EMU Replay of the 30´s

Related: Rogoff, Krugman och Austerity -Bank run, The beginning of the end - Europakten 2011

1929 - 1937 -

Stabiliseringspolitik - Keynes and other Gurus - Finanskrisen - Eurokrisen

The west, it’s said, is going back to the 1930s. Then as now, we have urban violence, economic stagnation, rising populists and a menacing Russia. Isis is auditioning for the role of Nazi Germany.

The 1930s analogy could still prove correct. But, so far at least, there’s a more plausible comparison. Our current era is more similar to the 1970s than the 1930s.

Why we’re reliving the 1970s

Simon Kuper, FT 15 April 2016

Troubling warnings for the US from the 1930s

Edward Luce, FT March 13, 2016

The most insidious trend is vanishing optimism about the future.

Contrary to what is widely believed, the majority’s pessimism pre-dates the 2008 financial collapse.

At the height of the last property bubble in 2005, Alan Greenspan, then chairman of the Federal Reserve,

said society could not long tolerate a situation where most people we were suffering from declining standards of living.

“This is not the sort of thing that a democratic society — a capitalist democratic society — can readily accept without addressing,” he said.

This came after several years of falling median income.

For most Americans and Europeans the situation is worse today than it was then.

Today’s economic situation in Europe has parallels with the 1930s and Hitler’s speedy recovery

Re-reading John Weitz’s biography of Hjalmar Schacht, Hitler’s Banker ,

I noted some interesting parallels between the 1930s and now that I had not considered before.

Wolfgang Münchau, FT 7 February 2016

Schacht had two stints as president of the Reichsbank — in the 1920s, when he brought an end to the hyperinflation then crippling Germany,

and again from 1933 to 1939.

John Weitz’s biography of Hjalmar Schacht, Hitler’s Banker

amazon.com/Hitlers-Banker-Hjalmar

Today’s politicians and central bankers are fixated with fiscal targets and debt reduction.

As in the early 1930s, policy orthodoxy has pathological qualities.

Whenever they run out of things to say, today’s central bankers refer to “structural reforms”,

although they never say what precisely such reforms would achieve.

Wolfgang Münchau, FT 7 February 2016

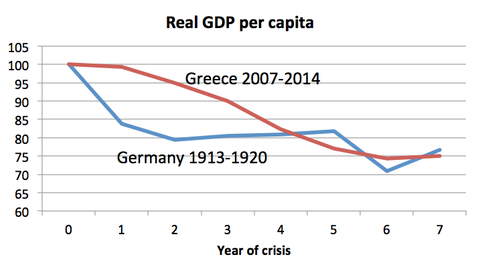

To me it is striking to what extent the economic and political situation in Greece resembles that of Germany in the early 1930s.

The Market Monetarist 13 February 2015

Weimar and Greece

Paul Krugman, 15 February 2015

Weimar, it’s never about the deflationary effects of the gold standard and austerity in 1930-32,

which is, you know, what brought you-know-who to power.

Euron är vår tids guldmyntfot i Europa,

ett fast växelkurssystem som försvaras med ekonomisk åtstramning i länder med massarbetslöshet.

Doften av 30-tal blir allt starkare.

Nils Lundgren, Magasinet Neo, nr 1/2015

France’s 'AA' Hollande pays price for kowtowing to EMU deflation madness

Let me be clear. The quarrel is not with the German nation, but with the 1930s policies being enforced on Europe by Angela Merkel and German political establishment.

(Have they all forgotten – or never learned – that it was the Bruning deflation of 1930-1932 that destroyed Weimar?)

Ambrose Evans-Pritchard, November 8th, 2013

“The difference between genius and stupidity is; genius has its limits.”

Albert Einstein

Briefly, the problems with “austerity” in Europe are not so much due to governments cutting back as they are to membership in the euro itself.

In essence, the euro is a gold standard.

If the market cannot adjust currency values, the only choice left is a reduction in labor costs,

which in the real world translates into higher unemployment.

