ekonomin.

Tidigare trodde man att multiplikatorn låg på ungefär 0,5. Nu tycks den vara så hög som 1,7.

Why is everybody so surprised by those GDP numbers?

Eurointelligence Daily Briefing, 15 February 2013

These data must have come as no surprise whatsoever for anyone who has recently been doing the maths on fiscal multipliers.

The fact that they shocked so many tells us that a large majority of analysts still fail to understand the underlying dynamic of this crisis.

As austerity continues into 2013, expect more such “surprises”.

Den nuvarande ekonomiska krishanteringen riskerar att undergräva demokratins grundvalar.

Sverige måste ta en aktiv roll i diskussionen om EU:s framtid och behovet av en fördragsändring för ett ökat handlingsutrymme för politiken.

Johan Danielsson och Claes-Mikael Jonsson, LO, Europaportalen, 15 februari 2013

Nedskärningarna har lett till lägre efterfrågan, lägre tillväxt och högre arbetslöshet vilket i sin tur lett till en ökad statsskuld. Som svar på detta ordineras ytterligare besparingar, med samma resultat.

Vi är övertygade om att denna spiral måste brytas. Annars ökar risken för att allt fler medborgare vänder politiken ryggen.

Det är med stor oro vi ser hur kollektivavtal, anställningsskydd och välfärdssystem bryts sönder. Demokratins grundvalar undermineras och extrema krafter växer fram.

På sikt är både nationella och europeiska politiska system i fara.

The eurozone's North-South misalignment has not been resolved.

The Club Med bloc is still sliding into deeper depression.

The financial crisis — never more than a symptom — has graduated into a more intractable

economic, social, and therefore political crisis.

Ambrose Evans-Pritchard, January 23rd, 2013

The ECB's Mario Draghi has taken the risk of a sovereign default in Spain and Italy off the table, but he has not restored these countries to economic viability within a D-Mark currency bloc, and nor can he.

Take a moment to read Eurozone crisis: it ain't over yet by Professor Paulo Manasse from Bologna University, posted on VOX EU.

The European Commission’s 400-page report last week on the jobless crisis

quietly demolishes the claim that labour rigidities are the elemental cause of the social tornado sweeping across Club Med and parts of Eastern Europe.

It dutifully lists the sorts of things that can be done to help:

But then goes on to finger a "demand shock" as the real culprit. All else is "less relevant".

Ambrose Evans-Pritchard, 13 Jan 2013

Employment and Social Developments in Europe 2012 (08/01/2013)

EU Catalog N. : KE-BD-12-001-EN-C

Ambrose Evans-Pritchard (AEP) increasingly faces the risk of running out of hyperbolic war-analogies sooner than the euro collapses.

For months he has been numbing his readership with references to the Second World War or the First World War, or to ‘1930s-style policies’

so that not even the most casual reader on his way to the sports pages can be left in any doubt as to how bad this whole thing in Europe is,

and how bad it will get, and importantly, who is responsible.

Detlev Schlichter, 11 December 2012

Paul Krugman's Blind Spot

Sorry, but the New York Times' star columnist just doesn’t understand Europe.

Anders Åslund, Foreign Policy 8 November 2013

Since Krugman represents the mainstream of Anglo-American economic commentary and enjoys both popularity and an impact on policy, a post mortem of his positions in the European financial crisis are of broader relevance.

Argentina is a large, closed economy that has mostly pursued populist economic policies, while Latvia is a very small, open economy, a member of the European Union with small public debt and excellent business environment. The only similarities were financial crisis because of large current account deficits leading to an absence of market financing.

Krugman's most spectacular failure has been his prediction of the dissolution of the eurozone. As Niall Ferguson has noted, Krugman "wrote about the imminent break-up of the euro at least eleven times between April 2010 and July 2012." Well, that didn't happen. Not only did the eurozone remain intact but in 2009, Slovakia joined, as did Estonia in 2011; Latvia is set to join in January 2014.

Not only did the eurozone remain intact but in 2009, Slovakia joined, as did Estonia in 2011; Latvia is set to join in January 2014.

While anyone can make a mistake, Krugman's error was more profound, indicating a lack of understanding.

He treated the eurozone as primarily a system of fixed exchange rates, ignoring that it is a currency union with centralized clearing of payments.

As the euro crisis evolved, uncleared payment balances piled up. The best way of dissolving these imbalances was by restoring confidence in the euro system, which the European Central Bank (ECB) has done, sensibly, since July 2012

In the last century, three multi-nation currency unions in Europe have endured disorderly breakups -- namely the Habsburg Empire, Yugoslavia, and the Soviet Union.