John Mauldin, 9 May 2013

In the '30s, when governments on a gold standard devalued they saw a boost to their economies. But since Eurozone members cannot devalue, they are left with deflation and depression.

Then they blame others for not lending to them and forcing “austerity” upon them, when the primary culprit is their own inability to deal with their trade flows and labor costs.

But since the euro is a political and not an economic currency, you can’t address your national problem without leaving the euro, and that is not politically feasible. It is a conundrum.

John Mauldin, 9 May 2013

There is no way that Germany in particular will accept a fiscal stimulus for the sake of the southern European countries.

This is because Germany restrained itself by passing a balanced budget law that requires the government to run near-zero structural deficits indefinitely.

Wolfgang Münchau, Financial Times, May 5, 2013

That Time - Trettiotalet - was different, i Tyskland

BBC har en artikel som väcker många tankar, vilket förmodligen var avsikten.

I USA och Storbritannien har man sedan 1930-talet en tradition av debatt mellan Kenynesianer och Hooverister.

Men som BBC skriver "In Germany, that argument did not happen. The politics of the 1930s in Germany were different".

Rolf Englund 27 april 2013

EU Closes German-Designed Fiscal Straitjacket for Region

With Europe still struggling to contain a crisis that Greece triggered in late 2009, the two pieces of legislation complement 2011 laws that granted the EU stronger powers to sanction spendthrift euro countries.

The latest rules also follow a new European treaty aimed at limiting budget deficits.

Bloomberg March 12, 2013

In a provision that may limit any extra backsliding by France, the more-intrusive EU fiscal surveillance of euro countries will let the European Commission examine their draft budgets before approval by national parliaments.

Annual spending plans will have to be submitted to the Brussels-based commission by Oct. 15 the previous year.

Europe must stay the austerity course

Structural reforms are helping rebalance the economy

The eurozone is living through lean times, but there is light at the end of the tunnel

Olli Rehn, Financial Times December 10, 2012

On the one hand the short-term economic outlook remains weak. On the other hand, there are signs that confidence is returning.

Det vi beskådar är inte eurons kris.

Ordet kris antyder något övergående, ljuset i tunneln kommer snart...

Det vi beskådar är eurons dödskamp.

Slutet kan bara bli ett.

Men varför skall miljoner människor lida för att Angela Merkel skall hinna bli omvald i september?

Rolf Englund 11 mars 2013

Ambrose Evans-Pritchard (AEP) increasingly faces the risk of running out of hyperbolic war-analogies sooner than the euro collapses.

For months he has been numbing his readership with references to the Second World War or the First World War, or to ‘1930s-style policies’

so that not even the most casual reader on his way to the sports pages can be left in any doubt as to how bad this whole thing in Europe is,

and how bad it will get, and importantly, who is responsible.

Detlev Schlichter, 11 December 2012

From declining car sales in France to high youth-unemployment in Spain, everything is, according to AEP, the fault of Germany, a ‘foolish’ Germany. Apparently these nations had previously well-managed and dynamic economies but have now sadly fallen under the spell of Angela Merkel’s Thatcherite belief in balancing the books and her particularly Teutonic brand of fiscal sadism.

Freden - Tyskland - Interndevalvering

The strategy of triple-barrelled contraction across a string of inter-linked countries has been the greatest policy debacle since the early 1930s

Like the generals of the First World War, Europe’s leaders seem determined to send wave after wave of their youth into

the barbed wire of tight money, bank deleveraging, and fiscal austerity a l’outrance.

Ambrose Evans-Pritchard, 9 Dec 2012

. The outcome over the last three years has been worse than forecast at every stage, and in every key respect.

The eurozone has crashed back into double-dip recession. It will contract a further 0.3pc next year, according to a chastened European Central Bank. The ECB omitted mention of its own role in this fiasco by allowing all key measures of the money supply to stall in mid-2012, with the time-honoured consequences six months to a year later.

The North has been engulfed at last by the contractionary holocaust it imposed on the South. French car sales crashed 19pc last month, even before its fiscal shock therapy -- 2pc of GDP next year. The Bundesbank admitted on Friday tore up its forecast on Friday. Germany itself is in recession.

Spain's union leaders said this morning that the austerity strategy amounts to "economic suicide" for EMU's victim states. They said the willingness of their own government to bow to German demands has become "shameful".

A general strike has been called for November 14 /in Spain/. Yet they have nothing coherent to offer.

Like Greece's Syriza party, they make empty protests, catering to ignorance,

unwilling to accept that the euro itself has now become their real enemy.

As yet, I can see no clear proposal on the table in any EMU country

– from any major movement, party, or political leader – that offers a way out of the current impasse.

Somebody will fill the vacuum.

Ambrose, October 19th, 2012

It is hard for us in the US to understand, but the commitment of European leaders to a united Europe is amazingly strong.

They will do whatever they think they must do (and/or can sell to the voters) to maintain the European Union.

As a way to think about it, the US fought its most bloody war over the question of whether or not to remain a union. I think you have to call that commitment.

While I am not suggesting that Europe is getting ready to start a civil war, I think it is helpful to remember that commitments to an ideal can drive people into situations that others have a hard time understanding.

John Mauldin, 12 Nov 2011

Europe is in more danger than at any time since the 1930s.

I believe that the dominant form of political organisation over the next decade will be nationalism.

We are one charismatic leader away from a complete re-ordering of the continent.

Thomas Pascoe, Telegeraph July 13th, 2012

The problem with reparations, halted under the Nazi Party in 1933, was not that the Germans were unable to pay a debt which amounted to 83pct of GDP in 1923: on the contrary, they were (I recommend AJP Taylor’s Origins of the Second World War on this point).

Instead, it was that neither Germany nor pre-Anschluss Austria recognised the "war guilt" clause in the Treaty of Versailles which justified such payments.

Not only did the debtors believe the debts unjust, so did the creditors. Sophisticated opinion in Britain, shared by Cabinet ministers and Keynes, held that the peace terms were unduly harsh on the Germans and would cause unnecessary deprivation. This combination of stubbornness and sympathy ensured that when debts eventually went unpaid, no nation intervened to support the existing financial system.

There is a parallel here with the contemporary debts of the Club Med states, although their debts are higher – and headed to 170pc of GDP, according to Fitch.

The striking feature of almost every dispatch from Greece, Italy (downgraded today by Moody’s), Spain and Portugal is that, irrespective of the commitments of the political class, the population at large feel no culpability for the debts their leaders have amassed.

This crisis will produce a window for a skilled politician to unite the entire country against its debt obligations, against international finance, just as the Fascist parties did in the 1930s. No matter which path the EU chooses, the loss of either national sovereignty or proper enforcement mechanisms through the EU gives rise to an opportunity for a nationalist politician willing to repudiate his nation’s debts and start again.

Nigel Farage

Europe’s troubled single currency is dividing the continent into warring factions,

all of which could end in a “democratic…or violent revolution”

between the continent's indebted economies and their European creditors

Europa som vi känner det i dag är inget osänkbart skepp.

Allt fler talar om att vi riskerar ett nytt 1930-tal om inget görs. Men Merkel och Borg har vägrat byta kurs.

Europa verkar fast beslutet att köra in i isberget. I varje fall om Borg får styra.

Aftonbladet-ledare 28 juni 2012

But is she /Merkel/ drawing the wrong lessons from history?

It was not hyperinflation in the 1920s but depression and mass unemployment in the 1930s that propelled Hitler to power.

Like the hapless Weimar chancellor, Heinrich Brüning, Mrs Merkel is accused by critics of hastening disaster by pushing austerity during a deep recession.