Luckily for European democracies, the ultimate verdict on crisis management belongs to the voters.

Rome, Habsburg and the European Union

...

Aslund praises Reinhart and Rogoff for providing an important corrective to the view that fiscal stimulus is always right – a position that is common across the Anglo-American economic commentariat, led by Paul Krugman in the New York Times.

This is a curious thing for him to say, because it’s an outright lie

I can’t believe that Aslund doesn’t know this; why, then, would he discredit himself by repeating an easily refuted falsehood?

Paul Krugman, New York Times, 22 April 2013

As anyone who has been reading me, Martin Wolf, Brad DeLong, Simon Wren-Lewis, etc. knows, our case has always been that fiscal stimulus is justified only when you’re up against the zero lower bound on interest rates.

What I think is happening is that austerians have put themselves in a box. They threw themselves – and their personal reputations – completely behind the various elements of anti-Keynesian doctrine: expansionary austerity, critical debt thresholds, and so on.

And as Wolfgang Munchau says, the terrible thing was that their policy ideas were actually implemented, with disastrous results; on top of which their intellectual heroes have turned out to have feet of clay, or maybe Silly Putty.

As I see it, the sheer enormity of their error makes it impossible for them to respond to criticism in any reasonable way.

...

Latvia will join the euro on 1 January

but nearly 60% of Latvians oppose the single currency

EU Observer 27 December 2013

In 2010, most of the world’s wealthy nations, although still deeply depressed in the wake of the financial crisis, turned to fiscal austerity: slashing spending and, in some cases, raising taxes in an effort to reduce

budget deficits that had surged as their economies collapsed.

Basic economics said that austerity in an already depressed economy would deepen the depression. But the “austerians,” as many of us began calling them, insisted that spending cuts would lead to economic expansion, because they would improve business confidence.

The result came as close to a controlled experiment as one ever gets in macroeconomics

Paul Krugman, New York Times 19 December 2013

Why Austerity Works and Stimulus Doesn’t

The starkest contrasts are Latvia and Greece, two small countries hit the worst by the crisis.

They have pursued different policies, Latvia strict austerity, and Greece late and limited austerity.

Anders Aslund, Bloomberg 8 January 2013

Om ingenting görs åt Grekland illa kvickt går landet i konkurs.

I så fall kommer Portugal och Spanien likaså att tvingas ställa in sina betalningar, vilket inte alls är nödvändigt.

Då kollapsar en stor del av det europeiska banksystemet.

Europa skulle till och med kunna hamna i ny stor depression.

Gråt inte för Grekland utan för Lettland, som varit ett dygdemönster.

Anders Åslund DN Debatt 30/4 2010

Why Latvia Should Not Devalue

Anders Aslund | December 9th, 2008

The EMU would not be the first multi-country currency zone to break up. ,

The Latin Monetary Union The three other examples of breakups were of

the Habsburg Empire, the Soviet Union, and Yugoslavia.

Anders Aslund, The Peterson Institute March 12th, 2012

It all went wrong in 2010. The crisis in Greece was taken, wrongly, as a sign that all governments had better slash spending and deficits right away.

Austerity became the order of the day, and supposed experts who should have known better cheered the process on, while the warnings of some (but not enough) economists that austerity would derail recovery were ignored.

Paul Krugman, New York Times 6 January 2013

Europe must stay the austerity course

Structural reforms are helping rebalance the economy

The eurozone is living through lean times, but there is light at the end of the tunnel

Olli Rehn, Financial Times December 10, 2012

The strategy of triple-barrelled contraction across a string of inter-linked countries has been the greatest policy debacle since the early 1930s

Like the generals of the First World War, Europe’s leaders seem determined to send wave after wave of their youth into

the barbed wire of tight money, bank deleveraging, and fiscal austerity a l’outrance.

Ambrose Evans-Pritchard, 9 Dec 2012

The fond hope of EU leaders and commissars is that the North-South chasm in competitiveness will be closed by "internal devaluations" in Club Med states before their democracies blow up.

This morally indefesible policy relies on pushing unemployment to such traumatic levels that it breaks labour resistance to pay cuts

Ambrose 18 Nov 2012

And as we can see from the youth jobless rates in Greece (58pc) Spain (55pc), Portugal (36pc), Italy (35pc) it can take carpet-bombing to achieve effect.

indefesible = cannot be altered or voided

EuroCliff

Det budgetstup som alla; Tyskland, EU, Internationella Valutafonden IMF och andra ekonomiska pekpinneviftare är överens om att USA måste undvika till varje pris,

är precis det som flera av Europas länder redan knuffats ut över.