But whereas the 1930s is seared in American memory, it is less clearly remembered in Germany. Germany returned to full employment more quickly,

thanks partly to Hitler’s own form of Keynesian stimulus: notably autobahn-building and rearmament.

Charlemagne, The Economist print, June 16th 2012

If Spain is touched, Italy is sure to follow and France may not be so far behind. As one observer in Berlin puts it, Germany’s real fear is not that the euro zone unravels to the Alps, but that it collapses all the way up to the Rhine. That is an existential threat for Germany, not just economically but also politically; its post-war rehabilitation and prosperity is built on reconciliation with France and deeper European integration.

The mood in the chancellor’s ultra-modern offices, opposite the reconstructed Reichstag, is a mix of scorn, gloom and outrage at being misunderstood by the world.

The refrain in Berlin is that European leaders like to talk of mutualising national liabilities, but hate to discuss sharing national sovereignty. As a federal state, Germany can easily imagine shifting powers to Brussels. But such ideas will test France, where the Fifth Republic gives the president huge power.

Such fundamental changes would also require a rewriting of European treaties and perhaps even a new German constitution.

The danger is that the euro may be gone before all this can be done.

All through the 1930s, the European elites continued to blame the Great Depression on Wall Street excess and the crash of 1929

(a minor, if colourful, event).

They continued to do so long after Roosevelt had broken free of fixed-exchange ruin and launched a blistering recovery with monetary stimulus

They clung to this belief into the final years of the cataclysm, resolutely grinding their democracies into the dust

by enforcing debt-deflation and contraction

Ambrose, 19 June 2012

Global economic meltdown, a rapidly spreading virus

That was 2009. Since then Johnson, former IMF chief economist, co-wrote last year’s bestseller “13 Bankers: The Wall Street Takeover and the Next Financial Meltdown” and the new “White House Burning.”

Other new books echo the same doomsday warning: Peter Schiff’s “The Real Crash: America’s Coming Bankruptcy” … Paul Krugman’s “End This Depression Now” … James Rickards’s “Currency Wars” … Philip Coogan’s “Paper Promises” … Joseph Stiglitz, “The Price of Inequity” … Ian Bremmer, “Every Nation For Itself,” and other reminders of doomsday.

MarketWatch 19 June 2012

På väg mot 1931

Grekland kan bara klara sig undan katastrof om såväl väljare som politiker besinnar sig.

Långsamt växer insikten om att EU måste få en starkare institutionell överbyggnad som medger mer långtgående samordning.

Per T Ohlsson, Sydsvenskan 17 juni 2012

Det finns vissa likheter mellan Europas eurokris idag och den process som ledde fram till den stora depressionen i början av 1930-talet i USA.

Både eurozonen och USA hade bundit sin valuta på ett sätt som initialt gjorde det omöjligt att vidta kraftfulla motåtgärder mot den begynnande krisen.

Danne Nordling 11 juni 2012

Betraktar man de senaste årens utveckling i Europa inser man att 30-talskollapsen inte alls är obegriplig eller omöjlig att upprepa.

Den dystra sanningen är ju att eurokrisen bär på många av de frön som en gång framkallade den stora depressionen.

Peter Wolodarski, Dagens Nyheter 10 juni 2012

Highly recommended

Latvia, Internal devalutation

Oh, wow — another bank bailout, this time in Spain. Who could have predicted that?

The answer, of course, is everybody.

Paul Krugman, New York Times June 10, 2012

For years Spain and other troubled European nations have been told that they can only recover through a combination of fiscal austerity and “internal devaluation,” which basically means cutting wages.

Latvian success consists of one year of pretty good growth following a Depression-level economic decline over the previous three years.

True, 5.5 percent growth is a lot better than nothing. But it’s worth noting that America’s economy grew almost twice that fast — 10.9 percent! — in 1934, as it rebounded from the worst of the Great Depression.

What explains this trans-Atlantic paralysis in the face of an ongoing human and economic disaster?

Whatever the deep roots of this paralysis, it’s becoming increasingly clear that it will take utter catastrophe to get any real policy action that goes beyond bank bailouts.

But don’t despair: at the rate things are going, especially in Europe, utter catastrophe may be just around the corner.

The demands being made of the German government spring from a sincere desire to avoid a rerun of the 1930s,

when economic disaster provoked political catastrophe.

However, while these demands may make economic sense, they are politically unrealistic and dangerous.

They are textbook solutions that fail the real-world test.

Worse, if enacted, they would risk provoking the very political radicalisation they are ultimately meant to prevent.

Gideon Rachman, Financial Times 11 June 2012

The European Union, the world’s biggest economic area, could plunge into a spiral of bank busts, defaults and depression

— a financial calamity to dwarf the mayhem unleashed by the bankruptcy of Lehman Brothers in 2008.

The Econoomist print 9 June 2012

The world is uncomfortably close to a 1931 moment

Italy must guarantee 22pc of the bail-out funds, even though it cannot raise money itself at a sustainable rate.

You could hardly design a surer way to pull Italy into the fire.

Ambrose Evans-Pritchard, 10 Jun 2012

Italy’s public debt is the world’s third largest after the US and Japan at €1.9 trillion. There is no margin for political error.

The EU machinery (EFSF/ESM) exists largely on paper, a €500bn declaration of intent.

It had trouble raising trivial sums last year to fund Irish and Portuguese loan tranches -- understandably so, since the fund is a transparent attempt to evade the imperative of Eurobonds and EMU debt pooling.

China’s sovereign wealth fund said last week that it was withdrawing from Europe’s debt markets, fearing a collapse of the euro.

Investors are willing to pay zero rates for German sovereign debt, or near zero for French debt, sure that these nations will emerge from the rubble come what may.

They patently do not want mangled guarantees from an EMU club at risk of disintegration.

Sovereignty is all that counts now.

Europe has lit the fuse on an economic and financial bomb.

The rescue package for Spain cannot plausibly be contained to €100bn once it begins, given the subordination of private creditors and collapse of global confidence in the governing structure of monetary union.

Full text of excellent artiicla

What would make some difference is if the money provided were not some sort of loan but rather an outright gift.

Such gifts can be made in advance (although they rarely are) or after the event, when they are called write-offs.

Sometimes a recipient itself turns what was once a loan into a gift. This is called a default.

But northern countries understandably don't want their past loans turned into gifts, and

they don't want to be forced to make new gifts until the crack of doom.

Roger Bootle, Telegraph 24 June 2012

Yet even continued gifts under some sort of fiscal union would not bring prosperity, as we see clearly in Italy.

Italian unification in 1861 married the Germanic north with the Latin south. The consequent misalignment continues to this day.

If the euro holds together, this would leave the southern peripheral countries as a giant version of the Mezzogiorno.

Their costs are 30-40pc out of line with Germany's. It is a fantasy to believe that such a gap can be closed by "reform".

Consequently, when nominal values get out of line, the problem can only be solved by a price or exchange rate adjustment.

Theoretically, this could be through internal deflation but that would increase the real value of debt and depress aggregate demand still more.

Deflation is the road to catastrophe.

Throwing yet more money at the vulnerable countries and calling this by a fancy name is not an answer. Just as with the Gold Standard and with Bretton Woods, the system has to break.

But doubtless the participants at this week's summit will smother themselves in every sort of illusion in order to avoid facing up to that uncomfortable reality.

In the end, market processes will overwhelm them. The bond markets are currently the most obvious threat.

But I suspect that the irresistible pressure will come as depositors move more euro deposits out of the vulnerable countries and into German banks.

Greek depositors are already protecting themselves against the consequences of a Greek default and euro exit by shifting the risk onto European taxpayers.

When the country in question is Spain or Italy the amounts involved will be so huge that the ECB would have to stop its recycling activities pretty quickly.

And that would send these countries into a banking crisis from which the only escape would be euro exit.