Den kur som sägs ta kål på USA påstås alltså kunna rädda Europa.

Andreas Cervenka, SvD Näringsliv 14 November 2012

Några exempel. Spaniens budgetunderskott skulle enligt order från övriga EU-länder minskas från 6,3 procent av BNP i år till 2,8 procent 2014.

I Portugal ska budgeten kapas med motsvarande över 3 procent av BNP bara under 2013 och i Grekland är besparingarna 7 procent av BNP under 2013 och 2014 varav det mesta ska tas nästa år.

Detta trots att budgetunderskotten alltså är större i USA.

Bland de som varit med och ställt upp dessa krav finns bland andra IMF.

Can struggling eurozone countries achieve the necessary ‘internal devaluation’

– and at what political cost?

OpenEurope Report 27 September 2012

With widespread anti-austerity protests sweeping Madrid, Athens and Lisbon, Open Europe has published a new briefing looking at the degree of ‘internal devaluation’ needed in struggling countries to keep the Eurozone intact – and whether citizens are likely to be able to stomach such adjustments.

Open Europe’s Head of Economic Research Raoul Ruparel said:

“The history of the Baltic states – and to some extent Ireland – shows that large scale internal devaluation is fully possible in certain circumstances. But, against a backdrop of plummeting real GDP, internal devaluation also produces a politically explosive combination of falling wages and rising unemployment – all leading to a reversal in living standards. This is the eurozone’s great curse: do what’s economically necessary but risk massive political and social fallout.”

Räntechocken en besk medicin som verkar än

Johan Schück och Thorbjörn Spängs DN 8 september 2012

Trots att Sverige ännu inte var EU-medlem knöts kronan strax före valet 1991 /av finansminister Allan Larsson och statsminister Ingvar Carlsson/ till EU:s valutaenhet ecun - som var en föregångare till euron.

Riksbankens uppgift var att försvara kronans växelkurs och den borgerliga regeringen, som tillträdde hösten 1991, var på samma linje.

Samma dag som Sverige slog till med rekordräntan 500 procent gav Srorbritannien upp och lämnade EU:s valuasamarbete ERM.

Det hade varit bättre att ge upp kronförsvaret i september, framhåller Olle Wästberg som var Anne Wibbles statssekreterare.

Carl Bildt ser det alltjämt som ett misslyckande att man till sist tvingades släppa den fasta växelkursen.

Det är inte med glädje som Carl Bildt ser tillbaka på torsdagen den 19 november 1992 då kronan slutligen tilläts falla.

- Sverige skulle ändå ha tagit sig ur krisen

DN 8 september 2012

Ingvar Carlsson och Carl Bildt är överens om att Sverige numera är betydligt bättre rustat än för 20 år sedan. Med 1990-talskrisen inleddes en reformprocess som betyder att svenskarna har drabbats relativt litet av dagens kris i Europa.

När det gäller eurokrisen visar båda besvikelse över att valutaunionen inte blev vad de hoppades. Carl Bildt tror dock alltjämt på en gemensam europeisk valua, där vad han kallar relevanta länder är med.

---Ur Carl Bildts veckobrev v1/2002

Jag var statsminister under dessa år och fast övertygad om fördelarna med en hårdvalutapolitik. Det hade delvis att göra med de tidigare decenniernas erfarenhet av devalveringspolitik, men var delvis en konsekvens av att jag strävade efter att Sverige skulle gå in i det europeiska samarbetets kärna, också den ekonomiska och monetära unionen, och därmed vara med i den gemensamma europeiska valutan från dess första dag.

Därför var Sverige väl rustat inför finanskrisen

Reformer som stärker ekonomin är vad som till slut avgör, i Grekland och Spanien likaväl som i Sverige.

Det finns ingen enklare utväg, inte heller för länder som låter sin valuta flyta

Johan Schück, DN 8 september 2012

- Sverige tvingades låta kronan flyta. Ur detta misslyckande föddes en framgång. Sverige fick visserligen betala ett högt pris för 1990-talskrisen, särskilt genom att arbetslösheten fastnade på hög nivå. Men samtidigt gavs chansen till stora förändringar som annars varit omöjliga.

Den massiva sammanhållningen, tvärs över de politiska blockgränserna, förlängde kampen onödigt länge. Men på plussidan fanns den växande insikten om att Sverige behövde grundligt reformeras.

Allt blev inte perfekt, men få längtar tillbaka till Televerkets monopol eller oändliga taxiköer.

Lärdomarna från 1990-talskrisen sitter djupt, även om några bankers expansion i Baltikum och påföljane stora kreditförluster tyder på annat.

Vi segrade vid Poltava 1992

Rolf Englund blog 19 oktober 2012

Tomas Fischer: Med Bildt mot Poltava

Aftonbladet 22 december 1991

Johan Schück, Poltava-föreningens hovreporter

Kronkrigarna från valutafronten firar. Poltavaföreningen höll möte, skrev Carl A Hamilton i en legendarisk artikel i Aftonbladet 2002. Nu tio år senare var det dags igen för Poltavaföreningen att fira sin seger hösten 1992. Poltavaföreningens hovreporter Johan Schück inkallades under fanorna och resultatet blev två artiklar i Dagens Nyheter den 8 september 2012.

Rolf Englund blog 28 oktober 2012

Grekland, Spanien och fredspriset till EU

Någon ekonomisk vändpunkt är ej i sikte.

Peter Wolodarski, signerat DN 14 oktober 2012

Under den stora depressionen på 1930-talet fick ekonomen John Maynard Keynes kritik för att ha bytt ståndpunkt om penningpolitiken. Keynes replik blev klassisk: ”När mitt faktaunderlag förändras anpassar jag mina slutsatser. Vad gör ni, min herre?”

Samma fråga skulle kunna ställas till dagens beslutsfattare runt om i Europa, som ansvarar för de senaste årens åtstramningspolitik.

I Grekland backar ekonomin för femte året i rad, samtidigt som arbetslösheten passerat 25 procent och fortsätter att öka. De som har kvar arbetet tvingas acceptera drastiska lönesänkningar för att rädda jobben.

I Spanien, som före krisen sågs som en europeisk framgångssaga, är situationen på arbetsmarknaden inte mycket bättre. De dystra tiderna driver dessutom landet mot upplösning, påhejat av katalanska nationalister. Samma separationstrend syns för övrigt i flera europeiska stater.

Anders Borg tror att Grekland kan komma att tvingas lämna eurozonen

– Skulle man lämna eurosamarbetet är det troligt att man får tillbaka sin konkurrenskraft

och då kanske Grekland kan komma på fötter vart efter.

– Det är en smärtsam och komplicerad väg

men det är svårt att se en alternativ väg som skulle kunna fungera.

Ekot 12 oktober 2012

Politicians are kept from taking full responsibility for battling recessions by the intellectual baggage of past decades.

Some cling to the notion that stimulus is unhelpful, risky and hard. Such views need updating.

The Economist, 7 September 2017

Multiplikatorn A deficit of common sense

The debate about budget cuts has become dangerously theological

The Economist print Oct 27th 2012

What matters is how austerity is imposed and what other policies accompany it. The experience of the past couple of years argues against sudden sharp cuts, and especially against tightening more when the economy turns out weaker than expected. Better to have a medium-term plan which gradually reduces underlying deficits.

The debate centred on the value of an economic variable called a “multiplier”.

A fiscal multiplier describes the change in GDP that is due to a change in tax-and-spending policy. A multiplier of 1.5, for instance, means that $1 in government-spending cuts reduces GDP by $1.50; a multiplier of 0.5 means a $1 cut in spending only reduces GDP by 50 cents. Multipliers work both ways: during the recession experts bickered over the extra economic bang to be expected from a given stimulus buck. But it is the impact of austerity that now preoccupies people.

A simple example illustrates the multiplier’s importance. Take an economy growing at 1.5% a year and with a government budget deficit of 1% of GDP. If the multiplier is 2, spending cuts big enough to close the deficit produce a drop in GDP in the year the cuts take effect. For its pains the economy ends the year with a higher debt-to-GDP ratio than it started with. A multiplier below 1.5 means slow growth and a lower debt burden at year’s end.

In 2013 economists at the IMF rendered their verdict on these austerity programmes:

they had done far more economic damage than had been initially predicted, including by the fund itself.

What had the IMF got wrong when it made its earlier, more sanguine forecasts?

It had dramatically underestimated the fiscal multiplier.

The Economist print 13 August 2016

Highly Recommended

Hur stor är multiplikatorn, egentligen?

IMF skrev i en rapport att åtstramningarna slog hårdare mot tillväxten än modellerna antagit