Bank run, The beginning of the end

Full text of excellent article

In the popular imagination, the slump of the 1930s was set off by the sharp falls in share prices in the Wall Street Crash of 1929.

In fact, the direct effect of the Crash was probably not that great. More important was the international banking crisis

which followed the collapse of the Austrian bank, Creditanstalt, in 1931.

Roger Bootle, Telegraph 10 Jun 2012

Om detta skrev Peter Wolodarski i nedanstående artikel följande:

När den stora österrikiska banken Creditanstalt visade sig vara bankrutt 1931 greps marknaden av panik. Kapital började flöda ut från landet.

Regeringen i Wien begärde internationell hjälp för att undvika en större kollaps. Men Österrike fick inget krispaket

därför att den franske premiärministern Laval blockerade lånet (han ingick senare i Vichyregimen och avrättades efter kriget).

Betraktar man de senaste årens utveckling i Europa inser man att 30-talskollapsen inte alls är obegriplig eller omöjlig att upprepa.

Den dystra sanningen är ju att eurokrisen bär på många av de frön som en gång framkallade den stora depressionen.

Peter Wolodarski, Dagens Nyheter 10 juni 2012

Highly recommended

I Sverige är det dominerande politiska tänkandet i både regering och opposition slående likt det tyska... På flera sätt låter retoriken som ett eko från 1930-talets förödande moralism.

Men på marknaden och bland internationella ekonomer ser fler och fler det uppenbara: euroländernas krispolitik formar sig till ett historiskt misstag.

Precis som en gång guldmyntfoten låste fast de deltagande nationerna, bakbinder medlemskapet i euron flera av krisländerna

1930-talet rymmer några av den ekonomiska historiens mest avgörande lärdomar: den centrala roll som staten spelar vid en finansiell kris, vikten av att centralbanker aktivt motverkar stora nedgångar, faran med självuppfyllande finansiell panik och värdet av ett starkt internationellt samarbete.

Dessa slutsatser sågs länge som så självklara att 30-talet efter hand kom att ses som ett tragiskt undantag bland nationalekonomerna. I undervisningen de senaste decennierna har depressionsåren tagit liten plats, eftersom de inte passade in i ekonomins vanliga konjunkturmönster.

Att världen hamnade i en så djup kris framstod som tämligen obegripligt och något som inte skulle inträffa igen.

/Before now, I had never really understood how the 1930s could happen.

Now I do.

Martin Wolf, Financial Times, June 5, 2012 10:39 pm/

Återigen väcks frågan hur man ska möta en kraftig nedgång i den ekonomiska aktiviteten efter en finansiell krasch.

Sker det bäst med åtstramning eller med motverkande åtgärder som håller uppe efterfrågan?

Herbert Hoover var USA:s president när landet gled in i den stora depressionen på 1930-talet. I efterhand skrev han bittert om dem i hans administration som förespråkade passivitet under nedgången.

Finansminister Mellon, konstaterar Hoover, hade bara ett recept: låt krisen verka ut sig själv. Han ansåg till och med att den panik som brutit ut inte bara var av ondo:

”Den kommer att rena systemet från allt ruttet. Höga levnadsomkostnader och lyxliv försvinner. Människor kommer att arbeta hårdare, leva ett mer moraliskt liv. Värderingarna anpassar sig och de företagsamma plockar upp spillrorna efter de mindre dugliga.”

Citatet berättar inte att Hoover själv varit en entusiastisk tillskyndare av den förda politiken, men så var det.

Flera av tidens kända politiker och ekonomer i såväl Europa som USA förespråkade låt-gå-linjen (Laissez-faire, Wikipedia), som förvandlade en svår nedgång till en social, ekonomisk och politisk katastrof.

Den amerikanska centralbanken såg inte till att pumpa ut likviditet i ekonomin efter börskraschen 1929.

I Tyskland iscensatte förbundskansler Brüning kraftiga pris- och lönesänkningar för att återställa konkurrenskraften och till varje pris undvika inflation. Så såg den ekonomiska ortodoxin ut, vilket banade väg för Hitlers maktövertagande.

Berlin har rätt i att efterlysa strukturreformer och bättre ordning i de offentliga finanserna. Men det långsiktigt nödvändiga har övergått i en kortsiktig och farlig dogmatism.

Som den ekonomiskt liberale skribenten Samuel Brittan konstaterade i veckan i Financial Times: det finns inget vänster eller socialistiskt i att acceptera budgetunderskott när det råder massarbetslöshet och ekonomin befinner sig långt under sin normala kapacitet.

Kommentar av Rolf Englund:

Efter denna lysande artikel av Peter Wolodarski sätter jag in honom på listan över vacklande Ja-sägare, trots att han formellt ännu inte har explicit skrivit att han och tidningen har bytt uppfattning om att Sverige bör gå med i EMU

Europa har slagit in på en kamikazekurs som ser ut att leda mot att euron bryts sönder.

/Spanien/ riskerar att dras ned i en negativ spiral som kan knäcka banksystemet, orsaka en statsbankrutt och leda till att Spanien lämnar den europeiska valutaunionen.

Peter Wolodarski, Dagens Nyheter 3 juni 2012

Den bygger ett gemenskaptänkande vilket är viktigt i Europa givet vår historiska belastning och bakgrund

Men den blev inte som det var tänkt.

Fredrik Reinfeldt, Ekot Lördagsintervju 9 maj 2012

The most infamous proponent of this point of view was Andrew Mellon, President Herbert Hoover's Treasury Secretary. He called for letting the Depression run its course without government interference: "Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate," he remarked.

Doing so would "purge the rottenness out of the system."

Det fungerar inte att få fart på Europas ekonomier genom att spä på redan ohållbart stora skulder, eftersom effekterna då uteblir.

Istället för att låna mer bör Europa satsa mer på frihandelsavtal och underlätta handeln med tjänster inom Europa.

Statsminister Fredrik Reinfeldt, SvD Näringsliv 29 maj 2012

Walter Eltis, Wall Street Journal, den 25 september 1997:

George Soros has warned that the single cunrency would bear the brunt of European anger over unemployment and is likely to exacerbate (förvärra) nationalist sentiments.

Canada has a common currency and Quebec pays an interest rate that is almost 100 basis points higher than oil-rich Alberta. This is because their provincial governments have dilferent credit ratings. … Alberta has no responsibility to service Quebec's debt.

The German government will similarly accept no responsibility to honor debt incurred by the Italian, Spanish and Portuguese governments which will continue to be entirely their legal responsibility.

If there is any suspicion of the Italian government's ability to service its debt, whether in liras or euros, its Standard and Poor's rating will fall and the comparative interest rate it has to pay will rise.

Walter Eltis, Emeritus Fellow of Exeter College, Oxford, Wall Street Journal, den 25 september 1997.

Eltis har har författat en rapport, "The Creation and Destruction of EMU", utgiven av Centre for Policy Studies.

The Perils of Ignoring History

This Time, Europe Really Is on the Brink

Niall Ferguson and Nouriel Roubini, Der Spiegel 12 June 2012

Berlin is ignoring the lessons of the 1930s

We find it extraordinary that it should be Germany, of all countries, that is failing to learn from history

Niall Ferguson and Nouriel Roubini

Financial Times June 8, 2012 8:04 pm

Fixated on the non-threat of inflation, today’s Germans appear to attach more importance to 1923 (the year of hyperinflation)

than to 1933 (the year democracy died).

They would do well to remember how a European banking crisis two years before 1933 contributed directly to the breakdown of democracy not just in their own country but right across the European continent.

On a recent visit to Barcelona, one of us was repeatedly asked if it was safe to leave money in a Spanish bank. This kind of process is potentially explosive.

Chancellor Heinrich Bruening’s austerity administration

At the Chancellery in Berlin, the television images from Athens now remind Merkel's advisers

of conditions in the ill-fated Weimar Republic of 1919-1933.

Der Spiegel, Staff, 14 maj 2012

In 1931, Austria was attempting to deliver the kind of austerity now being witnessed in parts of southern Europe.

The crisis culminated in the failure of Creditanstalt, a major Viennese bank – the 1931 equivalent of Lehman Brothers.

A handful of years later, Hitler was welcomed by cheering crowds in Vienna.

Stephen King, HSBC Group’s chief economist, Financial Times, 9 May 2012

Plans show Germany will meet its debt brake goal

- which foresees a cut in the structural deficit to no more than 0.35 percent of gross domestic product -

two years earlier than previously expected in 2014 and balance the budget in 2016.

CNBC 21 March 2012

There is no way that Germany in particular will accept a fiscal stimulus for the sake of the southern European countries.

This is because Germany restrained itself by passing a balanced budget law that requires the government to run near-zero structural deficits indefinitely.

Wolfgang Münchau, Financial Times, May 5, 2013

The European fiscal compact, an inter-governmental treaty that came into effect in January, provides far less flexibility to countries as they try to meet their deficit-cutting targets than they had under previous agreements.

Under the fiscal compact, Italy will be required to pay back debt worth more than 2 per cent of GDP each year.

To achieve that goal, Italy will need to run very large structural surpluses for almost a generation.

The fiscal compact that was the summit’s centrepiece is flawed

The idea is to write fiscal discipline into national constitutions

But such a compact will not safeguard the euro against future booms and busts.

Until financial markets crashed in 2008, Spain and Ireland were hailed as economic stars,

with lower public-debt burdens and healthier budgets than Germany.

The Economist print, Dec 17th 2011

Alla euroländer ska införa en ny finanspolitisk regel enligt vilken

det strukturella budgetunderskottet får vara högst 0,5 procent av BNP.

Är dessa åtgärder tillräckliga för att massiva ECB-stöd ska vara förenliga med ett långsiktigt hållbart system?

Enligt min mening är svaret nej.

Lars Calmfors, kolumn DN 13 december 2011

EU på väg upprepa Tysklands misstag

Rolf Englund blog 10 december 2011

The long shadow of the 1930s

Could things go bad again?

I mean really bad – Great Depression bad, world war bad?

The kind of cataclysmic event my generation has learned to think belongs only in the history books.

Gideon Rachman, Financial Times, November 28, 2011

If I had to give a snap judgment on the embryonic plan to “save the euro”,

I would say it is deflationary in the short term and inflationary in the long term

If the Republicans do well in the 2012 US elections, the stage will be set for a repetition of

many of the economic errors of the 1930s, when countries tried to fight depression with cuts of all kinds.

Samuel Brittan, 15 December 2011

German finance minister Wolfgang Schauble – the most dangerous man in the world – is imposing a reactionary policy of synchronized tightening on the whole eurozone

through the EU institutions, invoking a doctrine of “expansionary fiscal contractions”

that has no record of success without offsetting monetary and exchange stimulus.

Ambrose Evans-Pritchard, DT, 20 Nov 2011

Europe stumbles blindly towards its 1931 moment

Unless the ECB takes fast and dramatic action, it risks destroying the currency it is paid to manage, and allowing a political catastrophe to unfold in Europe.

Ambrose Evans-Pritchard 14 Nov 2010

Depression and Democracy

Unemployment in both America and Europe remains disastrously high.

Leaders and institutions are increasingly discredited.

And democratic values are under siege.

Paul Krugman, New York Times, December 11, 2011

Orwellian Currency Area

Kevin O’Rourke has a very good point:

what European leaders are describing as “fiscal union” is very nearly the opposite

Paul Krugman, December 10, 2011

Events on the Continent have come to feel much like the drift into war.

There is a feeling of powerless inevitability about it.

Jeremy Warner, 1 Dec 2011